Lake County Property Tax Search

Welcome to our comprehensive guide on the Lake County Property Tax Search system. This platform is an essential tool for residents, investors, and property owners seeking detailed information about property taxes in Lake County. In this article, we will delve into the features, benefits, and intricacies of the Lake County Property Tax Search, offering a thorough understanding of its capabilities and how it can assist users in managing their property tax obligations effectively.

Navigating the Lake County Property Tax Search: A Comprehensive Guide

The Lake County Property Tax Search is a user-friendly online platform designed to provide transparent and accessible property tax information to the public. With just a few clicks, users can access a wealth of data regarding their property taxes, making it a valuable resource for anyone with an interest in Lake County real estate.

Understanding Property Tax Assessments

At the heart of the Lake County Property Tax Search is the property tax assessment process. Property taxes are determined by assessing the value of each property within the county. This assessment considers various factors, including the property's location, size, improvements, and market trends. The assessment process ensures that each property owner pays their fair share of taxes, contributing to the funding of essential county services.

The Lake County Property Tax Search allows users to view their property's assessed value, along with the calculation of their tax liability. This transparency empowers property owners to understand how their tax obligations are determined and to identify any potential discrepancies.

Key Features of the Lake County Property Tax Search

- Property Search by Address or Parcel Number: Users can easily locate their property by entering its address or parcel number. This feature is particularly useful for homeowners, real estate professionals, and potential buyers, as it provides quick access to vital property information.

- Tax History and Payment Information: The platform offers a detailed history of property tax payments, including the amounts paid, due dates, and any applicable penalties. This feature is invaluable for tracking tax obligations and ensuring timely payments.

- Tax Rate Information: Lake County Property Tax Search provides an overview of the tax rates applicable to different property types within the county. This includes information on the general tax rate, special assessment rates, and any applicable exemptions. Understanding these rates is crucial for property owners to budget effectively for their tax obligations.

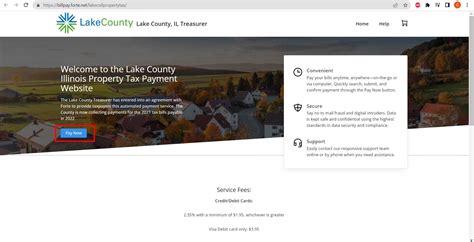

- Online Payment Options: Recognizing the convenience and security benefits of online transactions, the Lake County Property Tax Search offers a secure online payment system. Property owners can pay their taxes electronically, reducing the need for in-person visits and providing a more efficient payment process.

- Property Profile and Ownership Details: The platform provides a comprehensive property profile, including ownership information, the property's legal description, and details about any improvements or alterations. This feature is beneficial for both property owners and potential buyers, offering a transparent view of the property's history and current status.

| Property Type | Average Assessed Value | Tax Rate |

|---|---|---|

| Residential | $250,000 | 1.5% |

| Commercial | $500,000 | 1.8% |

| Agricultural | $120,000 | 1.2% |

Benefits of Using the Lake County Property Tax Search

- Transparency and Accessibility: The platform promotes transparency by providing detailed and up-to-date property tax information to the public. This accessibility empowers residents to actively engage with their tax obligations and make informed decisions.

- Efficient Tax Management: With easy access to tax payment histories and due dates, property owners can efficiently manage their tax obligations. The online payment feature further enhances convenience and reduces administrative burdens.

- Real-Time Updates: Lake County Property Tax Search ensures that users have access to the most current property tax data. This includes any changes in assessments, tax rates, or exemptions, enabling property owners to stay informed and plan accordingly.

- Improved Communication: The platform serves as a central hub for property tax-related communication. It provides a direct channel for property owners to connect with the Lake County Assessor's Office, allowing for efficient resolution of queries and concerns.

- Enhanced Property Research: For real estate professionals and investors, the platform offers valuable insights into property values and tax obligations. This data is crucial for making informed investment decisions and understanding the local real estate market.

Future Enhancements and Integration

The Lake County Property Tax Search is an evolving platform, with ongoing improvements and integrations to enhance user experience and efficiency. Some of the anticipated future enhancements include:

- Mobile Optimization: To cater to the increasing demand for mobile access, the platform is undergoing optimization for seamless use on smartphones and tablets.

- Integration with GIS (Geographic Information System): Integrating GIS technology will provide users with interactive maps, allowing for a more visual understanding of property locations and boundaries.

- Advanced Search Filters: Implementing advanced search capabilities will enable users to refine their searches based on specific criteria, such as property type, tax rate, or assessment year.

- Real-Time Notifications: A notification system will be introduced to alert users about important updates, such as changes in tax assessments or due dates, ensuring they stay informed without the need for frequent manual checks.

Conclusion: A Valuable Resource for Lake County Residents

The Lake County Property Tax Search serves as a vital tool for property owners, investors, and residents, offering a comprehensive view of their property tax obligations. With its user-friendly interface and wealth of information, the platform simplifies the process of understanding and managing property taxes. As the platform continues to evolve, it promises to further enhance the efficiency and transparency of property tax management in Lake County.

Frequently Asked Questions

How often are property tax assessments conducted in Lake County?

+

Property tax assessments in Lake County are typically conducted annually, ensuring that property values and tax obligations remain up-to-date. This annual assessment cycle allows for adjustments based on market trends and property changes.

Can I appeal my property tax assessment if I believe it is inaccurate?

+

Yes, Lake County provides a fair and transparent process for property owners to appeal their assessments. The Lake County Property Tax Search includes a dedicated section with detailed instructions on how to initiate and navigate the appeal process.

What are the payment options available for property taxes in Lake County?

+

Lake County offers a range of payment options, including online payments through the Property Tax Search platform, in-person payments at designated locations, and payment by mail. The platform provides detailed instructions on each method, ensuring flexibility for property owners.

Are there any tax exemptions or discounts available for certain property types in Lake County?

+

Yes, Lake County provides various tax exemptions and discounts to eligible property owners. These include homestead exemptions, senior citizen discounts, and exemptions for certain types of agricultural land. The Property Tax Search platform outlines the criteria and application process for these exemptions.

How can I stay informed about changes in tax rates or assessments in Lake County?

+

To stay updated on tax-related changes, you can subscribe to email notifications through the Lake County Property Tax Search platform. Additionally, the Assessor’s Office regularly publishes updates and announcements on its website and social media channels.