Ohio State Tax Calculator

Welcome to the ultimate guide to understanding and calculating Ohio state taxes! In this comprehensive article, we will delve into the intricacies of Ohio's tax system, providing you with the knowledge and tools to navigate the process efficiently. Whether you're a resident, a business owner, or simply curious about Ohio's tax landscape, this article will serve as your trusted companion.

Unraveling the Ohio State Tax System

Ohio, known for its vibrant economy and diverse industries, has a tax system that plays a vital role in supporting the state's growth and development. With a range of taxes, including income tax, sales tax, and property tax, understanding how these taxes work is crucial for individuals and businesses alike.

In this section, we will explore the fundamentals of Ohio's tax structure, breaking down the different types of taxes, their rates, and how they impact residents and businesses. Get ready to uncover the key components that make up Ohio's tax landscape and gain a deeper understanding of this essential aspect of the Buckeye State's economy.

Income Tax: A Comprehensive Overview

Ohio's income tax is a critical component of the state's revenue stream. It is imposed on various sources of income, including wages, salaries, business profits, and investment earnings. Understanding the income tax structure is essential for individuals and businesses to ensure compliance and optimize their tax strategies.

The income tax rate in Ohio varies based on income brackets. As of [current year], the state's income tax rates range from [lowest rate]% to [highest rate]%, with different thresholds for single filers, married couples filing jointly, and head of household filers. These rates are subject to change, so it's important to stay updated with the latest tax laws.

To illustrate the impact of Ohio's income tax, let's consider an example. Imagine a single filer with an annual income of $50,000. Based on the current tax brackets, they would fall into the [appropriate tax bracket] and be subject to a tax rate of [applicable rate]%. Using a simple calculation, we can estimate their income tax liability to be approximately [estimated tax liability] for the year.

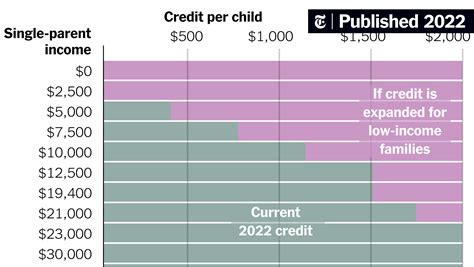

However, it's important to note that Ohio offers various deductions and credits that can reduce taxable income. These include deductions for dependent children, education expenses, and certain medical costs. Additionally, Ohio provides tax credits for research and development, job creation, and energy efficiency initiatives, encouraging economic growth and innovation.

| Tax Bracket | Tax Rate | Threshold (Single Filers) |

|---|---|---|

| Bracket 1 | [Rate 1]% | $0 - $5,000 |

| Bracket 2 | [Rate 2]% | $5,001 - $10,000 |

| ... | ... | ... |

| Bracket 10 | [Rate 10]% | $100,000 and above |

Sales and Use Tax: A Dynamic System

Ohio's sales and use tax is a vital source of revenue for the state, impacting both consumers and businesses. The sales tax is imposed on the sale of tangible personal property and certain services, while the use tax applies to purchases made outside of Ohio but used or consumed within the state.

The sales and use tax rate in Ohio is [current rate]%, which is a state-wide uniform rate. However, local jurisdictions within Ohio may impose additional sales taxes, resulting in a combined rate that varies across the state. For example, in the city of Columbus, the sales tax rate is [Columbus sales tax rate]%, with an additional [local jurisdiction rate]% applied in certain areas.

To illustrate the impact of sales tax, let's consider a common purchase: a new laptop. If you purchase a laptop priced at $1,000 in Columbus, you would pay a sales tax of approximately [estimated sales tax] based on the combined sales tax rate. This showcases how sales tax can significantly affect the final cost of goods and services.

Ohio's sales tax also applies to certain digital products and services, such as streaming subscriptions and software downloads. This ensures that the state's revenue remains dynamic and adapts to the evolving nature of commerce.

Businesses operating in Ohio must register for a sales tax permit and collect the appropriate taxes from customers. Failure to comply with sales tax regulations can result in penalties and interest charges. It is crucial for businesses to stay informed about their sales tax obligations and accurately report and remit the collected taxes to the state.

Property Tax: Assessing Real Estate and Personal Property

Property tax is a significant aspect of Ohio's tax system, impacting homeowners, landowners, and businesses alike. It is a tax levied on real estate and certain types of personal property, with rates varying across different counties and municipalities.

