Does Sc Have A State Tax

In the United States, state tax regulations vary significantly from one state to another, and South Carolina is no exception. The state's tax system is an intricate network of laws and regulations that impact both individuals and businesses. Understanding South Carolina's tax landscape is crucial for residents, investors, and businesses alike, as it can significantly influence financial planning and decision-making.

South Carolina’s State Tax Structure

South Carolina, like many other states, imposes various taxes to fund its operations and provide public services. These taxes are a significant source of revenue for the state, contributing to infrastructure development, education, healthcare, and other essential services.

Income Tax

South Carolina levies an income tax on its residents and nonresidents with income sourced from the state. The state’s income tax system is progressive, meaning that higher income brackets are taxed at a higher rate. As of the 2023 tax year, there are six tax brackets, ranging from 0% to 7%.

For example, let’s consider a hypothetical taxpayer, Mr. Johnson, who resides in South Carolina and has an annual income of 60,000. Based on the state's tax brackets, Mr. Johnson would fall into the 5% tax bracket, paying a state income tax of approximately 3,000 for the year.

| Tax Bracket | Tax Rate |

|---|---|

| Up to 2,899</td> <td>0%</td> </tr> <tr> <td>2,900 - 5,599</td> <td>2%</td> </tr> <tr> <td>5,600 - 10,999</td> <td>3%</td> </tr> <tr> <td>11,000 - 16,999</td> <td>4%</td> </tr> <tr> <td>17,000 - 121,499</td> <td>5%</td> </tr> <tr> <td>Over 121,500 | 7% |

Sales and Use Tax

South Carolina also imposes a sales and use tax on the sale of tangible personal property and certain services. The state’s general sales tax rate is 6%, but this can vary depending on local jurisdictions. For instance, the city of Charleston has an additional 1% local sales tax, bringing the total sales tax rate to 7% within city limits.

Property Tax

Property taxes are another significant source of revenue for South Carolina. The state’s property tax system is primarily administered at the county level, resulting in varying tax rates across the state. Property tax rates can range from 0.4% to over 1% of the property’s assessed value.

To illustrate, let’s consider a homeowner, Ms. Davis, who owns a property in Greenville County. The county’s property tax rate is 0.5%, and the assessed value of Ms. Davis’ property is 200,000. Therefore, her annual property tax bill would amount to 1,000.

Other Taxes

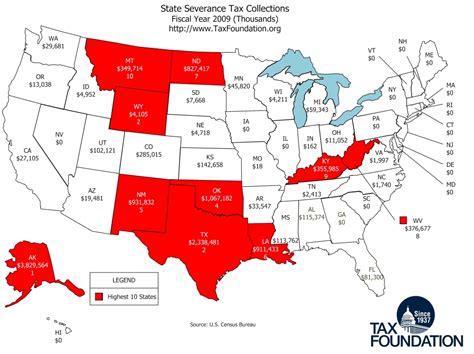

South Carolina also imposes various other taxes, including gasoline tax, cigarette tax, alcohol tax, and estate tax. These taxes are designed to fund specific initiatives and programs, such as road maintenance, healthcare, and education.

Impact of State Taxes on South Carolina’s Economy

State taxes play a critical role in shaping South Carolina’s economy. They provide the necessary funding for public services, infrastructure development, and economic growth initiatives. By understanding the state’s tax system, businesses and individuals can make informed decisions regarding their financial strategies and contributions to the state’s economy.

Economic Development and Tax Incentives

South Carolina has implemented several tax incentives and programs to encourage economic development and attract new businesses. These incentives often take the form of tax credits, grants, and reduced tax rates for qualifying businesses. For instance, the state offers tax credits for job creation, research and development, and investment in certain industries.

One notable example is the South Carolina Rural Infrastructure Advantage Grant, which provides financial assistance to businesses that create jobs and invest in infrastructure in rural areas of the state. This grant can significantly reduce the tax burden for eligible businesses, making it an attractive incentive for companies looking to expand their operations in South Carolina.

State Tax Revenue and Public Services

The revenue generated from state taxes is vital for funding essential public services. These services include education, healthcare, public safety, and infrastructure development. For instance, the state’s income tax revenue is a significant contributor to the education budget, ensuring that schools across South Carolina receive the necessary funding for quality education.

Tax Policy and Economic Growth

South Carolina’s tax policies have a direct impact on the state’s economic growth and business environment. A well-designed tax system can attract businesses, stimulate investment, and create jobs. On the other hand, complex or burdensome tax policies can deter businesses and hinder economic growth.

The state’s recent efforts to simplify its tax code and reduce tax rates have been praised by many businesses and economic experts. These reforms aim to make South Carolina more competitive in the global market and attract businesses looking for a favorable tax environment.

Conclusion

South Carolina’s state tax system is a critical component of the state’s economy and public services. Understanding the various taxes, their rates, and their impact is essential for individuals and businesses operating within the state. By offering a balanced tax structure and attractive incentives, South Carolina aims to foster economic growth and improve the lives of its residents.

What is the current income tax rate in South Carolina?

+

As of the 2023 tax year, South Carolina has six income tax brackets ranging from 0% to 7%. The tax rate increases progressively with higher income brackets.

Are there any sales tax exemptions in South Carolina?

+

Yes, South Carolina offers various sales tax exemptions for specific items, such as food, prescription drugs, and certain manufacturing equipment. These exemptions can vary based on local jurisdictions.

How does South Carolina’s property tax system work?

+

Property taxes in South Carolina are administered at the county level, resulting in varying tax rates across the state. The tax is typically calculated as a percentage of the property’s assessed value.

What tax incentives does South Carolina offer to businesses?

+

South Carolina provides a range of tax incentives, including tax credits for job creation, research and development, and investment in certain industries. These incentives aim to attract businesses and stimulate economic growth.

How do state taxes impact South Carolina’s economy and public services?

+

State taxes are a critical source of revenue for South Carolina, funding public services, infrastructure development, and economic growth initiatives. A well-designed tax system can attract businesses and improve the overall economic landscape.