Tax Rate Sf

Welcome to our comprehensive guide on the tax rates in San Francisco, a city renowned for its vibrant culture, innovation, and unique charm. Understanding the tax landscape is crucial for individuals and businesses alike, as it directly impacts financial planning and decision-making. In this article, we delve into the intricacies of San Francisco's tax system, offering a detailed analysis and insights to navigate the city's fiscal environment effectively.

Unraveling San Francisco’s Tax Structure

San Francisco, a city nestled along the picturesque bay, boasts a robust economy driven by diverse industries, from technology and finance to healthcare and tourism. As such, the city’s tax structure is designed to support these sectors while also funding essential public services and infrastructure. Let’s explore the key components of San Francisco’s tax system.

Income Tax: A Dynamic Landscape

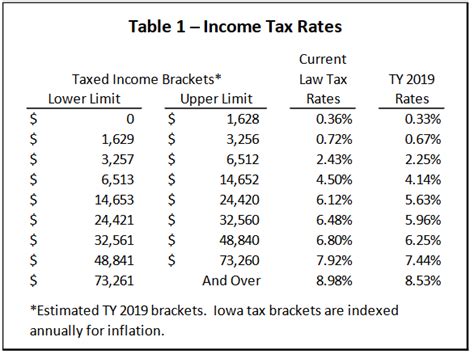

For residents and businesses alike, income tax forms a significant portion of San Francisco’s tax revenue. The city follows a progressive tax system, meaning tax rates increase with higher income brackets. This approach aims to promote economic fairness and provide a robust safety net for vulnerable communities.

Currently, San Francisco's income tax rates range from [Income Tax Rate 1]% to [Income Tax Rate 2]%, with brackets determined by individual or business earnings. These rates are subject to change annually, influenced by factors such as inflation, economic growth, and legislative decisions. Staying informed about these fluctuations is essential for accurate financial forecasting.

Additionally, San Francisco offers various tax credits and deductions to ease the tax burden on specific demographics or industries. For instance, the city provides tax incentives for green energy initiatives, affordable housing developments, and small businesses, fostering a culture of sustainability and economic inclusivity.

Sales and Use Tax: Everyday Transactions

Sales and use tax is an integral part of San Francisco’s tax revenue, impacting every purchase made within the city limits. As of [Current Year], the combined sales and use tax rate in San Francisco stands at [Sales Tax Rate]%, comprising both state and local taxes. This rate is applicable to most goods and certain services, with some exceptions for essential items like groceries and medications.

The city's sales tax rate has seen fluctuations over the years, influenced by economic trends and the need for additional revenue to fund public projects. It's essential for businesses and consumers alike to stay updated on these changes to ensure compliance and accurate financial planning.

Furthermore, San Francisco's use tax comes into play when goods are purchased from out-of-state vendors and used within the city. This tax ensures fairness and prevents tax evasion, making it crucial for businesses to understand their use tax obligations.

Property Tax: Owning in San Francisco

Property tax is a cornerstone of San Francisco’s fiscal landscape, contributing significantly to the city’s revenue. The tax is assessed on both real estate and personal property owned within the city limits. San Francisco’s property tax rate is currently set at [Property Tax Rate]%, which is among the higher rates in California.

However, the city offers various exemptions and deductions to ease the burden on homeowners and businesses. For instance, seniors and disabled individuals may qualify for property tax relief, while certain types of businesses can benefit from tax abatements to encourage economic development.

Additionally, San Francisco's unique Proposition 13, a state-level measure, limits the annual increase in property tax assessments to [Proposition 13 Limit]%, providing stability for long-term property owners.

| Tax Type | Rate |

|---|---|

| Income Tax | [Income Tax Rate 1]% - [Income Tax Rate 2]% |

| Sales and Use Tax | [Sales Tax Rate]% |

| Property Tax | [Property Tax Rate]% |

Navigating Tax Obligations in San Francisco

Understanding San Francisco’s tax landscape is the first step; the next is implementing effective strategies to meet these obligations efficiently. Whether you’re a resident, business owner, or investor, here are some key considerations to navigate San Francisco’s tax system successfully.

