Understanding the Purpose of Negative Income Tax in Modern Economics

In recent decades, the discourse around social safety nets and equitable economic policies has intensified, foregrounding mechanisms like the Negative Income Tax (NIT) as pivotal tools in addressing income inequality and poverty. Unlike traditional welfare systems, the NIT offers a streamlined, universally accessible approach to income redistribution, aiming to provide a guaranteed minimum income while reducing administrative complexity. As economies grapple with escalating disparities and the need for adaptable social policies, understanding the nuanced role of the Negative Income Tax within modern economic frameworks becomes imperative for policymakers, economists, and social advocates alike.

Fundamental Concept and Historical Context of Negative Income Tax

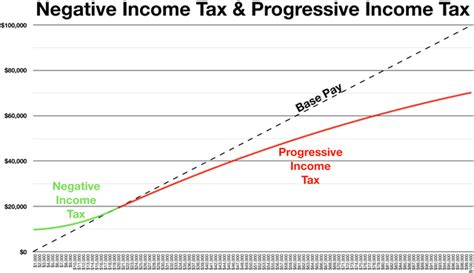

The Negative Income Tax (NIT) is an advanced form of income redistribution policy designed to supplement the income of individuals whose earnings fall below a specified threshold. Conceptually, it functions as a reverse tax mechanism: instead of paying to the government, low-income earners receive direct cash transfers that gradually taper off as their income increases. This system’s roots can be traced back to the mid-20th century, with economist Milton Friedman popularizing the concept in his 1962 book, Capitalism and Freedom, as a practical alternative to complex welfare programs. The core idea challenged the traditional welfare state model by proposing an automatically phase-in or phase-out subsidy, minimizing stigma and administrative burdens.

Historical evolution and pilot implementations

From the 1960s through the 1980s, several pilot programs in the United States, Canada, and other countries tested the efficacy of NIT-like schemes. Notably, the Manitoba Family Allowance Supplement in Canada and the Stockton Economic Empowerment Demonstration in California provided empirical data on how NIT influences labor participation, poverty alleviation, and administrative costs. These experiments demonstrated that a well-structured NIT could reduce poverty rates without discouraging work, countering early fears of “welfare trap” effects. Modern iterations leverage digital payment systems, enabling more precise targeting and reducing leakages, thus aligning with contemporary technological capabilities in public policy implementation.

Mechanics and Operational Framework of Modern Negative Income Tax Systems

The operational principle centers on defining a basic income threshold—above which individuals or households pay taxes normally and below which they receive a subsidy. The calculation typically follows a formula: for example, the NIT equals the difference between a fixed income guarantee and the beneficiary’s actual income. This system effectively functions as a negative tax rate on low incomes, encouraging labor market participation while ensuring a safety net.

Key parameters and variables

Several critical parameters shape the design of an NIT program, including:

- Income threshold (or breakpoint): the income level below which the subsidy begins.

- Phase-in rate: the rate at which benefits increase as income decreases.

- Phase-out rate: the rate at which benefits decline as income approaches or exceeds the threshold.

- Maximum benefit: the upper limit of the subsidy provided for individuals with zero income.

| Parameter | Typical Range | Implications |

|---|---|---|

| Income threshold | $10,000–$20,000 (per annum) | Defines eligibility and target severity of support |

| Phase-in rate | 20–50% | Affects the incentivization of earning additional income |

| Phase-out rate | 50–70% | Balancing act between discouraging additional work and preventing significant benefit cliff effects |

Advantages of Negative Income Tax: Promoting Equity and Economic Flexibility

Among the most compelling advocacy points for NIT is its potential to simplify and unify social welfare administration. Unlike multi-program systems that distribute benefits based on complex eligibility criteria, the NIT offers a universal framework adaptable across diverse economic contexts. Furthermore, this uniform approach diminishes bureaucratic overhead, reduces administrative costs, and mitigates eligibility stigma, cultivating higher participation rates among beneficiaries.

Enhanced work incentives and economic participation

Empirical studies suggest that a properly implemented NIT can incentivize employment among recipients. For instance, a 2018 randomized controlled trial in Ontario noted that recipients of a guaranteed minimum income experienced increased labor market attachment compared to traditional welfare beneficiaries, primarily because the tapering structure eliminated benefit cliffs. This dynamic supports economic dynamism, especially in times of labor market transition or technological displacement.

