City Of San Diego Sales Tax

San Diego, a vibrant city nestled along the picturesque California coastline, is not only known for its stunning beaches and year-round sunny weather but also for its vibrant economy and thriving business scene. One aspect that often comes into play when discussing business operations and consumer spending in San Diego is the city's sales tax. Understanding the intricacies of the sales tax system is crucial for both local businesses and consumers alike. This article aims to delve into the specifics of the City of San Diego's sales tax, providing a comprehensive guide to its rates, application, and implications.

Understanding the San Diego Sales Tax Structure

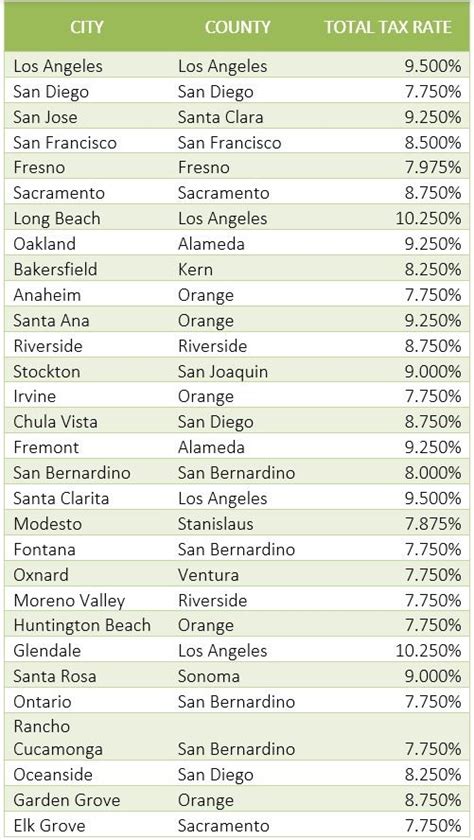

The sales tax in San Diego is a multifaceted system, consisting of several components that combine to form the total sales tax rate. This rate is applicable to various goods and services sold within the city limits. Let’s break down the different layers of the sales tax structure in San Diego.

State Sales Tax

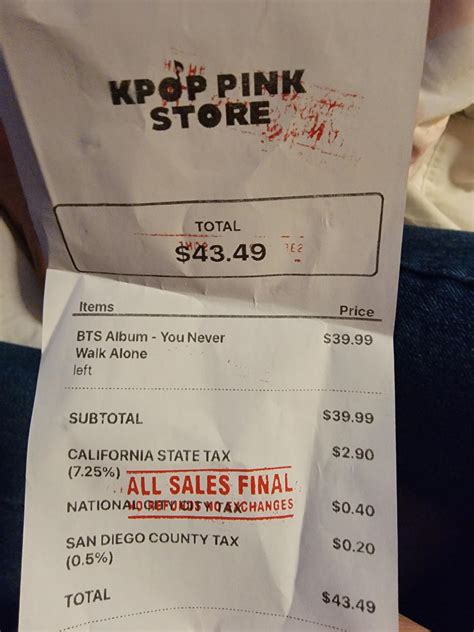

California, the sunny state known for its diverse landscapes and thriving cities, imposes a state-wide sales tax. As of the latest information, this state sales tax stands at 7.25%. This rate is a fundamental component of the overall sales tax applicable in San Diego and is uniformly applied across the state.

City Sales Tax

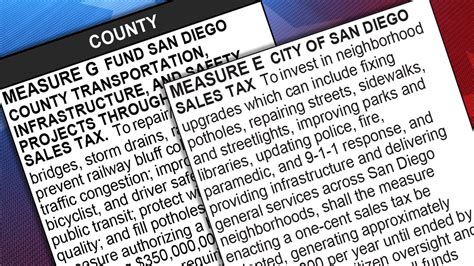

In addition to the state sales tax, the City of San Diego imposes its own city sales tax. This municipal tax is implemented to generate revenue for local infrastructure, community development, and various city projects. The current city sales tax rate in San Diego is 0.50%, which is added to the state sales tax to form the base rate for the city.

County Sales Tax

San Diego County, of which the City of San Diego is a part, also levies its own sales tax. This county sales tax is used to fund county-wide initiatives and services. The current sales tax rate for San Diego County is 0.50%, contributing to the overall sales tax burden in the region.

