New York Sales Tax For Cars

Sales tax is an essential aspect of purchasing a vehicle, and it can significantly impact the overall cost. In the state of New York, understanding the sales tax regulations for cars is crucial for both buyers and sellers. Let's delve into the specifics of New York's sales tax for cars, exploring the rates, exemptions, and important considerations for a comprehensive understanding.

Understanding New York’s Sales Tax Structure

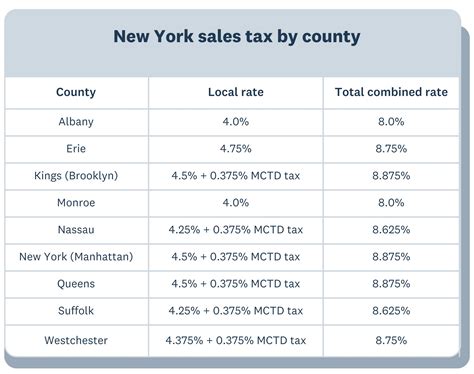

New York State imposes a sales tax on the sale of tangible personal property, including vehicles. The tax is calculated as a percentage of the purchase price and is applied at the point of sale. While the state sets the base sales tax rate, it’s important to note that local jurisdictions may also add their own taxes, leading to varying rates across different regions within the state.

The current base sales tax rate in New York State is 4%. However, this rate can increase depending on the county and city where the vehicle is purchased. For instance, New York City imposes an additional 4.5% tax on top of the state rate, resulting in a total sales tax of 8.5% for vehicle purchases within the city limits.

| County | Sales Tax Rate |

|---|---|

| Albany | 8% |

| Bronx | 8.875% |

| Erie | 8% |

| Kings (Brooklyn) | 8.875% |

| Nassau | 8.625% |

| Queens | 8.875% |

| Richmond (Staten Island) | 8.875% |

| Suffolk | 8.625% |

It's crucial for buyers to be aware of these varying rates to accurately estimate the total cost of their vehicle purchase. Additionally, it's worth noting that certain counties may offer temporary sales tax incentives or discounts, particularly during specific periods or for certain types of vehicles. These initiatives aim to stimulate local economies and promote eco-friendly vehicle choices.

Sales Tax Exemptions in New York

While sales tax is generally applicable to vehicle purchases, New York does offer certain exemptions and incentives to promote specific initiatives or support particular demographics. Here are some notable exemptions:

Vehicles for Individuals with Disabilities

New York provides sales tax exemptions for the purchase of vehicles adapted for individuals with disabilities. This exemption applies to the adaptive equipment and modifications made to the vehicle to accommodate the disability. However, it’s important to note that the exemption only covers the additional cost of the adaptive equipment, not the entire vehicle purchase price.

Vehicle Trade-Ins

When trading in an old vehicle as part of a new purchase, New York allows for a sales tax credit. The credit is calculated based on the trade-in value of the old vehicle and can be applied to reduce the sales tax owed on the new vehicle. This incentive encourages vehicle upgrades and promotes the recycling of older models.

Military and Veteran Exemptions

New York recognizes the service of military personnel and veterans by offering sales tax exemptions for certain vehicle purchases. Active-duty military members, veterans, and their spouses may qualify for this exemption. The specific requirements and eligible vehicles vary, so it’s advisable to consult the New York State Department of Taxation and Finance for detailed information.

Electric and Hybrid Vehicles

To encourage the adoption of environmentally friendly vehicles, New York provides sales tax incentives for the purchase of electric and hybrid vehicles. These incentives can take the form of tax credits or reduced sales tax rates, making these vehicles more affordable and attractive to consumers. The exact incentives may vary depending on the type of vehicle and the county of purchase.

Calculating Sales Tax for Your Vehicle Purchase

When purchasing a vehicle in New York, accurately calculating the sales tax is crucial. Here’s a step-by-step guide to help you estimate the sales tax for your vehicle:

- Determine the Base Sales Tax Rate: Start by identifying the base sales tax rate applicable to your county or city. This information is readily available from the New York State Department of Taxation and Finance's website.

- Calculate the Vehicle Price: Include all relevant costs associated with the vehicle, such as the base price, additional features, and any applicable fees. This total amount will serve as the basis for calculating the sales tax.

- Apply the Sales Tax Rate: Multiply the total vehicle price by the applicable sales tax rate, including any local additions. This calculation will provide you with the estimated sales tax amount.

- Consider Exemptions or Incentives: If you qualify for any sales tax exemptions or incentives, deduct the applicable amount from the calculated sales tax. This step will give you a more accurate estimate of the final sales tax due.

By following these steps, you can obtain a precise estimate of the sales tax you'll owe when purchasing a vehicle in New York. Remember to consult official sources and seek professional advice if needed to ensure compliance with the latest regulations and guidelines.

Sales Tax Collection and Remittance

For dealers and sellers, understanding the sales tax collection process is essential. In New York, the sales tax is typically collected by the seller at the point of sale and remitted to the appropriate tax authorities. Dealers are responsible for accurately calculating and collecting the sales tax, ensuring compliance with state and local regulations.

