Aarp Tax Return Help

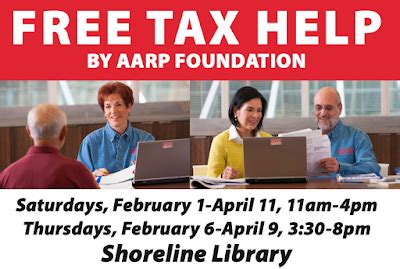

With tax season upon us, many older adults turn to AARP Foundation Tax-Aide for assistance in navigating the complexities of their tax returns. This free, volunteer-driven program has been a valuable resource for millions of taxpayers for decades, offering a helping hand to those who may find the tax process daunting. Let's delve into the world of AARP Tax-Aide, exploring its history, services, and the impact it has on the community.

A History of Tax Assistance: The Evolution of AARP Tax-Aide

The origins of AARP Tax-Aide can be traced back to the early 1960s when a group of AARP volunteers in California recognized the need for tax assistance among older adults. They initiated a pilot program, offering free tax preparation services to low- and middle-income taxpayers with simple returns. The program’s success led to its expansion, and by the 1970s, it had grown into a nationwide initiative, reaching taxpayers in all 50 states and the District of Columbia.

Over the years, AARP Tax-Aide has adapted to the evolving tax landscape, incorporating new technologies and staying abreast of changing tax laws. This adaptability has ensured that the program remains relevant and accessible to taxpayers, providing accurate and up-to-date information. Today, AARP Tax-Aide is the largest volunteer-run tax preparation and assistance program in the United States, offering a vital service to millions of individuals and families.

The Services Offered: A Comprehensive Tax Assistance Program

At its core, AARP Tax-Aide is dedicated to providing free tax preparation and e-filing services to taxpayers with low to moderate income, with special attention given to those 50 and older. The program’s volunteers, many of whom are trained and certified by the IRS, offer expert guidance and assistance in completing tax returns accurately and efficiently.

Beyond tax preparation, AARP Tax-Aide volunteers also provide crucial education and support. They help taxpayers understand the tax laws and regulations that impact their returns, ensuring that individuals are aware of the credits and deductions they are eligible for. This educational aspect is particularly valuable for older adults, who may face unique tax situations due to retirement income, social security benefits, or other age-related considerations.

A Snapshot of AARP Tax-Aide Services

- Free tax preparation and e-filing for low- and middle-income taxpayers

- Assistance with federal and state tax returns, including complex forms and schedules

- Education on tax laws, credits, and deductions

- Specialized support for older adults, including retirement and social security considerations

- Assistance with prior-year tax returns, amendments, and extensions

- Help with health insurance marketplace tax provisions

- Support for military personnel and veterans

- Spanish-language assistance available at select locations

The Impact: Empowering Taxpayers and Strengthening Communities

The impact of AARP Tax-Aide extends far beyond the completion of tax returns. By offering free services, the program ensures that taxpayers, regardless of their income level, have access to the support they need to navigate the tax system. This not only helps individuals and families receive the refunds or credits they are entitled to but also prevents them from falling victim to predatory tax preparation services or scams.

The program's reach is extensive, with AARP Tax-Aide serving more than 1.8 million taxpayers in 2022 alone. These taxpayers collectively received over $1 billion in refunds and credits, underscoring the program's significant financial impact. Moreover, the program's volunteers, who dedicate countless hours to helping others, form strong connections within their communities, fostering a sense of trust and support.

Key Impacts of AARP Tax-Aide

| Taxpayers Served | Over 1.8 million |

|---|---|

| Refunds and Credits Received | $1 billion |

| Community Connections | Stronger and more supportive |

| Volunteer Hours | Millions of hours dedicated to helping others |

The Future of Tax Assistance: Expanding Reach and Impact

Looking ahead, AARP Tax-Aide is committed to continuing its vital work, adapting to the changing needs of taxpayers and the tax landscape. The program aims to expand its reach, particularly in underserved communities, ensuring that all taxpayers have access to the support they need. This includes efforts to increase awareness of the program and its services, as well as initiatives to attract and train new volunteers.

Furthermore, AARP Tax-Aide is exploring ways to enhance its digital capabilities, recognizing the growing importance of technology in tax preparation. By embracing digital tools and platforms, the program can reach a wider audience and offer even more convenient and efficient services to taxpayers.

Future Initiatives

- Expanding services to underserved communities

- Increasing awareness and outreach efforts

- Attracting and training new volunteers

- Enhancing digital capabilities for remote assistance

- Staying abreast of tax law changes and regulations

As AARP Tax-Aide continues its journey, it remains a beacon of support for taxpayers, particularly older adults, offering a helping hand through the often-daunting tax process. With its dedicated volunteers and comprehensive services, the program will continue to empower taxpayers and strengthen communities for years to come.

How can I find an AARP Tax-Aide location near me?

+You can use the AARP Tax-Aide locator tool on their website. Simply enter your zip code or city and state to find the nearest Tax-Aide location and its operating hours.

What are the income requirements for AARP Tax-Aide services?

+AARP Tax-Aide services are available to taxpayers with low to moderate income. While the exact income limits may vary by location, generally, the program serves individuals with incomes of 58,000 or less and couples with incomes of 93,000 or less.

Can AARP Tax-Aide assist with complex tax situations, such as business income or real estate transactions?

+Yes, AARP Tax-Aide volunteers are trained to handle a wide range of tax situations, including complex forms and schedules. They can assist with business income, rental property income, and other specialized tax scenarios.