Hennepin County Tax Records

Welcome to an in-depth exploration of the Hennepin County Tax Records, a comprehensive guide designed to provide you with all the information you need about this crucial administrative aspect of the county. Hennepin County, located in the state of Minnesota, USA, is home to a diverse range of communities and businesses, and understanding its tax system is essential for residents, businesses, and anyone interested in the county's economic landscape.

The Significance of Hennepin County Tax Records

Tax records are the backbone of any county’s financial system, and Hennepin County is no exception. These records play a vital role in the county’s governance, impacting various aspects of life for its residents and businesses. From property assessments to tax rates and payment deadlines, these records provide a transparent and organized framework for financial obligations.

The county's tax system ensures the provision of essential public services, from maintaining roads and infrastructure to funding education and social services. By understanding the tax records, residents can actively participate in the county's financial planning and hold local authorities accountable for their fiscal responsibilities.

Understanding Property Assessments

At the heart of Hennepin County’s tax system are property assessments. These assessments determine the value of real estate properties within the county, which in turn determines the amount of property taxes due. The process is intricate, involving a team of professionals who evaluate properties based on various factors such as location, size, improvements, and market trends.

Property assessments are not just a financial obligation but also a reflection of the property's value in the local real estate market. They influence the property's marketability, resale value, and its overall contribution to the county's tax base. Residents and property owners have the right to review and appeal their assessments, ensuring a fair and accurate valuation process.

| Assessment Category | Assessment Details |

|---|---|

| Residential Properties | Assessed at 90% of market value. Market value is determined by recent sales of similar properties, adjustments for unique features, and consideration of economic factors. |

| Commercial Properties | Assessed at 100% of market value. Market value is based on income potential, location, and market conditions. Special assessments may apply for improvements like road construction. |

| Agricultural Lands | Assessed based on productivity and soil quality. Special valuation methods consider the land's capacity for agricultural production, ensuring fairness for farmers. |

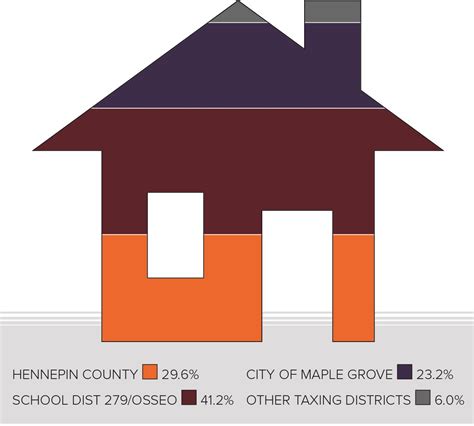

Tax Rates and Payment Deadlines

Once properties are assessed, the county determines the tax rates, which are applied to the assessed values to calculate the tax liability for each property. These rates are set annually and are influenced by the county’s budgetary needs and the tax base.

Hennepin County operates on a biennial tax system, with taxes levied in odd-numbered years based on the previous year's assessments. This system provides stability and predictability for property owners. The county sends tax statements to property owners, detailing the assessed value, applicable taxes, and payment deadlines.

| Tax Type | Tax Rate (2023) | Payment Deadline |

|---|---|---|

| Residential Property Tax | 0.01475% of assessed value | Due in two installments: May 15th and October 15th |

| Commercial Property Tax | 0.015% of assessed value | Same as residential, with an additional installment due on February 15th for commercial properties with a high tax liability. |

| Special Assessments | Varies based on the improvement project | Payment plans are available, and the county works with property owners to ensure affordability. |

Online Tax Services and Resources

Hennepin County understands the importance of accessibility and convenience in tax administration. The county offers an array of online services to make tax-related tasks easier for residents and businesses.

- Online Property Tax Lookup: Residents can easily look up their property tax records, including assessed values, tax amounts, and payment history, all from the comfort of their homes.

- e-Services: This platform allows for secure online tax payments, saving time and reducing the need for physical visits to the county offices.

- Tax Calendar: Hennepin County provides an online calendar with important tax-related dates, ensuring residents stay informed about deadlines and avoid penalties.

- Appeal Process: Property owners can initiate the appeal process online, making it more accessible and efficient. The county provides clear guidelines and support throughout the appeal process.

Impact on Local Economy and Community

Hennepin County’s tax system plays a pivotal role in shaping the local economy and community. The revenue generated from property taxes funds vital public services, ensuring the county’s infrastructure, education, and social safety nets remain robust.

By investing in these public goods, the county attracts businesses and residents, fostering economic growth and development. Additionally, the transparency and fairness of the tax system build trust between the county and its stakeholders, encouraging civic participation and a sense of community.

Future Implications and Trends

As Hennepin County continues to grow and evolve, its tax system must adapt to meet changing needs and expectations. The county is committed to exploring innovative solutions, such as online platforms and payment options, to enhance the tax experience for residents and businesses.

Furthermore, the county is dedicated to ensuring tax equity, considering factors like income levels and property values. By analyzing data and trends, Hennepin County aims to create a tax system that is fair, efficient, and responsive to the diverse needs of its residents.

Conclusion

Hennepin County’s tax records are a vital component of the county’s governance and economic health. By understanding these records, residents and businesses can actively participate in the county’s financial planning, ensuring a bright and sustainable future for all.

This comprehensive guide aims to demystify the county's tax system, providing clarity and insight into a crucial aspect of Hennepin County's administration. For more information and updates, residents and stakeholders are encouraged to visit the Hennepin County website and explore the array of resources available.

How often are property assessments conducted in Hennepin County?

+Property assessments are conducted every year in Hennepin County. These assessments ensure that property values are up-to-date and reflect current market conditions.

What happens if I miss a tax payment deadline?

+Missing a tax payment deadline can result in penalties and interest charges. Hennepin County encourages timely payments to avoid these additional costs. If you anticipate difficulties with a payment, it’s advisable to contact the county’s tax office to discuss potential arrangements.

Can I appeal my property assessment if I believe it’s inaccurate?

+Absolutely! Hennepin County provides a fair and transparent process for property owners to appeal their assessments. You can initiate the appeal process online, and the county will guide you through the necessary steps. It’s important to gather evidence and be prepared to justify your claim.

Are there any tax relief programs available for low-income residents or seniors?

+Yes, Hennepin County offers several tax relief programs to support low-income residents and seniors. These programs include the Homestead Credit, which provides a reduction in property taxes for eligible homeowners, and the Market Value Credit, which offers relief based on income levels. The county’s website provides detailed information on these programs and eligibility criteria.