Sales Tax In Va

Understanding sales tax in Virginia is crucial for both businesses and consumers alike. In the Commonwealth of Virginia, sales tax is a vital component of the state's revenue generation and economic framework. It plays a significant role in funding essential public services and infrastructure projects. This article aims to provide a comprehensive guide to sales tax in Virginia, covering its rates, exemptions, and the impact it has on the state's economy.

Sales Tax Rates in Virginia

Virginia’s sales and use tax is a key revenue source for the state, contributing to its overall financial stability. The state imposes a standard sales tax rate of 4.3%, which is applicable to most retail sales, leases, or rentals of tangible personal property, as well as certain services. However, it’s important to note that this base rate is just the beginning, as various localities across Virginia may opt to levy additional taxes, resulting in varying effective sales tax rates throughout the state.

These locality-specific tax rates are often referred to as local sales and use taxes or special district taxes. They are typically imposed to fund specific projects or initiatives within a particular region. As a result, the total sales tax rate a consumer pays can vary significantly depending on their location. For instance, in the city of Norfolk, the total sales tax rate stands at 7.0%, while in the town of Blacksburg, it's 5.3%. These rates are subject to change periodically as local governments adjust their fiscal strategies.

| Locality | Local Sales Tax Rate |

|---|---|

| Arlington County | 1.0% |

| Fairfax County | 0.75% |

| City of Alexandria | 0.75% |

| City of Chesapeake | 1.0% |

| City of Norfolk | 2.7% |

Understanding these local variations is essential for businesses operating in multiple regions within Virginia. It allows them to accurately calculate and remit sales taxes, ensuring compliance with state and local regulations. For consumers, being aware of these rates can influence purchasing decisions, especially when comparing prices across different localities.

Exemptions and Special Cases

While the standard sales tax rate of 4.3% applies to most transactions, Virginia does provide certain exemptions and special considerations. These are designed to support specific industries, promote economic development, and assist vulnerable populations.

For instance, groceries are exempt from sales tax in Virginia, providing a significant savings for families and individuals. Additionally, certain manufacturing equipment and machinery used in the production process are also exempt, encouraging investment in Virginia's industrial sector. Moreover, qualified rehabilitative services for individuals with disabilities are exempt, demonstrating the state's commitment to inclusivity and accessibility.

Other notable exemptions include sales of prescription drugs, agricultural equipment, and certain types of software. These exemptions vary based on specific criteria and are subject to regular review by the Virginia Department of Taxation.

Impact on Virginia’s Economy

Sales tax is a significant driver of Virginia’s economy, contributing to its overall financial health and stability. In fiscal year 2022, sales and use taxes accounted for approximately 29.5% of the state’s total revenue, highlighting its importance as a revenue stream.

The funds generated through sales tax are vital for maintaining and improving Virginia's infrastructure, including roads, bridges, and public transportation systems. They also support vital public services such as education, healthcare, and public safety. For instance, a portion of the sales tax revenue is dedicated to funding the Virginia Transportation Trust Fund, which finances critical transportation projects across the state.

Furthermore, sales tax plays a key role in supporting local economies. By imposing additional local sales taxes, localities can generate revenue for specific projects or initiatives that benefit their communities directly. This localized approach to taxation allows for a more tailored and responsive approach to economic development and public service provision.

E-commerce and Remote Sellers

With the rise of e-commerce, Virginia, like many other states, has had to adapt its sales tax regulations to ensure fairness and compliance in the digital marketplace. The Virginia Department of Taxation has implemented various measures to address the challenges posed by online sales, particularly from out-of-state sellers.

One significant development is the Economic Nexus rule, which requires remote sellers who meet certain sales thresholds to collect and remit sales tax on transactions with Virginia consumers. This rule ensures that online retailers contribute fairly to the state's revenue stream, just as their brick-and-mortar counterparts do.

Additionally, Virginia has implemented a Marketplace Facilitator Law, which holds online marketplace operators responsible for collecting and remitting sales tax on behalf of their third-party sellers. This law streamlines the sales tax collection process for both the state and the marketplace platforms, enhancing compliance and ensuring a level playing field for all sellers.

Compliance and Enforcement

Ensuring compliance with Virginia’s sales tax regulations is a critical responsibility for both businesses and individuals. The Virginia Department of Taxation takes a proactive approach to enforcement, utilizing various tools and resources to monitor compliance and address any instances of non-compliance.

For businesses, this means maintaining accurate records of sales transactions, including the collection and remittance of sales tax. Regular audits by the Department of Taxation help to ensure that businesses are meeting their tax obligations accurately and in a timely manner. Non-compliance can result in penalties, interest charges, and legal consequences.

Individuals also have a role to play in sales tax compliance. When making purchases, especially online, it's important to be aware of the applicable sales tax rates and ensure that the seller is properly collecting and remitting the tax. This not only ensures a fair playing field for all businesses but also contributes to the overall financial health of the state.

How often are sales tax rates reviewed and adjusted in Virginia?

+

Sales tax rates in Virginia are subject to periodic reviews and adjustments by both the state and local governments. While the state sales tax rate has remained stable at 4.3% for several years, local governments have the authority to adjust their rates based on their fiscal needs and priorities. These changes can occur annually or at any time, depending on the locality’s specific circumstances.

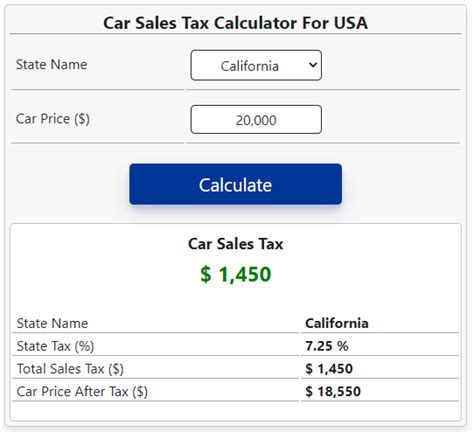

Are there any online resources to help businesses calculate and remit sales tax in Virginia?

+

Yes, the Virginia Department of Taxation provides an online Sales and Use Tax Calculator tool. This calculator helps businesses estimate the total sales tax applicable to a transaction based on the location of the sale. It considers both the state and local sales tax rates, making it a valuable resource for businesses operating in multiple localities.

What happens if a business fails to collect and remit sales tax in Virginia?

+

Non-compliance with sales tax regulations can result in serious consequences for businesses in Virginia. The Virginia Department of Taxation has the authority to impose penalties, interest charges, and even criminal charges for severe cases of non-compliance. It’s essential for businesses to stay informed about their tax obligations and seek professional advice if needed.

Are there any initiatives to simplify the sales tax system in Virginia for small businesses?

+

Yes, Virginia has implemented several initiatives to support small businesses in their sales tax compliance efforts. For instance, the Small Business Sales Tax Simplification Act of 2017 streamlined the registration and filing process for small businesses, making it easier for them to understand and meet their tax obligations. Additionally, the state provides various resources and workshops to educate small business owners about sales tax regulations.

How does Virginia handle sales tax for online purchases made by its residents from out-of-state sellers?

+

Virginia has implemented several measures to address the collection of sales tax from out-of-state sellers, particularly in the context of e-commerce. The Economic Nexus rule requires remote sellers who meet certain sales thresholds to collect and remit sales tax on transactions with Virginia consumers. Additionally, the Marketplace Facilitator Law holds online marketplace operators responsible for collecting and remitting sales tax on behalf of their third-party sellers, ensuring compliance with Virginia’s sales tax regulations.