Ira Withdrawal Tax Rate Calculator

The concept of early retirement is gaining traction, and with it, the need for effective financial planning strategies. One crucial aspect of this planning is understanding the tax implications of withdrawing funds from your Individual Retirement Accounts (IRAs). While IRAs offer tax advantages during the accumulation phase, withdrawals can trigger taxes, potentially impacting your overall retirement income. This comprehensive guide will delve into the intricacies of calculating IRA withdrawal tax rates, providing you with the knowledge to navigate this complex process effectively.

Understanding IRA Withdrawal Tax Basics

When you make withdrawals from your IRA, whether it’s a traditional IRA or a Roth IRA, the tax treatment differs based on several factors. These factors include the type of IRA, the timing of your withdrawals, and the nature of the funds being withdrawn. Understanding these differences is essential to accurately calculate your tax liability.

Traditional IRA Withdrawals

Withdrawing funds from a traditional IRA generally results in taxable income. The Internal Revenue Service (IRS) treats these distributions as ordinary income, subject to your marginal tax rate. This means that the tax rate applied to your IRA withdrawals depends on your overall income level and tax bracket for the year.

Additionally, if you make early withdrawals (before reaching age 59½), you may incur a 10% penalty on top of the regular income tax. However, there are exceptions to this penalty, such as for qualified education expenses, first-time home purchases, or disability.

Roth IRA Withdrawals

Roth IRA withdrawals are tax-free, provided certain conditions are met. To qualify for tax-free distributions, you must meet the five-year holding period and be at least 59½ years old or meet other specific criteria like disability or first-time home purchase.

For non-qualified withdrawals (not meeting the above criteria), the earnings portion of the withdrawal is subject to ordinary income tax, while the contribution portion remains tax-free. The tax calculation for Roth IRA withdrawals can be complex, as it involves determining the basis (contributions) and the growth (earnings) within the account.

Calculating IRA Withdrawal Tax Rates

To accurately determine your tax liability for IRA withdrawals, you’ll need to consider various factors and potentially use different methods based on the type of IRA.

Traditional IRA Withdrawal Tax Calculation

For traditional IRA withdrawals, the tax calculation is straightforward. You simply apply your marginal tax rate to the distribution amount. Here’s a step-by-step guide:

- Determine Your Marginal Tax Rate: Refer to the current tax brackets to find your marginal tax rate based on your taxable income for the year.

- Calculate the Taxable Portion: Typically, the entire distribution from a traditional IRA is taxable. However, if you’ve made non-deductible contributions, you can reduce the taxable amount by the non-deductible basis.

- Apply the Tax Rate: Multiply the taxable amount by your marginal tax rate to find the tax liability for the withdrawal.

For example, if your marginal tax rate is 22% and you withdraw $10,000 from your traditional IRA, the tax liability would be $2,200.

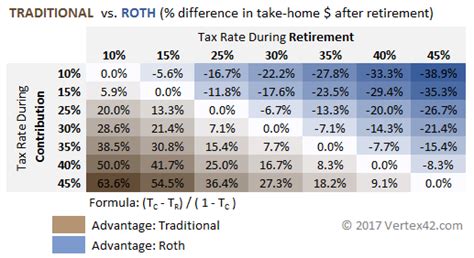

Roth IRA Withdrawal Tax Calculation

Calculating tax on Roth IRA withdrawals is more complex due to the separation of contributions and earnings. Here’s a simplified process:

- Separate Contributions and Earnings: You’ll need to track the contributions you’ve made to your Roth IRA and the growth (earnings) within the account.

- Determine Qualified vs. Non-Qualified Withdrawals: If your withdrawal meets the qualified criteria (5-year rule and age 59½ or other exceptions), it’s tax-free. Otherwise, it’s non-qualified.

- Calculate Tax on Non-Qualified Earnings: For non-qualified withdrawals, calculate the tax on the earnings portion using your marginal tax rate. The contribution portion remains tax-free.

Let's say you've contributed $5,000 to your Roth IRA and it has grown to $15,000. If you make a non-qualified withdrawal of $10,000, you'll pay tax on the $5,000 of earnings, using your marginal tax rate.

Factors Affecting IRA Withdrawal Tax Rates

Several factors can influence the tax rate applied to your IRA withdrawals. Understanding these factors can help you optimize your tax strategy.

