Understanding the Importance of Your Business Tax Number for Financial Success

Amidst the intricate web of financial management and corporate operations, one element consistently emerges as the linchpin for legal compliance, strategic planning, and resource optimization: the Business Tax Number. Often overlooked by entrepreneurs and even seasoned managers, this seemingly simple identifier wields profound influence over a company's fiscal health and reputation. Grasping its multifaceted significance extends beyond mere registration—it's an essential component that underpins transparency, credibility, and sustainable growth. In this deep-dive, we will explore why understanding and properly utilizing your business tax number can become a decisive factor for long-term financial success.

The Role of a Business Tax Number in Corporate Identity and Compliance

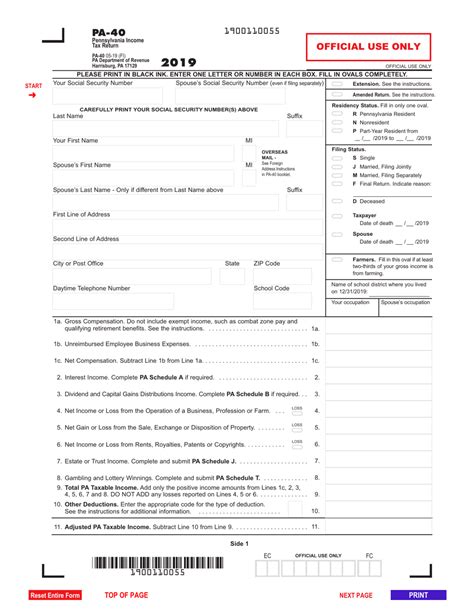

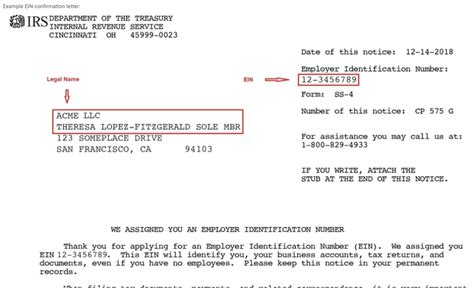

A business tax number—known variably as Employer Identification Number (EIN) in the United States, VAT registration number in Europe, or Business Registration Number in other jurisdictions—serves as an official, unique identifier issued by tax authorities. Its primary function is to link a company’s financial activities with its legal registration, ensuring compliance with taxation laws, facilitating accurate record-keeping, and enabling transparent reporting. Without this number, businesses risk administrative complications, legal penalties, and compromised credibility in financial dealings.

From a legal standpoint, possessing an officially recognized tax number is non-negotiable. It acts as a foundational credential that affirms legitimacy in the eyes of regulatory bodies, vendors, clients, and financial institutions. Significantly, this identifier also simplifies tax filing processes, enabling swift submission of returns, avoiding fines, and establishing a clear audit trail—a critical advantage in financial scrutiny scenarios.

Financial Operations and Strategic Planning Anchored on Tax Identification

Beyond compliance, a business tax number becomes an anchor for expansive financial activities—opening bank accounts, securing credit, and managing payroll. Banks and financial institutions rely heavily on this number to assess creditworthiness, verify legal existence, and process transactions. Without it, a business encounters hurdles in establishing credit lines, attracting investors, or even establishing trading partnerships.

Strategically, understanding the nuances of your tax number can unlock tax incentives and deductions. For instance, in many jurisdictions, specific accounting for VAT or sales tax hinges on accurate registration and recording under your business tax number. Entrepreneurs who leverage this insight can optimize cash flows, reduce tax liabilities, and reinvest savings into growth initiatives. Moreover, having a recognized tax number enhances the company's data credibility in financial models and investor presentations, securing confidence and facilitating expansion.

Implications for Digital Transactions and Global Market Engagement

The digital economy amplifies the importance of your business tax number in international contexts. Cross-border e-commerce, online services, and digital payment platforms often require verification via this identifier to legitimize transactions. Non-compliance or ignorance around proper registration can lead to service restrictions, penalties, or even blacklisting in certain markets.

For multinational enterprises, the tax number also enables adherence to international reporting standards such as FATCA (Foreign Account Tax Compliance Act) or CRS (Common Reporting Standard), making compliance smoother and business operations more transparent. As global tax regimes grow increasingly interconnected, the importance of your business tax number as a trust marker cannot be overstated.

