New York Sales Tax Login

Welcome to the comprehensive guide to the New York Sales Tax Login process. Navigating the world of sales tax compliance can be a complex task, but with the right information and resources, it becomes more manageable. In this article, we will delve into the intricacies of the New York Sales Tax Login system, providing you with a detailed roadmap to ensure a seamless and efficient experience. Whether you're a seasoned business owner or new to the realm of sales tax, this guide will serve as your trusted companion, empowering you to tackle the intricacies of sales tax management with confidence.

Understanding the Importance of New York Sales Tax

Before we dive into the login process, let’s first grasp the significance of sales tax in New York. Sales tax is a crucial component of the state’s revenue generation strategy, playing a pivotal role in funding essential public services and infrastructure development. By collecting sales tax from businesses, New York ensures a stable and sustainable source of income to support its economic growth and the well-being of its residents.

For businesses operating within the state, complying with sales tax regulations is not just a legal obligation but also a demonstration of responsible citizenship. It ensures fair competition among businesses, promotes transparency, and contributes to the overall economic health of New York. Understanding the importance of sales tax compliance sets the foundation for a smooth and compliant journey through the New York Sales Tax Login process.

Preparing for Your New York Sales Tax Login Journey

Embarking on the New York Sales Tax Login journey requires meticulous preparation. Here are some essential steps to ensure a seamless and efficient process:

Gathering Necessary Documentation

Before you begin, gather all the required documents. This typically includes your business registration details, tax identification number, and any other relevant paperwork. Having these documents readily available will expedite the login process and minimize potential delays.

Understanding Your Business’s Tax Obligations

Take the time to understand your business’s specific tax obligations. Different businesses may have varying sales tax responsibilities based on their industry, location, and the nature of their transactions. Familiarize yourself with the applicable tax rates, filing frequencies, and any exemptions that may apply to your business. This knowledge will help you navigate the login process more confidently.

Choosing the Right Platform

New York offers multiple platforms for sales tax registration and management. Research and select the platform that best suits your business needs. Consider factors such as user-friendliness, integration capabilities, and additional features that may streamline your tax compliance processes. A well-chosen platform can significantly enhance your overall sales tax management experience.

Step-by-Step Guide to New York Sales Tax Login

Now, let’s walk through the step-by-step process of logging into the New York Sales Tax system. By following these instructions, you’ll be well on your way to efficient sales tax management:

Step 1: Accessing the New York Department of Taxation and Finance Website

Begin by visiting the official website of the New York Department of Taxation and Finance at https://www.tax.ny.gov. This is the primary gateway to all your sales tax-related activities.

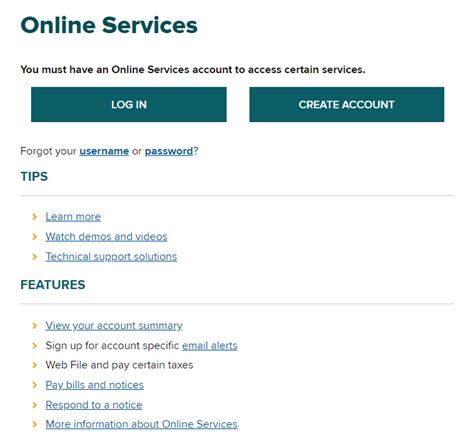

Step 2: Navigating to the Sales Tax Login Portal

Once on the website, locate the “Sales Tax” section. Within this section, you will find a dedicated login portal specifically designed for sales tax management. Click on the “Login” button to proceed.

Step 3: Creating an Account

If you are a new user, you will need to create an account. Follow the prompts to provide your business details, including your business name, tax identification number, and contact information. Ensure that all the information is accurate and up-to-date.

Step 4: Verifying Your Identity

To enhance security and prevent fraudulent activities, the New York Department of Taxation and Finance may require additional verification steps. This could involve answering security questions, providing supporting documents, or even setting up two-factor authentication. Follow the instructions carefully to complete the verification process.

