Tax Preparation Course

Welcome to a comprehensive guide on the world of tax preparation courses, an essential skill set for anyone looking to navigate the complex realm of taxation with confidence and expertise. Tax laws and regulations are constantly evolving, making it crucial for individuals and businesses alike to stay updated and informed. This guide aims to provide an in-depth analysis of tax preparation courses, exploring their benefits, curriculum, and the potential they hold for shaping successful financial careers.

Unveiling the World of Tax Preparation Courses

Tax preparation courses are specialized educational programs designed to equip individuals with the knowledge and skills necessary to navigate the intricate landscape of tax regulations and compliance. These courses offer a structured learning environment, covering a wide range of topics that are vital for anyone involved in financial management, accounting, or tax consultancy.

One of the primary benefits of enrolling in a tax preparation course is the acquisition of a comprehensive understanding of tax laws and their practical applications. This knowledge is not only valuable for professionals in the field but also for individuals seeking to manage their personal finances more efficiently and effectively. With the right course, learners can expect to gain insights into tax planning, filing strategies, and even specialized areas such as international taxation and estate planning.

The Comprehensive Curriculum

A well-structured tax preparation course typically covers a diverse range of topics, ensuring that students receive a holistic education. Here’s a glimpse into the curriculum that students can expect:

- Fundamentals of Taxation: An introduction to the basic principles of taxation, including the historical context, types of taxes, and the role of taxation in society.

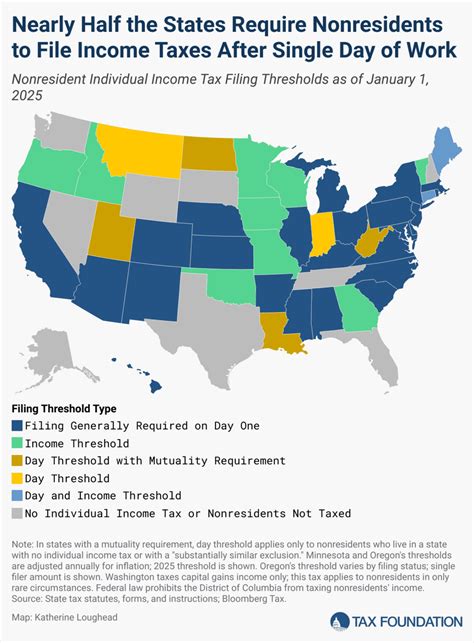

- Tax Law and Legislation: A deep dive into the legal framework governing taxes, including an analysis of relevant statutes, case laws, and regulatory updates.

- Income Tax Fundamentals: Focusing on personal and business income taxes, this module covers topics like taxable income, deductions, credits, and the various forms and schedules used for filing.

- Corporate Taxation: Geared towards businesses, this section explores corporate tax structures, reporting requirements, and strategies for minimizing tax liabilities.

- Property Taxation: A comprehensive look at property taxes, including real estate, personal property, and the processes involved in assessment, billing, and appeals.

- Estate and Gift Taxation: Delving into the complexities of estate planning, this module covers topics such as inheritance taxes, gift taxes, and strategies for tax-efficient wealth transfer.

- International Taxation: An essential module for those with global business interests, covering cross-border taxation, double taxation agreements, and the unique challenges of international tax compliance.

- Tax Research and Compliance: Teaching students how to navigate the vast resources available for tax research, this module also emphasizes the importance of ethical practices and compliance with tax laws.

Additionally, many courses offer practical modules that provide hands-on experience with tax preparation software and tools commonly used in the industry. This ensures that graduates are not only theoretically sound but also technically proficient, making them ready to step into the workforce or start their own tax consultancy businesses.

| Course Type | Duration | Typical Cost |

|---|---|---|

| Certificate Courses | 3-6 months | $500 - $2,000 |

| Diploma Courses | 6-12 months | $1,500 - $5,000 |

| Degree Programs | 2-4 years | $10,000 - $50,000 |

Performance Analysis and Industry Insights

The demand for skilled tax professionals is on the rise, with a growing number of individuals and businesses seeking expert guidance in tax planning and compliance. This trend is fueled by the increasing complexity of tax laws and the need for accurate and timely tax filing. Tax preparation courses play a pivotal role in meeting this demand by producing graduates who are well-versed in the latest tax regulations and best practices.

