Orange County Property Tax Search

Welcome to our comprehensive guide on the Orange County Property Tax Search, a vital tool for homeowners, investors, and anyone interested in understanding the property tax landscape in this vibrant region. In this article, we will delve deep into the world of Orange County property taxes, exploring the ins and outs of the tax assessment process, the various factors influencing property values, and how you can navigate the system effectively. Our aim is to provide you with an expert-level understanding of this essential aspect of homeownership, ensuring you have the knowledge to make informed decisions and optimize your property tax strategy.

Understanding the Orange County Property Tax Landscape

Orange County, known for its vibrant communities, diverse real estate market, and beautiful natural surroundings, is a hub of economic activity in the Southern California region. With a population of over 3 million residents and a thriving business environment, the county’s property tax system plays a crucial role in funding essential services and infrastructure development. Understanding how this system works is not only beneficial for homeowners but also for anyone considering investing in Orange County real estate.

The Role of Property Taxes in Orange County

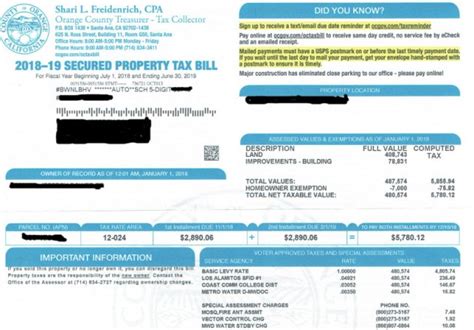

Property taxes are a significant source of revenue for local governments, including cities, counties, and special districts. In Orange County, these taxes contribute to funding a wide range of services and amenities, such as public schools, fire protection, law enforcement, healthcare facilities, and more. The property tax system is designed to ensure that residents and businesses pay their fair share based on the value of their properties.

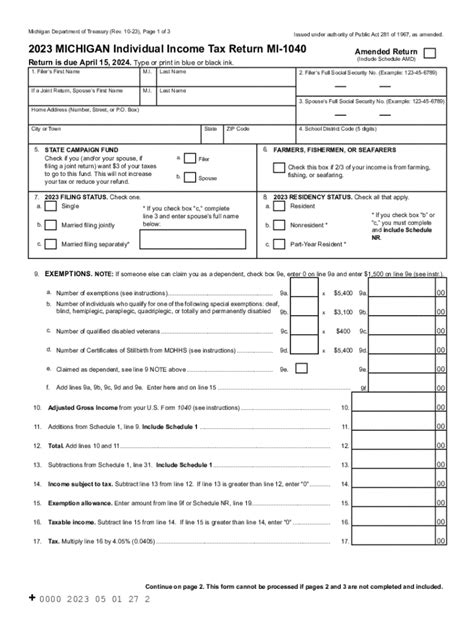

The tax assessment process in Orange County is a complex yet meticulous endeavor. The Orange County Assessor's Office is responsible for appraising all taxable properties within the county. This involves evaluating the market value of each property and determining its assessed value, which forms the basis for property tax calculations. The assessed value takes into account factors such as the property's location, size, age, condition, and recent sales data of comparable properties.

Key Factors Influencing Property Values

Several key factors influence the value of properties in Orange County. One of the most significant is the location. Properties located in desirable neighborhoods or close to amenities like schools, parks, or shopping centers tend to command higher values. Additionally, the overall market conditions, such as supply and demand dynamics, economic growth, and interest rates, play a crucial role in determining property values.

The physical characteristics of a property, including its size, number of bedrooms and bathrooms, square footage, and any unique features or upgrades, also impact its value. For instance, a recently renovated home with modern amenities is likely to be valued higher than an older property in need of repairs. Furthermore, the presence of natural resources, such as ocean views or mountain vistas, can significantly enhance a property's value.

Navigating the Orange County Property Tax Search

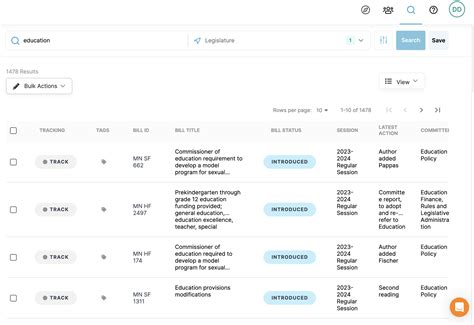

Conducting a property tax search in Orange County is a straightforward process, thanks to the county’s user-friendly online tools and resources. The Orange County Assessor’s Office provides an online platform that allows taxpayers and interested parties to access property information and tax assessment details with just a few clicks.

