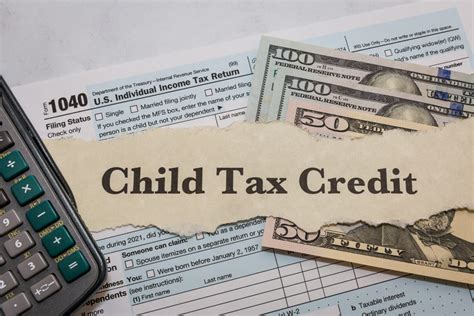

Sahm Tax Credit

The Sahm Tax Credit, officially known as the Child Tax Credit, is a significant tax benefit introduced in the United States to provide financial support to families with children. This credit has played a crucial role in easing the financial burden on parents and has become a key component of the country's tax system. With its focus on supporting child-rearing costs, the Sahm Tax Credit has not only offered economic relief but has also contributed to the overall well-being of families across the nation.

Understanding the Sahm Tax Credit

The Sahm Tax Credit, named after the economist Casey B. Mullinix Sahm, is a non-refundable tax credit available to eligible taxpayers who have qualifying children. This credit is designed to offset the costs associated with raising children, which can be substantial. The credit amount varies based on the number of qualifying children and their ages, providing a much-needed financial boost to families.

Introduced in the late 1990s, the Sahm Tax Credit has undergone several revisions and expansions over the years. One of the most significant changes was made in the Tax Cuts and Jobs Act of 2017, which increased the credit amount and made it partially refundable, benefiting a broader range of families. This credit has since become a cornerstone of the U.S. tax system, providing essential support to millions of households.

Eligibility Criteria

To qualify for the Sahm Tax Credit, taxpayers must meet specific criteria. The credit is generally available to taxpayers with a valid Social Security Number who have dependent children under the age of 17. The child must also meet the relationship test, meaning they are the taxpayer’s biological or adopted child, stepchild, foster child, or a descendant of any of these, such as a grandchild.

Additionally, the child must reside with the taxpayer for at least half of the tax year and not provide more than half of their own financial support. Taxpayers claiming the credit must also meet certain income requirements, as the credit phases out for higher-income earners.

Credit Amount and Calculation

The amount of the Sahm Tax Credit depends on the taxpayer’s income and the number of qualifying children. For the tax year 2023, the credit is set at $2,000 per qualifying child for taxpayers with adjusted gross income (AGI) below a certain threshold. This threshold varies based on filing status, with single taxpayers having a higher threshold than married couples.

| Filing Status | Income Threshold |

|---|---|

| Single | $200,000 |

| Married Filing Jointly | $400,000 |

| Head of Household | $200,000 |

The credit amount begins to phase out for taxpayers with AGI above these thresholds, reducing by $50 for every additional $1,000 of income. It's important to note that the credit amount is subject to change annually, so taxpayers should refer to the latest IRS guidelines for accurate information.

Impact and Benefits of the Sahm Tax Credit

The Sahm Tax Credit has had a profound impact on the financial stability of families across the United States. By providing a substantial credit for each qualifying child, it has helped reduce the tax burden on parents, especially those with multiple children. This credit has been particularly beneficial for middle- and lower-income families, as it can significantly reduce their tax liability or even result in a refund.

One of the key advantages of the Sahm Tax Credit is its potential to lift families out of poverty. For households struggling to make ends meet, this credit can provide a much-needed financial cushion, allowing them to allocate more resources to essential needs such as education, healthcare, and basic living expenses. By reducing financial stress, the credit can contribute to improved well-being and better outcomes for children.

Enhancing Child Welfare

The Sahm Tax Credit has been a powerful tool in promoting child welfare and reducing child poverty rates. Studies have shown that families receiving this credit are more likely to invest in their children’s education and overall development. The credit enables parents to afford extracurricular activities, tutoring, and other educational opportunities that can enhance their children’s skills and future prospects.

Additionally, the credit has been associated with improved health outcomes for children. With the financial support provided by the credit, families can more easily access healthcare services, ensuring regular check-ups, vaccinations, and timely medical care. This can lead to better overall health and reduced healthcare costs in the long run.