The property tax rate in Ohio is determined by a combination of factors, including the assessed value of the property and the tax rates set by local governments. The assessed value is typically based on the property's fair market value, with periodic reassessments conducted to ensure accuracy.

For example, let's consider a residential property located in Franklin County. If the property has an assessed value of $200,000, and the tax rate is [Franklin County tax rate]%, the annual property tax liability would be approximately [estimated property tax liability] for the year. This calculation takes into account the assessed value and the applicable tax rate, providing an estimate of the property owner's tax obligation.

Ohio offers various property tax exemptions and abatements to encourage economic development and support certain sectors. These include exemptions for agricultural land, senior citizens, and veterans. Additionally, the state provides property tax relief programs, such as the Homestead Exemption, which reduces property taxes for eligible homeowners.

Businesses operating in Ohio are also subject to property taxes on their commercial properties. The tax rate for commercial properties may differ from residential properties, and it is essential for businesses to understand their tax obligations and ensure timely payment to avoid penalties.

Ohio State Tax Calculation: Tools and Resources

Calculating Ohio state taxes can be a complex process, but fortunately, there are various tools and resources available to simplify the task. In this section, we will explore some of the most reliable and user-friendly options to assist you in accurately determining your tax liability.

Online Tax Calculators: A Convenient Solution

Online tax calculators are a popular choice for individuals and businesses seeking a quick and convenient way to estimate their tax obligations. These calculators often provide a user-friendly interface, allowing users to input their income, deductions, and other relevant information to generate an estimated tax liability.

One highly recommended online tax calculator for Ohio residents and businesses is the Ohio Department of Taxation's Official Calculator. This calculator is designed to provide accurate and up-to-date tax estimates based on the latest tax laws and regulations. It covers various tax types, including income tax, sales tax, and estimated tax payments.

To use the Ohio Department of Taxation's calculator, simply visit their official website and navigate to the tax calculator page. You will be prompted to input your income, deductions, and any applicable credits. The calculator will then generate a detailed estimate of your tax liability, including a breakdown of the different tax components.

Online tax calculators like this one are particularly useful for individuals who prefer a DIY approach to tax calculations. They offer a convenient and accessible way to estimate taxes without the need for extensive tax knowledge or professional assistance.

Tax Software: Precision and Efficiency

For those seeking a more comprehensive and accurate approach to tax calculation, tax software is an excellent option. Tax software programs offer a range of features and capabilities, allowing users to input their financial information and generate precise tax calculations.

One highly regarded tax software for Ohio taxpayers is [Tax Software Name]. This software is designed specifically for Ohio residents and businesses, ensuring compliance with the state's tax laws and regulations. It offers a user-friendly interface, intuitive navigation, and a wide range of tax calculation tools.

[Tax Software Name] provides features such as automatic data import from financial institutions, customizable tax forms, and advanced tax planning capabilities. It supports various tax scenarios, including income tax, sales tax, property tax, and business tax calculations. The software also offers real-time updates on tax laws and regulations, ensuring users have the most current information.

By utilizing tax software like [Tax Software Name], taxpayers can streamline their tax calculation process, reduce the risk of errors, and optimize their tax strategies. The software's advanced features and precision make it a valuable tool for individuals and businesses looking for an efficient and accurate tax solution.

Professional Tax Services: Expert Guidance

While online calculators and tax software are valuable tools, some taxpayers may prefer the expertise and guidance of professional tax services. Engaging the services of a tax professional can provide personalized assistance, ensuring compliance, and optimizing tax strategies.

When seeking professional tax services in Ohio, it's crucial to choose a reputable and experienced tax advisor or firm. Look for professionals who specialize in Ohio state taxes and have a strong understanding of the local tax landscape. They should be able to provide comprehensive tax planning, preparation, and filing services.

Tax professionals can offer a range of benefits, including personalized tax strategies tailored to your unique circumstances, assistance with complex tax situations, and representation in case of audits or tax disputes. They can also provide ongoing support and guidance throughout the tax season and beyond.

When selecting a tax professional, consider factors such as their qualifications, experience, and client testimonials. Ensure they are licensed and have a good track record of providing accurate and reliable tax services. A professional tax advisor can provide peace of mind and ensure you navigate the complex world of Ohio state taxes with confidence.

