Alabama Auto Sales Tax

Welcome to the comprehensive guide on understanding the Alabama Auto Sales Tax. As a car enthusiast and financial planner, I often receive questions about the intricacies of automotive taxation in the state of Alabama. This article aims to provide an in-depth analysis, shedding light on the nuances of the Alabama auto sales tax system, its impact on car buyers, and the various factors influencing this taxation process.

The Basics of Alabama Auto Sales Tax

Alabama imposes a sales tax on the purchase of vehicles, including automobiles, trucks, motorcycles, and other motor vehicles. This tax is levied on the sales price of the vehicle and is collected by the Alabama Department of Revenue. The sales tax is a percentage of the vehicle’s value, and it applies to both new and used car purchases. It’s an essential revenue source for the state, contributing to infrastructure development, education, and other public services.

The Alabama auto sales tax rate is a fixed percentage across the state, ensuring uniformity. As of my last update, the standard sales tax rate for vehicles in Alabama is 4%. However, it's crucial to note that this rate is subject to change, and buyers should verify the current rate with official sources before finalizing their purchase.

Understanding the Tax Calculation

The Alabama auto sales tax is calculated based on the purchase price of the vehicle. For instance, if you’re purchasing a new car priced at 30,000, the sales tax would amount to 1,200 (4% of $30,000). This tax is usually added to the total cost of the vehicle, including any additional fees and charges.

It's worth mentioning that Alabama also has a Title Ad Valorem Tax, which is an additional tax based on the vehicle's value. This tax is typically paid when registering a vehicle and is calculated as a percentage of the vehicle's assessed value. The Title Ad Valorem Tax is separate from the sales tax and is an important consideration for car buyers.

| Tax Type | Rate | Application |

|---|---|---|

| Sales Tax | 4% | Levied on the sales price of a vehicle |

| Title Ad Valorem Tax | Varies by County | Based on vehicle's assessed value at registration |

Factors Influencing the Alabama Auto Sales Tax

Several factors can impact the overall tax burden on car buyers in Alabama. Understanding these factors can help consumers make more informed decisions and potentially negotiate better deals.

Vehicle Price and Type

The sales tax is directly proportional to the vehicle’s price. Higher-priced vehicles will attract a higher tax amount. Additionally, the type of vehicle can also influence the tax calculation. Certain luxury vehicles or vehicles with specialized features may be subject to additional taxes or fees.

County-Specific Taxes

Alabama allows counties to impose additional taxes on vehicle purchases. These taxes can vary significantly from one county to another. For instance, Mobile County has a 2% additional sales tax on vehicle purchases, while other counties may have different rates or no additional tax at all. It’s essential to research the county-specific taxes before finalizing your purchase location.

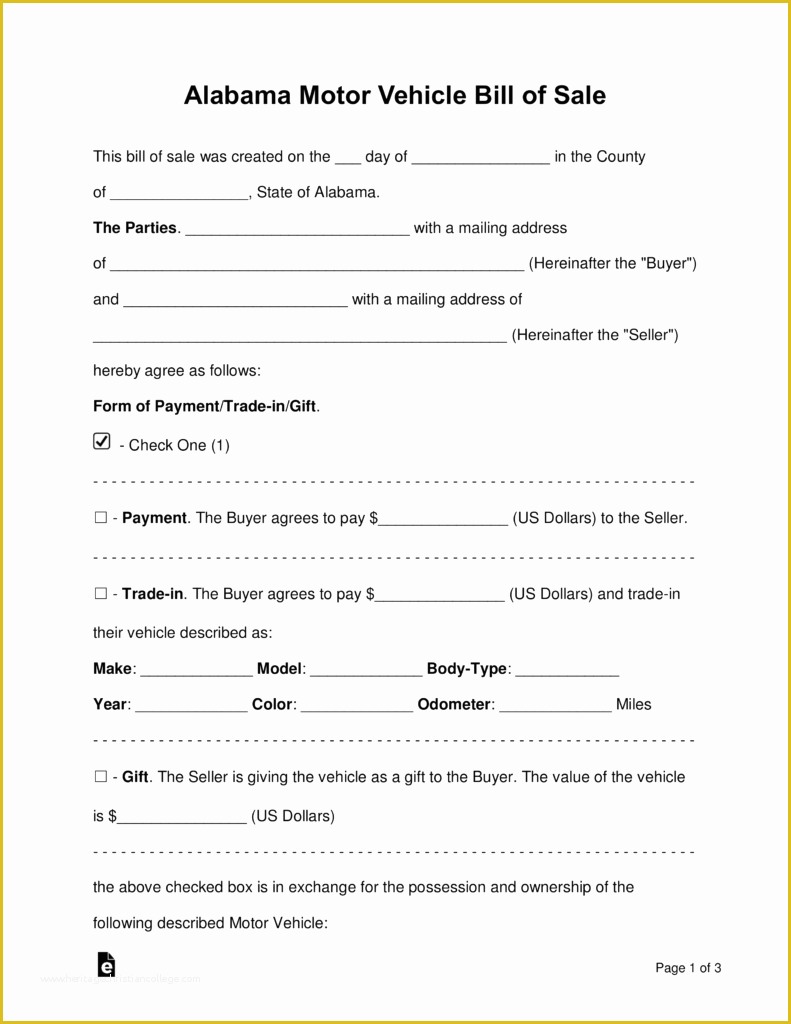

Trade-Ins and Discounts

The sales tax calculation is based on the net purchase price after any trade-ins or discounts. If you’re trading in your old vehicle or negotiating a discount on the new one, these factors can significantly impact the final tax amount. Always consider these variables when estimating your total costs.

