Toledo Income Tax

Toledo, a vibrant city nestled along the shores of Lake Erie, is not only a cultural hub but also a city with a unique income tax system. The Toledo Income Tax is a municipal income tax levied on residents and businesses within the city limits, playing a crucial role in the city's fiscal framework. In this comprehensive guide, we will delve into the intricacies of the Toledo Income Tax, exploring its history, its impact on the local economy, and how it compares to other municipal taxes across the United States.

A Historical Perspective

The Toledo Income Tax has a rich history that dates back to the mid-20th century. In 1967, Toledo became one of the first cities in Ohio to implement a local income tax. This move was a response to the city's growing need for stable revenue sources to fund essential services and infrastructure development. The initial tax rate was set at 1%, applying to both individuals and businesses.

Over the years, the tax rate has undergone several adjustments, reflecting the changing economic landscape and the city's financial requirements. These adjustments have been a delicate balance between ensuring sufficient revenue for city operations and maintaining competitiveness with neighboring regions.

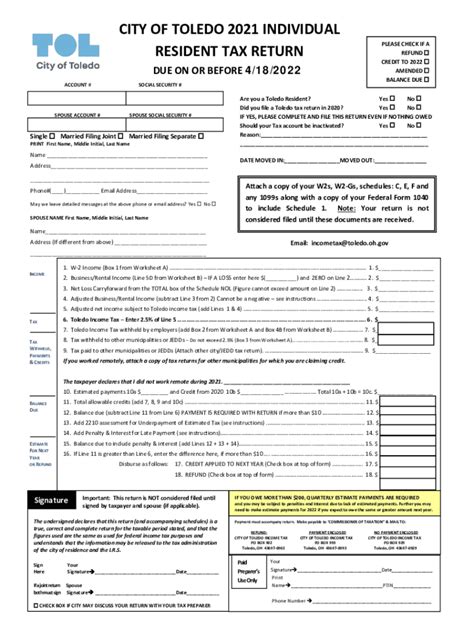

How Does Toledo Income Tax Work?

The Toledo Income Tax is a progressive tax, meaning the tax rate increases as income levels rise. This structure aims to ensure that those with higher incomes contribute proportionally more to the city's finances. The current tax rates are as follows:

| Income Level | Tax Rate |

|---|---|

| Up to $10,000 | 1.00% |

| $10,001 - $25,000 | 1.50% |

| $25,001 - $50,000 | 1.75% |

| $50,001 and above | 2.00% |

It's important to note that Toledo residents who also work within the city limits are subject to the tax on their entire income, while those who work outside Toledo are taxed only on the income earned within the city. This distinction is a critical aspect of the Toledo Income Tax system.

