Where Do Taxes Go

Taxes are a fundamental aspect of modern society, serving as the primary source of revenue for governments to fund essential public services and infrastructure. The question of where our tax dollars go is a valid and important one, as it directly impacts our daily lives and the overall functioning of our communities. In this article, we will delve into the various aspects of tax revenue allocation, shedding light on the vital role taxes play in shaping our society and its future.

The Journey of Tax Dollars: Understanding the Basics

When we pay taxes, whether through income taxes, sales taxes, or property taxes, these funds embark on a journey that contributes to the development and maintenance of our society. This section aims to provide a comprehensive overview of the fundamental aspects of tax revenue allocation.

Key Components of Tax Revenue

Tax revenue is a multifaceted concept, encompassing various sources and types of taxes. Here are the key components that make up the tax revenue pie:

- Income Taxes: The cornerstone of tax revenue, income taxes are levied on individuals and businesses based on their earnings. This includes personal income taxes, corporate taxes, and various payroll taxes.

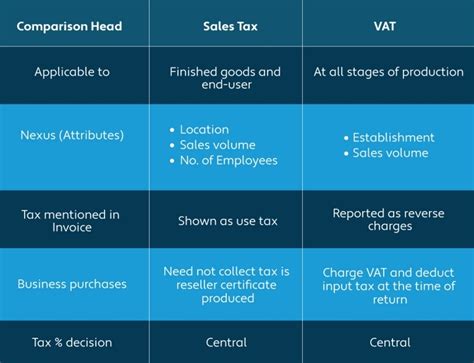

- Sales and Consumption Taxes: These taxes are imposed on the sale of goods and services, often as a percentage of the purchase price. They are a significant source of revenue for many governments, especially at the state and local levels.

- Property Taxes: Property taxes are assessed on the value of real estate, including land and buildings. They are commonly used to fund local government services and are an essential component of municipal revenue.

- Excise Taxes: Excise taxes are levied on specific goods and activities, such as gasoline, tobacco, and alcohol. They are often used to discourage certain behaviors or to fund specific programs related to the taxed goods.

- Other Taxes: Governments may also collect revenue through various other taxes, such as estate taxes, gift taxes, and customs duties, which contribute to the overall tax base.

The Allocation Process

Once tax revenue is collected, it undergoes a meticulous allocation process to ensure that funds are distributed effectively and efficiently. This process involves several key steps:

- Federal, State, and Local Allocation: Tax revenue is first allocated between different levels of government. In many countries, a significant portion goes to the federal government, while state and local governments receive their share based on predetermined formulas or grants.

- Budgeting and Appropriations: Governments create detailed budgets, outlining how tax revenue will be spent. This involves allocating funds to various departments, agencies, and programs, ensuring that essential services are funded adequately.

- Grants and Subsidies: Governments often provide grants and subsidies to specific industries, communities, or individuals to support economic development, social welfare, or other strategic initiatives.

- Debt Servicing: A portion of tax revenue is dedicated to servicing government debt, including interest payments and principal repayments. This ensures financial stability and credibility in the global financial markets.

- Reserves and Contingency Funds: Governments may set aside a portion of tax revenue as reserves or contingency funds to prepare for unforeseen events or economic downturns, ensuring fiscal stability.

The Impact of Tax Revenue on Public Services

The primary purpose of tax revenue is to fund essential public services that benefit society as a whole. These services encompass a wide range of areas, each playing a critical role in the well-being and progress of our communities.

Education: Nurturing the Future

Education is a cornerstone of any thriving society, and tax revenue plays a pivotal role in funding this vital sector. Here’s how tax dollars contribute to education:

- Public Schools: A significant portion of tax revenue is allocated to public education, covering the costs of teachers’ salaries, school infrastructure, textbooks, and other educational resources. This ensures that every child has access to quality education.

- Higher Education: Tax revenue also supports public universities and colleges, making higher education more accessible and affordable for students. Scholarships, grants, and financial aid programs are often funded through tax dollars.