Alabama Auto Sales Tax: A Comparative Analysis

To provide context, let’s compare Alabama’s auto sales tax with that of neighboring states. This analysis can offer valuable insights into the competitiveness of Alabama’s tax system and help buyers make informed decisions.

Alabama vs. Georgia

Georgia has a 7% sales tax rate for vehicle purchases. This means that for a 30,000 vehicle, the sales tax in Georgia would be 2,100, compared to $1,200 in Alabama. This difference could be a significant consideration for car buyers living near the Alabama-Georgia border.

Alabama vs. Tennessee

Tennessee, on the other hand, has a 7.5% sales tax rate for vehicles. For the same 30,000 vehicle, the sales tax in Tennessee would amount to 2,250. Again, this disparity can influence buying decisions, especially for those considering cross-state purchases.

| State | Sales Tax Rate | Tax on $30,000 Vehicle |

|---|---|---|

| Alabama | 4% | $1,200 |

| Georgia | 7% | $2,100 |

| Tennessee | 7.5% | $2,250 |

The Impact of Alabama Auto Sales Tax on Car Buyers

The Alabama auto sales tax, while an essential revenue source for the state, can significantly impact the overall cost of purchasing a vehicle. For many car buyers, this tax can represent a substantial financial burden, especially for those purchasing high-value vehicles.

Budgeting and Financial Planning

Understanding the auto sales tax is crucial for effective budgeting and financial planning. Buyers need to consider not only the vehicle’s sticker price but also the additional tax burden. This tax can make a substantial difference in the overall affordability of a vehicle, especially for those on a tight budget.

Negotiating Power and Strategies

Knowledge of the auto sales tax can also empower buyers during negotiations. By understanding the tax implications, buyers can strategize their purchases to minimize costs. For instance, negotiating a lower sales price can result in a lower tax amount, ultimately saving money.

The Role of Dealerships and Negotiations

Dealerships play a significant role in the auto sales tax process. They are responsible for calculating and collecting the tax, which is then remitted to the state. While dealerships have a set tax rate, they can sometimes offer incentives or discounts that can reduce the overall tax burden. It’s always beneficial to discuss tax implications with the dealership and explore potential savings.

Future Implications and Potential Changes

The Alabama auto sales tax system is subject to change, and staying informed about potential modifications is essential for car buyers. While the current tax rate is stable, there have been discussions about potential reforms and adjustments to the taxation system.

Potential Reforms and Adjustments

Some experts advocate for a shift from a sales tax model to a value-added tax (VAT) system for vehicle purchases. A VAT would be applied at each stage of the vehicle’s production and distribution, potentially simplifying the tax system. However, the implementation of such a reform is uncertain and would require significant legislative changes.

Impact of Economic Factors

Economic factors, such as inflation and the state’s financial health, can also influence the auto sales tax. In times of economic hardship, the state may consider increasing tax rates to generate additional revenue. Conversely, during prosperous periods, the state might reduce tax rates to stimulate economic growth.

Staying Informed

To stay updated on any changes to the Alabama auto sales tax, car buyers should regularly check official sources, such as the Alabama Department of Revenue’s website. Additionally, staying informed about local news and legislative updates can provide valuable insights into potential tax reforms.

Conclusion

Understanding the Alabama auto sales tax is a critical aspect of car buying in the state. This guide has provided an in-depth analysis, offering valuable insights into the tax system, its implications, and potential future changes. By staying informed and proactive, car buyers can make well-informed decisions, ensuring they get the best value for their purchases.

Frequently Asked Questions

How often does Alabama change its auto sales tax rate?

+

The Alabama auto sales tax rate is relatively stable, with changes occurring infrequently. However, it’s essential to check for updates before making a significant vehicle purchase.

Are there any exceptions or exemptions to the Alabama auto sales tax?

+

Certain vehicles, such as those used exclusively for agricultural or commercial purposes, may be eligible for tax exemptions. It’s advisable to consult with a tax professional or the Alabama Department of Revenue for specific exemptions.

Can I negotiate the auto sales tax with the dealership?

+

The auto sales tax is a mandatory fee set by the state, and dealerships have little control over it. However, you can negotiate the vehicle’s sales price, which directly impacts the tax amount.