Addressing income inequality and poverty alleviation

By providing a guaranteed income floor, NIT directly confronts income inequality, which critics argue, hampers social mobility and fosters economic marginalization. Data indicates that such schemes can halve child poverty rates in pilot areas and improve adult self-sufficiency by reducing financial distress, thus fostering healthier communities and reducing long-term social costs.

Limitations, Challenges, and Critiques of Negative Income Tax Implementation

Despite its apparent benefits, implementing an NIT is not without complications. Critics point to concerns such as inflationary pressures, distortions in work effort, fiscal sustainability, and political feasibility.

Fiscal sustainability dilemmas

Funding an expansive NIT requires significant public expenditure, often estimated to run into hundreds of billions annually in large economies. While some argue that restructured tax policies, such as higher marginal tax rates on the wealthy, can offset these costs, the political resilience of tax reform remains uncertain.

Work disincentive concerns

Though empirical data largely refutes the notion of widespread work disincentives, critics fear the potential for beneficiaries to reduce labor effort, especially with generous benefits coupled with high phase-out rates. These effects could undermine productivity and economic growth if poorly calibrated.

Technical and administrative hurdles

Implementing a precision-based NIT requires robust data infrastructure, real-time income verification, and integration with existing tax systems. Privacy concerns and technological disparities across regions can impede seamless adoption, especially in developing economies.

| Key Challenge | Potential Mitigation Strategy |

|---|---|

| Fiscal sustainability | Gradual phased implementation coupled with tax reforms favoring progressive taxation |

| Work disincentives | Careful calibration of phase-in and phase-out rates; integrating work incentives within benefit formulas |

| Administrative complexity | Leveraging digital payment and income reporting systems; pilot testing before large-scale deployment |

Comparative Analysis: Negative Income Tax versus Universal Basic Income

While both NIT and Universal Basic Income (UBI) aim to provide income security, their operational philosophies diverge notably. UBI offers a flat, unconditional grant, simplifying delivery but risking fiscal strain if set excessively high. Conversely, NIT’s conditionality based on income level promotes targeted assistance, potentially offering better fiscal control and work incentives.

Complementarity and hybrid models

Some economies explore hybrid schemes combining elements of NIT and UBI, seeking the universality of unconditional cash transfers with the targeted efficiency of income-based subsidies. For instance, a fixed UBI supplemented with NIT-like adjustments for targeted groups could harness the advantages of both systems, fostering robust social safety nets adaptable to economic shifts.

Key Points

- Targeted social support: NIT can precisely address income deficits while maintaining work incentives.

- Cost and fiscal planning: Calibrated parameters are crucial for sustainable implementation.

- Technological integration: Digital systems are vital to effective rollout and monitoring.

- Political viability: Consensus-building and transparent policy design underpin success.

- Context-specific adaptation: Regional economic conditions shape program parameters for maximum impact.

Conclusion: Strategic Positioning of Negative Income Tax in Modern Welfare State Architecture

As economies confront entrenched disparities and the need for resilient social protection mechanisms, the Negative Income Tax emerges as a compelling candidate for reform. Its capacity to unify social support, incentivize work, and adapt to technological innovations makes it particularly relevant in the 21st century. Nonetheless, its adoption necessitates meticulous calibration, technological modernization, and political will. In weaving NIT into broader economic and social policies, governments can craft a more inclusive, efficient, and adaptable approach to poverty alleviation that aligns with evolving societal aspirations and fiscal realities.

How does a Negative Income Tax differ from traditional welfare programs?

+Unlike traditional welfare programs, which often involve multiple eligibility criteria and complex administrative processes, NIT provides a straightforward, income-based cash transfer that automatically adjusts based on earnings, reducing bureaucracy and stigma.

Can Negative Income Tax discourage people from working?

+Empirical evidence indicates that with properly calibrated phase-in and phase-out rates, NIT can actually encourage work by removing benefit cliffs. Overly generous benefits or high phase-out rates, however, could pose disincentive risks if not carefully managed.

What are the primary challenges in implementing a Negative Income Tax?

+Major challenges include ensuring fiscal sustainability, establishing robust data systems for income verification, and navigating political and public acceptance. These require careful planning and technological infrastructure development.