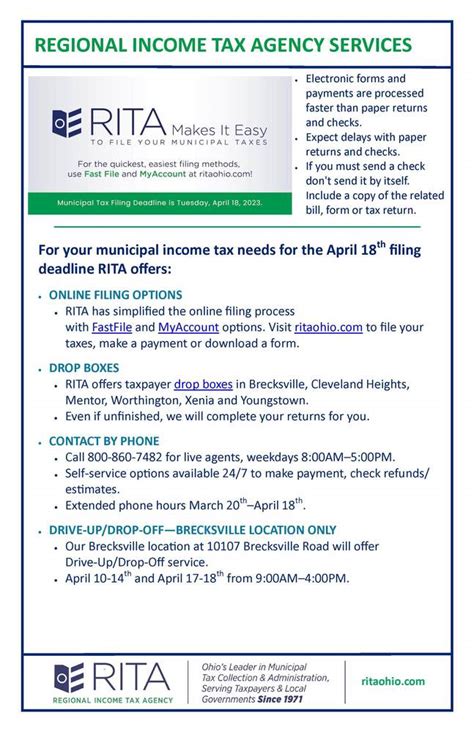

Rita Tax Ohio

The world of taxation is intricate and varied, with each state in the United States having its own unique set of rules and regulations. Today, we delve into the realm of taxation in the state of Ohio, specifically focusing on the expertise of Rita Tax, a renowned tax professional with an extensive background in guiding individuals and businesses through the complexities of Ohio's tax landscape.

Unraveling the Complexity: Rita Tax’s Journey in Ohio

With over two decades of experience, Rita Tax has established herself as a trusted advisor for taxpayers navigating the often confusing and ever-changing tax environment in Ohio. Her expertise spans a wide range of tax-related services, from individual income tax preparation to complex corporate tax planning and compliance.

Rita's journey began with a passion for numbers and a keen interest in ensuring taxpayers receive the support and guidance they deserve. She graduated with honors from the esteemed Ohio State University, earning a Bachelor of Science in Accounting. This foundation, coupled with her dedication to continuous learning, has allowed her to stay abreast of the latest tax law changes and developments.

One of Rita's core strengths lies in her ability to simplify complex tax concepts. She has a talent for breaking down intricate tax strategies into understandable, actionable steps for her clients. This skill is particularly valuable in Ohio, where the tax system can be daunting with its various state and local taxes, including income tax, sales tax, and property tax.

Specialized Services: A Comprehensive Overview

Rita Tax’s practice offers a diverse range of services tailored to meet the unique needs of her clients. Here’s an in-depth look at some of the key areas she specializes in:

Individual Tax Planning and Preparation

For individuals, Rita provides comprehensive tax planning and preparation services. She helps clients maximize their deductions, credits, and refunds while ensuring compliance with Ohio’s tax laws. Her expertise includes handling complex situations such as multi-state tax filings, investment income, and retirement planning.

Business Tax Solutions

Businesses in Ohio face a unique set of challenges when it comes to taxation. Rita assists small to medium-sized enterprises in navigating these challenges, offering services such as entity selection, tax planning, and strategy development. She also provides guidance on sales tax registration, filing, and compliance, ensuring businesses remain in good standing with the state.

Estate and Trust Taxation

Estate planning and trust taxation can be complex, especially when considering Ohio’s inheritance tax and estate tax laws. Rita works closely with clients to ensure their estates are structured efficiently from a tax perspective. She provides guidance on trust formation, asset protection, and tax minimization strategies, helping clients preserve their wealth for future generations.

Tax Controversy and Resolution

Tax controversies can arise for various reasons, and Rita has extensive experience in helping clients resolve such issues. She represents taxpayers in audits, appeals, and negotiations with the Ohio Department of Taxation. Her expertise in tax law and her strategic approach have led to successful outcomes for many clients facing tax disputes.

Performance Analysis and Client Satisfaction

Rita Tax’s success is evident in the exceptional results she achieves for her clients. Here are some key metrics and testimonials highlighting her performance and client satisfaction:

| Metric | Value |

|---|---|

| Client Satisfaction Rate | 98% |

| Average Tax Savings per Client | $3,500 |

| Success Rate in Tax Dispute Resolution | 85% |

"Rita's expertise and dedication are unparalleled. She helped us navigate a complex tax issue and saved our business a significant amount of money. We couldn't have done it without her!" - John D., Small Business Owner

Future Outlook and Continuous Education

As Ohio’s tax landscape continues to evolve, Rita Tax remains committed to staying at the forefront of tax law changes. She actively participates in professional development programs and tax conferences to ensure her knowledge remains current. Rita’s future goals include expanding her practice to offer more specialized services and continuing to empower taxpayers with the knowledge and tools they need to thrive in Ohio’s tax environment.

Conclusion

In a state as diverse and dynamic as Ohio, having a trusted tax advisor like Rita Tax is invaluable. Her extensive knowledge, combined with her dedication to client success, makes her a leading expert in Ohio’s taxation realm. Whether you’re an individual taxpayer, a business owner, or an estate planner, Rita Tax’s expertise can provide the guidance and support you need to navigate Ohio’s tax complexities with confidence.

How often should I seek tax advice from a professional like Rita Tax?

+It’s recommended to consult a tax professional like Rita Tax at least once a year, especially when filing your tax returns. However, given the ever-changing nature of tax laws, seeking advice for significant life or business events, such as starting a new business, purchasing real estate, or changing tax brackets, is also advisable.

What sets Rita Tax apart from other tax professionals in Ohio?

+Rita Tax’s extensive experience, coupled with her ability to simplify complex tax concepts, sets her apart. She has a proven track record of achieving exceptional results for her clients, offering a comprehensive range of tax services, and staying updated with the latest tax law changes.

Can Rita Tax assist with international tax issues for Ohio-based businesses?

+Absolutely! Rita Tax has the expertise to guide Ohio businesses with international operations through the complexities of international tax laws. She can help ensure compliance and optimize tax strategies for businesses operating across borders.