What Are Personal Property Taxes

Personal property taxes are an essential component of the tax system in many jurisdictions worldwide, playing a significant role in generating revenue for local governments and municipalities. These taxes are imposed on various forms of personal property owned by individuals, businesses, and entities, contributing to the funding of essential public services and infrastructure.

In this comprehensive guide, we will delve into the world of personal property taxes, exploring their definition, how they are calculated, the types of property they cover, and their impact on taxpayers. We will also examine the benefits and considerations associated with these taxes and provide valuable insights for property owners to navigate this complex yet crucial aspect of financial planning.

Understanding Personal Property Taxes

Personal property taxes, often referred to as personal property taxes, are levied on tangible assets owned by individuals, businesses, or organizations. These assets are distinct from real estate or real property, which are subject to separate taxation. Personal property includes a wide range of items, from vehicles and jewelry to machinery and equipment, with the specific definition and scope varying across different jurisdictions.

The primary purpose of personal property taxes is to generate revenue for local governments, which use these funds to finance critical public services and maintain infrastructure. This includes funding for education, law enforcement, fire protection, road maintenance, and other essential community services. By taxing personal property, local governments ensure a stable revenue stream to support the well-being and development of their communities.

How Personal Property Taxes Work

The process of assessing and collecting personal property taxes involves several key steps. Here’s an overview of how these taxes are typically administered:

Taxable Property Identification

The first step in personal property taxation is identifying the types of property that are subject to taxation. This varies depending on the jurisdiction and may include vehicles, boats, aircraft, business equipment, inventory, and other tangible assets. Certain categories of property, such as household goods or personal clothing, are often exempt from taxation.

Assessment and Valuation

Once the taxable property is identified, the next step is to assess its value. Tax assessors, typically employed by the local government, are responsible for determining the fair market value of the property. They may use various methods, such as depreciation schedules, market value comparisons, or appraisal techniques, to establish an accurate valuation.

Tax Rate Determination

After the property’s value is assessed, the applicable tax rate is determined. Tax rates for personal property can vary widely, both within and across jurisdictions. These rates are often expressed as a percentage of the property’s assessed value. Local governments set these rates, which are then used to calculate the tax liability for each property owner.

Tax Calculation

The tax liability for a specific property is calculated by multiplying the assessed value of the property by the applicable tax rate. This calculation provides the amount of tax owed by the property owner for the current tax period. In some cases, there may be additional surcharges or exemptions that further impact the final tax amount.

Tax Payment

Property owners are typically responsible for paying their personal property taxes on an annual or semi-annual basis. The tax bills are issued by the local government, and payment options may include online payment portals, check, or money order. Failure to pay personal property taxes can result in penalties, interest, and potential legal consequences.

Types of Personal Property Covered

Personal property taxes encompass a broad range of tangible assets owned by individuals and businesses. Here are some common types of personal property that may be subject to taxation:

Vehicles

Vehicles, including cars, trucks, motorcycles, and recreational vehicles, are frequently taxed based on their assessed value. The tax rate and assessment method may vary depending on the vehicle’s age, make, and model.

Boats and Aircraft

Boats, yachts, and other watercraft, as well as aircraft, are often subject to personal property taxes. The tax liability for these assets is typically based on their current market value or a specified formula determined by the jurisdiction.

Business Equipment and Inventory

Businesses may be required to pay personal property taxes on their equipment, machinery, and inventory. This can include office furniture, computers, manufacturing equipment, and raw materials. The tax liability is usually based on the depreciated value of the assets.

Jewelry and Collectibles

High-value personal items, such as jewelry, artwork, collectibles, and precious metals, may be subject to personal property taxes. These items are often assessed based on their appraised value, and the tax liability can vary significantly depending on the item’s rarity and market demand.

Other Personal Property

Additional personal property that may be taxed includes mobile homes, recreational vehicles (RVs), farm equipment, and certain types of specialized machinery. The specific types of personal property subject to taxation and the applicable tax rates vary widely across jurisdictions.

Benefits and Considerations of Personal Property Taxes

Personal property taxes offer several benefits to local governments and communities. These taxes provide a stable and reliable source of revenue, enabling local governments to plan and budget effectively for essential services. Additionally, personal property taxes contribute to the equitable distribution of tax burden, as they are based on the value of assets owned rather than income levels.

However, there are also considerations and challenges associated with personal property taxes. One of the primary concerns is the administrative burden on both taxpayers and tax administrators. The process of assessing and valuing personal property can be complex and time-consuming, requiring specialized knowledge and resources. Additionally, the potential for tax avoidance or evasion exists, as taxpayers may undervalue their assets or fail to report certain types of property.

