Vat Tax Vs Sales Tax

Welcome to a comprehensive exploration of the differences and similarities between Value-Added Tax (VAT) and Sales Tax, two widely used indirect tax systems across the globe. This comparison aims to shed light on the unique characteristics, functionalities, and implications of each tax type, offering valuable insights for businesses, consumers, and anyone interested in understanding the intricate world of taxation.

Understanding Value-Added Tax (VAT)

Value-Added Tax, commonly known as VAT, is an indirect tax levied on the consumption or use of goods and services. It is a multi-stage tax, meaning it is applied at each stage of the supply chain, from the production of raw materials to the sale of the final product to the end consumer. VAT is a progressive tax, as it aims to capture the value added at each stage, ensuring a fair tax contribution from businesses.

Key Characteristics of VAT

- Broad Base: VAT applies to most goods and services, making it a comprehensive tax system with a wide revenue base.

- Cascading Effect: VAT is designed to prevent tax cascading, where taxes are charged on taxes, by allowing businesses to claim back the VAT they have paid on their purchases. This ensures that the tax burden is ultimately borne by the final consumer.

- Registration Thresholds: Businesses are typically required to register for VAT once their turnover exceeds a certain threshold, which varies by jurisdiction. This ensures that smaller businesses are not burdened with administrative costs.

- Zero-Rated and Exempt Supplies: Certain goods and services may be zero-rated (taxed at 0%) or exempt from VAT, depending on the jurisdiction’s policies. These categories often include essential items like basic food, education, and healthcare.

| Country | Standard VAT Rate |

|---|---|

| European Union (EU) Average | 20% |

| United Kingdom (UK) | 20% |

| Canada | 5% (GST) + Provincial Rates |

| United States (US) | Varies by State (No Federal VAT) |

Sales Tax: A Different Approach

Sales Tax, unlike VAT, is a single-stage tax imposed on the sale of goods and certain services. It is typically levied at the point of sale, with the tax burden falling directly on the consumer. Sales tax is a more straightforward tax system, often easier to understand and implement, but it can also lead to certain inefficiencies in the tax collection process.

Key Features of Sales Tax

- Point of Sale Taxation: Sales tax is charged at the final point of sale, making it a simpler system to administer for businesses. However, it can lead to higher administrative costs for retailers.

- Varied Rates: Sales tax rates can vary significantly depending on the jurisdiction and the type of goods or services being sold. This can make compliance more complex for businesses operating across multiple regions.

- Exemptions and Reductions: Like VAT, sales tax may have exemptions for certain goods and services, such as groceries, prescription drugs, or educational materials. Some jurisdictions also offer reduced rates for specific items.

- Collection and Remittance: Sales tax is typically collected by the retailer and then remitted to the tax authority. This can create a burden on retailers, especially if they are not equipped with efficient tax management systems.

| State | Sales Tax Rate |

|---|---|

| California | 7.25% |

| Texas | 6.25% |

| Florida | 6% |

| New York | 4% |

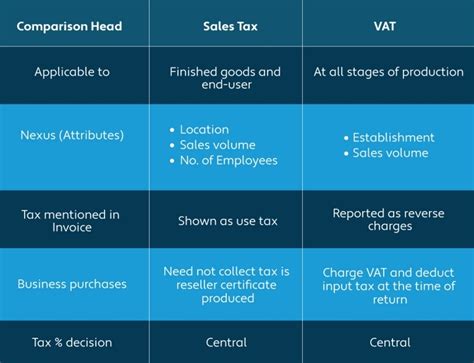

Comparative Analysis: VAT vs Sales Tax

While both VAT and sales tax serve the purpose of generating revenue for governments, they differ significantly in their approach and impact on businesses and consumers.

Administrative Burden

VAT is generally considered more complex to administer due to its multi-stage nature. Businesses need to keep meticulous records of purchases and sales to accurately calculate and remit VAT. On the other hand, sales tax is simpler to manage for businesses, as it involves a single calculation at the point of sale.

Revenue Generation

VAT tends to generate more revenue for governments, as it captures the value added at each stage of the supply chain. This can be particularly beneficial for countries with a large informal sector, as VAT can help formalize the economy and increase tax compliance.

Impact on Businesses

For businesses, VAT can be more advantageous, especially for larger enterprises. The ability to claim back input VAT (VAT paid on purchases) can reduce the overall tax burden. However, smaller businesses may face challenges due to the administrative costs and compliance requirements associated with VAT.

Consumer Perspective

From a consumer standpoint, both taxes can lead to an increase in the final price of goods and services. However, the cascading effect of VAT can sometimes result in a higher overall tax burden compared to sales tax, as the tax is accumulated at each stage of production.

Future Implications and Trends

The landscape of indirect taxation is constantly evolving, and both VAT and sales tax systems are subject to ongoing reforms and adaptations.

VAT Reform and Digital Economy

With the rise of the digital economy, VAT systems are being adapted to capture revenue from online transactions. This includes the implementation of digital service taxes and the harmonization of VAT rates across jurisdictions to prevent tax evasion.

Sales Tax Simplification

Sales tax systems are also undergoing changes to simplify compliance and reduce administrative burdens. This includes the introduction of centralized sales tax systems and the implementation of sales tax holidays to boost consumer spending.

Global Tax Trends

On a global scale, there is a growing trend towards adopting VAT-like systems, as evidenced by the implementation of goods and services tax (GST) in countries like India and Singapore. This shift towards broader-based consumption taxes is driven by the need for more efficient and equitable tax systems.

Conclusion

The choice between VAT and sales tax depends on a country’s economic structure, revenue needs, and policy objectives. Both systems have their advantages and challenges, and a well-designed tax system should aim to balance revenue generation, administrative efficiency, and fairness for businesses and consumers.

Frequently Asked Questions

How does VAT impact international trade?

+

VAT can have a significant impact on international trade, especially with the rise of e-commerce. Businesses need to navigate complex VAT regulations when selling goods across borders. This includes understanding import and export VAT rules, as well as the potential for reverse charges and distance selling thresholds.

What are the key differences between VAT and sales tax for businesses?

+

VAT requires businesses to manage a more complex tax system, with the need to track and account for input VAT. Sales tax, on the other hand, is simpler to manage but can lead to higher costs for retailers due to the point-of-sale collection.

How do VAT and sales tax impact consumer prices?

+

Both taxes can increase the final price of goods and services for consumers. However, VAT’s cascading effect can sometimes result in a higher overall tax burden, as the tax is accumulated at each stage of production.