Historical Context and Evolution of Business Tax Identification

The concept of business identification numbers isn’t new. Historically, trade guilds and merchant associations issued membership numbers for tax and regulation purposes. The modern formalization began in the early 20th century with the establishment of national tax authorities seeking streamlined compliance and enforcement mechanisms. Over decades, technological innovations transitioned these systems from manual record-keeping to sophisticated digital platforms, leading to the instantaneous issuance and validation of tax identifiers.

| Relevant Category | Substantive Data |

|---|---|

| Global Adoption Rate | Over 180 countries maintain some form of business tax registration system, with nearly 99% requiring a tax number for formal businesses. |

| Processing Time | Most jurisdictions issue tax numbers within 1-14 days post-application, with expedited options available in certain cases. |

| Tax Compliance Impact | Businesses without proper registration face fines averaging 15-30% of unpaid taxes or operational suspension in extreme cases. |

Strategies to Maximize the Benefits of Your Business Tax Number

Optimal utilization of your business tax number involves strategic registration, diligent record maintenance, and proactive compliance management. Here are key strategies to consider:

- Ensure Accurate and Timely Registration: Start by registering with the correct authorities—this differs per jurisdiction—ensuring all legal forms are properly completed. Delays or inaccuracies can hinder access to financial channels or attract penalties.

- Maintain Up-to-Date Records: Keep your registration details current, especially in cases of organizational changes, address updates, or business activity expansion. Outdated or inconsistent data may invalidate your tax number’s legal standing or complicate audits.

- Leverage Digital Compliance Tools: Use accounting software and compliance management systems that integrate with tax authorities. Automating reporting deadlines and data submission reduces errors and ensures seamless adherence to regulations.

- Consult Tax Professionals: Engage with tax experts to interpret evolving legislation, identify applicable incentives, and plan accordingly. Their insights can help you avoid pitfalls and capitalize on jurisdiction-specific benefits.

- Monitor International Regulations: For companies operating across borders, stay informed about cross-jurisdictional tax agreements, reporting standards, and registration requirements to navigate global markets without legal friction.

The Digital Age and Future Outlook of Business Tax Identification

As we progress further into digitization, the future of business tax numbers likely involves integration with blockchain-based registries, AI-driven compliance analytics, and real-time reporting protocols. Governments worldwide are increasingly adopting electronic tax administration systems, reducing manual processes, and improving transparency standards.

Additionally, the integration of business tax data with financial ecosystems encourages innovation in fintech, enabling instant credit approvals based on verified tax credentials, automated tax filing, and global tax harmonization efforts. For entrepreneurs, staying ahead of these trends necessitates embracing digital tools and maintaining proactive engagement with regulatory bodies.

Key Points

- Understanding the business tax number is vital for legal compliance, financial transparency, and strategic positioning.

- Proper registration and recordkeeping streamline operations and open avenues for tax advantages.

- Digital transformation will continue to evolve the role and functionality of tax identifiers, emphasizing real-time, integrated compliance.

- Global engagement depends heavily on accurate, recognized tax identification for cross-border transactions and reporting.

- Continuous learning about evolving jurisdictions and technological advances enhances long-term financial success.

What is a business tax number and why is it important?

+A business tax number is a unique identifier issued by tax authorities to a business entity. It’s essential for legal compliance, tax reporting, opening bank accounts, and engaging in financial transactions, especially in regulated environments.

How do I obtain my business tax number?

+The process varies by jurisdiction but generally involves submitting registration forms online or in person, providing documentation about your business, and paying applicable fees. Often, the tax authority issues the number within one to two weeks.

Can a business operate without a tax number?

+Operating without a valid tax number is typically illegal and can result in fines, sanctions, or even operational suspensions. It’s a fundamental requirement for legally conducting business activities in most jurisdictions.

What are the benefits of maintaining a current business tax number?

+A current tax number ensures ongoing compliance, enables access to banking and credit facilities, facilitates tax deductions and incentives, and enhances credibility with clients and partners.

How does digital technology impact the management of business tax numbers?

+Digital technology enables real-time registration, automatic reporting, integration with financial systems, and streamlined compliance processes, significantly reducing administrative burdens and error risks.