Title Ad Valorem Tax

Ad Valorem Tax, a concept deeply rooted in economic principles, has evolved into a complex yet essential component of modern taxation systems worldwide. This tax, assessed on the value of property or goods, serves as a critical revenue generator for governments, funding essential public services and infrastructure development. With its widespread implementation, understanding the intricacies of Ad Valorem Tax has become increasingly vital, especially for businesses and property owners.

Unraveling the Complexity of Ad Valorem Tax

Ad Valorem Tax, often referred to as a value-added tax or simply VAT, is a consumption tax levied on the value of goods and services at each stage of production and distribution. This tax system, widely adopted by over 160 countries, plays a pivotal role in government revenue generation, contributing significantly to economic growth and development. In essence, Ad Valorem Tax is a key tool for governments to maintain fiscal stability and fund vital public services, from healthcare and education to infrastructure projects.

The complexity of Ad Valorem Tax lies in its multi-stage nature, where the tax is applied at each point of the supply chain, from production to distribution and final sale. This system ensures that the tax burden is distributed across the entire economy, capturing value at every step. The tax rate, typically expressed as a percentage, is applied to the value added at each stage, making it a highly efficient method of revenue collection. Furthermore, Ad Valorem Tax is known for its transparency, as the tax is usually displayed separately on receipts, making it easily identifiable for consumers.

How Ad Valorem Tax Works: A Comprehensive Breakdown

Ad Valorem Tax operates on the principle of value-added, which means that it is calculated based on the difference between the cost of inputs and the final selling price of a product or service. This approach ensures that the tax is directly linked to the economic activity and value creation within a jurisdiction. Here’s a step-by-step breakdown of how Ad Valorem Tax typically works:

- Production Stage: During production, businesses incur costs for raw materials, labor, and overhead expenses. These costs are known as inputs. The value added at this stage is the difference between the output (the product's selling price) and the inputs.

- Distribution Stage: Once the product is manufactured, it moves to the distribution stage. Distributors add their own value by incurring costs for storage, transportation, and marketing. They pay Ad Valorem Tax on the value they add, which is the difference between the selling price to retailers and their purchase price from manufacturers.

- Retail Stage: At the retail level, stores add their margin by marking up the product's price. They are liable to pay Ad Valorem Tax on this margin, which represents the value they've added through their services and markups.

- Final Sale to Consumers: When a consumer purchases a product, the tax is usually displayed separately on the receipt. This final value-added tax payment represents the cumulative tax paid at each stage of the supply chain.

This multi-stage process ensures that the tax burden is spread across the supply chain, with each participant paying tax on the value they've added. It also encourages transparency and efficiency in the taxation system, making it a preferred choice for many governments.

Benefits and Challenges of Ad Valorem Tax

Ad Valorem Tax offers several advantages to governments and economies. Firstly, it’s a broad-based tax, applying to most goods and services, which ensures a steady and substantial revenue stream. Secondly, it encourages economic efficiency by taxing value creation, thus incentivizing businesses to operate in a more productive and innovative manner. Additionally, Ad Valorem Tax is generally considered to be a fair tax system as it is levied on the ability to pay, with higher-value transactions bearing a larger tax burden.

However, the implementation of Ad Valorem Tax is not without its challenges. One of the primary concerns is the potential for tax evasion, especially in the informal sector, where transactions may go unreported. Furthermore, the multi-stage nature of the tax can lead to administrative complexities and compliance burdens for businesses, especially small and medium-sized enterprises. There's also the risk of cascading or double taxation, where the tax is levied multiple times on the same transaction, which can increase the overall tax burden and lead to inefficiencies.

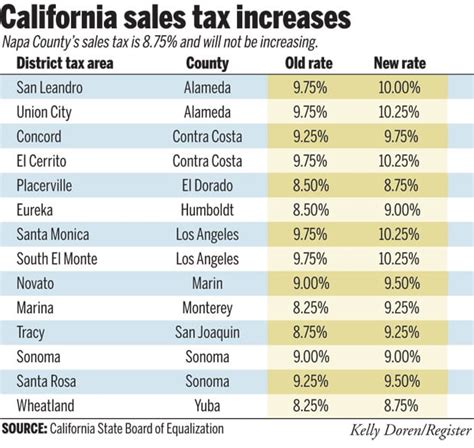

Ad Valorem Tax Around the Globe: A Comparative Analysis

Ad Valorem Tax, or VAT as it’s commonly known, is a global phenomenon, with variations in implementation across different countries and jurisdictions. While the basic principle remains the same - taxing the value added at each stage of production and distribution - the specific rates, exemptions, and administrative procedures can vary widely.

Global VAT Rates: A Snapshot

VAT rates around the world are diverse, ranging from single-digit percentages to rates well above 20%. Here’s a glimpse at some of the VAT rates across different regions:

| Country/Region | Standard VAT Rate |

|---|---|

| European Union (EU) | Varies by country, with an average of around 20% |

| United States | No federal VAT, but some states have sales taxes ranging from 4% to 10% |

| Canada | Federal GST (Goods and Services Tax) of 5%, with additional provincial sales taxes ranging from 7% to 10% |

| Australia | GST of 10% |

| China | VAT rates range from 3% for basic necessities to 16% for most goods and services |

| Japan | Standard consumption tax rate of 10% |

These rates can vary within a country or region as well, with different rates applied to different goods and services or for specific economic sectors.

