Ar State Tax Refund Status

As a resident of Arkansas, it is important to understand the process of checking the status of your state tax refund. The Arkansas Department of Finance and Administration (DFA) offers convenient methods to track the progress of your refund, ensuring transparency and efficiency in the tax refund process. This guide will provide an in-depth look at the various ways to check the status of your Arkansas state tax refund, offering practical advice and insights to make the process as smooth as possible.

Understanding the Arkansas State Tax Refund Process

The Arkansas DFA aims to process individual income tax refunds within 45 days of receiving a complete and accurate tax return. However, there are instances where refunds may take longer, such as when there are errors or discrepancies in the tax return, or when further review is required. In such cases, the DFA may send a letter requesting additional information or documentation.

Arkansas offers several methods to check the status of your state tax refund, allowing you to stay informed throughout the process. These methods include the Arkansas Tax Refund Tracker, online portals, and traditional mail or phone inquiries.

Arkansas Tax Refund Tracker: A Modern Approach

The Arkansas Tax Refund Tracker is a user-friendly online tool designed to provide real-time information on the status of your state tax refund. This innovative platform offers a convenient way to stay updated without the need for constant phone calls or mail inquiries.

How to Access the Arkansas Tax Refund Tracker

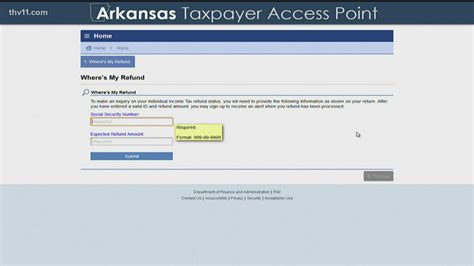

To utilize the Arkansas Tax Refund Tracker, you will need to visit the official Arkansas DFA website. Here's a step-by-step guide to accessing the tracker:

- Navigate to the Arkansas DFA website (https://www.dfa.arkansas.gov).

- Locate and click on the "Check Your Refund Status" link, which is typically found under the "Taxes" section.

- On the refund status page, you will be prompted to enter your Social Security Number, Filing Status, and the Amount of Your Refund as shown on your tax return.

- Click "Submit" to access your refund status.

The Arkansas Tax Refund Tracker provides a secure and efficient way to check your refund status, offering up-to-date information without the need to provide additional personal details.

Features and Benefits of the Arkansas Tax Refund Tracker

The Arkansas Tax Refund Tracker offers several advantages, including:

- Real-Time Updates: The tracker provides current information on the status of your refund, allowing you to stay informed throughout the process.

- Convenience: Accessible 24/7, the tracker eliminates the need for phone calls or mail inquiries, providing a quick and convenient way to check your refund status.

- Security: The tracker uses secure encryption to protect your personal information, ensuring a safe and confidential experience.

- User-Friendly Interface: Designed with simplicity in mind, the tracker is easy to navigate, even for those who are not tech-savvy.

Alternative Methods: Online Portals and Traditional Inquiries

While the Arkansas Tax Refund Tracker is a modern and efficient way to check your refund status, there are alternative methods available for those who prefer traditional approaches or require additional assistance.

Arkansas DFA Online Portal

The Arkansas DFA offers an online portal where taxpayers can access a range of services, including checking the status of their state tax refund. Here's how to utilize this portal:

- Visit the Arkansas DFA website (https://www.dfa.arkansas.gov).

- Click on the "Online Services" link, typically found in the main navigation menu.

- Select the "Individual Income Tax" option.

- Choose the "Check Your Refund Status" option from the available services.

- Follow the prompts to log in or create an account to access your refund status.

The online portal provides a secure and comprehensive platform to manage your tax-related matters, including checking the status of your refund, filing tax returns, and more.

Traditional Inquiries: Mail and Phone

For those who prefer more traditional methods, the Arkansas DFA offers the option to inquire about your state tax refund status via mail or phone.

Inquiring by Mail

To inquire about your refund status by mail, you will need to send a written request to the Arkansas DFA. Here's the address:

Arkansas Department of Finance and Administration

Revenue Division

P.O. Box 1272

Little Rock, AR 72203

Include the following information in your written request:

- Your full name as shown on your tax return

- Your Social Security Number

- Your Arkansas tax account number (if available)

- The tax year for which you are inquiring about the refund

Inquiring by Phone

The Arkansas DFA provides a toll-free number for taxpayers to inquire about their state tax refund status. Call 1-800-925-7229 during regular business hours to speak with a representative who can assist you.

Frequently Asked Questions (FAQ)

What if I have not received my refund within the estimated timeframe?

+If you have not received your refund within the estimated timeframe, it is advisable to first check the status of your refund using the Arkansas Tax Refund Tracker. If the tracker indicates a delay, you may need to wait a few more days, as refunds can sometimes take longer due to various reasons. However, if the tracker shows that your refund has been issued and you still have not received it, contact the Arkansas DFA for further assistance.

Can I track the status of my joint tax return refund separately?

+Yes, you can track the status of your joint tax return refund separately. When using the Arkansas Tax Refund Tracker, you will need to enter your Social Security Number, filing status, and the amount of your refund as shown on your tax return. Each spouse can access their own refund status using their individual information.

How can I ensure my refund is processed accurately and efficiently?

+To ensure accurate and efficient processing of your refund, it is crucial to submit a complete and accurate tax return. Double-check all the information you provide, including your personal details, filing status, and deductions or credits claimed. Additionally, ensure that you are using the correct tax forms and schedules for your specific situation. If you have any doubts or questions, consider seeking professional tax advice.

Can I check the status of my business tax refund using the same methods?

+Yes, you can use the same methods to check the status of your business tax refund in Arkansas. The Arkansas Tax Refund Tracker, online portal, and traditional mail or phone inquiries are available for both individual and business tax refunds. However, keep in mind that the process and requirements for business tax refunds may differ, so ensure you have the necessary information and documentation ready when checking the status.

Conclusion: Stay Informed and Up-to-Date

Understanding the various methods to check the status of your Arkansas state tax refund empowers you to stay informed and take control of your financial matters. Whether you choose the modern approach of the Arkansas Tax Refund Tracker or prefer the traditional methods of mail or phone inquiries, the Arkansas DFA offers convenient and secure options to suit your needs. By utilizing these resources, you can ensure a smooth and efficient tax refund process, allowing you to plan your finances with confidence.