Florida Miami Sales Tax

Florida's tax system, including its sales and use tax, is an integral part of the state's revenue structure. The state's sales tax, often referred to as the "Florida Sales Tax," is a consumption tax levied on the sale of goods and certain services. In this comprehensive article, we will delve into the specifics of Florida's sales tax, focusing on the city of Miami, to understand its rates, exemptions, and implications for businesses and consumers alike.

Understanding Florida’s Sales Tax Framework

Florida, known for its vibrant economy and diverse industries, relies on a robust tax system to fund public services and infrastructure. The sales and use tax is a significant component of this system, contributing to the state’s fiscal health. It is administered by the Florida Department of Revenue (DOR), which ensures compliance and manages tax collections.

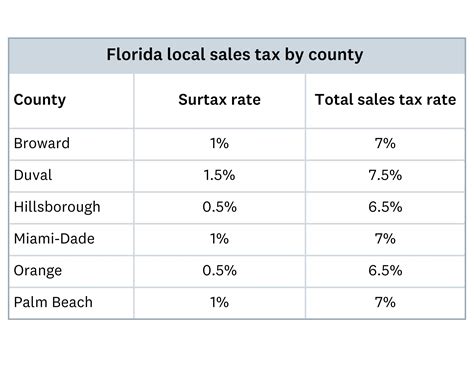

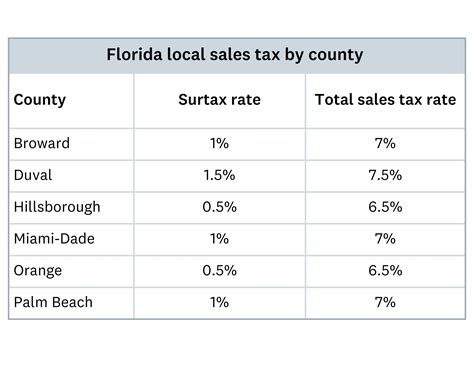

The sales tax in Florida is a state-level tax, which means the tax rate is uniform across the state. However, local governments, including counties and municipalities, have the authority to impose additional taxes, often referred to as local option taxes. These local taxes are added to the state sales tax rate, resulting in varying tax rates across different regions within Florida.

As of [current year], the state sales tax rate in Florida stands at [current state tax rate]%, making it one of the lower sales tax rates among U.S. states. However, when combined with local option taxes, the effective tax rate can vary significantly from one location to another. For instance, in Miami-Dade County, where the city of Miami is located, the total sales tax rate includes the state tax plus any applicable county and city taxes.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| State of Florida | [current state tax rate]% |

| Miami-Dade County | [current county tax rate]% |

| City of Miami | [current city tax rate]% |

| Total Sales Tax Rate (Miami) | [combined tax rate]% |

It's important to note that while Miami is the focal point of this article, sales tax rates can vary within the county, with some municipalities having their own unique tax rates. This complexity arises from the flexibility granted to local governments in Florida's tax structure, which allows them to tailor tax rates to meet their specific financial needs.

Sales Tax Exemptions and Special Considerations

Florida’s sales tax, like many other state-level taxes, includes various exemptions and special provisions. These exemptions are designed to alleviate tax burdens on certain sectors, promote specific industries, or provide relief to targeted consumer groups.

Food and Groceries

One notable exemption in Florida’s sales tax framework is the tax exemption on food and groceries. This exemption applies to the sale of unprepared food items intended for human consumption. However, it’s important to distinguish between food for home consumption and food sold in restaurants or similar establishments, as the latter is generally subject to sales tax.

Prescription Drugs

Sales of prescription drugs are also exempt from Florida’s sales tax. This exemption extends to both over-the-counter medications and prescription medications sold by licensed pharmacies. It is a significant benefit for consumers, particularly those with ongoing medical needs.

Manufacturing and Production

Florida’s sales tax includes provisions for the manufacturing and production sector. Sales of machinery and equipment used directly in manufacturing, processing, or production processes are exempt from sales tax. This exemption aims to support the state’s manufacturing base and encourage economic growth in this sector.

Agricultural Sales

Sales of agricultural products, including farm machinery and equipment, are exempt from sales tax in Florida. This exemption applies to both retail and wholesale sales of agricultural goods, providing a tax benefit to the state’s agricultural industry.

Government Entities and Nonprofits

Florida sales tax law includes exemptions for government entities and qualified nonprofit organizations. These entities are not required to pay sales tax on their purchases, which can significantly reduce their operational costs.

Compliance and Reporting for Businesses

For businesses operating in Miami and Florida, understanding and complying with sales tax regulations is crucial. The Florida Department of Revenue provides comprehensive guidelines and resources to help businesses navigate the tax system effectively.

Registration and Permits

Businesses involved in the sale of taxable goods or services in Florida must obtain a sales and use tax permit from the DOR. This permit authorizes the business to collect and remit sales tax on behalf of the state and local governments. The application process typically involves providing detailed information about the business, its location, and the nature of its operations.

