Yomovies Tax

In the ever-evolving landscape of online entertainment, the accessibility of free streaming platforms has become a double-edged sword. While they offer a vast array of content, often without any subscription fees, the question of legality and taxation looms large. Yomovies, one of the prominent players in this domain, has been a subject of curiosity and debate regarding its tax implications. This article aims to delve into the intricacies of Yomovies' tax status, its impact on the industry, and the broader implications for users and content creators.

The Enigma of Yomovies’ Tax Status

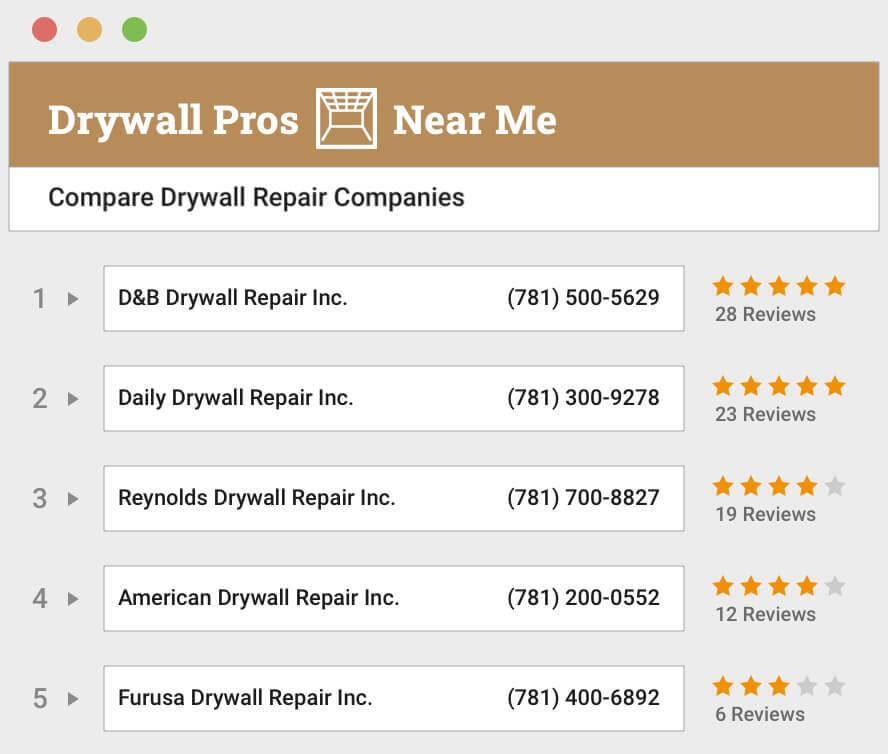

Yomovies, a popular streaming platform known for its extensive library of movies and TV shows, has maintained an enigmatic stance on taxation. With a user base spanning continents, the platform’s tax obligations are a complex matter, entangled in international tax laws and online business regulations.

At its core, Yomovies operates as a free streaming service, monetizing its content through advertisements. This business model, while seemingly straightforward, presents a unique challenge when it comes to taxation. Unlike traditional media companies, Yomovies lacks a centralized physical presence, making it difficult to attribute its revenue to a specific jurisdiction.

The platform's revenue stream is primarily generated through advertising partnerships, where it hosts ads from various brands and agencies. These ads are strategically placed before, during, or after the content, ensuring maximum exposure to its vast audience. However, the revenue generated from these ads is often shared with content creators, adding another layer of complexity to the tax equation.

The Global Reach and Local Tax Laws

Yomovies’ global reach is a testament to its popularity, but it also presents a significant challenge in terms of tax compliance. The platform operates across multiple countries, each with its own set of tax laws and regulations. Navigating these diverse legal landscapes is no easy feat, especially when dealing with the intricacies of online businesses.

In some countries, Yomovies might be considered a digital service provider, subject to specific tax regulations. These regulations often include Value Added Tax (VAT) or Goods and Services Tax (GST), which can vary significantly from one jurisdiction to another. Failure to comply with these laws can result in hefty penalties and legal repercussions.