Step 5: Accessing Your Sales Tax Dashboard

Upon successful login and verification, you will be granted access to your personalized sales tax dashboard. This dashboard serves as your central hub for managing all sales tax-related activities. From here, you can view your tax obligations, file returns, make payments, and access valuable resources and guidance.

Maximizing Your Sales Tax Management Experience

Now that you have successfully logged into the New York Sales Tax system, it’s time to explore the features and functionalities that will enhance your sales tax management experience.

Filing Sales Tax Returns Efficiently

The New York Sales Tax Login portal offers a user-friendly interface for filing sales tax returns. You can easily input your sales data, calculate the applicable tax amounts, and generate accurate returns. The system may even provide tools for importing data from accounting software, further streamlining the filing process.

Utilizing Online Payment Options

To simplify the payment process, the New York Sales Tax Login portal integrates various online payment options. You can choose to pay your sales tax obligations through secure payment gateways, ensuring a convenient and timely payment experience. This eliminates the need for manual checks and reduces the risk of late payments.

Accessing Tax Guidance and Resources

The New York Department of Taxation and Finance understands the complexities of sales tax compliance. Therefore, they provide a wealth of resources and guidance materials within the login portal. From detailed tax guides to frequently asked questions, you’ll have access to valuable information to navigate any sales tax-related queries.

Staying Informed with Tax Updates

Sales tax regulations are subject to periodic updates and changes. To stay compliant, it’s crucial to stay informed about any modifications. The New York Sales Tax Login portal often includes a dedicated section for tax updates, ensuring you receive timely notifications about any changes that may impact your business.

Troubleshooting Common Login Issues

While the New York Sales Tax Login process is designed to be user-friendly, occasional issues may arise. Here are some common problems and their solutions:

Forgotten Password or Username

If you’ve forgotten your password or username, don’t panic. The login portal typically provides a “Forgot Password” or “Username Recovery” option. Follow the instructions to reset your credentials and regain access to your account.

Technical Glitches or Errors

In rare cases, technical glitches or errors may occur during the login process. If you encounter such issues, try refreshing the page or clearing your browser’s cache. If the problem persists, contact the New York Department of Taxation and Finance’s technical support team for assistance.

Account Access Denied

If your account access is denied, it could be due to security measures or verification requirements. Ensure that you have completed all necessary verification steps and that your account details are accurate. If the issue persists, reach out to the support team for further guidance.

Conclusion: Empowering Your Business with Sales Tax Compliance

By following this comprehensive guide, you are well-equipped to navigate the New York Sales Tax Login process with confidence. Remember, sales tax compliance is not just a legal requirement but also an opportunity to contribute to the economic prosperity of New York. Embrace the tools and resources provided by the New York Department of Taxation and Finance to streamline your sales tax management and ensure a smooth journey toward compliance.

FAQ

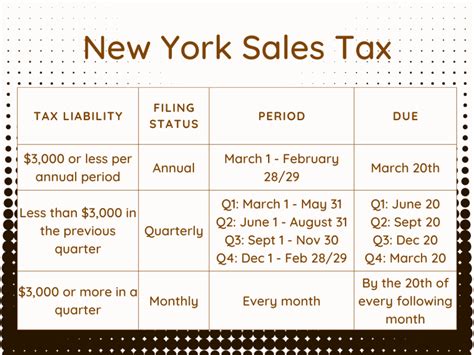

How often do I need to file sales tax returns in New York?

+The filing frequency depends on your business’s sales volume and tax obligations. Typically, businesses file sales tax returns quarterly, but some may require monthly or annual filings. Refer to the guidelines provided by the New York Department of Taxation and Finance for accurate information.

Can I integrate my accounting software with the New York Sales Tax Login portal?

+Yes, the New York Sales Tax Login portal offers integration capabilities with popular accounting software. This integration simplifies data transfer and reduces manual entry, enhancing the overall efficiency of your sales tax management process.

What happens if I miss a sales tax filing deadline in New York?

+Missing a sales tax filing deadline may result in penalties and interest charges. It’s crucial to stay organized and plan your filings accordingly. The New York Department of Taxation and Finance provides resources and reminders to help businesses stay on top of their filing obligations.