Tax Treatment Rsu

Restricted stock units (RSUs) have become an increasingly popular form of employee compensation, particularly in the technology and startup sectors. As a deferred compensation arrangement, RSUs offer a unique blend of benefits and complexities, one of which is their tax treatment. This article aims to delve into the intricacies of how RSUs are taxed, providing a comprehensive guide for employees, employers, and tax professionals alike.

Understanding RSUs and Their Tax Implications

RSUs are a form of equity compensation where employees are granted the right to receive company stock at a future date, often upon the satisfaction of certain vesting conditions. These conditions could be time-based, performance-based, or a combination of both. Unlike stock options, RSUs do not provide the holder with immediate rights to the underlying stock but rather grant the right to acquire the stock upon vesting.

The tax treatment of RSUs is complex and can vary depending on a multitude of factors, including the jurisdiction of the employer, the employee's residence, the specific terms of the RSU grant, and the timing of various events. It's crucial to note that the information provided here is of a general nature and may not apply to every situation. Always consult with a qualified tax professional for personalized advice.

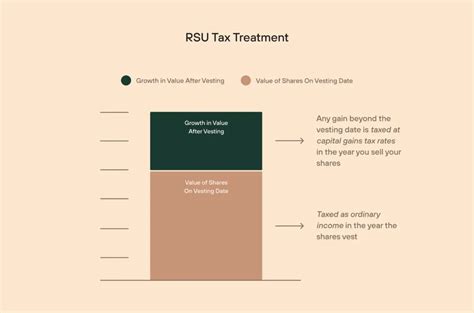

Taxation upon Vesting

One of the key aspects of RSU tax treatment is the timing of taxation. In most cases, RSUs are taxed when they vest, meaning when the employee gains the right to receive the underlying shares. At this point, the employee typically recognizes ordinary income equal to the fair market value (FMV) of the shares on the date of vesting.

For example, if an employee is granted 1,000 RSUs with a fair market value of $50 per share, and these RSUs vest on January 1, 2023, the employee will recognize ordinary income of $50,000 ($50 x 1,000 shares) on that date. This income is subject to regular income tax withholding, as well as applicable employment taxes such as Social Security and Medicare.

Tax Withholding and Reporting

Employers are generally responsible for withholding taxes from the income generated by RSUs. The amount withheld will depend on the employee’s overall tax situation, including their tax bracket, allowances, and any other income or deductions. Employers will typically withhold taxes at the employee’s marginal tax rate to ensure sufficient coverage of the tax liability.

The employer will also report the income and withholding on the employee's W-2 form for the year in which the RSUs vest. This form is crucial for the employee's tax return preparation, as it provides a record of the income and taxes withheld.

Tax Treatment of Dividends

Dividends paid on the underlying shares of RSUs are also subject to tax. If the company pays dividends on its stock during the vesting period, the employee may be entitled to receive these dividends, either in cash or in additional shares. These dividend payments are typically taxable as ordinary income at the employee’s marginal tax rate.

For instance, if the company pays a dividend of $2 per share on its stock, and the employee holds 1,000 RSUs, the employee will receive a dividend payment of $2,000 ($2 x 1,000 shares). This dividend will be subject to regular income tax withholding and will be reported on the employee's W-2 form.

Section 83(b) Election

In some cases, employees may have the option to make a special tax election under Internal Revenue Code Section 83(b). This election allows the employee to be taxed on the RSUs at the time of grant rather than at vesting. This can be beneficial if the employee expects the value of the shares to increase significantly between the grant and vesting dates.

By making this election, the employee can potentially lower their tax liability by recognizing the income when the shares are less valuable. However, it's important to note that this election must be made within 30 days of the RSU grant, and it's irrevocable. It's crucial to consult with a tax professional before making this decision.

Tax Treatment of Forfeited RSUs

If RSUs are forfeited, meaning the employee does not meet the vesting conditions, there may be tax implications. In some cases, the employee may be able to deduct the value of the forfeited RSUs as a capital loss. However, this depends on various factors, including the specific terms of the RSU grant and the employee’s overall tax situation.

International Considerations

The tax treatment of RSUs can become even more complex when dealing with international employees or employers. Different countries have different tax laws and regulations regarding equity compensation, and it’s essential to understand the specific rules and requirements in each jurisdiction.

For example, some countries may require additional tax reporting or withholding for RSUs, while others may have different tax rates or thresholds. Additionally, the tax treaty between the employee's country of residence and the employer's country can impact the tax treatment of RSUs.

It's crucial for international employees and employers to seek guidance from local tax professionals to ensure compliance with all applicable laws and regulations.

Best Practices and Tips

Navigating the tax landscape of RSUs can be challenging, but there are several best practices and tips that can help employees and employers manage this process effectively.

- Understand the Terms of Your RSU Grant: Before accepting an RSU grant, thoroughly review and understand the terms and conditions. Pay attention to the vesting schedule, any performance conditions, and the potential tax implications.

- Seek Professional Advice: Given the complexity of RSU tax treatment, it's highly recommended to consult with a qualified tax professional. They can provide personalized advice based on your specific situation and ensure you're maximizing the benefits while remaining compliant.

- Stay Informed on Tax Laws: Tax laws and regulations can change over time. Stay updated on any relevant changes that could impact the tax treatment of your RSUs. This includes both domestic and international tax laws if you're an international employee or employer.

- Plan Your Vesting Strategy: Consider your financial goals and tax situation when planning the timing of your RSU vesting. If you have multiple RSU grants with different vesting dates, you may be able to manage your tax liability by coordinating the vesting of your RSUs.

- Utilize Tax-Efficient Strategies: Explore tax-efficient strategies, such as tax-loss harvesting or tax-efficient withdrawal strategies, to optimize your tax situation. These strategies can help you minimize your tax liability while still achieving your financial goals.

RSUs can be a valuable component of an employee's compensation package, but they come with unique tax considerations. By understanding the tax treatment of RSUs and implementing best practices, employees and employers can navigate this complex landscape effectively and maximize the benefits of this form of equity compensation.

Conclusion

The tax treatment of RSUs is a multifaceted topic that requires a deep understanding of tax laws and regulations. This article has provided an overview of the key aspects of RSU taxation, but it’s essential to recognize that every situation is unique. As such, it’s crucial to consult with tax professionals who can provide personalized advice and ensure compliance with all applicable laws.

By staying informed, seeking professional guidance, and implementing tax-efficient strategies, individuals can navigate the complexities of RSU taxation and make the most of this valuable form of compensation.

What are the key differences between RSUs and stock options in terms of tax treatment?

+RSUs and stock options are both forms of equity compensation, but they differ significantly in their tax treatment. RSUs are generally taxed upon vesting, when the employee recognizes ordinary income equal to the fair market value of the shares. In contrast, stock options are taxed upon exercise, and the tax liability is based on the difference between the exercise price and the fair market value of the shares at the time of exercise. This difference is known as the spread and is taxed as a capital gain.

Can employees choose when to be taxed on their RSUs?

+Yes, employees may have the option to make a Section 83(b) election, which allows them to be taxed on their RSUs at the time of grant rather than at vesting. This election must be made within 30 days of the RSU grant and is irrevocable. It’s important to consult with a tax professional before making this decision, as it can have significant tax implications.

What happens if an employee forfeits their RSUs?

+If an employee forfeits their RSUs, there may be tax implications. In some cases, the employee may be able to deduct the value of the forfeited RSUs as a capital loss. However, this depends on various factors, including the specific terms of the RSU grant and the employee’s overall tax situation. It’s important to consult with a tax professional to understand the potential tax consequences of forfeiting RSUs.