Challenges and Potential Solutions

To address these challenges, jurisdictions have implemented various strategies. Some local governments have established centralized databases or online platforms to streamline the assessment and reporting process. These platforms allow taxpayers to easily declare and update their personal property holdings, reducing the administrative burden on both taxpayers and tax administrators.

Additionally, jurisdictions may collaborate with third-party valuation services or utilize advanced technology to enhance the accuracy and efficiency of property assessments. By leveraging data analytics and machine learning, tax assessors can identify potential under-reporting or undervaluation of assets, ensuring a more equitable distribution of the tax burden.

Tips for Property Owners

For property owners, understanding personal property taxes and their implications is crucial for effective financial planning. Here are some tips to help navigate this complex tax landscape:

Stay Informed

Familiarize yourself with the personal property tax laws and regulations in your jurisdiction. Understand the types of property that are taxable, the assessment methods used, and the applicable tax rates. Stay updated on any changes or amendments to the tax code that may impact your tax liability.

Keep Accurate Records

Maintain detailed records of your personal property holdings, including purchase dates, acquisition costs, and any subsequent improvements or upgrades. These records will be valuable when it comes to accurately assessing the value of your property and determining your tax liability.

Declare and Report

Ensure that you declare all taxable personal property to the appropriate tax authorities. Failure to report certain assets may result in penalties and interest charges. Stay compliant with the tax laws and regulations to avoid legal consequences.

Utilize Exemptions and Deductions

Research and take advantage of any available exemptions or deductions that may reduce your personal property tax liability. Some jurisdictions offer exemptions for certain types of property, such as farm equipment or low-value personal items. Additionally, deductions for business expenses or depreciation may be applicable.

Consider Professional Advice

If you own a significant amount of personal property or have complex financial circumstances, consider seeking professional advice from a tax advisor or accountant. They can provide personalized guidance and help you optimize your tax strategy while ensuring compliance with the law.

Future Implications and Innovations

As technology advances and data analytics become more sophisticated, the administration of personal property taxes is likely to undergo further innovations. Jurisdictions may increasingly leverage digital platforms and data-driven approaches to enhance the accuracy and efficiency of tax assessment and collection processes.

Additionally, the concept of a universal property tax system, where all forms of property are taxed under a unified framework, has been proposed by some economists and policymakers. Such a system would simplify the tax code and ensure a more equitable distribution of the tax burden. However, implementing such a system would require significant legal and administrative reforms and may face resistance from various stakeholder groups.

Conclusion

Personal property taxes are an integral part of the tax landscape, providing crucial revenue for local governments to fund essential public services. While these taxes offer benefits such as stability and equitable distribution of the tax burden, they also present challenges in terms of administration and compliance. By staying informed, maintaining accurate records, and seeking professional advice when needed, property owners can effectively navigate the complex world of personal property taxes.

FAQ

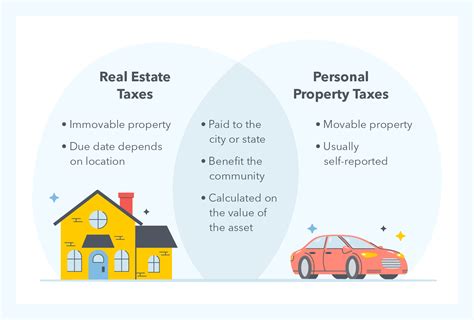

Are personal property taxes the same as real estate taxes?

+No, personal property taxes and real estate taxes are distinct from each other. Personal property taxes are levied on tangible assets owned by individuals or businesses, while real estate taxes are imposed on real property, such as land and buildings.

How often do I need to pay personal property taxes?

+The frequency of personal property tax payments can vary depending on the jurisdiction. Typically, property owners are required to pay these taxes on an annual or semi-annual basis. It is essential to check the specific requirements in your area to ensure timely payment.

Can I deduct personal property taxes from my income tax returns?

+The deductibility of personal property taxes depends on the jurisdiction and your individual tax situation. In some cases, personal property taxes may be deductible as itemized deductions on federal or state income tax returns. However, it is crucial to consult with a tax professional to understand the specific rules and regulations in your area.

What happens if I fail to pay my personal property taxes?

+Failure to pay personal property taxes can result in various consequences, including penalties, interest charges, and potential legal actions. In some cases, the local government may place a lien on your property, which can impact your creditworthiness and future financial transactions. It is essential to stay current with your tax obligations to avoid these negative outcomes.

Are there any exemptions or deductions available for personal property taxes?

+Yes, many jurisdictions offer exemptions or deductions for certain types of personal property. These may include exemptions for low-value items, farm equipment, or business inventory. Additionally, some jurisdictions provide deductions for depreciation or business expenses related to the property. It is crucial to research and understand the specific exemptions and deductions available in your area to optimize your tax liability.