Pay Virginia State Taxes Online

As a Virginia resident or business owner, it's important to understand the process of paying state taxes online. The Virginia Department of Taxation offers a convenient and secure platform for taxpayers to fulfill their tax obligations efficiently. This guide will provide a comprehensive overview of the steps involved in paying Virginia state taxes online, covering everything from registration to the final payment.

Navigating the Virginia Tax System

The Virginia Department of Taxation provides an online portal known as the Virginia Tax Online System, which serves as a one-stop platform for taxpayers to manage their tax-related activities. This system offers a range of services, including registering for new accounts, filing tax returns, making payments, and accessing tax information and resources.

Before diving into the payment process, it's crucial to understand the different tax types and obligations that may apply to you or your business. Virginia state taxes encompass various categories, such as:

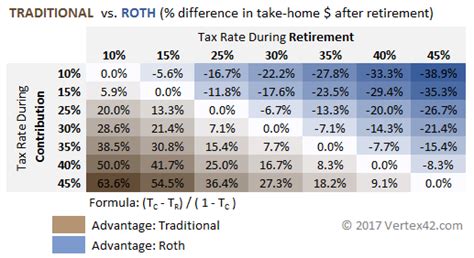

- Income Tax: This tax is levied on individuals and businesses based on their taxable income. Virginia has a progressive tax system with five income brackets, ranging from 2% to 5.75%.

- Sales and Use Tax: A tax applied to the sale or lease of tangible personal property and certain services. The standard rate is 4.3%, but local jurisdictions may impose additional taxes.

- Corporate Income Tax: Corporations doing business in Virginia are subject to a flat rate of 6% on their taxable income.

- Property Tax: Property taxes are primarily levied by local governments and school boards, with rates varying across different jurisdictions.

- Estate and Inheritance Tax: These taxes apply to the transfer of property upon death. The tax rate depends on the relationship between the deceased and the beneficiary.

Understanding these tax categories and your specific obligations is essential for accurate filing and payment.

Registering for an Online Account

To access the Virginia Tax Online System and pay your state taxes online, you’ll need to register for an account. Here’s a step-by-step guide to the registration process:

- Visit the Virginia Department of Taxation website at www.tax.virginia.gov.

- Navigate to the "Online Services" section and select "Register for Online Services".

- You'll be directed to a registration form where you'll need to provide personal information, such as your name, address, and contact details.

- Choose a unique username and password for your account. Ensure that your password meets the required complexity criteria for security purposes.

- Select the tax programs or services you wish to register for. This may include income tax, sales tax, or other relevant programs.

- Read and agree to the terms and conditions of the online system. This includes acknowledging the privacy policy and security measures.

- Complete the registration process by verifying your identity through a secure code sent to your email or mobile phone.

- Once your registration is successful, you'll receive a confirmation email with your account details and login credentials.

Note on Business Registration

If you’re registering as a business entity, you may need additional documentation and information, such as your Employer Identification Number (EIN) or business registration details. Ensure that you have these ready before beginning the registration process.

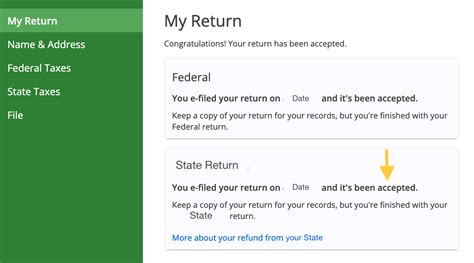

Filing Your Tax Return Online

After registering for your online account, you can proceed to file your tax return. The process may vary slightly depending on the tax type, but here’s a general overview:

- Log in to your Virginia Tax Online System account using your username and password.

- Navigate to the "File a Return" section and select the appropriate tax program, such as income tax or sales tax.

- Choose the tax year for which you're filing the return. Ensure you're using the correct form and instructions for that specific tax year.

- Enter your tax information accurately and completely. This may include income details, deductions, credits, and other relevant data.

