Montana Income Tax

In the world of personal finance and taxation, understanding the nuances of state-specific income tax systems is crucial. Montana, known for its stunning natural beauty and diverse economy, has a unique approach to income taxation that impacts both its residents and businesses. Let's delve into the specifics of Montana's income tax system, exploring its rates, brackets, deductions, and how it compares to other states.

Understanding Montana’s Income Tax Structure

Montana’s income tax system operates on a progressive scale, meaning that higher incomes are taxed at higher rates. This progressive structure aims to ensure fairness and contribute to the state’s revenue generation. The tax rates and brackets are periodically adjusted to account for inflation and changing economic conditions.

Income Tax Rates and Brackets

As of the most recent tax year, Montana has five income tax brackets, each with its own tax rate. These brackets are designed to capture different income levels, providing a balanced approach to taxation. The tax rates and corresponding income brackets are as follows:

| Tax Rate | Income Bracket |

|---|---|

| 0% | Up to $3,400 for Single filers; $6,800 for Joint filers |

| 2% | $3,401 - $9,500 for Single filers; $6,801 - $19,000 for Joint filers |

| 3% | $9,501 - $16,000 for Single filers; $19,001 - $32,000 for Joint filers |

| 4% | $16,001 - $32,000 for Single filers; $32,001 - $64,000 for Joint filers |

| 6.9% | Over $32,000 for Single filers; Over $64,000 for Joint filers |

These brackets ensure that individuals and couples with lower incomes face a relatively low tax burden, while higher-income earners contribute a larger share to the state's revenue.

Deductions and Credits

Montana offers a range of deductions and credits to help taxpayers reduce their taxable income. These deductions are designed to provide relief for various expenses and circumstances. Some of the key deductions and credits include:

- Standard Deduction: Taxpayers can opt for a standard deduction, which varies based on filing status. This deduction simplifies the tax process by providing a fixed amount that taxpayers can subtract from their taxable income.

- Itemized Deductions: For those with eligible expenses, itemizing deductions can be beneficial. Common itemized deductions include medical expenses, charitable contributions, mortgage interest, and state and local taxes.

- Personal Exemptions: Montana allows for personal exemptions, which reduce taxable income. These exemptions are available for the taxpayer, spouse, and dependents.

- Tax Credits: Various tax credits are available to encourage specific behaviors or support certain groups. For instance, there are credits for education expenses, low-income individuals, and veterans.

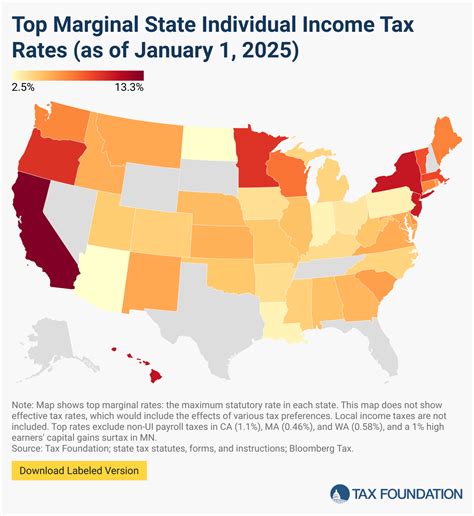

Comparison with Other States

When compared to other states, Montana’s income tax system stands out for its simplicity and relatively low tax rates. While some states have more complex structures with numerous tax brackets and high top rates, Montana’s approach is more straightforward. This can be advantageous for taxpayers, as it simplifies the tax filing process.

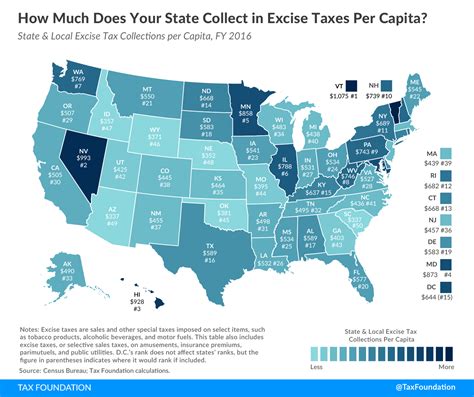

Additionally, Montana's income tax rates are generally lower than those of many neighboring states. This can make the state an attractive option for businesses and individuals seeking a more tax-friendly environment. However, it's important to note that the overall tax landscape, including property taxes and sales taxes, should also be considered when evaluating the tax climate of a state.

Filing and Compliance

For individuals and businesses operating in Montana, understanding the filing requirements and deadlines is essential. The state’s tax agency provides clear guidelines and resources to assist taxpayers in navigating the process. Here are some key aspects to consider:

Filing Deadlines

Montana adheres to the standard federal tax filing deadline of April 15th for most taxpayers. However, it’s important to note that certain circumstances, such as extensions or specific filing scenarios, may impact the exact deadline. It’s recommended to consult the official tax guidelines or seek professional advice to ensure compliance.