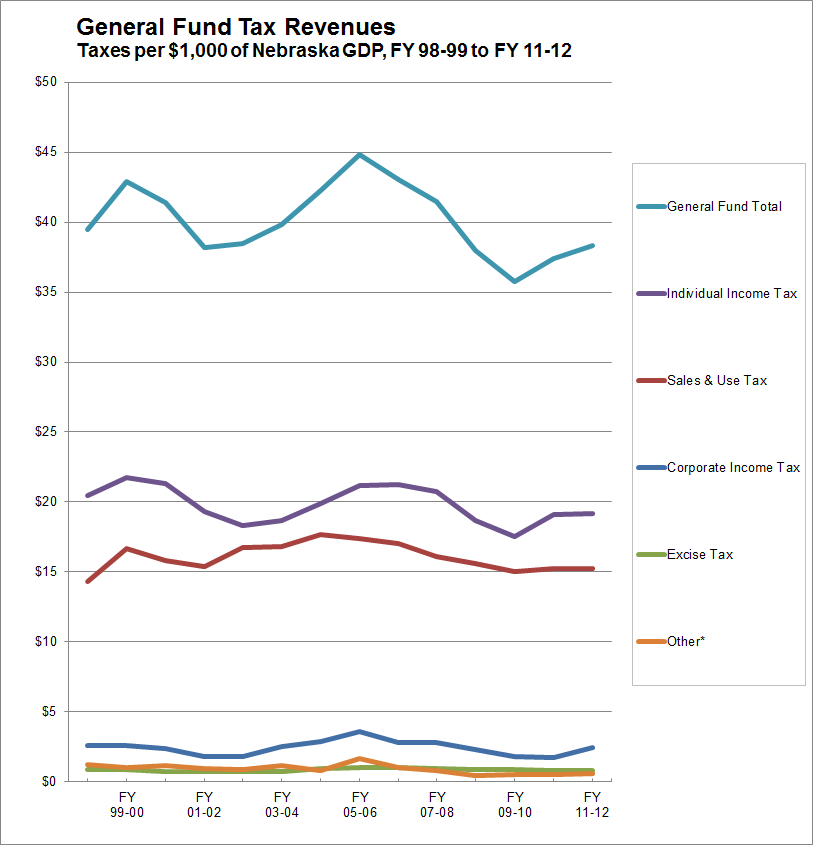

Impact on the Local Economy

The Toledo Income Tax has had a significant impact on the city's economic landscape. It has provided a stable source of revenue, allowing the city to invest in critical infrastructure projects, improve public services, and support local businesses. This tax has been a key driver in the city's economic development, attracting new businesses and fostering a vibrant business ecosystem.

Additionally, the progressive nature of the tax has helped distribute the financial burden fairly across different income levels. This has contributed to a more equitable distribution of resources and has supported the overall well-being of Toledo's residents.

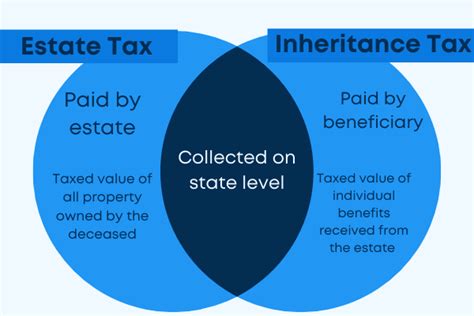

Comparison with Other Municipal Taxes

When compared to other municipal income taxes across the United States, Toledo's tax system stands out for its progressive nature and relatively high tax rates. While many cities also levy income taxes, the rates and structures can vary significantly.

For instance, cities like Cleveland and Columbus, also in Ohio, have income tax rates ranging from 1.8% to 2.5%, with varying brackets. In contrast, cities like Chicago have a flat tax rate of 2.9%, regardless of income level.

Toledo's progressive approach is designed to align with its specific economic needs and demographics. It ensures that higher-income earners contribute more, providing a more equitable distribution of tax burden.

The Role of Exemptions and Credits

To mitigate the impact on low-income earners and encourage certain economic activities, the Toledo Income Tax system includes exemptions and tax credits. These provisions provide relief to specific segments of the population and businesses.

- Homestead Exemption: Residents who own their primary residence in Toledo may be eligible for a $200 exemption from the income tax. This exemption helps reduce the tax burden on homeowners.

- Senior Citizen Exemption: Senior citizens over the age of 65 who meet certain income criteria may be exempt from the income tax, providing financial relief to this demographic.

- Research and Development Tax Credit: To encourage innovation, Toledo offers a tax credit for businesses engaged in research and development activities within the city.

These exemptions and credits demonstrate the city's commitment to supporting its residents and fostering economic growth.