Dealers must register with the New York State Department of Taxation and Finance to obtain a sales tax certificate. This certificate authorizes them to collect and remit sales tax on behalf of the state. Failure to properly collect and remit sales tax can result in penalties and legal consequences.

It's important for sellers to maintain accurate records of sales transactions, including the purchase price, applicable sales tax, and any exemptions or incentives applied. These records are essential for tax reporting purposes and can help resolve any discrepancies or disputes that may arise.

Impact of Sales Tax on Vehicle Affordability

The sales tax on vehicles can significantly impact their overall affordability. In New York, with varying rates across counties and potential additional taxes, the final cost of a vehicle can differ considerably. Buyers should carefully consider the sales tax implications when budgeting for a vehicle purchase.

To illustrate the impact of sales tax, let's compare the total cost of a vehicle purchase with and without sales tax. Assuming a vehicle with a base price of $25,000 and a sales tax rate of 8% (including state and local taxes), the total cost would be approximately $27,000, including sales tax. In contrast, without sales tax, the total cost would be the base price of $25,000.

This example highlights how sales tax can add a significant amount to the overall cost of a vehicle purchase. It's crucial for buyers to factor in these additional costs when making financial plans and considering their purchasing power.

Sales Tax and Online Vehicle Purchases

With the rise of online vehicle marketplaces, it’s important to understand how sales tax applies to online purchases. In New York, sales tax is still applicable to online vehicle purchases, and buyers should be aware of their tax obligations.

When purchasing a vehicle online, the sales tax rate is typically based on the buyer's shipping address. The online seller is responsible for collecting and remitting the appropriate sales tax to the tax authorities in the buyer's jurisdiction. Buyers should receive a breakdown of the sales tax on their purchase invoice or receipt.

It's essential for online buyers to verify the sales tax calculation and ensure that the seller is properly collecting and remitting the tax. This ensures compliance with tax regulations and helps prevent any potential issues with the tax authorities.

Future Trends and Considerations

As technology and consumer preferences evolve, the sales tax landscape for vehicles may also undergo changes. Here are some potential future trends and considerations to keep in mind:

Electric Vehicle Incentives

With the growing popularity of electric vehicles (EVs), New York and other states may continue to offer incentives and tax breaks to promote their adoption. These incentives could take the form of reduced sales tax rates, tax credits, or other financial incentives to encourage consumers to transition to eco-friendly transportation options.

Online Sales Tax Collection

As online vehicle sales become more prevalent, there may be increased scrutiny and regulation surrounding sales tax collection. Tax authorities may implement measures to ensure that online sellers properly collect and remit sales tax, preventing tax evasion and ensuring a level playing field for all businesses.

Automated Sales Tax Calculation

To streamline the sales tax calculation process, technology-driven solutions may emerge to automate the calculation of sales tax for vehicle purchases. These tools could integrate with vehicle pricing platforms, dealer management systems, or online marketplaces, providing accurate and up-to-date sales tax rates and calculations.

Consumer Awareness

As consumers become more aware of the impact of sales tax on vehicle purchases, there may be increased demand for transparency and clarity in sales tax calculations. Dealers and sellers should be prepared to provide detailed breakdowns of sales tax amounts and any applicable exemptions or incentives to build trust and confidence among buyers.

How often are sales tax rates updated in New York?

+Sales tax rates in New York are subject to periodic updates and revisions. While the state sales tax rate remains stable, local jurisdictions may adjust their tax rates from time to time. It’s advisable to check with the New York State Department of Taxation and Finance or local tax authorities for the most current sales tax rates applicable to your county or city.

Are there any exceptions to the sales tax for vehicles in New York?

+Yes, New York offers sales tax exemptions for specific categories of vehicles or buyers. These exemptions include adaptive equipment for individuals with disabilities, trade-in credits, military and veteran benefits, and incentives for electric and hybrid vehicles. It’s important to research and understand the specific requirements and qualifications for these exemptions.

How can I verify the accuracy of my sales tax calculation for a vehicle purchase in New York?

+To verify the accuracy of your sales tax calculation, you can consult official resources provided by the New York State Department of Taxation and Finance. These resources often include calculators or guidelines to assist with sales tax computations. Additionally, you can seek advice from tax professionals or consult with your dealer to ensure compliance with the latest regulations.

What happens if I fail to pay the correct sales tax on my vehicle purchase in New York?

+Failing to pay the correct sales tax on a vehicle purchase in New York can result in penalties and legal consequences. The tax authorities may impose fines, interest charges, or even initiate legal proceedings. It’s essential to accurately calculate and remit the sales tax to avoid these potential issues and maintain compliance with tax regulations.

Can I receive a refund for overpaid sales tax on a vehicle purchase in New York?

+If you believe you have overpaid sales tax on a vehicle purchase in New York, you may be eligible for a refund. The process for claiming a refund typically involves submitting a request to the New York State Department of Taxation and Finance, providing supporting documentation, and following the prescribed procedures. It’s advisable to consult the official guidelines or seek professional advice to ensure a successful refund claim.