Do Puerto Ricans Pay Us Taxes

The unique relationship between Puerto Rico and the United States raises intriguing questions about the island's fiscal responsibilities. One of the most common inquiries is whether Puerto Ricans pay taxes to the U.S. government, and if so, how this system functions. In this article, we delve into the intricate world of Puerto Rican taxation, exploring the nuances and implications of this fiscal arrangement.

The Complex Tax Structure of Puerto Rico

Puerto Rico, an unincorporated territory of the United States, operates under a unique tax system that differs significantly from the 50 states. This distinct system has evolved over time, shaped by various economic and political factors. Understanding the specifics of this tax structure is crucial to grasping the island’s fiscal obligations.

Income Tax: A Dual System

The income tax system in Puerto Rico is a two-pronged approach. Puerto Ricans are subject to two sets of income taxes: federal taxes, which are levied by the U.S. government, and local taxes, administered by the Puerto Rican government.

- Federal Income Tax: Puerto Ricans with certain types of income, such as investment gains or certain government employee salaries, are required to pay federal income tax. However, this is not the standard for all Puerto Rican residents.

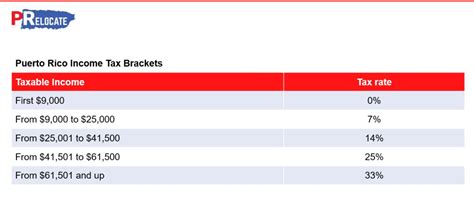

- Local Income Tax: The Puerto Rican government imposes its own income tax, known as the Impuesto sobre Ingresos, on residents’ earnings. This tax is separate from the federal system and is used to fund local government operations and services.

| Tax Type | Applicable To | Rate |

|---|---|---|

| Federal Income Tax | Specific Income Categories | Varies by Income Bracket |

| Local Income Tax (Impuesto sobre Ingresos) | All Resident Income | Graduated Rates, up to 33% |

Other Tax Obligations

Beyond income taxes, Puerto Ricans also contribute to other federal and local taxes, including:

- Social Security Tax: Puerto Ricans pay into the U.S. Social Security system, just like mainland residents. This tax is used to fund retirement, disability, and other social programs.

- Sales and Use Tax (Impuesto sobre Ventas y Uso): Similar to mainland states, Puerto Rico imposes a sales tax on goods and services. This tax varies by municipality and is used to fund local government initiatives.

- Property Tax: Property owners in Puerto Rico are subject to property taxes, which are used to support local infrastructure and services.

Impact on Puerto Rican Economy and Residents

The unique tax structure of Puerto Rico has significant implications for the island’s economy and its residents. While it provides certain advantages, it also presents challenges.

Advantages of the Current System

One of the most notable advantages is the federal tax exemption for Puerto Rico-sourced income. This means that, for the most part, businesses and individuals in Puerto Rico are not subject to federal income tax on income generated within the island. This exemption has been a key factor in attracting investment and businesses to Puerto Rico.

Challenges and Future Implications

However, the tax system also presents challenges. The limited revenue base due to the federal tax exemption means that Puerto Rico relies heavily on local taxes and federal funding for its operations. This can make the island vulnerable to economic fluctuations and policy changes at the federal level.

Furthermore, the complexity of the tax system can be a barrier for businesses and individuals navigating the fiscal landscape. Understanding the intricacies of both federal and local tax laws requires specialized knowledge, which can be a challenge for those new to the island.

Conclusion: A Complex Fiscal Relationship

The taxation of Puerto Ricans is a multifaceted issue, shaped by the island’s unique political and economic status. While Puerto Ricans do pay certain taxes to the U.S. government, the system is markedly different from that of the 50 states. The current tax structure has both advantages and challenges, impacting the island’s economy and its residents’ financial well-being.

As the relationship between Puerto Rico and the United States continues to evolve, so too will the fiscal landscape. It remains to be seen how future policy changes will affect the tax obligations of Puerto Ricans and the island’s economic prospects.

Do all Puerto Ricans pay federal income tax?

+No, not all Puerto Ricans pay federal income tax. Only certain types of income, such as investment gains or specific government employee salaries, are subject to federal taxation.

What is the local income tax rate in Puerto Rico?

+The local income tax rate in Puerto Rico is graduated, ranging from 0% to 33%, depending on income level.

How does the tax system in Puerto Rico affect business investment?

+The tax system, particularly the federal tax exemption for Puerto Rico-sourced income, has been a significant draw for businesses, as it can reduce their tax obligations. However, the complexity of the system may also present challenges for new businesses.