- Education Initiatives: Governments use tax revenue to launch innovative education programs, such as STEM initiatives, language immersion programs, and career and technical education, preparing students for the modern workforce.

Healthcare: A Pillar of Well-Being

Tax revenue is instrumental in funding healthcare systems, ensuring that citizens have access to quality medical care. Here’s how tax dollars impact healthcare:

- Public Healthcare Systems: Many countries have publicly funded healthcare systems, where tax revenue is used to provide universal or near-universal coverage. This includes funding hospitals, clinics, and healthcare professionals, ensuring equal access to healthcare services.

- Medicine and Research: Tax revenue supports medical research, leading to advancements in treatment and cures for various diseases. It also funds the development and distribution of essential medicines, making healthcare more affordable.

- Public Health Initiatives: Governments use tax revenue to launch public health campaigns, such as vaccination programs, mental health awareness initiatives, and disease prevention strategies, promoting overall well-being.

Infrastructure: The Backbone of Society

Tax revenue is a crucial driver of infrastructure development, creating the physical foundations that support economic growth and social well-being. Here’s how tax dollars shape our infrastructure:

- Transportation Networks: Tax revenue funds the construction and maintenance of roads, highways, bridges, and public transportation systems. This ensures efficient movement of people and goods, connecting communities and promoting economic activity.

- Energy and Utilities: Governments use tax revenue to invest in energy infrastructure, including power generation, transmission, and distribution. This ensures a stable and reliable energy supply, supporting both residential and industrial needs.

- Water and Sanitation: Tax dollars contribute to the development and maintenance of water treatment plants, sewage systems, and clean water access initiatives. This is vital for public health and environmental sustainability.

- Digital Infrastructure: In the digital age, tax revenue supports the expansion of broadband internet access, ensuring that communities have the necessary infrastructure for economic participation and access to information.

The Role of Taxes in Economic Development

Tax revenue is not only about funding public services; it also plays a crucial role in driving economic growth and development. Here’s how taxes contribute to a thriving economy:

Business and Industry Support

Governments use tax revenue to support businesses and industries, fostering economic growth and job creation. This includes:

- Business Incentives: Tax incentives, such as tax credits and deductions, are often offered to encourage investment, innovation, and job creation. These incentives can make it more attractive for businesses to operate in specific regions or sectors.

- Industry-Specific Programs: Tax revenue funds programs that support specific industries, such as agriculture, manufacturing, or renewable energy. These programs may provide grants, loans, or tax breaks to help businesses thrive and innovate.

- Startup and Small Business Support: Governments allocate tax revenue to support entrepreneurial initiatives, offering grants, mentorship programs, and access to capital for startups and small businesses.

Job Creation and Employment Programs

Tax revenue is used to fund employment programs and initiatives, helping to reduce unemployment and support workforce development. This includes:

- Training and Skills Development: Governments invest in training programs and apprenticeships, equipping individuals with the skills needed to enter the workforce or transition into new careers.

- Job Placement Services: Tax revenue supports job placement agencies and career counseling services, helping individuals find suitable employment opportunities.

- Employment Incentives: Governments may offer tax incentives to businesses that create new jobs or hire specific demographics, such as youth or veterans, to promote employment diversity and inclusivity.

Economic Stability and Growth

Tax revenue is a critical tool for maintaining economic stability and fostering long-term growth. Governments use tax dollars to:

- Stimulate the Economy: During economic downturns, governments may use tax revenue for stimulus packages, providing financial support to businesses and individuals to prevent further economic decline.

- Investment in Research and Development: Tax revenue funds research and development initiatives, driving innovation and technological advancements that can lead to new industries and economic opportunities.

- Fiscal Policy Management: Governments carefully manage tax revenue to implement fiscal policies that influence economic activity, such as tax cuts to boost consumption or tax increases to curb inflation.

