Tax Filing For Active Military

For those serving in the United States military, tax filing can present unique challenges and considerations. Active military personnel, whether stationed domestically or abroad, have distinct circumstances that impact their tax obligations and strategies. This comprehensive guide aims to provide an in-depth analysis of tax filing for active military members, offering practical insights and strategies to navigate the complex world of military taxation.

Understanding Military Tax Benefits and Challenges

Active military personnel face a range of tax-related complexities due to their unique service circumstances. These include:

- Deployment and Combat Pay: Military members may receive special pay and allowances while deployed, which can impact their taxable income. Understanding how these payments are taxed is crucial.

- Military Housing Allowances: BAH (Basic Allowance for Housing) and similar allowances can affect tax liability. Knowing how these are treated by the IRS is essential for accurate tax filing.

- Tax Residency: Determining tax residency can be complex for military members with frequent moves. Understanding the rules for establishing residency and avoiding double taxation is vital.

- Military Retirement Pay: For those eligible, military retirement pay has specific tax considerations, including potential tax advantages.

Additionally, military personnel often have access to unique tax benefits and credits, such as the Armed Forces Tax Credit and the Survivor Benefit Plan, which can significantly reduce tax liability. However, navigating these benefits requires a thorough understanding of the complex tax code.

Tax Strategies for Active Military

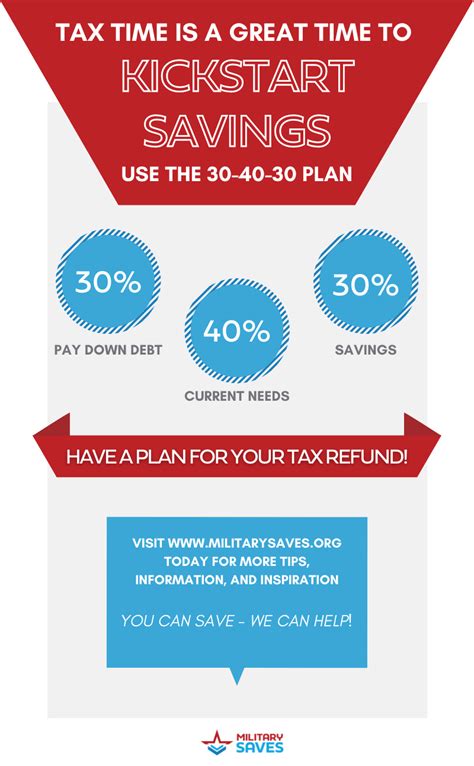

Developing effective tax strategies is key for active military members to optimize their financial outcomes. Here are some strategies to consider:

Maximizing Deductions and Credits

Active military personnel have access to a range of deductions and credits, including:

- Moving Expenses: Military members often incur significant moving costs. Deducting these expenses can reduce taxable income.

- Combat Zone Exclusion: Pay earned while serving in a combat zone may be exempt from federal income tax. Understanding the requirements and limits is essential.

- Education Credits: Military personnel and their families may be eligible for education credits, such as the American Opportunity Tax Credit, which can significantly reduce tax liability.

- Child and Dependent Care Credits: These credits can help offset the cost of childcare, providing valuable tax savings.

Strategically utilizing these deductions and credits can result in substantial tax savings.

Filing Status and Dependency Exemptions

Choosing the right filing status is crucial for military members. Options include Single, Married Filing Jointly, Married Filing Separately, or Head of Household. Each status has different tax implications, and understanding which is most beneficial can save money.

Additionally, military members may be able to claim dependents, which can provide significant tax advantages. Dependency exemptions and credits can reduce taxable income and lower tax liability.

Retirement Planning and Tax Strategies

For those approaching retirement, tax planning becomes even more critical. Military retirement pay has specific tax considerations, and understanding these can help optimize financial outcomes.

Strategies may include:

- Traditional vs. Roth Retirement Accounts: Choosing the right type of retirement account can have significant tax implications. Understanding the differences and potential benefits is essential.

- Tax-Efficient Withdrawal Strategies: Developing a plan for withdrawing retirement funds can minimize tax liability and maximize after-tax income.

- Military Pension and Social Security: Military pensions and Social Security benefits have unique tax rules. Understanding these can help avoid unexpected tax surprises.

Navigating International Tax Considerations

Military members stationed overseas face additional tax complexities. These include:

- Foreign Earned Income Exclusion: The Foreign Earned Income Exclusion allows military members serving abroad to exclude a certain amount of income from taxation. Understanding the limits and requirements is crucial.

- Tax Treaties: The US has tax treaties with many countries, which can impact tax liability. Knowing the specific treaty provisions is essential for accurate tax filing.

- Foreign Housing Exclusion: Similar to the BAH exclusion in the US, the Foreign Housing Exclusion can reduce taxable income for those serving abroad.

Navigating these international tax considerations requires a deep understanding of both US and foreign tax laws, and seeking professional guidance is often beneficial.

Resources and Professional Assistance

Given the complexity of military taxation, seeking professional assistance is often advisable. Military-specific tax preparers and financial advisors can provide invaluable guidance and ensure accurate tax filing.

Additionally, military personnel have access to a range of resources, including:

- Military OneSource: A comprehensive resource offering financial guidance and tax assistance specifically for military members and their families.

- Tax Preparation Assistance: Many military bases offer free tax preparation assistance during tax season, provided by trained volunteers.

- Military Spouse Tax Benefits: Spouses of active military members may be eligible for unique tax benefits, such as the Military Spouse Career Advancement Account (MyCAA) program.

Conclusion

Tax filing for active military personnel is a complex process, but with the right strategies and resources, it can be effectively managed. By understanding the unique tax benefits and challenges, military members can optimize their financial outcomes and ensure compliance with tax laws. Whether stationed domestically or abroad, seeking professional guidance and utilizing military-specific resources can provide invaluable support throughout the tax filing process.

Can military members claim the Standard Deduction or is it better to itemize deductions?

+Whether to claim the Standard Deduction or itemize deductions depends on individual circumstances. If military members have significant expenses that qualify as itemized deductions, such as medical costs, charitable donations, or mortgage interest, it may be beneficial to itemize. However, if their deductions are relatively low, claiming the Standard Deduction can be simpler and provide a basic tax benefit.

Are there any special tax considerations for military spouses?

+Yes, military spouses may be eligible for unique tax benefits. For example, the Military Spouse Career Advancement Account (MyCAA) program provides tax-free funding for education and career training. Additionally, military spouses may be able to claim the Spousal IRA deduction, which can help reduce taxable income and save for retirement.

What is the Foreign Earned Income Exclusion, and how does it work for military members stationed overseas?

+The Foreign Earned Income Exclusion allows US citizens living and working abroad to exclude a certain amount of their foreign-earned income from US taxation. For military members, this exclusion can significantly reduce their tax liability. The exclusion amount is adjusted annually and applies to earned income, including military pay and allowances.