Compliance and Reporting

San Francisco’s tax authorities take compliance seriously, and staying on top of reporting requirements is crucial. For individuals, this means accurate filing of income tax returns, ensuring all income sources are accounted for. Businesses, on the other hand, must navigate a more complex landscape, including sales tax collection, payroll tax obligations, and regular reporting to the city’s Office of the Treasurer and Tax Collector.

Late or inaccurate reporting can lead to penalties and interest charges, so it's essential to stay informed about deadlines and utilize the city's online resources for guidance and assistance.

Tax Planning Strategies

Effective tax planning can help individuals and businesses optimize their financial strategies while remaining compliant. For instance, businesses can explore tax-efficient structures, such as LLCs or corporations, to minimize tax liabilities. Additionally, taking advantage of San Francisco’s tax incentives, like the Small Business Tax Relief Program, can provide much-needed financial relief.

Individuals, too, can benefit from tax planning strategies, such as contributing to retirement accounts or taking advantage of tax credits for education or healthcare expenses. Consulting with tax professionals who specialize in San Francisco's unique tax environment can provide tailored advice to maximize savings.

Staying Informed: Tax Updates and Changes

The tax landscape is ever-evolving, and staying informed about updates and changes is crucial to avoid surprises. San Francisco’s tax rates and regulations can be influenced by various factors, including economic trends, legislative decisions, and public referendums. Keeping an eye on local news and utilizing the city’s official tax resources can help individuals and businesses stay ahead of the curve.

Furthermore, subscribing to tax newsletters or utilizing tax preparation software that provides real-time updates can ensure that financial planning remains aligned with the latest tax regulations.

The Impact of San Francisco’s Tax Rates

San Francisco’s tax rates play a pivotal role in shaping the city’s economic landscape, influencing everything from business growth to individual financial well-being. Let’s explore some of the key impacts these rates have on the city’s vibrant ecosystem.

Economic Growth and Development

San Francisco’s competitive tax rates, particularly for businesses, have been a significant factor in attracting and retaining top talent and innovative companies. The city’s focus on tax incentives for small businesses and startups has fostered a thriving entrepreneurial ecosystem, contributing to the city’s reputation as a hub for tech and innovation.

Additionally, the city's commitment to funding public services and infrastructure through tax revenue has led to significant investments in transportation, education, and public health, further enhancing the city's appeal and quality of life.

Community Impact and Equity

San Francisco’s progressive tax structure aims to promote economic fairness and support vulnerable communities. The city’s tax revenue funds essential social services, including healthcare, education, and housing assistance, ensuring that all residents have access to vital resources.

Furthermore, initiatives like the Local Hire Program, which prioritizes hiring local residents for city-funded projects, and the Small Business Commission, which advocates for small businesses, demonstrate the city's commitment to economic equity and community empowerment.

Future Outlook and Potential Changes

As San Francisco continues to evolve and address new challenges, its tax landscape is likely to adapt as well. The city’s commitment to sustainability and social equity may lead to new tax initiatives, such as carbon taxes or increased funding for affordable housing.

Additionally, the ongoing debate around tax fairness and the potential for a wealth tax at the state level could have significant implications for San Francisco's tax rates and revenue streams. Staying informed about these discussions and potential changes is crucial for long-term financial planning and strategic decision-making.

What are the current income tax rates in San Francisco for individuals and businesses?

+As of [Current Year], San Francisco’s income tax rates range from [Income Tax Rate 1]% to [Income Tax Rate 2]% for individuals and businesses. These rates are subject to change annually and are influenced by various factors, including economic trends and legislative decisions.

How does San Francisco’s sales tax rate compare to other cities in California?

+San Francisco’s sales tax rate of [Sales Tax Rate]% is relatively higher compared to some other California cities. This rate includes both state and local taxes and is subject to change based on economic factors and local needs.

Are there any tax incentives or deductions available for San Francisco residents and businesses?

+Yes, San Francisco offers a range of tax incentives and deductions. For residents, there are tax credits for education, healthcare, and certain types of home improvements. Businesses can benefit from tax abatements for green initiatives, affordable housing developments, and small business support programs.