Furthermore, the platform's revenue sharing model with content creators adds another dimension to the tax puzzle. Content creators, especially those based in different countries, may have varying tax obligations. Yomovies, in its role as a revenue generator, needs to ensure that these obligations are met, further complicating its tax responsibilities.

| Country | Tax Rate (%) |

|---|---|

| United States | 7.25 |

| United Kingdom | 20 |

| India | 18 |

| Australia | 10 |

As illustrated in the table above, the tax rates for digital services can vary widely, emphasizing the complexity of Yomovies' tax situation. The platform's ability to navigate these varying rates and ensure compliance is a critical aspect of its business operations.

The Impact on Content Creators and Users

Yomovies’ tax status has a direct impact on both content creators and users. For content creators, especially those relying on revenue sharing from platforms like Yomovies, tax compliance becomes a crucial aspect of their financial strategy. Understanding the tax implications of their earnings and ensuring proper reporting is essential to avoid legal troubles.

Users, on the other hand, might find themselves indirectly affected by Yomovies' tax obligations. The platform's need to comply with tax laws could influence its business decisions, potentially leading to changes in content availability, advertising strategies, or even subscription models. Understanding these potential impacts is crucial for users to make informed choices about their entertainment preferences.

The Future of Yomovies and Taxation

As the entertainment industry continues to evolve, the tax landscape for online streaming platforms like Yomovies is expected to undergo significant changes. The increasing scrutiny from regulatory bodies and the public spotlight on tax compliance make it imperative for platforms like Yomovies to adapt and ensure compliance.

One potential strategy for Yomovies could be the adoption of a more transparent and structured tax approach. This might involve clearly defining its tax obligations in different jurisdictions and ensuring that its revenue sharing model is in line with local tax laws. By doing so, Yomovies can not only ensure compliance but also build trust with its users and content creators.

Additionally, the platform could explore partnerships with tax experts or legal advisors who specialize in international tax laws. This would provide Yomovies with the necessary expertise to navigate the complex tax landscapes and ensure its long-term sustainability.

The Role of Regulatory Bodies

Regulatory bodies play a crucial role in shaping the future of Yomovies’ tax obligations. As online streaming platforms gain prominence, these bodies are increasingly focused on ensuring fair tax practices. This includes not only monitoring compliance but also providing guidelines and frameworks to help platforms like Yomovies navigate the complex tax terrain.

By working closely with regulatory bodies, Yomovies can stay updated with the latest tax regulations and ensure that its operations are in line with industry standards. This collaboration can also lead to the development of best practices for tax compliance in the online streaming industry, benefiting not only Yomovies but also other platforms facing similar challenges.

User Experience and Long-Term Sustainability

Ultimately, Yomovies’ tax obligations are closely intertwined with its ability to provide a seamless user experience. As the platform works towards tax compliance, it must also ensure that its core offering - free access to a vast library of content - remains unaffected. This delicate balance is crucial for maintaining user satisfaction and loyalty.

Additionally, tax compliance can contribute to Yomovies' long-term sustainability. By ensuring that it operates within the legal framework, the platform can build a strong reputation and attract investors and partners. This, in turn, can lead to further growth and innovation, benefiting both the platform and its users.

Conclusion

The tax status of Yomovies is a multifaceted issue, intertwined with international tax laws, content creator revenues, and user experiences. As the platform navigates these complexities, its approach to tax compliance will shape its future trajectory and its place in the online streaming industry. By embracing transparency, seeking expert guidance, and working collaboratively with regulatory bodies, Yomovies can ensure its longevity and continue to provide its users with a seamless entertainment experience.

Is Yomovies a legal streaming platform?

+The legality of Yomovies is a complex matter, as it operates in a gray area due to its free streaming model and the sources of its content. While it may offer a vast library of movies and TV shows, the platform’s legality can vary depending on the jurisdiction and the specific content being streamed.

How does Yomovies monetize its content without charging users?

+Yomovies primarily generates revenue through advertising. It hosts ads before, during, or after the content, allowing it to offer a free streaming experience while still earning income. This revenue model is common among free streaming platforms.

What are the tax implications for content creators on Yomovies?

+Content creators on Yomovies, especially those who receive revenue sharing from the platform, need to be aware of their tax obligations. These obligations can vary based on their location and the tax laws of their jurisdiction. It’s crucial for creators to understand and comply with these requirements to avoid legal issues.