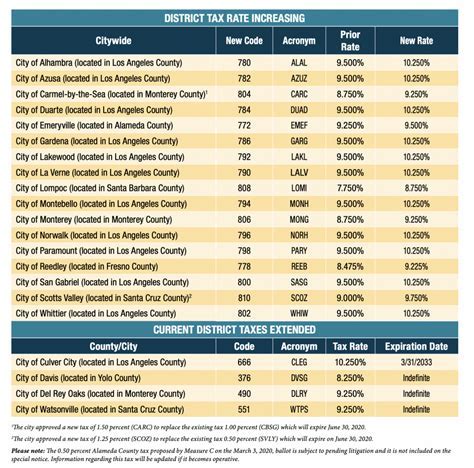

District Sales Tax

Certain areas within the City of San Diego may be subject to additional sales taxes known as district taxes. These taxes are levied by specific districts or authorities within the city to support local projects and improvements. District sales taxes can vary based on the location and the specific district’s needs. For instance, in areas with active transit projects, a transit district sales tax may be imposed to fund these initiatives.

| Sales Tax Component | Rate |

|---|---|

| State Sales Tax | 7.25% |

| City Sales Tax | 0.50% |

| County Sales Tax | 0.50% |

| District Sales Tax (varies) | Varies |

By combining these various sales tax rates, the total sales tax applicable in the City of San Diego can be calculated. As of the most recent information, the total sales tax rate in San Diego stands at 8.25%, which includes the state, city, and county sales taxes. This rate is subject to change based on legislative decisions and the needs of the local community.

Sales Tax Exemptions and Special Considerations

While the sales tax in San Diego applies to a wide range of goods and services, there are certain exemptions and special considerations to be aware of. These exceptions are designed to accommodate specific situations and industries, ensuring a fair and equitable sales tax system.

Exempt Goods and Services

Certain goods and services are exempt from sales tax in San Diego. These exemptions are granted based on state and local regulations and can vary depending on the nature of the item or service. Some common examples of exempt goods and services include:

- Prescription medications

- Certain medical devices

- Grocery items (with specific restrictions)

- Residential rent

- Educational services

- Select professional services, such as legal and accounting services

It's important for businesses and consumers to be aware of these exemptions, as they can significantly impact the overall sales tax burden. For businesses, understanding these exemptions is crucial for accurate tax compliance and for consumers, it ensures they are not overcharged.

Special Tax Rates for Certain Items

In addition to the general sales tax rate, certain items in San Diego are subject to special tax rates. These rates are imposed to address specific concerns or to generate revenue for particular purposes. For instance, the sale of alcoholic beverages in San Diego is subject to an additional 10.25% tax, bringing the total sales tax rate for these items to 18.50%. This additional tax is dedicated to funding alcohol-related programs and initiatives.

Taxable vs. Nontaxable Sales

Determining whether a sale is taxable or nontaxable can be a complex task. The California Board of Equalization provides guidelines and resources to help businesses and consumers understand the nuances of taxable and nontaxable sales. In general, taxable sales refer to the sale of tangible personal property and certain services. Nontaxable sales, on the other hand, include exempt items or services as well as sales that occur outside the state’s jurisdiction.

Sales Tax Compliance and Reporting

Ensuring compliance with the sales tax regulations in San Diego is a critical aspect of doing business in the city. Businesses are responsible for collecting, reporting, and remitting the appropriate sales tax to the California Department of Tax and Fee Administration (CDTFA). Failure to comply with these regulations can result in penalties and legal consequences.

Registering for Sales Tax

To begin collecting and remitting sales tax, businesses operating in San Diego must first register with the CDTFA. This process involves providing relevant business information and selecting a sales tax filing frequency, which can be either monthly, quarterly, or annually, depending on the business’s sales volume. Once registered, businesses will receive a unique seller’s permit number, which is required for all sales tax-related transactions.

Collecting Sales Tax

Businesses are required to collect sales tax from customers at the point of sale. This tax is calculated based on the total purchase amount, including any applicable discounts or promotions. The collected sales tax must be remitted to the CDTFA along with the appropriate filing, ensuring accurate and timely reporting.