- Review your return for accuracy. The online system may provide tools or calculators to assist with calculations and ensure compliance.

- Submit your tax return. The system will generate a confirmation number or code, which you should note for future reference.

Important Note on Deadlines

It’s crucial to be aware of the filing deadlines for each tax type. Late filing may result in penalties and interest charges. The most common deadlines are:

- Income Tax: Generally due by April 15th of each year. However, if this date falls on a weekend or holiday, the deadline is extended to the next business day.

- Sales and Use Tax: Due dates vary based on the reporting period. For monthly filers, it's typically the 20th of the following month. For quarterly filers, it's the 20th of the month after the quarter ends.

- Corporate Income Tax: Due by the 15th day of the third month after the close of the corporation's tax year.

Making Online Payments

Once you’ve filed your tax return, you can proceed to make your tax payment online. The Virginia Tax Online System offers several payment options to cater to different preferences and needs:

1. Electronic Funds Transfer (EFT)

Electronic Funds Transfer allows you to transfer funds directly from your bank account to the Virginia Department of Taxation. Here’s how to set up an EFT payment:

- Log in to your Virginia Tax Online System account.

- Navigate to the "Make a Payment" section and select "Electronic Funds Transfer".

- Enter the required information, including your bank account details, the amount to be paid, and the tax program or return to which the payment applies.

- Review the payment details and confirm the transaction. The funds will be deducted from your account, and you'll receive a confirmation number.

2. Credit Card or Debit Card

You can also pay your taxes using a credit or debit card. This option provides immediate payment confirmation and is convenient for those who prefer to use their cards for transactions. Here’s how to make a card payment:

- Log in to your Virginia Tax Online System account.

- Go to the "Make a Payment" section and select "Credit/Debit Card".

- Enter your card details, including the card number, expiration date, and CVV code.

- Select the tax program or return for which you're making the payment and specify the amount.

- Review the transaction details and confirm the payment. You'll receive a confirmation number and an email receipt.

3. Online Bill Pay

If you have online banking, you can utilize your bank’s bill pay feature to send a payment directly to the Virginia Department of Taxation. Here’s a general guide:

- Log in to your online banking account with your financial institution.

- Navigate to the "Bill Pay" or "Payments" section.

- Add the Virginia Department of Taxation as a payee. You'll need to provide the department's information, which can be found on their website or in your tax documents.

- Enter the amount you wish to pay and select the tax program or return to which the payment applies.

- Schedule the payment for the desired date and confirm the transaction. The funds will be deducted from your bank account and sent to the Department of Taxation.

4. Electronic Check (eCheck)

An electronic check, or eCheck, is a digital version of a paper check. This payment method allows you to make a secure payment directly from your bank account without the need for physical checks. Here’s how to set up an eCheck payment:

- Log in to your Virginia Tax Online System account.

- Go to the "Make a Payment" section and select "eCheck".

- Enter your bank account details, including the routing number and account number.

- Specify the amount you wish to pay and the tax program or return to which the payment applies.

- Review the payment details and confirm the transaction. The funds will be deducted from your account, and you'll receive a confirmation number.

Payment Options and Considerations

When choosing a payment method, consider the following factors:

- Fees and Charges: Credit and debit card payments incur convenience fees, while other payment methods may have lower or no fees.

- Security: Ensure that your chosen payment method provides adequate security measures to protect your financial information.

- Processing Time: Some payment methods, like EFT, may take a few business days to process, while others, like credit cards, provide immediate confirmation.

- Payment Limits: Certain payment methods may have limits on the amount that can be paid in a single transaction.

Alternative Payment Methods

In addition to the online payment methods, the Virginia Department of Taxation accepts payments through other channels:

- Mail: You can send a check or money order along with your payment voucher to the address specified on your tax return.

- Phone: Call the Department of Taxation's toll-free number and provide your payment information to make a payment over the phone.

- In-Person: Visit a local tax office or authorized payment center to make a payment in person. Bring your payment voucher and the appropriate form of payment.