Ohio State Tax: A Dynamic Landscape

Ohio's tax system is a dynamic and evolving landscape, influenced by various factors such as economic conditions, legislative changes, and technological advancements. Understanding the future implications and potential changes in Ohio's tax structure is crucial for individuals and businesses to stay ahead and adapt their tax strategies accordingly.

Economic Factors and Tax Revenue

Ohio's tax revenue is closely tied to the state's economic performance. During periods of economic growth and prosperity, tax revenue tends to increase as businesses and individuals experience higher incomes and increased consumption. This leads to a positive impact on the state's budget and funding for essential services.

Conversely, economic downturns and recessions can result in decreased tax revenue. During these times, businesses may face financial challenges, leading to reduced profits and lower tax obligations. Individuals may also experience reduced incomes, impacting their tax liability. As a result, the state may face budgetary constraints and prioritize tax reforms to stabilize revenue streams.

To mitigate the impact of economic fluctuations, Ohio has implemented various tax policies and incentives. These include tax credits for job creation, research and development, and business expansion. By encouraging economic growth and attracting investments, the state aims to maintain a stable tax base and promote long-term prosperity.

Legislative Changes and Tax Reforms

Ohio's tax system is subject to legislative changes and reforms, which can significantly impact taxpayers. Over the years, Ohio has implemented various tax reforms to address budget deficits, promote economic development, and simplify the tax code.

For example, in recent years, Ohio has implemented tax reforms aimed at reducing income tax rates and broadening the tax base. These reforms have included changes to tax brackets, deductions, and credits, impacting individuals and businesses differently. It is crucial for taxpayers to stay informed about these legislative changes to ensure compliance and optimize their tax planning.

Ohio's legislative body, the Ohio General Assembly, plays a vital role in shaping the state's tax policies. They review and propose tax reforms, considering factors such as economic growth, fairness, and revenue generation. By actively engaging with the legislative process, taxpayers can provide input and influence the direction of tax policies that affect their livelihoods.

Technological Advancements and Tax Compliance

Technological advancements have revolutionized the way Ohio's tax system operates, enhancing compliance and efficiency. The state has embraced digital technologies to streamline tax processes, improve taxpayer services, and combat tax evasion.

One notable technological advancement is the implementation of electronic filing systems. Ohio taxpayers can now file their tax returns online, reducing paperwork and simplifying the filing process. Electronic filing systems offer real-time updates, instant confirmation of receipt, and improved accuracy, making tax filing more convenient and efficient.

Additionally, Ohio has leveraged technology to enhance tax compliance and enforcement. The state utilizes data analytics and advanced software to identify potential tax evasion and non-compliance. By analyzing patterns and anomalies, tax authorities can target specific areas and industries, ensuring a fair and equitable tax system.

As technology continues to advance, Ohio is likely to further integrate digital solutions into its tax system. This includes exploring blockchain technology for secure and transparent record-keeping, implementing artificial intelligence for enhanced tax audits, and developing user-friendly tax administration platforms.

Frequently Asked Questions

How often does Ohio update its tax laws and regulations?

+

Ohio’s tax laws and regulations are subject to periodic updates and amendments. The Ohio General Assembly regularly reviews and proposes changes to the tax code, taking into account economic conditions, budgetary needs, and taxpayer feedback. It is important for taxpayers to stay informed about these updates to ensure compliance with the latest tax requirements.

Are there any tax incentives or credits available for businesses in Ohio?

+

Yes, Ohio offers a range of tax incentives and credits to attract and support businesses. These include tax credits for job creation, research and development, and energy efficiency initiatives. Businesses can take advantage of these incentives to reduce their tax liability and promote economic growth. It is advisable to consult with a tax professional or refer to the Ohio Department of Taxation’s website for detailed information on available incentives.

How can I stay updated with Ohio’s tax deadlines and due dates?

+

To stay updated with Ohio’s tax deadlines and due dates, it is recommended to regularly visit the Ohio Department of Taxation’s official website. The website provides a comprehensive calendar of tax deadlines, including due dates for income tax returns, sales tax filings, and other tax-related obligations. Additionally, you can subscribe to their newsletter or follow their social media channels for timely updates and reminders.