Hawaii Real Property Tax

In the enchanting islands of Hawaii, real estate is not just a commodity but a cherished way of life. The Hawaii real property tax system plays a crucial role in shaping the real estate landscape, impacting homeowners, investors, and the vibrant communities that call these islands home. This comprehensive guide delves into the intricacies of Hawaii's real property tax, offering an in-depth analysis of its structure, rates, exemptions, and the unique challenges it presents.

Understanding Hawaii’s Real Property Tax Landscape

Hawaii’s real property tax, a fundamental part of the state’s revenue generation, is levied on both residential and commercial properties. The assessment and collection of this tax are overseen by the Department of Taxation, with each of Hawaii’s four counties administering and collecting the tax locally. This decentralized approach ensures a tailored and efficient tax system, reflecting the diverse needs of each county.

Assessment and Valuation Process

The real property tax assessment in Hawaii is based on the property’s market value, which is determined by the County Assessor. The valuation process considers factors such as location, size, improvements, and recent sales of similar properties. This market-based approach ensures that property owners pay taxes commensurate with their property’s worth.

The County Assessor's office typically conducts a full reassessment every two years, with an interim review in the intervening year. This process ensures that property values remain current and that the tax burden is distributed fairly among property owners.

| County | Assessment Cycle |

|---|---|

| Hawaii County | Even-numbered years (e.g., 2022, 2024) |

| Maui County | Odd-numbered years (e.g., 2023, 2025) |

| Kauai County | Odd-numbered years (e.g., 2023, 2025) |

| Honolulu County | Even-numbered years (e.g., 2022, 2024) |

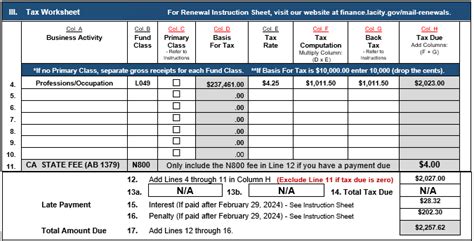

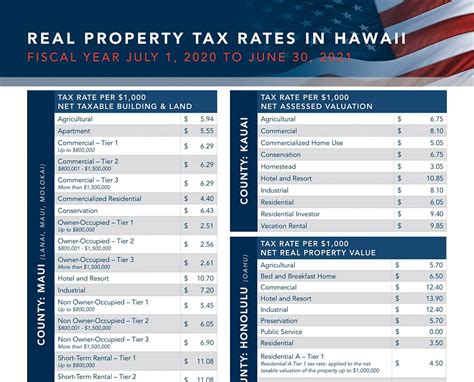

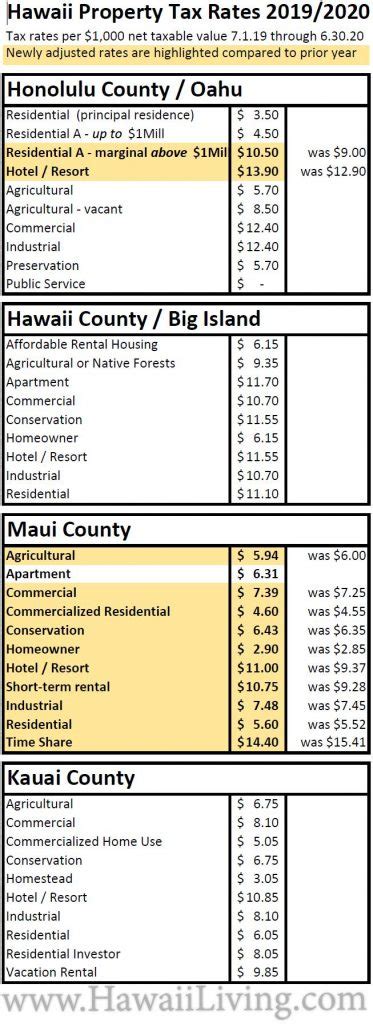

Real Property Tax Rates and Calculations

Hawaii’s real property tax rates vary across counties and are determined by the County Council or Board of Supervisors of each respective county. These rates are applied to the assessed value of the property, with the tax bill calculated by multiplying the assessed value by the applicable tax rate.

As of 2023, the real property tax rates in Hawaii range from approximately 0.25% to 0.45%, depending on the county. For instance, Honolulu County has a general real property tax rate of 0.37%, while Maui County levies a rate of 0.28%. These rates can change annually, reflecting the county's budgetary needs and local economic conditions.

It's important to note that Hawaii also imposes an excise tax on the conveyance of real property, which is typically paid by the buyer and is calculated as a percentage of the property's sale price. This excise tax is separate from the annual real property tax and is a one-time cost incurred upon the transfer of ownership.

Exemptions and Credits: Navigating Tax Relief in Hawaii

Hawaii offers a range of exemptions and credits designed to alleviate the tax burden on certain property owners. These provisions are aimed at supporting homeowners, protecting natural resources, and promoting community development.

