Aa County Real Estate Taxes

Welcome to a comprehensive exploration of AA County's Real Estate Taxes, a topic of great interest to property owners and investors in this vibrant region. Understanding the intricacies of property taxation is essential for making informed decisions, and this guide aims to provide an in-depth analysis, offering valuable insights and practical advice.

Situated in the heart of Maryland, AA County boasts a thriving real estate market, attracting a diverse range of homeowners, investors, and businesses. The county's tax system plays a crucial role in shaping the local economy and impacting the lives of its residents. As we delve into the specifics, we'll uncover the key factors that influence real estate taxes, explore the assessment process, and provide a detailed breakdown of the tax rates and their implications.

The Essence of AA County Real Estate Taxes

AA County’s real estate tax system is a critical component of the local government’s revenue stream, funding essential services such as education, public safety, infrastructure development, and more. The taxes levied on properties are determined by a combination of factors, including the property’s assessed value, location, and various exemptions and incentives.

The assessment process is a meticulous undertaking, involving the evaluation of each property's market value and the application of specific formulas to calculate the taxable amount. This process ensures fairness and accuracy in taxation, taking into account recent sales data, property improvements, and other relevant factors. Let's dive deeper into the specifics of how AA County assesses and taxes real estate.

Property Assessment: The First Step

The journey towards understanding your real estate tax liability begins with the property assessment process. In AA County, the Department of Assessments and Taxation (SDAT) is responsible for evaluating properties annually. This evaluation considers a range of factors to determine the assessed value, which forms the basis for calculating your real estate taxes.

SDAT employs a team of experienced assessors who visit each property, gathering information on its physical characteristics, such as size, number of rooms, and any recent improvements. Additionally, they analyze recent sales data in the area to ensure that the assessed value aligns with market trends. This comprehensive approach aims to provide an accurate valuation, ensuring fairness for all property owners.

| Assessment Factors | Description |

|---|---|

| Physical Characteristics | Includes size, rooms, amenities, and condition. |

| Recent Sales Data | Analyzed to ensure market value alignment. |

| Location | Influences value due to amenities and infrastructure. |

| Property Improvements | Considered for accuracy in valuation. |

Once the assessment is complete, property owners receive a notice detailing the assessed value and any changes from the previous year. This notice provides an opportunity for property owners to review and, if necessary, appeal the assessment. The appeal process is designed to ensure that property values are fair and accurately reflect market conditions.

Tax Rate Determination: Unlocking the Equation

With the assessed value established, the next step is to calculate the actual tax liability. AA County’s tax rates are expressed as millage rates, which represent the amount of tax owed per $1,000 of assessed value. These rates are set annually by the County Council, taking into account the county’s budgetary needs and the impact on taxpayers.

For the current fiscal year, the AA County millage rate stands at 0.765, which is a slight decrease from the previous year's rate of 0.78. This rate is applied uniformly to all properties within the county, ensuring consistency and fairness. However, it's important to note that this is just one part of the equation, as other factors can influence your overall tax liability.

Exemptions and Incentives: Navigating the Tax Landscape

AA County offers a range of exemptions and incentives to property owners, designed to promote homeownership, support certain industries, and provide relief to specific groups. These exemptions can significantly reduce your tax liability, making it crucial to understand which ones you may be eligible for.

One notable exemption is the Homestead Tax Credit, which provides a credit of up to $2,500 on the taxable value of your primary residence. This credit aims to ease the tax burden on homeowners, making homeownership more affordable. Additionally, the county offers senior citizen and veteran exemptions, providing reduced tax rates for those who qualify.

| Exemption or Incentive | Description |

|---|---|

| Homestead Tax Credit | Up to $2,500 credit on primary residence taxable value. |

| Senior Citizen Exemption | Reduced tax rates for eligible seniors. |

| Veteran Exemption | Tax relief for qualifying veterans. |

| Agricultural Preservation | Incentives for preserving agricultural land. |

Furthermore, AA County encourages the preservation of agricultural land through the Agricultural Preservation Program, which offers tax incentives to landowners who agree to maintain their property for agricultural use. This program not only supports local farming but also contributes to the county's overall sustainability goals.

Understanding Your Tax Bill: A Detailed Breakdown

Your real estate tax bill is a comprehensive document that provides a clear breakdown of your tax liability. Let’s explore the key components to ensure a thorough understanding.

- Assessed Value: The value of your property as determined by SDAT, serving as the basis for tax calculations.

- Taxable Value: The assessed value after applying any applicable exemptions or incentives.

- Tax Rate: The millage rate set by the County Council, expressed as a decimal.

- Tax Amount: The final amount owed, calculated by multiplying the taxable value by the tax rate.

- Due Dates: Real estate taxes in AA County are typically due in two installments, with specific due dates specified on your tax bill.

It's essential to carefully review your tax bill to ensure accuracy and take advantage of any exemptions or incentives you may be eligible for. If you have any questions or concerns, AA County provides a dedicated Taxpayer Services Office, offering assistance and guidance to property owners.

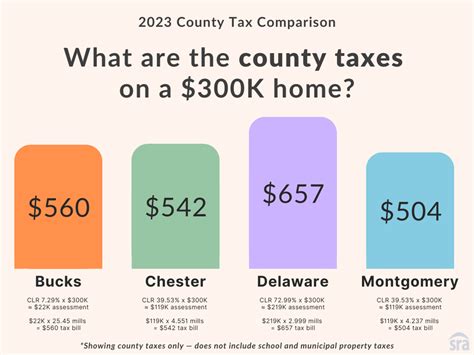

AA County Real Estate Taxes: A Comparative Analysis

To gain a broader perspective, let’s compare AA County’s real estate tax landscape with other counties in Maryland and beyond. This analysis will provide valuable insights into how AA County’s tax system stacks up against its peers, helping property owners and investors make informed decisions.