Sales Tax Filing and Remittance

The frequency of sales tax filing and remittance depends on the business’s sales volume and the selected filing frequency during registration. For most businesses, sales tax returns and payments are due by the 20th of the month following the reporting period. Late filings and payments may result in penalties and interest charges.

Businesses can file and remit sales tax online through the CDTFA's website, which offers a secure and convenient platform for tax compliance. Alternatively, paper returns and payments can be mailed to the CDTFA, although online filing is generally recommended for its efficiency and accuracy.

The Impact of Sales Tax on Businesses and Consumers

The sales tax in San Diego has a significant impact on both businesses and consumers. Understanding this impact is crucial for making informed decisions and ensuring a healthy economic environment.

Effect on Business Operations

For businesses, the sales tax system in San Diego can present both challenges and opportunities. On the one hand, collecting and remitting sales tax adds an administrative burden, requiring dedicated resources and attention. Businesses must ensure accurate tax collection and reporting to avoid legal issues and maintain a positive relationship with the CDTFA.

On the other hand, the sales tax system can also provide benefits to businesses. By collecting sales tax, businesses contribute to the local economy and support various community initiatives. Additionally, the sales tax can help stabilize business revenues, as it is a predictable and consistent source of income for the business.

Impact on Consumer Spending

Consumers in San Diego are directly impacted by the sales tax system. The added tax burden can influence their purchasing decisions and overall spending habits. While the sales tax may encourage consumers to seek out sales and discounts, it can also deter them from making certain purchases, particularly for high-value items.

To mitigate the impact of sales tax on consumer spending, businesses can employ various strategies. Offering competitive pricing, providing value-added services, and implementing effective marketing campaigns can help attract and retain customers despite the sales tax burden. Additionally, understanding consumer behavior and preferences can help businesses tailor their offerings to meet the needs of their target audience.

Future Outlook and Potential Changes

The sales tax system in San Diego is subject to change based on legislative decisions and economic factors. While the current sales tax rates are well-established, there is always the potential for adjustments to address changing community needs or economic conditions.

Potential Sales Tax Rate Adjustments

The sales tax rates in San Diego, both at the state and local levels, can be adjusted to meet specific goals or address financial constraints. For instance, during economic downturns, increasing the sales tax rate can be a way to generate additional revenue for essential services and programs. Conversely, reducing the sales tax rate can stimulate economic growth and encourage consumer spending.

Implications of Future Changes

Any changes to the sales tax rates in San Diego would have significant implications for both businesses and consumers. For businesses, an increase in the sales tax rate could lead to higher operational costs and potentially impact their profitability. On the other hand, a decrease in the sales tax rate could boost consumer spending and drive economic growth, benefiting businesses through increased sales.

For consumers, changes in the sales tax rate would directly impact their purchasing power and spending decisions. A higher sales tax rate could make certain purchases less affordable, while a lower rate could encourage more discretionary spending. Understanding these potential changes is crucial for both businesses and consumers to adapt their strategies and make informed choices.

Conclusion

The sales tax system in the City of San Diego is a complex but crucial aspect of the local economy. By understanding the various components of the sales tax structure, businesses and consumers can make informed decisions and navigate the tax system effectively. As the city continues to evolve and adapt to changing economic conditions, the sales tax system will remain a key factor in shaping the local business landscape and consumer behavior.

What is the current sales tax rate in San Diego?

+The current sales tax rate in San Diego is 8.25%, which includes the state sales tax of 7.25%, city sales tax of 0.50%, and county sales tax of 0.50%. Additional district sales taxes may also apply in certain areas.

Are there any sales tax exemptions in San Diego?

+Yes, certain goods and services are exempt from sales tax in San Diego. Common exemptions include prescription medications, certain medical devices, grocery items, residential rent, educational services, and select professional services.

How often do businesses need to file and remit sales tax in San Diego?

+The frequency of sales tax filing and remittance depends on the business’s sales volume. Most businesses file and remit sales tax on a monthly, quarterly, or annual basis. Late filings and payments may result in penalties and interest charges.

Can sales tax rates change in San Diego?

+Yes, sales tax rates in San Diego can be adjusted based on legislative decisions and economic factors. Changes to the sales tax rate can have significant implications for both businesses and consumers.