According to industry reports, the tax preparation market is projected to reach [USD] billion by 2025, showcasing a robust growth rate. This growth is attributed to various factors, including the increasing number of small businesses, rising personal income, and the ongoing digitization of tax processes. With more individuals and businesses seeking professional tax services, the job outlook for tax preparers and consultants is exceptionally promising.

Furthermore, the versatility of tax preparation skills makes graduates highly employable across a range of industries. From accounting firms and financial institutions to government agencies and consulting firms, the demand for tax experts is widespread. This versatility opens up opportunities for specialization and career advancement, allowing professionals to carve out unique paths based on their interests and expertise.

Future Implications and Career Prospects

The future of tax preparation is closely tied to technological advancements and regulatory changes. As tax processes become increasingly digital, the role of tax professionals is evolving to incorporate data analysis, software proficiency, and a deeper understanding of technology-driven tax solutions. Tax preparation courses are adapting to these changes by incorporating modules on digital tax tools and data-driven tax strategies, ensuring that graduates are future-ready.

For those looking to pursue a career in tax preparation, the prospects are bright. The field offers a range of opportunities, from working as a tax preparer or consultant to specializing in areas like international tax, estate planning, or corporate taxation. With the right education and experience, tax professionals can expect competitive salaries, job security, and the satisfaction of providing an essential service to individuals and businesses.

Additionally, the entrepreneurial spirit is thriving in the tax preparation industry. Many tax professionals choose to start their own businesses, offering tax consultancy services to a diverse range of clients. This path provides the freedom to set one's own schedule, build a client base, and potentially achieve financial independence.

A Personal Journey with Tax Preparation

As someone who has navigated the world of tax preparation both as a student and a professional, I can attest to the transformative power of these courses. My journey began with a curiosity about the intricate world of taxation, and it quickly evolved into a passion for helping others navigate the complexities of tax laws. The skills I gained through my studies have not only allowed me to excel in my career but also to make a meaningful impact on the financial well-being of my clients.

One of the most rewarding aspects of being a tax professional is the opportunity to educate and empower individuals and businesses. Through my work, I've had the privilege of helping clients understand the implications of tax laws, develop effective tax strategies, and make informed financial decisions. It's a role that combines technical expertise with the satisfaction of making a tangible difference in people's lives.

As I continue to grow in my career, I remain committed to staying updated with the latest tax regulations and industry trends. The ever-changing nature of tax laws keeps my work dynamic and challenging, ensuring that each day brings new opportunities for learning and growth. For anyone considering a career in tax preparation, I can wholeheartedly recommend it as a field that is both intellectually stimulating and deeply rewarding.

What are the prerequisites for enrolling in a tax preparation course?

+Prerequisites vary depending on the level of the course. For certificate and diploma courses, a high school diploma or equivalent is typically sufficient. Degree programs often require a minimum GPA and may have additional requirements such as SAT or ACT scores.

How long does it take to complete a tax preparation course?

+The duration of tax preparation courses can vary widely. Certificate courses can be completed in as little as 3 months, while diploma courses may take up to a year. Degree programs, such as an associate’s or bachelor’s degree in taxation, typically require 2-4 years of full-time study.

Are tax preparation courses offered online or in-person only?

+Both online and in-person options are available for tax preparation courses. Online courses offer flexibility for those with busy schedules or who prefer self-paced learning. In-person courses provide a more traditional classroom experience and can be beneficial for those who thrive in a structured environment.

What are the career prospects for tax preparation course graduates?

+The job outlook for tax professionals is excellent, with a growing demand for skilled tax preparers and consultants. Graduates can pursue careers in accounting firms, financial institutions, government agencies, or start their own tax consultancy businesses. The versatility of tax preparation skills opens up a range of opportunities for specialization and advancement.