Michigan Income Tax Calculator

The Michigan income tax calculator is a powerful tool for individuals and businesses alike, providing an easy and accurate way to estimate and calculate tax liabilities in the state of Michigan. This calculator, designed to navigate the complexities of Michigan's tax system, is a crucial resource for ensuring compliance with state tax regulations. With its user-friendly interface and precise calculations, it simplifies the process of determining tax obligations, offering a valuable service to taxpayers across the state.

Understanding Michigan’s Income Tax System

Michigan operates a flat tax system for personal income, meaning all taxable income is subject to the same tax rate. Currently, the state income tax rate in Michigan stands at 4.25%. However, it’s important to note that this rate is subject to change based on legislative decisions and budget considerations. Additionally, Michigan allows for a homestead property tax credit, which provides a tax refund to homeowners and renters based on their income and property taxes paid. This credit aims to offset some of the property tax burden for eligible residents.

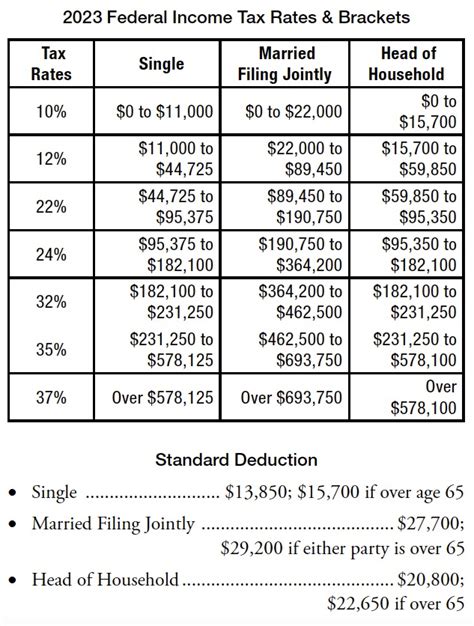

Income Tax Rates and Brackets

While Michigan maintains a flat tax rate for personal income, it’s worth exploring the nuances of its tax brackets. The state’s tax system divides income into different brackets, each with its own unique considerations. For instance, income up to $37,650 is taxed at a rate of 4.25%, but this rate is applicable to the entire income amount, not just the portion above the bracket threshold. This system ensures a fair and balanced approach to taxation, taking into account the varying financial circumstances of taxpayers.

| Income Bracket | Tax Rate |

|---|---|

| Up to $37,650 | 4.25% |

| $37,651 and above | 4.25% |

Taxable Income and Deductions

Determining taxable income in Michigan involves a careful consideration of various factors. The state defines taxable income as federal adjusted gross income with certain modifications. These modifications include the subtraction of federal and state tax refunds, as well as deductions for contributions to certain retirement plans. It’s essential to consult the Michigan Department of Treasury’s guidelines for a comprehensive understanding of what constitutes taxable income and eligible deductions.

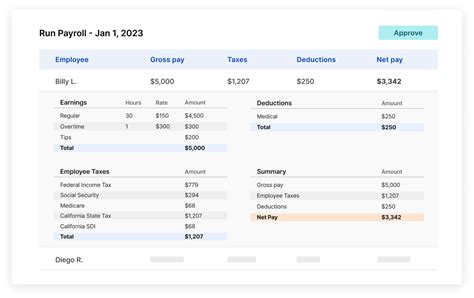

Using the Michigan Income Tax Calculator

The Michigan income tax calculator is a user-friendly tool, designed to simplify the tax calculation process. Users input their personal details, including income, deductions, and credits, and the calculator provides an estimate of their tax liability. This calculator is particularly useful for taxpayers who are self-employed, have multiple sources of income, or are claiming various credits and deductions. It ensures that these taxpayers can accurately calculate their tax obligations, taking into account all relevant factors.

Calculator Features and Benefits

The Michigan income tax calculator offers several key features that enhance its usability and accuracy. These include:

- Real-time Calculations: The calculator provides instant results, allowing users to quickly estimate their tax liability.

- Customizable Inputs: Users can input their specific financial details, ensuring an accurate representation of their tax situation.

- Tax Bracket Analysis: The calculator displays which tax bracket the user's income falls into, offering a clear understanding of their tax rate.

- Deduction and Credit Calculations: It accounts for various deductions and credits, providing a comprehensive estimate of tax liability.

Step-by-Step Guide to Using the Calculator

- Access the Michigan income tax calculator online. (Provide a link if available.)

- Enter your personal information, including name, address, and filing status.

- Input your total income for the year, including all sources.

- Select any applicable deductions and credits. The calculator will guide you through the options.

- Review and confirm your entries. The calculator will then provide an estimate of your tax liability.

Tax Planning and Strategy

The Michigan income tax calculator serves as a valuable tool for tax planning and strategy development. By providing an accurate estimate of tax liability, it enables taxpayers to make informed decisions about their financial choices. For instance, it can help individuals determine the optimal timing for income generation or the best strategies for claiming deductions and credits.

Maximizing Deductions and Credits

Michigan offers several deductions and credits that can significantly reduce tax liabilities. These include deductions for contributions to certain retirement plans, medical expenses, and charitable donations. Additionally, the state provides credits for low-income taxpayers and those with dependents. By using the income tax calculator, taxpayers can identify these opportunities and strategize ways to maximize their deductions and credits, ultimately reducing their tax burden.

Future Tax Considerations

While the current tax rate in Michigan is 4.25%, it’s important to stay informed about potential changes. The state’s tax system is subject to legislative amendments and budget considerations, which could impact tax rates and brackets. Therefore, it’s advisable to regularly consult official sources, such as the Michigan Department of Treasury, for the latest tax information and updates. This ensures that taxpayers can plan effectively for the future, taking into account any potential changes to the tax landscape.

Conclusion

The Michigan income tax calculator is an indispensable tool for anyone navigating the state’s tax system. By providing accurate and timely tax estimates, it empowers taxpayers to make informed financial decisions. Whether for personal or business use, this calculator simplifies the process of calculating tax liabilities, ensuring compliance with Michigan’s tax regulations. As a trusted resource, it continues to play a vital role in the financial planning and strategy development of taxpayers across the state.

What is the current income tax rate in Michigan?

+The current income tax rate in Michigan is 4.25% for all taxable income.

Are there any income tax brackets in Michigan?

+Yes, Michigan has a flat tax rate, but it still divides income into brackets. Income up to $37,650 is taxed at 4.25%, with the same rate applying to income above this threshold.

How can I calculate my Michigan income tax liability?

+You can use the Michigan income tax calculator, which is available online. Input your personal details, income, deductions, and credits to estimate your tax liability.

Are there any deductions or credits available in Michigan to reduce my tax liability?

+Yes, Michigan offers deductions for contributions to certain retirement plans, medical expenses, and charitable donations. Additionally, there are credits available for low-income taxpayers and those with dependents.

Where can I find the latest information on Michigan’s tax rates and regulations?

+The Michigan Department of Treasury is the official source for tax information. Their website provides the latest updates on tax rates, brackets, and regulations.