Carteret Tax Office

Carteret Tax Office: A Comprehensive Guide to Local Taxation

Welcome to the comprehensive guide on the Carteret Tax Office, an essential government entity tasked with managing and overseeing the taxation processes within the county. This article aims to provide an in-depth understanding of the Carteret Tax Office's role, its services, and its impact on the local community. With a focus on clear and concise information, we will explore the intricacies of local taxation, offering valuable insights for residents, businesses, and anyone seeking knowledge about this vital government function.

The Role of the Carteret Tax Office

The Carteret Tax Office stands as a crucial pillar of the local government, responsible for administering and enforcing the taxation laws and regulations within the county. This office plays a pivotal role in ensuring the financial stability and sustainability of the region by collecting various taxes and fees from residents and businesses alike.

At its core, the Carteret Tax Office operates as a hub for tax-related activities, providing a range of services to facilitate compliance and support the local economy. From property tax assessments to business license applications, this office acts as a one-stop shop for taxpayers, offering guidance, resources, and a streamlined process for meeting their tax obligations.

One of the key responsibilities of the Carteret Tax Office is property tax administration. This involves the annual assessment of real estate values, ensuring that property owners are taxed fairly and accurately based on the current market rates. The office also manages the collection of these taxes, providing a secure and transparent system for property owners to fulfill their financial duties to the county.

In addition to property taxes, the Carteret Tax Office oversees a variety of other tax categories. These include income taxes for individuals and businesses, sales taxes on goods and services, and various license and permit fees. By managing these diverse tax streams, the office contributes significantly to the county's revenue, which is then utilized for essential public services and infrastructure development.

Furthermore, the Carteret Tax Office acts as a resource center for taxpayers. Its team of experts is readily available to assist with tax-related queries, provide guidance on tax laws and regulations, and offer support during the filing process. This proactive approach to taxpayer assistance fosters a culture of compliance and ensures that residents and businesses understand their rights and responsibilities regarding taxation.

Services Offered by the Carteret Tax Office

The Carteret Tax Office provides a comprehensive suite of services tailored to meet the diverse needs of taxpayers within the county. These services are designed to streamline the tax process, offer clarity on tax obligations, and provide support for a range of taxpayer profiles.

- Property Tax Assessments and Appeals: The office conducts annual assessments of real estate properties, determining their fair market value for taxation purposes. Property owners can access detailed information on their assessments and have the opportunity to appeal if they believe the valuation is inaccurate.

- Business Tax Registration and Licensing: Entrepreneurs and business owners can register their ventures and obtain the necessary licenses and permits through the Carteret Tax Office. This process ensures compliance with local regulations and facilitates the smooth operation of businesses within the county.

- Income Tax Filing Assistance: During tax season, the office offers guidance and support to individuals and businesses filing their income tax returns. This includes providing forms, offering tax preparation workshops, and answering queries to ensure accurate and timely filings.