Maryland’s Real Estate Tax Landscape

Maryland, known for its diverse real estate market, offers a range of tax rates and incentives across its counties. While AA County’s tax rate of 0.765 is relatively competitive, other counties in the state offer slightly lower or higher rates, depending on their budgetary needs and local economies.

For instance, neighboring Baltimore County has a slightly higher tax rate of 0.82, while Howard County boasts a lower rate of 0.72. These variations reflect the unique characteristics and priorities of each county. Understanding these differences can be crucial for property owners and investors considering a move or expansion within the state.

| County | Millage Rate |

|---|---|

| AA County | 0.765 |

| Baltimore County | 0.82 |

| Howard County | 0.72 |

| Montgomery County | 0.99 |

| Anne Arundel County | 0.89 |

National Perspective: AA County’s Standing

On a national level, AA County’s real estate tax rate compares favorably with many other regions. While some states have significantly higher tax rates, AA County’s competitive positioning makes it an attractive destination for homeowners and investors.

For instance, states like New Jersey and New York are known for their high property taxes, with average rates surpassing 1.5%. In contrast, AA County's rate of 0.765 places it among the more affordable regions, making it a compelling choice for those seeking a balance between property values and tax liabilities.

| State | Average Property Tax Rate |

|---|---|

| New Jersey | 2.19% |

| New York | 1.67% |

| Illinois | 1.78% |

| Texas | 1.87% |

| California | 0.76% |

The Impact of Property Values: A Key Consideration

When evaluating the overall tax burden, it’s essential to consider not only the tax rate but also the property values in the region. AA County’s real estate market is characterized by a diverse range of property values, from affordable starter homes to high-end luxury properties.

While the tax rate remains consistent across properties, the impact of the tax liability varies based on the assessed value. This means that while AA County offers a competitive tax rate, the overall tax burden can differ significantly depending on the property's value. It's a crucial factor for buyers and investors to consider when making decisions.

The Future of AA County Real Estate Taxes

As we look ahead, it’s essential to consider the potential future trends and developments that may impact AA County’s real estate tax landscape. Understanding these dynamics can provide valuable insights for property owners and investors, allowing them to make informed decisions and adapt to changing circumstances.

Economic Factors and Their Influence

AA County’s real estate market is intimately tied to the overall economic health of the region. As the local economy flourishes, property values tend to rise, leading to increased tax revenues for the county. Conversely, economic downturns can impact property values and, consequently, tax liabilities.

The county's leadership plays a crucial role in managing these economic dynamics. By fostering a business-friendly environment, attracting new industries, and supporting local businesses, AA County can ensure a stable and growing tax base. This, in turn, allows for consistent funding of essential services and the maintenance of competitive tax rates.

Potential Tax Reform and Its Implications

Tax reform is a constant topic of discussion among policymakers, and AA County is no exception. While the current tax system has served the county well, there may be opportunities for improvement or modernization. Potential reforms could include adjustments to the assessment process, changes in tax rates, or the introduction of new incentives to promote specific economic sectors.

Any tax reform proposal would undergo thorough scrutiny and public consultation to ensure fairness and effectiveness. Property owners and investors should stay informed about these discussions, as they can have a direct impact on their tax liabilities and the overall attractiveness of the county as a real estate destination.

The Role of Technology in Tax Administration

Advancements in technology are transforming the way taxes are administered and collected. AA County, like many other jurisdictions, is exploring ways to leverage technology to enhance the tax assessment and collection processes. This includes the use of advanced data analytics to improve assessment accuracy and the implementation of online platforms for convenient tax payment and management.

By embracing technological innovations, AA County can streamline its tax administration, reduce costs, and improve the overall experience for taxpayers. Additionally, these technological advancements can enhance transparency and accountability, fostering trust between the county and its residents.

Community Engagement and Tax Awareness

AA County recognizes the importance of community engagement and tax awareness in maintaining a healthy tax system. The county actively engages with property owners and residents through public meetings, workshops, and educational initiatives to ensure a clear understanding of the tax process and its implications.

By fostering tax awareness, AA County aims to build trust and ensure that taxpayers feel confident in the fairness and efficiency of the system. This community-centric approach not only strengthens the relationship between the county and its residents but also encourages active participation in shaping the future of AA County's real estate taxes.

How often are real estate taxes assessed in AA County?

+Real estate taxes in AA County are assessed annually. The Department of Assessments and Taxation (SDAT) evaluates properties each year to determine their assessed value, which forms the basis for calculating tax liability.

Can I appeal my property assessment in AA County?

+Yes, property owners have the right to appeal their assessment if they believe it is inaccurate or unfair. AA County provides a clear appeals process, allowing taxpayers to present their case and potentially adjust their assessed value.

What is the current AA County millage rate for real estate taxes?

+For the current fiscal year, the AA County millage rate stands at 0.765. This rate is applied uniformly to all properties within the county, determining the tax liability based on the assessed value.

Are there any exemptions or incentives for real estate taxes in AA County?

+Yes, AA County offers various exemptions and incentives to property owners. These include the Homestead Tax Credit, senior citizen and veteran exemptions, and incentives for preserving agricultural land.

How can I pay my AA County real estate taxes?

+AA County provides several convenient payment options, including online payments through their official website, mail-in payments, and in-person payments at designated locations. Taxpayers can choose the method that best suits their preferences and needs.