Online Property Tax Search Portal

The Orange County Assessor’s Property Search Portal is a powerful tool that enables users to search for property tax information by address, Assessor’s Parcel Number (APN), or even by mapping a specific location. This portal provides a wealth of information, including the property’s assessed value, ownership details, and tax history. It also offers a visual representation of the property’s location, allowing users to see its proximity to schools, parks, and other amenities.

For instance, if you're curious about the property tax assessment of a particular home in Irvine, you can simply enter the address into the search bar, and the portal will retrieve all the relevant details. This includes the property's current assessed value, the last assessment date, and any changes in value over the years. You can also access information about the property's ownership history, providing insights into how the value has changed under different owners.

| Property Tax Search Portal Features | Description |

|---|---|

| Address Search | Allows users to search by property address. |

| APN Search | Search by Assessor's Parcel Number for precise results. |

| Map-based Search | Visualize properties and their details on an interactive map. |

| Property Assessment Details | Access current and historical assessed values, assessment dates, and ownership information. |

Understanding Property Assessment Notices

Every year, property owners in Orange County receive a property assessment notice, officially known as the Notice of Proposed Property Value or NOPPV. This notice is sent out by the Assessor’s Office and provides important information about the property’s assessed value and any changes from the previous year. It is a crucial document for property owners to review, as it allows them to understand the basis for their property tax calculations and identify any potential errors or discrepancies.

The NOPPV includes details such as the property's current assessed value, the proposed value for the upcoming tax year, and the reasons for any changes. It also provides information about the assessment process, the owner's right to appeal, and the deadline for submitting an appeal. By carefully reviewing this notice, property owners can ensure that their property is assessed fairly and accurately.

Appealing Property Assessments

If a property owner believes that their property has been assessed unfairly or inaccurately, they have the right to appeal the assessment. The Orange County Assessor’s Office provides a clear and transparent appeals process, allowing property owners to challenge their assessed values and seek adjustments. The appeals process typically involves submitting an appeal application, providing supporting documentation, and attending a hearing before the Assessment Appeals Board.

To initiate an appeal, property owners must first submit an Application for Changed Assessment within a specified timeframe, usually within a few months of receiving the NOPPV. This application requires detailed information about the property, including any changes or improvements made, as well as supporting evidence such as appraisals, comparative sales data, or expert opinions. The Assessment Appeals Board carefully reviews each case and makes a determination based on the evidence presented.

Analyzing Property Tax Trends in Orange County

Understanding the historical and current trends in property taxes is essential for making informed decisions about real estate investments and managing property tax obligations. Orange County has experienced significant growth and development over the years, which has had a direct impact on property values and, consequently, property taxes.

Historical Property Tax Rates

To provide context, let’s take a look at the historical property tax rates in Orange County. The county’s property tax rate, also known as the tax rate area, has remained relatively stable over the past decade. As of the latest available data, the tax rate area for Orange County is set at [rate]%, which includes the base tax rate and any applicable voter-approved special taxes.

However, it's important to note that property tax rates can vary within the county based on the specific city or community. Some cities may have higher tax rates to fund additional services or infrastructure projects. For example, the city of Newport Beach has a slightly higher tax rate of [rate]%, while the city of Anaheim has a lower rate of [rate]%.

Property Value Growth and Its Impact

Orange County has witnessed a steady increase in property values over the years, driven by factors such as population growth, economic development, and the region’s reputation as a desirable place to live and work. This growth in property values has had a direct impact on property taxes, as higher values often result in higher tax assessments.