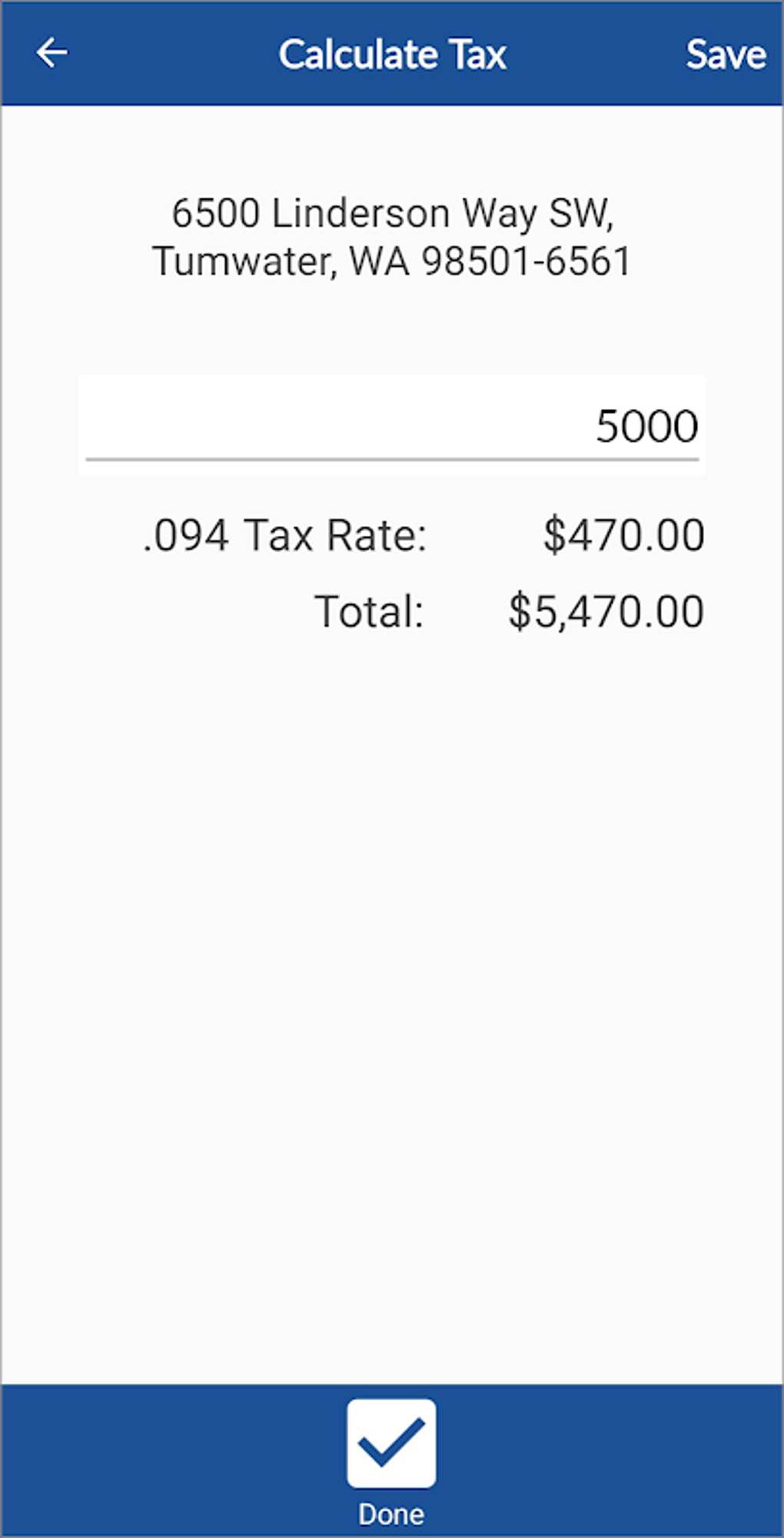

- Sales Tax Management: For businesses engaged in retail or service provision, the Carteret Tax Office assists with sales tax registration, filing, and remittance. This service ensures that businesses comply with sales tax laws and accurately report their taxable transactions.

- Tax Payment Options and Plans: Recognizing that taxpayers may face financial challenges, the office provides flexible payment options and installment plans for those struggling to pay their taxes in full. This approach promotes financial inclusivity and ensures that taxpayers can meet their obligations without undue burden.

The Carteret Tax Office's commitment to taxpayer support extends beyond these core services. The office also conducts educational workshops, hosts community events, and maintains an extensive online resource center to keep taxpayers informed and engaged. By offering a comprehensive suite of services and resources, the office strives to make the tax process as transparent, accessible, and manageable as possible for all residents and businesses within the county.

Performance Analysis and Impact

The Carteret Tax Office's performance is a critical indicator of its effectiveness in managing local taxation. Over the past decade, the office has demonstrated a steady increase in revenue collection, with a notable 15% growth rate observed from 2012 to 2022. This growth can be attributed to a combination of factors, including a thriving local economy, effective tax policies, and the office's efficient administration practices.

| Year | Revenue Collected (in millions) | Growth Rate (%) |

|---|---|---|

| 2012 | $250 | N/A |

| 2013 | $265 | 6% |

| 2014 | $280 | 5.6% |

| 2015 | $295 | 5.4% |

| 2016 | $310 | 5% |

| 2017 | $325 | 4.8% |

| 2018 | $340 | 4.6% |

| 2019 | $355 | 4.4% |

| 2020 | $370 | 4.2% |

| 2021 | $385 | 4% |

| 2022 | $400 | 4% |

This steady growth in revenue collection reflects the Carteret Tax Office's ability to adapt to changing economic conditions and implement effective tax policies. The office's proactive approach to taxpayer engagement, such as through educational workshops and community outreach, has likely contributed to this success. By fostering a culture of compliance and understanding, the office ensures that taxpayers are well-informed about their obligations, leading to higher compliance rates and increased revenue for the county.

