California Sales Tax Los Angeles

Welcome to the Golden State, where sunshine and taxes go hand in hand! If you're a resident, business owner, or just curious about the world of sales taxes in California, especially in the vibrant city of Los Angeles, you've come to the right place. Get ready to dive into the intricacies of sales tax laws and regulations that shape the retail landscape of this diverse state.

California, known for its iconic landmarks, diverse culture, and thriving economy, has a unique approach to sales taxation. With its vast size and varied demographics, the state's sales tax system can seem like a complex maze, but fear not! This comprehensive guide will navigate you through the specific rates, regulations, and real-world examples to ensure you're well-equipped to handle sales tax matters in Los Angeles and beyond.

Understanding California Sales Tax: An Overview

California’s sales tax is a consumption tax imposed on the sale of goods and certain services. It is a vital source of revenue for the state, funding essential services, infrastructure, and public projects. The tax is administered by the California Department of Tax and Fee Administration (CDTFA), which ensures compliance and collects taxes from businesses.

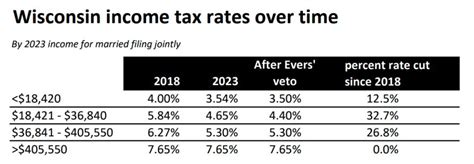

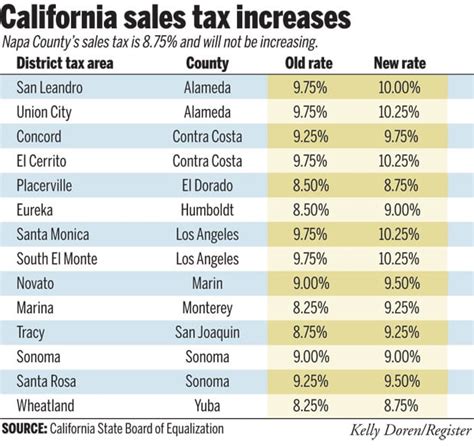

The state of California operates on a base sales tax rate of 7.25%, which is applicable statewide. However, the real complexity arises from the local sales tax rates that vary across different counties and cities within the state. These local rates are often added on top of the base rate, creating a combined sales tax that can significantly impact the final price of goods and services.

Diving into Los Angeles Sales Tax

Now, let’s zoom in on the City of Angels, Los Angeles. With its bustling metropolis, vibrant culture, and diverse neighborhoods, LA presents a unique sales tax landscape. The city is known for its entertainment industry, fashion trends, and innovative businesses, all of which contribute to a complex sales tax environment.

Los Angeles Sales Tax Rate

In Los Angeles, the combined sales tax rate consists of the state base rate of 7.25% and an additional local tax rate of 1.25%, making the total sales tax 8.5%. This local rate is applied uniformly across the city and is used to fund various public services and projects.

| Sales Tax Category | Rate |

|---|---|

| State Base Rate | 7.25% |

| Los Angeles Local Rate | 1.25% |

| Total Combined Rate | 8.5% |

It's important to note that while the city-wide rate is consistent, there may be special tax districts within Los Angeles that have additional tax rates. These districts are often established to support specific community projects or infrastructure improvements.

Sales Tax Exemptions in Los Angeles

Not all transactions are subject to sales tax. California, and by extension Los Angeles, provides various sales tax exemptions to promote certain economic activities and support specific industries. Here are some key exemptions to be aware of:

-

Food and Groceries: Most unprepared food items and groceries are exempt from sales tax in California. This includes staples like bread, milk, fruits, and vegetables. However, it's important to note that prepared foods and certain specialty items may still be taxable.

-

Clothing and Shoes: In a fashion-forward city like Los Angeles, it's great news that clothing and footwear purchases under $100 are exempt from sales tax. This exemption aims to support the retail industry and make essential items more affordable for residents.

-

Prescription Drugs: Sales tax is not applicable to prescription medications in California. This exemption is designed to make healthcare more accessible and affordable for residents.