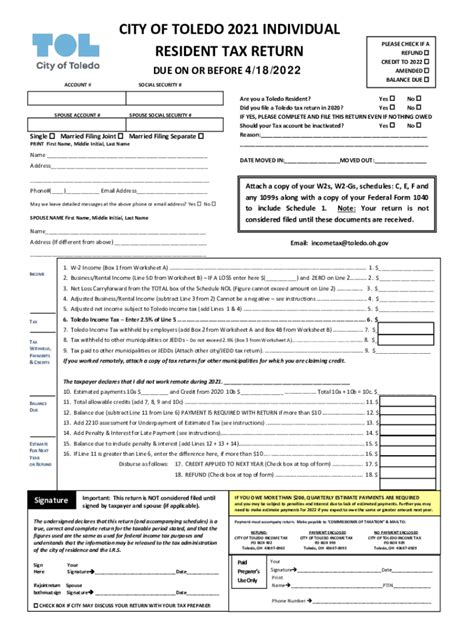

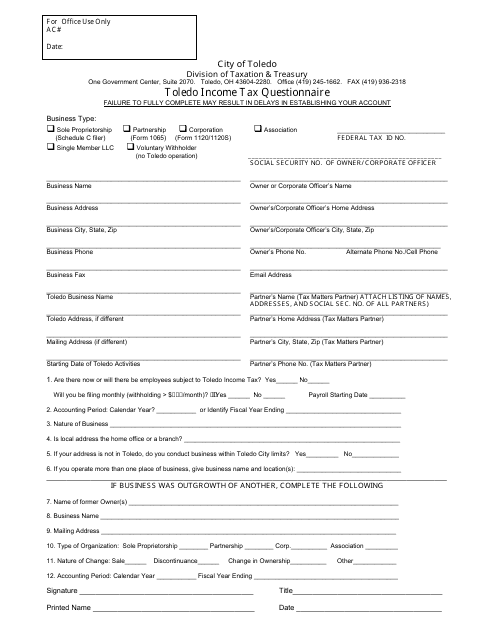

Compliance and Enforcement

Ensuring compliance with the Toledo Income Tax is a critical aspect of the system. The city has implemented a robust enforcement mechanism to ensure that taxpayers meet their obligations. Failure to comply can result in penalties and interest charges.

The Toledo Income Tax Bureau is responsible for administering and enforcing the tax. They provide guidance to taxpayers, assist with filing, and ensure that the tax system is fair and equitable for all.

Future Outlook and Potential Changes

As with any tax system, the Toledo Income Tax is subject to ongoing evaluation and potential adjustments. The city regularly assesses its financial needs and the economic climate to determine if tax rates should be modified.

In recent years, there has been a growing discussion about the potential for tax reform to make the system more streamlined and equitable. This includes proposals to simplify tax brackets and explore new ways to support the city's economic growth while ensuring fairness for all residents.

Additionally, with the rise of remote work and changing economic dynamics, the city may need to consider how the tax system adapts to these shifts.

Frequently Asked Questions

How often do Toledo residents need to file their income tax returns?

+Toledo residents are required to file their income tax returns annually, typically by April 15th each year. However, the city may offer extensions under certain circumstances.

Are there any online resources available to assist with filing Toledo Income Tax?

+Yes, the Toledo Income Tax Bureau provides an online filing system, making it convenient for taxpayers to file their returns electronically. This system offers guidance and ensures a smooth filing process.

Can non-residents who work in Toledo be exempt from the income tax?

+Non-residents who work in Toledo are generally subject to the income tax on their earnings within the city. However, there may be specific exemptions or reciprocity agreements with other states or municipalities.

What happens if a taxpayer fails to file their Toledo Income Tax return on time?

+Late filing of Toledo Income Tax returns can result in penalties and interest charges. It is important for taxpayers to meet their filing obligations to avoid these additional costs.

Are there any tax incentives for businesses operating in Toledo?

+Yes, Toledo offers various tax incentives to attract and support businesses. These include tax abatements, job creation credits, and incentives for specific industries. The city works closely with businesses to understand their needs and provide tailored incentives.

The Toledo Income Tax is a vital component of the city’s financial ecosystem, shaping its economic landscape and supporting its growth. As Toledo continues to evolve, the tax system will likely adapt to meet the changing needs of its residents and businesses, ensuring a sustainable and prosperous future for the city.