Taxable Transactions

Businesses must identify taxable transactions and apply the appropriate sales tax rate. This includes sales made in-store, online, or through other channels. It’s important to note that Florida has a destination-based sales tax system, meaning the tax rate applied to a sale is determined by the location where the product is delivered or the service is provided, not the location of the business or the customer.

Remittance and Reporting

Businesses are required to remit sales tax to the DOR on a regular basis. The frequency of remittance can vary depending on the business’s sales volume and other factors. Along with the tax payment, businesses must submit a sales tax return, providing details of taxable sales, exempt sales, and any applicable deductions or credits.

Impact on Consumer Behavior

The sales tax rate in Miami and Florida can significantly influence consumer behavior and spending patterns. Higher sales tax rates can discourage large purchases, especially for discretionary items, as consumers may opt to shop in areas with lower tax rates or consider online retailers that may not collect sales tax.

Conversely, lower sales tax rates can stimulate consumer spending and make the city more attractive for retail businesses. Miami's relatively moderate sales tax rate, combined with its vibrant tourism industry, contributes to a thriving retail sector, attracting both local and international shoppers.

Online Shopping and Sales Tax

The rise of e-commerce has added a layer of complexity to sales tax collection. While online retailers may not collect sales tax in certain situations, particularly for out-of-state sales, the Wayfair decision by the U.S. Supreme Court has allowed states to require online retailers to collect sales tax based on economic nexus rather than physical presence.

In Florida, online retailers with substantial connections to the state, such as through a significant number of sales or customers, are required to collect and remit sales tax. This ensures a level playing field between online and brick-and-mortar retailers, preventing an unfair advantage for online businesses.

Sales Tax and Tourism in Miami

Miami’s status as a popular tourist destination adds a unique dimension to its sales tax dynamics. The city’s tourism industry, known for its vibrant culture, beautiful beaches, and diverse attractions, contributes significantly to the local economy.

Tourists, who may not be subject to local taxes in their home jurisdictions, often view Miami's sales tax as an additional cost of their vacation. However, the city's moderate tax rate, combined with its reputation as a shopper's paradise, makes it an attractive destination for retail therapy.

Additionally, Miami's tourism industry benefits from the state's tourist development tax, a tax levied on the cost of accommodations, such as hotel rooms and vacation rentals. This tax, separate from the sales tax, is used to fund tourism-related infrastructure and promotions, further enhancing the city's appeal to visitors.

Future Implications and Potential Changes

As Florida’s economy evolves and the state’s fiscal needs change, the sales tax framework may undergo modifications. Proposed changes could include adjustments to the state sales tax rate, revisions to exemption policies, or shifts in the distribution of tax revenue between state and local governments.

The ongoing debate over sales tax fairness and the potential for a national sales tax also impacts Florida's tax system. While a national sales tax could simplify tax administration and provide a more uniform tax system, it may also lead to reduced state autonomy in tax policy. Florida, like other states, will need to carefully consider the implications of any proposed changes to the federal tax structure.

Furthermore, the continued growth of e-commerce and the increasing complexity of online sales tax collection present ongoing challenges for tax administrators and businesses alike. Florida's tax system will need to adapt to ensure fair tax collection from online retailers, while also minimizing the administrative burden on businesses.

Conclusion

Florida’s sales tax, including the rates applicable in Miami, plays a vital role in funding public services and infrastructure while also influencing consumer behavior and business operations. The state’s tax system, with its exemptions and special considerations, aims to balance revenue generation with economic growth and consumer welfare.

For businesses operating in Miami and Florida, understanding the intricacies of the sales tax system is essential for compliance and effective financial management. Consumers, too, benefit from a clear understanding of sales tax rates and exemptions, allowing them to make informed purchasing decisions.

As Florida's economy continues to evolve, the sales tax framework will likely undergo adjustments to meet changing needs and circumstances. Staying informed and adaptable is key for both businesses and consumers navigating Florida's tax landscape.

What is the current state sales tax rate in Florida?

+As of [current year], the state sales tax rate in Florida is [current state tax rate]%.

Are there any sales tax holidays in Florida?

+Yes, Florida occasionally holds sales tax holidays, during which certain items are exempt from sales tax. These holidays are typically scheduled for specific periods and apply to items like school supplies, clothing, or hurricane preparedness items.

How often do businesses need to remit sales tax in Florida?

+The frequency of sales tax remittance in Florida depends on the business’s sales volume and other factors. Businesses with higher sales volumes may be required to remit sales tax more frequently, such as monthly or quarterly, while others may remit on an annual basis.

Are there any plans to change the sales tax rate in Miami or Florida in the near future?

+As of my knowledge cutoff in January 2023, there were no immediate plans to change the sales tax rate in Miami or Florida. However, tax policy is an evolving field, and it’s always possible that proposals for changes could emerge in the future.