State Of Indiana Tax Return Status

In the world of tax filings and refunds, staying informed about the status of your Indiana tax return is crucial. The Indiana Department of Revenue provides an accessible and efficient online platform to help taxpayers track their refund status. This guide will delve into the process, offering step-by-step instructions and insights to ensure a smooth and informed experience.

Understanding the Indiana Tax Return Status Process

The Indiana Department of Revenue employs a user-friendly system to manage tax return processing and refund disbursements. This system is designed to provide taxpayers with real-time updates on the status of their returns, ensuring transparency and efficiency.

To begin, taxpayers must access the Indiana Individual Income Tax section on the Department's official website. This portal is a secure gateway to various tax-related services, including the Where's My Refund feature, which is pivotal for tracking refund status.

Step-by-Step Guide to Checking Your Indiana Tax Return Status

-

Visit the Official Website: Start by navigating to the Indiana Department of Revenue's website. This is the primary source for all tax-related information and services.

-

Access the Taxpayer Portal: Locate and click on the Taxpayer Portal link. This portal is a secure gateway to your tax information and services.

-

Log In or Create an Account: If you have an existing account, log in using your credentials. If not, create an account by providing the necessary details. This step ensures a personalized and secure experience.

-

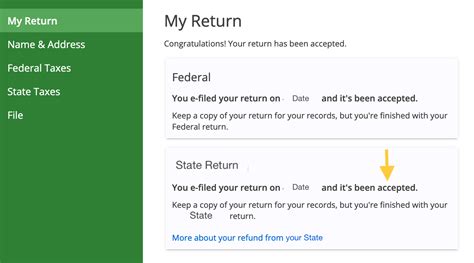

Navigate to the Refund Status Page: Once logged in, you'll find a dedicated section for Refund Status or Where's My Refund. Click on this link to access the status tracker.

-

Enter Your Information: The status tracker will require specific details, including your Social Security Number, Refund Amount, and Tax Year. Ensure the information is accurate to obtain precise results.

-

Submit and Review: After entering the required details, click Submit to process your request. The system will then display the current status of your refund, providing updates on its progress.

The Where's My Refund tool is designed to provide real-time updates, ensuring taxpayers are informed about the progress of their refunds. It's an efficient way to stay updated without the need for constant phone calls or visits to tax offices.

Understanding the Status Updates

The Where's My Refund tool provides a series of status updates, each indicating a specific stage in the refund process. Here's a breakdown of the common status updates and their meanings:

| Status Update | Explanation |

|---|---|

| Return Received | Your tax return has been successfully received by the Indiana Department of Revenue. This is the initial step in the refund process. |

| Return In Process | Your tax return is currently being processed. This stage may include various checks and verifications before a refund is issued. |

| Return Approved | Your tax return has been approved, and the refund process is about to begin. This is a positive indicator that your refund is on its way. |

| Refund Issued | Your refund has been officially issued and is in the process of being disbursed. This could mean it has been sent to your bank account (if direct deposit was chosen) or is in the mail (if a check was selected). |

| Refund Sent | Your refund has been successfully disbursed. If you opted for direct deposit, it should reflect in your account shortly. If a check was chosen, allow for postal delivery time. |

It's important to note that refund processing times can vary depending on various factors, including the complexity of the return and the volume of tax returns being processed during a particular period.

Conclusion: Stay Informed, Stay Proactive

The Indiana Department of Revenue's online platform is a powerful tool for taxpayers to stay informed about their tax return status and refund progress. By following the step-by-step guide and understanding the status updates, taxpayers can navigate the process with ease and confidence.

Remember, staying proactive and informed is key to a seamless tax experience. With the right tools and knowledge, managing your tax obligations and refunds can be a straightforward and stress-free process.

Frequently Asked Questions

How long does it typically take to receive my Indiana tax refund?

+

The processing time for Indiana tax refunds can vary, but typically, it takes between 2 to 4 weeks from the date your return is received. However, factors like errors or additional reviews can extend this timeframe. Direct deposit refunds are often processed faster than paper checks.

Can I track my Indiana tax refund status without an online account?

+

Yes, you can check your Indiana tax refund status without an online account by using the Department of Revenue’s Where’s My Refund tool. This tool requires specific details like your Social Security Number, Refund Amount, and Tax Year to provide a status update.

What should I do if my Indiana tax refund status shows an error message?

+

If you encounter an error message while checking your Indiana tax refund status, it’s recommended to contact the Indiana Department of Revenue’s Taxpayer Services Division. They can provide guidance and help resolve any issues you may be facing.

Are there any alternative methods to receive my Indiana tax refund besides direct deposit or check?

+

At present, the primary methods for receiving Indiana tax refunds are direct deposit and paper checks. However, the Department of Revenue may introduce new refund options in the future, so it’s advisable to stay updated with their announcements.

Can I check the status of my Indiana business tax return using the same method as individual tax returns?

+

Yes, you can use the same Where’s My Refund tool to check the status of your Indiana business tax return. However, you’ll need to provide specific details related to your business tax account, such as your Business Tax ID and the relevant tax year.