Managing Your Tax Account Online

The Virginia Tax Online System provides a range of features to help you manage your tax account efficiently. These include:

- Viewing Tax Returns: Access and review your previously filed tax returns, including the status, payment history, and any associated documents.

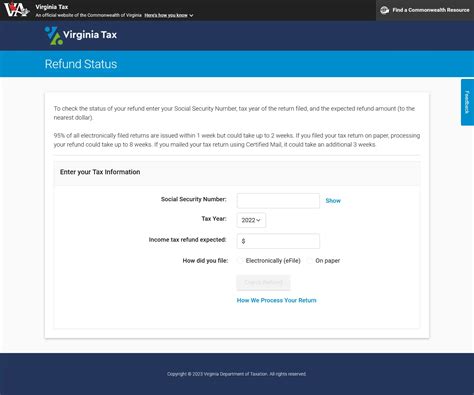

- Tracking Payment Status: Monitor the status of your payments, including whether they've been received, processed, or applied to your account.

- Updating Account Information: Edit your personal or business information, such as address changes or contact details.

- Receiving Notifications: Sign up for email or text notifications to stay informed about important deadlines, payment reminders, and other updates.

- Accessing Tax Resources: The online system provides a wealth of resources, including tax forms, instructions, and helpful guides to assist with filing and payment.

Tips for Online Account Management

To ensure a smooth experience with your online tax account, consider the following tips:

- Keep Your Account Secure: Protect your login credentials and ensure that your account is password-protected. Regularly update your password and avoid sharing it with others.

- Set Reminders: Utilize the notification system to receive reminders for upcoming deadlines and payments. This helps you stay organized and avoid late fees.

- Review Tax Information: Regularly review your tax returns and payment history to ensure accuracy and identify any potential errors or discrepancies.

- Seek Assistance: If you encounter any issues or have questions, the Virginia Department of Taxation provides a Taxpayer Assistance Center with helpful resources and contact information for further assistance.

Conclusion: A Seamless Tax Payment Experience

Paying Virginia state taxes online offers a convenient and secure way to fulfill your tax obligations. By registering for an online account, filing your tax returns, and making payments through the Virginia Tax Online System, you can efficiently manage your tax responsibilities. Remember to stay informed about deadlines, choose the payment method that best suits your needs, and utilize the various features and resources available to ensure a smooth and stress-free tax payment experience.

Frequently Asked Questions

What happens if I miss the tax filing deadline?

+

Missing the tax filing deadline can result in penalties and interest charges. It’s important to file your tax return as soon as possible to minimize these additional costs. The Virginia Department of Taxation may provide options for penalty relief in certain circumstances, so it’s advisable to contact them promptly.

Can I pay my taxes in installments?

+

Yes, the Virginia Department of Taxation offers an Installment Payment Agreement program for taxpayers who cannot pay their taxes in full by the due date. This program allows you to pay your taxes in multiple installments over a specified period. To qualify, you’ll need to complete an application and meet certain criteria.

How do I update my personal information on my tax account?

+

To update your personal information, log in to your Virginia Tax Online System account and navigate to the “Account Information” section. Here, you can edit your name, address, phone number, and other relevant details. Ensure that you provide accurate and up-to-date information to avoid any delays or complications.

What should I do if I receive a tax notice or have questions about my tax return?

+

If you receive a tax notice or have questions about your tax return, the Virginia Department of Taxation provides several resources to assist you. You can access their Taxpayer Assistance Center online, which offers helpful articles, frequently asked questions, and contact information for direct assistance. Additionally, you can call their toll-free number or visit a local tax office for personalized support.

Can I file and pay my taxes online if I’m a non-resident of Virginia?

+

Yes, the Virginia Tax Online System is accessible to non-residents as well. If you have tax obligations in Virginia, you can register for an online account, file your tax returns, and make payments just like residents. However, it’s important to ensure that you’re meeting your tax obligations accurately based on your residency status and any applicable non-resident tax laws.