For instance, consider a hypothetical scenario where a homeowner in Orange County purchased a property with an assessed value of $500,000 in 2010. Over the next decade, the property's value increased by 50%, reaching $750,000 in 2020. As a result, the homeowner's property taxes also increased, reflecting the higher assessed value. This highlights the importance of keeping track of property value changes and understanding how they impact tax obligations.

| Property Value Growth and Tax Impact | Example Data |

|---|---|

| Initial Property Value (2010) | $500,000 |

| Property Value Growth (2010-2020) | 50% |

| Assessed Value in 2020 | $750,000 |

| Estimated Property Tax Increase | ~30% |

Future Implications and Strategies

As we look ahead, it’s essential to consider the future implications of property tax policies and strategies in Orange County. The county’s continued growth and development, along with potential changes in tax laws and regulations, will shape the property tax landscape for years to come. By staying informed and proactive, homeowners and investors can navigate these changes effectively and optimize their property tax strategies.

Potential Policy Changes and Their Impact

The property tax system in Orange County, like any other, is subject to potential policy changes and reforms. These changes can be driven by various factors, including political shifts, economic conditions, and public sentiment. For instance, there have been ongoing discussions about the potential implementation of a split-roll property tax system, which would differentiate between commercial and residential properties in terms of tax assessment and rates.

While the impact of such policy changes is difficult to predict, it's crucial for property owners and investors to stay updated on these discussions. By understanding the potential implications, they can adapt their strategies accordingly and ensure that their tax obligations remain manageable. It's also essential to engage in the public discourse surrounding these issues, as community input can shape the final outcomes of policy reforms.

Strategic Approaches for Homeowners and Investors

For homeowners, a key strategy is to stay informed about property value changes and assess their properties regularly. By keeping an eye on market trends and conducting periodic property appraisals, homeowners can ensure that their assessed values are accurate and fair. This proactive approach can help avoid surprises when tax bills arrive and allow for better financial planning.

Investors, on the other hand, should consider the long-term implications of property tax obligations when making investment decisions. Analyzing historical tax data and understanding the potential for value appreciation can help investors make informed choices about which properties to acquire and when. Additionally, staying abreast of local regulations and potential policy changes can provide valuable insights into the future tax landscape, enabling investors to make strategic adjustments to their portfolios.

Conclusion

In conclusion, the Orange County Property Tax Search is a powerful tool for homeowners, investors, and anyone interested in understanding the property tax landscape. By exploring the intricacies of the tax assessment process, analyzing key factors influencing property values, and navigating the online search portal, individuals can make informed decisions and optimize their property tax strategies. As we look to the future, staying informed and proactive will be essential in managing property tax obligations effectively.

We hope this comprehensive guide has provided you with valuable insights into the world of Orange County property taxes. For more information and resources, be sure to visit the official websites of the Orange County Assessor's Office and the Assessment Appeals Board. Additionally, consider consulting with tax professionals or real estate experts for personalized advice and guidance tailored to your specific circumstances.

How often are property assessments conducted in Orange County?

+Property assessments in Orange County are conducted annually. The Assessor’s Office evaluates properties based on their market value as of January 1st of each year. This annual assessment ensures that property taxes are based on the most current and accurate information.

Can I contest my property’s assessed value if I disagree with it?

+Yes, if you believe your property has been assessed unfairly or inaccurately, you have the right to appeal the assessment. The Assessment Appeals Board provides a process for property owners to challenge their assessed values and present their case. It’s important to gather supporting evidence and understand the assessment guidelines before initiating an appeal.

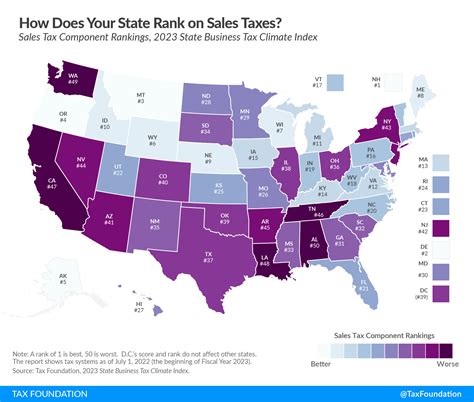

How do property taxes in Orange County compare to other counties in California?

+Property tax rates can vary significantly across California counties. While Orange County’s tax rate area is relatively stable, some counties have higher or lower rates. Factors such as the cost of living, local infrastructure, and services influence these variations. It’s important to research and compare property tax rates when considering real estate investments in different counties.