Exemptions and Special Cases

Many countries offer exemptions or reduced rates for certain goods and services. For instance, essential items like food, healthcare, and education are often exempt or subject to lower VAT rates to reduce the tax burden on basic necessities. Additionally, some countries have special VAT regimes for specific sectors like tourism or financial services.

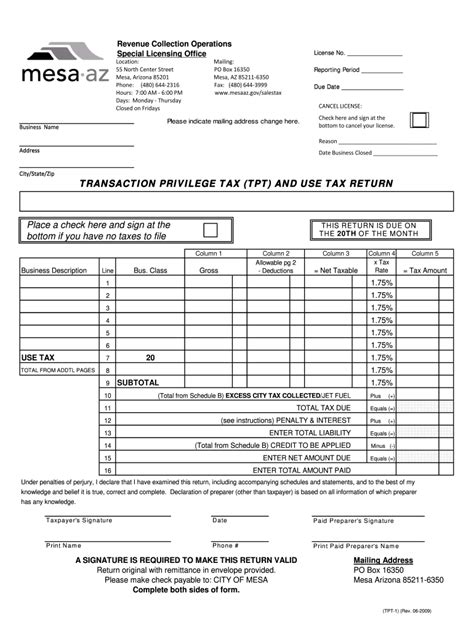

Administrative Procedures

The administrative procedures for Ad Valorem Tax also vary widely. In some countries, VAT is collected at the point of sale, while in others, it’s levied at the production or distribution stage. The frequency of tax payments, the threshold for registration, and the documentation requirements can differ significantly, making it crucial for businesses operating internationally to understand the local VAT regulations.

The Future of Ad Valorem Tax: Trends and Predictions

As the world continues to evolve, so too will the landscape of Ad Valorem Tax. Here are some key trends and predictions for the future of this tax system:

Digitalization and Automation

The increasing digitalization of the economy, particularly with the rise of e-commerce, is set to transform the administration of Ad Valorem Tax. Automated systems and digital platforms will likely play a more significant role in tax collection and compliance, streamlining processes and reducing administrative burdens for both taxpayers and tax authorities.

Focus on Tax Equity

With growing concerns about income inequality and the impact of taxation on different socio-economic groups, there’s likely to be a stronger focus on tax equity. This could lead to further refinements in Ad Valorem Tax systems, with more targeted exemptions and rates to ensure a fairer distribution of the tax burden.

Expansion of VAT Networks

As more countries adopt Ad Valorem Tax systems, the global VAT network is expected to expand. This expansion could lead to increased harmonization of VAT rates and regulations, making cross-border trade and investment more efficient and transparent.

Innovation in Tax Administration

Advancements in technology, such as blockchain and AI, could revolutionize tax administration, making it more efficient, secure, and transparent. These technologies could enhance data analytics, improve tax compliance, and reduce the potential for fraud and evasion.

Environmental Considerations

With a growing focus on environmental sustainability, Ad Valorem Tax systems may increasingly be used to promote eco-friendly behaviors and penalize harmful activities. This could lead to the introduction of carbon taxes or other environmental levies, as well as incentives for sustainable practices.

Expert Insights and Best Practices

Navigating the complexities of Ad Valorem Tax requires a strategic approach. Here are some expert insights and best practices for businesses and individuals:

- Stay Informed: Keep up-to-date with the latest tax regulations and changes in your jurisdiction. This is crucial for compliance and can also help you identify potential opportunities or challenges.

- Utilize Technology: Embrace digital tools and platforms to streamline your tax processes. From accounting software to tax compliance platforms, technology can simplify tax management and reduce errors.

- Plan for Tax Efficiency: Work with tax professionals to structure your business operations in a tax-efficient manner. This could involve optimizing your supply chain, utilizing tax incentives, or considering the tax implications of different business models.

- Communicate with Tax Authorities: Establish a positive relationship with tax authorities. This can help resolve queries or issues quickly and ensure you remain in good standing.

- Stay Compliant: Adherence to tax regulations is non-negotiable. Ensure you understand your tax obligations and meet them diligently. This not only avoids penalties but also maintains your business's reputation.

What is the primary purpose of Ad Valorem Tax?

+

Ad Valorem Tax, or Value-Added Tax (VAT), is primarily designed to generate revenue for governments, funding public services and infrastructure. It also serves to distribute the tax burden across the economy, taxing value creation at each stage of production and distribution.

How does Ad Valorem Tax differ from a sales tax?

+

While both Ad Valorem Tax and sales tax are levied on the sale of goods and services, Ad Valorem Tax is applied at each stage of production and distribution, capturing the value added at each step. In contrast, a sales tax is typically applied only at the final point of sale, making it a single-stage tax.

Are there any disadvantages to Ad Valorem Tax systems?

+

Yes, Ad Valorem Tax systems can be complex to administer and comply with, especially for small businesses. They may also lead to higher prices for consumers and can be prone to tax evasion, especially in the informal sector. Additionally, the multi-stage nature of the tax can sometimes result in double taxation.