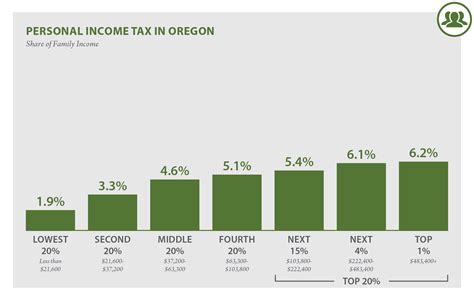

Tax Brackets and Marginal Tax Rates

The tax brackets set by the IRS determine your marginal tax rate, which in turn affects the tax liability on your IRA withdrawals. As your income increases, you may move into higher tax brackets, resulting in a higher tax rate on your withdrawals.

Timing of Withdrawals

The timing of your IRA withdrawals can have significant tax implications. Early withdrawals (before age 59½) may trigger the 10% penalty for traditional IRAs, while for Roth IRAs, it can affect the qualification for tax-free withdrawals.

Qualified vs. Non-Qualified Withdrawals

Whether your IRA withdrawal is qualified or non-qualified plays a crucial role in tax treatment. Qualified withdrawals are generally tax-free for Roth IRAs and may be subject to lower tax rates for traditional IRAs. Non-qualified withdrawals, on the other hand, are taxed at your marginal rate.

Non-Deductible Contributions

If you’ve made non-deductible contributions to a traditional IRA, these amounts reduce the taxable portion of your withdrawals. This reduction can lower your tax liability, especially if you have a substantial non-deductible basis.

Optimizing Your IRA Withdrawal Tax Strategy

To minimize the tax impact of your IRA withdrawals, consider the following strategies:

Roth IRA Conversions

Converting a traditional IRA to a Roth IRA can provide tax advantages. By paying tax on the conversion amount in a lower tax bracket, you can potentially reduce your overall tax liability and enjoy tax-free withdrawals in the future.

Strategic Withdrawal Timing

Planning your IRA withdrawals to align with your tax bracket can help optimize tax efficiency. For instance, withdrawing funds when your income is lower can result in a lower tax rate.

Coordination with Other Income Sources

Consider coordinating your IRA withdrawals with other income sources to stay within a lower tax bracket. This strategy can help you manage your overall tax liability effectively.

Utilizing Qualified Distributions

For Roth IRAs, understanding the qualified distribution rules can help you structure your withdrawals to maximize tax benefits. By meeting the criteria for qualified distributions, you can enjoy tax-free withdrawals.

Case Study: Optimizing IRA Withdrawals for Retirement

Let’s consider a hypothetical case to illustrate the impact of tax-efficient IRA withdrawal strategies. Meet John, a 60-year-old retiree with a substantial traditional IRA.

John's traditional IRA has a balance of $500,000, and he plans to withdraw $30,000 annually to supplement his retirement income. By carefully timing his withdrawals and coordinating them with his other income sources, John can stay in a lower tax bracket, reducing his overall tax liability.

For instance, if John coordinates his IRA withdrawals with his pension income, he can ensure that his total income remains within the 12% tax bracket. This strategic approach allows him to minimize the tax impact on his IRA withdrawals, optimizing his retirement income.

FAQs

How do I calculate the tax on my traditional IRA withdrawal?

+To calculate the tax on a traditional IRA withdrawal, determine your marginal tax rate based on your taxable income. Then, multiply the withdrawal amount by your marginal tax rate. If you’ve made non-deductible contributions, reduce the taxable amount by the non-deductible basis before applying the tax rate.

Are Roth IRA withdrawals always tax-free?

+Yes, qualified Roth IRA withdrawals are generally tax-free. To qualify, you must meet the 5-year holding period and be at least 59½ years old or meet other specific criteria. Non-qualified withdrawals may be subject to tax on the earnings portion.

What happens if I make early withdrawals from my traditional IRA?

+Early withdrawals from a traditional IRA before age 59½ may trigger a 10% penalty on top of the regular income tax. However, there are exceptions to this penalty, such as for qualified education expenses, first-time home purchases, or disability.

Can I avoid the 10% penalty for early IRA withdrawals?

+Yes, there are several exceptions to the 10% early withdrawal penalty for traditional IRAs. These include qualified education expenses, first-time home purchases, disability, medical expenses exceeding 7.5% of your income, and more. Consult a tax professional to determine if you qualify for any of these exceptions.