Stimulating the Economy

Beyond its direct benefits to families, the Sahm Tax Credit also has a positive impact on the economy as a whole. When families receive this credit, they tend to spend a significant portion of it on goods and services, stimulating local businesses and contributing to economic growth. This “trickle-up” effect can create a positive cycle, benefiting not only families but also the wider community.

Furthermore, by reducing the financial strain on parents, the credit can encourage higher labor force participation rates among women. This is particularly relevant given that women often bear a significant portion of the childcare responsibilities. With the credit providing financial support, more women can pursue employment opportunities, contributing to their financial independence and overall economic growth.

Challenges and Considerations

While the Sahm Tax Credit has proven to be a valuable tool for supporting families, it is not without its challenges and limitations. One of the primary concerns is the credit’s complexity, which can make it difficult for some taxpayers to understand and navigate. The eligibility criteria, income thresholds, and calculation methods can be confusing, especially for those without a background in tax law.

Another challenge is the potential for fraud and abuse. With a credit of this magnitude, there is always a risk that some individuals may attempt to misuse or claim the credit fraudulently. The IRS has implemented various measures to mitigate this risk, including enhanced verification processes and data matching, but it remains an ongoing concern.

Addressing Income Inequality

Despite its benefits, the Sahm Tax Credit has been criticized for potentially exacerbating income inequality. As the credit phases out for higher-income earners, some argue that it provides greater benefits to those who may already be financially stable, while leaving out families with higher incomes but substantial childcare expenses. This has led to discussions about potential reforms to make the credit more progressive and equitable.

Additionally, the credit's focus on dependent children under the age of 17 may exclude older children who may still require financial support, particularly those pursuing higher education. This has prompted calls for an expansion of the credit to include older dependents, ensuring that the financial needs of families with older children are also addressed.

Future Outlook and Potential Reforms

Looking ahead, there are ongoing discussions and proposals for reforms to the Sahm Tax Credit. One of the key areas of focus is making the credit fully refundable, ensuring that even taxpayers with no tax liability can benefit. This would provide support to low-income families who may not otherwise receive any tax benefits.

Another proposed reform is the expansion of the credit to include older dependents, as mentioned earlier. This would address the financial needs of families with children pursuing higher education or those with special needs, who may require ongoing support well beyond the age of 17.

Advancing Equity and Accessibility

To promote equity and accessibility, there are also proposals to simplify the credit’s calculation and eligibility criteria. Making the credit more straightforward and easier to understand would encourage more eligible taxpayers to claim it, ensuring that those who need the support can access it without unnecessary complexity.

Furthermore, there are discussions about extending the credit to cover a broader range of childcare expenses, such as daycare, babysitting, and after-school programs. This would provide additional support to working parents, especially those with non-traditional work schedules or those who require childcare for extended hours.

Conclusion

The Sahm Tax Credit has been a significant milestone in the U.S. tax system, providing essential financial support to families with children. Its impact on reducing financial strain, promoting child welfare, and stimulating the economy cannot be overstated. However, ongoing reforms and adjustments are necessary to address challenges and ensure that the credit remains an effective tool for supporting families across all income levels.

As discussions around tax policy continue, it is essential to consider the unique needs and circumstances of families with children. By making the Sahm Tax Credit more accessible, equitable, and responsive to the diverse needs of families, policymakers can ensure that this credit remains a powerful instrument for improving the lives of American families for generations to come.

Can I claim the Sahm Tax Credit if I’m not a U.S. citizen?

+Non-citizen residents with a valid Social Security Number and a qualifying child can claim the Sahm Tax Credit. However, specific rules apply to non-residents, so it’s important to consult the IRS guidelines or a tax professional for your particular situation.

How often can I claim the Sahm Tax Credit for the same child?

+You can claim the Sahm Tax Credit annually for each qualifying child as long as you meet the eligibility criteria and the child remains under the age of 17. The credit is recalculated each tax year based on your income and family situation.

Are there any restrictions on how I use the Sahm Tax Credit?

+The Sahm Tax Credit is a non-refundable credit, which means it can reduce your tax liability to zero but will not result in a refund beyond that amount. However, if you have other non-refundable credits, they may be able to generate a refund in conjunction with the Sahm Tax Credit.