Ira Withdrawal Tax Calculator

Planning for retirement is an essential aspect of financial planning, and one of the crucial decisions retirees face is determining how to withdraw funds from their Individual Retirement Accounts (IRAs) to ensure a steady income stream while also minimizing tax liabilities. The IRA Withdrawal Tax Calculator is a valuable tool designed to assist retirees in making informed decisions about their retirement finances. This comprehensive guide will delve into the intricacies of this calculator, exploring its features, benefits, and how it can help retirees navigate the complex world of IRA withdrawals and tax obligations.

Understanding the IRA Withdrawal Tax Calculator

The IRA Withdrawal Tax Calculator is an online tool developed to provide retirees with an accurate estimate of their tax liabilities when withdrawing funds from their IRA accounts. It considers various factors, including the type of IRA, withdrawal amount, age, and tax brackets, to calculate the potential tax consequences of each withdrawal scenario. This calculator aims to empower retirees by offering a clear understanding of their financial options and the associated tax implications.

Key Features of the Calculator

The IRA Withdrawal Tax Calculator boasts several features that make it an indispensable tool for retirees:

- Customizable Scenarios: Users can input their specific details, such as IRA type (Traditional, Roth, or Rollover), withdrawal amount, and expected tax bracket. This flexibility allows for precise calculations tailored to individual financial situations.

- Real-Time Tax Estimation: The calculator provides instant tax estimates, helping retirees visualize the potential impact of their withdrawal decisions. It factors in applicable taxes, such as federal income tax, state income tax (where applicable), and any early withdrawal penalties.

- Age-Based Calculations: Considering the age of the retiree is crucial, as it determines eligibility for certain tax benefits. The calculator adjusts its calculations based on the retiree’s age, accounting for early withdrawal penalties or favorable tax rates for those aged 59½ and older.

- Multiple Withdrawal Scenarios: Retirees can input various withdrawal amounts and frequencies to explore different financial strategies. This feature is particularly useful for retirees planning phased withdrawals or considering the impact of large, lump-sum distributions.

| IRA Type | Tax Implications |

|---|---|

| Traditional IRA | Withdrawals are generally taxed as ordinary income. Early withdrawals before age 59½ may incur a 10% penalty. |

| Roth IRA | Qualified distributions are tax-free, making Roth IRAs an attractive option for tax-efficient retirement planning. |

| Rollover IRA | Tax implications depend on the source of the rollover funds. A Rollover IRA can be treated similarly to a Traditional IRA or a Roth IRA, depending on the original account type. |

Benefits of Using the Calculator

The IRA Withdrawal Tax Calculator offers numerous advantages to retirees, including:

- Tax Planning: By understanding the tax consequences of their withdrawal decisions, retirees can make more informed choices, ensuring they optimize their retirement income while minimizing tax liabilities.

- Financial Strategy: The calculator allows retirees to explore different withdrawal strategies, helping them determine the most suitable approach for their financial goals and circumstances.

- Avoiding Penalties: Retirees can avoid costly early withdrawal penalties by using the calculator to assess the potential tax implications of withdrawing funds before reaching the required minimum distribution age.

- Long-Term Financial Planning: With the calculator’s ability to consider various scenarios, retirees can develop a comprehensive retirement plan, ensuring their IRA funds are managed effectively over the long term.

How to Maximize the Benefits of the IRA Withdrawal Tax Calculator

To make the most of the IRA Withdrawal Tax Calculator, retirees should consider the following steps:

- Gather Relevant Information: Before using the calculator, gather essential details, including your IRA account balance, expected withdrawal amounts, and your current and anticipated tax brackets.

- Explore Different Scenarios: Utilize the calculator’s flexibility by inputting various withdrawal amounts and frequencies. This will help you understand the tax implications of different financial strategies and make more confident decisions.

- Consult with a Financial Advisor: While the calculator provides valuable insights, it is always advisable to seek professional advice. A financial advisor can offer personalized guidance based on your unique financial situation and goals.

- Review and Adjust Your Plan: Regularly revisit your retirement plan and use the calculator to assess the impact of any changes in your financial circumstances or tax laws. This proactive approach ensures your plan remains aligned with your goals.

Real-World Applications

The IRA Withdrawal Tax Calculator has proven to be an invaluable tool for retirees in various situations. Here are a few real-world examples of how it has been utilized:

- Early Retirement: John, aged 55, plans to retire early and relies heavily on his Traditional IRA for income. Using the calculator, he discovers that he can minimize his tax burden by spreading his withdrawals over a longer period, avoiding early withdrawal penalties.

- Retirement Income Planning: Sarah, aged 62, wants to ensure her retirement income is sufficient and tax-efficient. By inputting her expected withdrawal amounts and tax bracket, the calculator helps her determine the optimal withdrawal strategy to maintain a steady income stream while minimizing taxes.

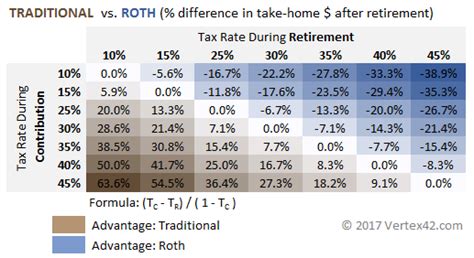

- Roth IRA Conversions: Michael, aged 45, considers converting his Traditional IRA to a Roth IRA to take advantage of tax-free withdrawals in retirement. The calculator assists him in understanding the potential tax consequences of the conversion and helps him decide if it aligns with his long-term financial goals.

Future Implications and Considerations

As retirement planning evolves, the IRA Withdrawal Tax Calculator will continue to play a crucial role in helping retirees navigate the complexities of IRA withdrawals and tax obligations. Here are some future implications and considerations:

- Changing Tax Laws: Tax laws are subject to change, and retirees must stay informed about any updates that may impact their IRA withdrawals. The calculator can be updated to reflect these changes, ensuring retirees have access to accurate and up-to-date information.

- Longevity and Health Considerations: As life expectancy increases, retirees must consider the potential need for longer-term retirement income. The calculator can assist in developing strategies to ensure IRA funds are available for an extended retirement period.

- Investment Strategy Integration: Retirees can benefit from integrating their IRA withdrawal plans with their overall investment strategy. The calculator can be a valuable tool in this process, helping retirees align their withdrawals with their investment goals and risk tolerance.

Can I use the calculator for multiple IRA accounts?

+Yes, the IRA Withdrawal Tax Calculator allows you to input information for multiple IRA accounts. This feature is especially useful for retirees with various IRA types or those who have consolidated their retirement funds.

Is the calculator suitable for all types of IRAs?

+Absolutely! The calculator is designed to work with Traditional IRAs, Roth IRAs, and Rollover IRAs. It considers the unique tax implications of each IRA type, ensuring accurate calculations for your specific situation.

Can I save my calculations for future reference?

+Yes, the calculator provides an option to save your calculations, allowing you to revisit and compare different scenarios. This feature is particularly useful when making long-term retirement planning decisions.