Homestead Exemption

The Homestead Exemption is a key provision in Hawaii’s real property tax system, providing relief to homeowners who occupy their property as their primary residence. This exemption reduces the assessed value of the property by a specified amount, thereby lowering the property tax liability.

To qualify for the Homestead Exemption, homeowners must meet certain residency and ownership requirements. The exemption amount varies across counties, with some counties offering a standard exemption while others provide additional benefits for elderly or disabled homeowners.

| County | Homestead Exemption Amount |

|---|---|

| Hawaii County | $100,000 |

| Maui County | $120,000 |

| Kauai County | $100,000 |

| Honolulu County | $100,000 |

Other Exemptions and Credits

In addition to the Homestead Exemption, Hawaii offers a variety of other tax relief measures, including:

- Agricultural Lands Exemption: Properties used for agricultural purposes may qualify for a reduced tax rate or exemption, encouraging the preservation of agricultural lands.

- Green Space Exemption: This exemption applies to properties designated as green spaces or conservation areas, promoting the protection of Hawaii's natural environment.

- Senior Citizen Exemption: Elderly homeowners may be eligible for additional exemptions or credits, helping to make housing more affordable for Hawaii's senior population.

- Disabled Veteran Exemption: Veterans with service-connected disabilities may qualify for a property tax exemption, providing financial support to those who have served our country.

Challenges and Considerations in Hawaii’s Real Property Tax System

While Hawaii’s real property tax system offers a range of benefits and exemptions, it also presents unique challenges. The state’s dynamic real estate market, characterized by rising property values and a limited land area, poses complexities for both taxpayers and tax administrators.

Impact of Rising Property Values

Hawaii’s real estate market has experienced significant growth over the past decade, with property values increasing at a rapid pace. This growth has positive implications for the state’s economy but also presents challenges in terms of tax assessments and affordability.

As property values rise, so do the assessed values for tax purposes. This can lead to higher tax bills for homeowners, even if their property's physical characteristics remain unchanged. To address this issue, Hawaii has implemented assessment caps, which limit the amount by which a property's assessed value can increase in a given year.

Assessment caps provide stability for taxpayers, ensuring that their tax liability does not increase disproportionately. However, they also present challenges for local governments, as they may limit the revenue generated from real property taxes, impacting the funding of essential services and infrastructure projects.

Limited Land and Affordable Housing

Hawaii’s unique geography, with its volcanic origins and limited land area, presents challenges in terms of land use and housing affordability. The state’s real property tax system plays a role in shaping the housing market and the availability of affordable housing options.

High property values and limited land availability can drive up the cost of housing, making it difficult for locals to purchase homes. This situation is further exacerbated by the state's thriving tourism industry, which attracts investors and second homeowners, potentially displacing local residents from the housing market.

To address these challenges, Hawaii has implemented measures such as inclusionary zoning and affordable housing incentives. These policies aim to encourage the development of affordable housing units and ensure that a portion of new housing developments are reserved for local residents.

Conclusion

Hawaii’s real property tax system is a critical component of the state’s fiscal landscape, impacting homeowners, investors, and the overall economic health of the islands. This comprehensive guide has explored the assessment and valuation process, tax rates, exemptions, and the unique challenges faced by Hawaii’s real property tax system.

By understanding the intricacies of Hawaii's real property tax, individuals and businesses can make informed decisions about real estate ownership and investment in the Aloha State. As Hawaii continues to evolve and adapt to the changing needs of its residents and the real estate market, the real property tax system will remain a key consideration for all stakeholders.

Frequently Asked Questions

How often are real property taxes assessed in Hawaii?

+

Real property taxes in Hawaii are assessed on a biennial basis, with a full reassessment every two years. This means that property owners will receive a new assessment and tax bill approximately every two years, depending on their county’s assessment cycle.

Are there any ways to reduce my real property tax bill in Hawaii?

+

Yes, Hawaii offers several exemptions and credits that can help reduce your real property tax bill. These include the Homestead Exemption, Agricultural Lands Exemption, and various senior citizen and disabled veteran exemptions. It’s important to review the eligibility criteria and apply for these benefits if you qualify.

What happens if I disagree with my property’s assessed value in Hawaii?

+

If you believe your property’s assessed value is inaccurate, you have the right to appeal. The process involves filing an appeal with your county’s Board of Review, providing evidence to support your claim. It’s advisable to consult with a tax professional or attorney to guide you through the appeal process.

How are real property tax rates determined in Hawaii?

+

Real property tax rates in Hawaii are set by the County Council or Board of Supervisors of each respective county. These rates are determined based on the county’s budgetary needs, the assessed value of properties, and other factors such as the cost of providing essential services and maintaining infrastructure.

Are there any tax incentives for green spaces or conservation areas in Hawaii?

+

Yes, Hawaii offers the Green Space Exemption, which applies to properties designated as green spaces or conservation areas. This exemption encourages the protection of Hawaii’s natural environment by reducing the tax burden on these properties. To qualify, the property must meet specific criteria and be properly designated as a green space or conservation area.