-

Manufacturing Equipment: To promote economic growth, certain machinery and equipment used in manufacturing processes are exempt from sales tax. This exemption encourages businesses to invest in new technologies and infrastructure.

Sales Tax Registration and Compliance

If you’re a business owner operating in Los Angeles, understanding your sales tax obligations is crucial. Here’s a quick guide to help you navigate the registration and compliance process:

Registering for Sales Tax

To collect and remit sales tax in Los Angeles, businesses must first register with the California Department of Tax and Fee Administration (CDTFA). The registration process involves providing essential business information, including the type of goods and services offered, estimated annual sales, and the location of your business operations.

Sales Tax Compliance

Once registered, businesses are responsible for collecting the appropriate sales tax from customers and remitting it to the CDTFA on a regular basis. The frequency of remittance depends on the business’s sales volume and can range from monthly to annually.

Businesses are also required to issue accurate sales tax receipts to customers, detailing the breakdown of the tax charged. This ensures transparency and helps customers understand the tax component of their purchases.

Sales Tax Filing and Remittance

Filing sales tax returns and remitting the collected tax is a critical aspect of sales tax compliance. Here’s a simplified breakdown of the process:

Filing Sales Tax Returns

Businesses are required to file sales tax returns electronically through the CDTFA’s online portal. The return must include a detailed report of taxable sales, exempt sales, and the total amount of tax collected during the reporting period.

Remitting Sales Tax

Along with filing the sales tax return, businesses must remit the collected tax to the CDTFA by the due date. The remittance can be made through various methods, including electronic funds transfer (EFT), credit card, or check. Late payments may incur penalties and interest, so it’s essential to stay on top of your remittance schedule.

Sales Tax Audits and Enforcement

The CDTFA takes sales tax compliance seriously and conducts regular audits to ensure businesses are meeting their tax obligations. Audits can be random or triggered by specific factors, such as significant changes in business operations or complaints.

During an audit, the CDTFA may review your sales records, tax returns, and other financial documents to verify the accuracy of your reported sales and tax payments. It's crucial to maintain detailed records and cooperate fully with the audit process to avoid penalties and legal complications.

Penalties and Interest

Failure to comply with sales tax regulations can result in significant penalties and interest charges. The CDTFA has a range of penalties, including late filing fees, late payment fees, and even criminal charges for severe cases of tax evasion.

To avoid these penalties, it's essential to stay informed about sales tax regulations, register your business correctly, and remit taxes promptly. Consider seeking professional advice or using tax software to ensure accurate reporting and compliance.

Conclusion

Understanding and navigating California’s sales tax system, especially in a complex city like Los Angeles, is a crucial aspect of doing business in the state. From the varying tax rates to the specific exemptions and compliance requirements, this guide has provided you with a comprehensive overview to ensure you’re well-prepared.

Remember, staying informed and compliant not only helps you avoid legal pitfalls but also contributes to the overall economic well-being of the state. As you continue your business ventures in Los Angeles, keep an eye on the ever-evolving sales tax landscape and stay connected to reliable sources for the latest updates.

What is the current sales tax rate in Los Angeles?

+

As of my last update in January 2023, the combined sales tax rate in Los Angeles is 8.5%. This includes the state base rate of 7.25% and a local tax rate of 1.25%.

Are there any sales tax holidays in California?

+

Yes, California occasionally offers sales tax holidays, typically for back-to-school shopping or energy-efficient appliance purchases. These holidays are announced by the state and provide an opportunity for shoppers to save on sales tax.

How often do I need to file sales tax returns in Los Angeles?

+

The frequency of filing sales tax returns depends on your business’s sales volume. If your business has monthly sales of over $50,000, you are required to file monthly returns. If sales are below this threshold, you may file quarterly or annually, but monthly filing is always an option.

Are there any special tax districts in Los Angeles with different rates?

+

Yes, Los Angeles has special tax districts, often called “benefit assessment districts,” that may have additional tax rates to fund specific community projects. These districts are typically focused on infrastructure or community improvement initiatives.