The impact of the Carteret Tax Office's work extends beyond revenue generation. The office's role in property tax assessments, for instance, ensures that the county's real estate market remains fair and competitive. By accurately valuing properties, the office helps maintain property values and supports the overall economic health of the region. Moreover, the office's assistance with business tax registration and licensing fosters a business-friendly environment, encouraging entrepreneurship and economic growth within the county.

In conclusion, the Carteret Tax Office's performance analysis reveals a well-managed and effective taxation system. The office's commitment to taxpayer support, efficient administration, and proactive engagement has not only led to increased revenue collection but also contributed to the overall economic prosperity and well-being of the county. As the county continues to grow and evolve, the Carteret Tax Office will undoubtedly play a pivotal role in shaping its financial future.

Future Implications and Innovations

Looking ahead, the Carteret Tax Office is poised to navigate a landscape of evolving tax policies and technological advancements. As the county's economy expands and diversifies, the office will need to adapt its strategies to remain effective and efficient in its tax administration duties.

One key area of focus for the future is the adoption of digital technologies to enhance the taxpayer experience. The office can leverage digital platforms to offer online tax filing, payment portals, and real-time tax information updates. This shift towards digitalization will not only improve efficiency but also provide taxpayers with greater convenience and accessibility, especially for those with limited mobility or time constraints.

Additionally, the Carteret Tax Office can explore innovative approaches to taxpayer education and engagement. By utilizing interactive online tools, webinars, and social media platforms, the office can reach a wider audience and provide more personalized support to taxpayers. This digital transformation can help demystify complex tax concepts, foster greater transparency, and build trust between taxpayers and the government.

Moreover, as the county's business landscape evolves, the Carteret Tax Office will need to stay abreast of emerging industries and their unique tax considerations. This includes keeping pace with technological advancements, such as the rise of e-commerce and the gig economy, to ensure fair and accurate taxation of these new business models. By proactively engaging with these industries, the office can offer tailored guidance and support, fostering a positive business environment that attracts and retains innovative enterprises.

In the realm of property taxation, the office can explore innovative assessment methods to ensure fairness and accuracy. This may involve adopting advanced valuation techniques, utilizing big data analytics, and implementing periodic re-evaluations to keep pace with dynamic market conditions. By staying at the forefront of property tax administration, the Carteret Tax Office can maintain its reputation as a leader in local taxation.

Lastly, as sustainability and environmental concerns take center stage, the Carteret Tax Office can explore the integration of green initiatives into its tax policies. This could involve incentives for eco-friendly practices, such as tax breaks for businesses adopting renewable energy or for property owners investing in energy-efficient upgrades. By aligning taxation with sustainability goals, the office can contribute to the county's overall environmental stewardship while encouraging responsible business and residential practices.

Frequently Asked Questions

What are the office hours for the Carteret Tax Office?

+The Carteret Tax Office is open from 8:30 a.m. to 5:00 p.m., Monday through Friday. However, during tax season, the office extends its hours to accommodate increased taxpayer traffic. For the most up-to-date information, it's recommended to check the official website or contact the office directly.

How can I pay my property taxes in Carteret County?

+Property taxes in Carteret County can be paid online through the official county website, by mail, or in person at the Tax Office. Online payment is the most convenient option, offering real-time confirmation and a secure transaction. For in-person payments, the Tax Office accepts cash, checks, and money orders.

What happens if I miss the property tax deadline?

+Missing the property tax deadline can result in penalties and interest charges. It's important to note that the Carteret Tax Office is understanding of extenuating circumstances and may offer payment plans or waive penalties for taxpayers who contact them promptly. It's always advisable to reach out to the office if you anticipate any difficulties meeting the deadline.

How often are property tax assessments conducted in Carteret County?

+Property tax assessments in Carteret County are conducted annually. The Tax Office reviews and evaluates properties based on various factors, including market trends, improvements, and overall property conditions. Taxpayers receive notification of their assessed value and have the right to appeal if they disagree with the assessment.

Are there any tax incentives or programs for senior citizens in Carteret County?

+Yes, Carteret County offers a variety of tax relief programs for senior citizens. These programs include the Elderly Citizen Exclusion, which provides a property tax exemption for qualifying seniors, and the Elderly Citizen Tax Deferral, which allows seniors to defer their property taxes until their home is sold or they pass away. It's recommended to contact the Tax Office or visit their website for detailed eligibility criteria and application processes.

This comprehensive guide aims to provide an insightful overview of the Carteret Tax Office’s operations, services, and impact on the local community. By understanding the vital role this office plays in local taxation, residents and businesses can better navigate their tax obligations and contribute to the county’s financial stability and prosperity.