The Future of Tax Revenue Allocation

As societies evolve and face new challenges, the allocation of tax revenue must adapt to meet changing needs. Here’s a glimpse into the future of tax revenue allocation:

Emerging Technologies and Innovation

The rapid advancement of technology is reshaping the landscape of tax revenue allocation. Governments are exploring new ways to leverage technology, such as:

- Blockchain and Cryptocurrency: Blockchain technology offers secure and transparent methods for tax collection and allocation, reducing fraud and improving efficiency. Additionally, governments are exploring the taxation of cryptocurrencies.

- AI and Data Analytics: Artificial intelligence and data analytics can optimize tax revenue allocation by identifying inefficiencies, predicting economic trends, and ensuring funds are directed to the most critical areas.

- Digital Taxation: As the digital economy grows, governments are developing strategies to tax digital services and transactions, ensuring that online businesses contribute to the tax base.

Sustainability and Environmental Initiatives

With a growing focus on sustainability and environmental concerns, tax revenue allocation is shifting to support green initiatives. This includes:

- Carbon Taxation: Governments are implementing carbon taxes to discourage carbon emissions and encourage the adoption of clean energy. The revenue generated can fund renewable energy projects and support environmental conservation efforts.

- Green Infrastructure: Tax revenue is being directed towards the development of sustainable infrastructure, such as renewable energy generation facilities, electric vehicle charging stations, and eco-friendly public transportation systems.

- Biodiversity and Conservation: Tax revenue is being allocated to protect and preserve natural habitats, support wildlife conservation efforts, and promote sustainable land management practices.

Social Welfare and Equality

Tax revenue plays a crucial role in promoting social welfare and reducing inequality. Governments are increasingly focused on:

- Social Safety Nets: Tax revenue funds social welfare programs, providing support to vulnerable populations, such as the elderly, disabled, and low-income individuals. This includes social security, healthcare subsidies, and housing assistance.

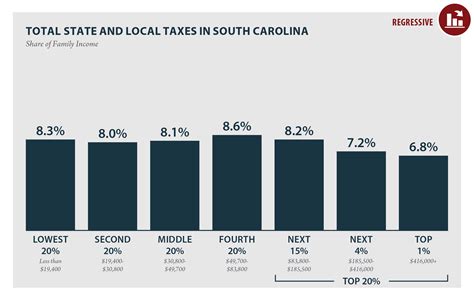

- Income Equality: Progressive tax systems are designed to reduce income inequality by taxing higher earners at higher rates. The revenue generated can be used to fund programs that support lower-income individuals and promote social mobility.

- Universal Basic Income: Some governments are exploring the concept of universal basic income, providing a regular stipend to all citizens, funded by tax revenue. This aims to reduce poverty and provide a safety net for those in need.

Conclusion

Taxes are not just a financial obligation; they are the lifeblood of our society, funding the essential services and initiatives that shape our daily lives and our future. From education and healthcare to infrastructure and economic development, tax revenue is a powerful tool for creating a better world. As we navigate the complexities of the modern world, it is crucial to understand where our tax dollars go and how they contribute to the greater good. By exploring the various aspects of tax revenue allocation, we can appreciate the vital role taxes play in building a thriving, sustainable, and equitable society.

How much of my tax dollars go towards military spending?

+Military spending varies significantly between countries. On average, a significant portion of tax revenue is allocated to defense and national security. However, the exact percentage can range from single digits to over 15% in some nations. It’s important to note that military spending also contributes to economic growth and technological advancement.

Are taxes fair and progressive?

+The fairness of taxes depends on the tax system in place. Many countries have progressive tax systems, where higher earners pay a larger proportion of their income in taxes. This aims to reduce income inequality. However, the effectiveness of such systems can vary, and some argue for further reforms to ensure fairness.

How can I ensure my tax dollars are used efficiently?

+As a taxpayer, staying informed about government spending and holding elected officials accountable is crucial. Participate in civic engagement, attend town hall meetings, and support organizations that advocate for transparent and responsible government spending. Your voice and participation matter in ensuring tax dollars are used effectively.