Filing Options

Montana offers various filing options to cater to different taxpayer preferences and needs. Taxpayers can choose to file electronically, utilizing online platforms and software, which can streamline the process and reduce the risk of errors. Alternatively, paper filing is also an option, providing a more traditional approach for those who prefer it.

Payment Options

The state provides flexible payment options to accommodate taxpayers’ financial situations. Taxpayers can pay their income tax liabilities in full at the time of filing or opt for installment plans if needed. Additionally, electronic payment methods, such as direct debit and credit card payments, are available for added convenience.

Tax Forms and Requirements

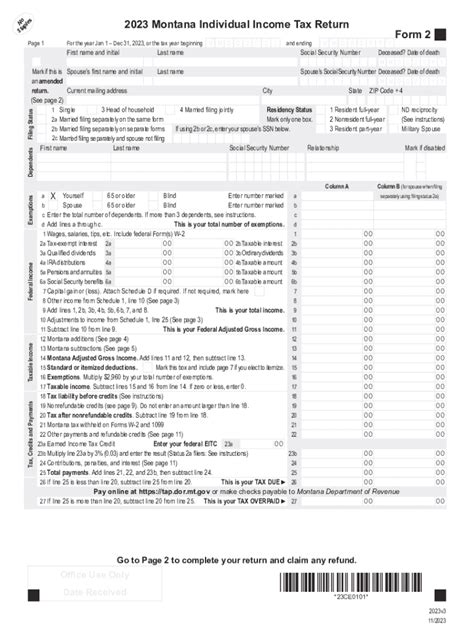

Montana’s tax agency provides a comprehensive set of tax forms and instructions tailored to different taxpayer profiles. These forms cover various scenarios, including individual income tax, business taxes, and specific deductions or credits. It’s crucial for taxpayers to carefully review and complete the appropriate forms to ensure accurate reporting and compliance.

Penalties and Interest

Like any tax jurisdiction, Montana imposes penalties and interest for late filing or late payment of taxes. These penalties can vary based on the specific circumstances and the amount owed. To avoid unnecessary financial burdens, it’s advisable to meet filing and payment deadlines or explore available options for extensions or payment plans.

Impact on Businesses and Investors

Montana’s income tax system not only affects individuals but also has implications for businesses and investors operating within the state. Understanding these impacts is crucial for strategic decision-making and long-term planning.

Business Income Taxation

Businesses in Montana, whether corporations or partnerships, are subject to the state’s income tax. The tax rates and brackets applicable to individuals also apply to business income. However, businesses have the added complexity of navigating various deductions, credits, and reporting requirements specific to their industry and structure.

For instance, businesses may be eligible for deductions related to business expenses, depreciation, and certain types of investments. Additionally, they must consider payroll taxes, sales taxes, and other business-specific taxes that contribute to their overall tax liability.

Corporate Tax Rates

Montana imposes a corporate income tax on businesses operating within the state. The tax rate for corporations is a flat 6.9%, which is applied to the net income of the corporation. This rate is relatively competitive compared to many other states, making Montana an attractive destination for businesses seeking a more favorable tax environment.

Investment Opportunities and Incentives

Montana offers a range of investment opportunities and incentives to attract businesses and investors. These incentives aim to stimulate economic growth and job creation within the state. Some key initiatives include:

- Business Tax Credits: Montana provides various tax credits to support specific industries and promote economic development. These credits can offset a portion of a business's tax liability, making Montana an appealing location for strategic investments.

- Research and Development Credits: Businesses engaged in research and development activities may be eligible for tax credits, encouraging innovation and technological advancements.

- Rural Development Initiatives: Montana focuses on supporting rural communities and businesses through targeted initiatives and tax incentives. This includes programs aimed at agricultural development, infrastructure improvements, and job creation in underserved areas.

Future Implications and Considerations

As with any tax system, Montana’s income tax structure is subject to potential changes and evolving economic realities. Understanding these future implications is crucial for taxpayers, businesses, and investors to make informed decisions.

Potential Tax Reforms

Montana’s tax system, like those of other states, may undergo reforms and adjustments over time. These reforms could impact tax rates, brackets, deductions, and overall tax policy. While it’s challenging to predict specific changes, staying informed about legislative discussions and proposed amendments is essential for proactive planning.

Economic Impact and Growth

Montana’s income tax system plays a vital role in the state’s economic health and growth. The revenue generated through income taxes contributes to funding essential public services, infrastructure development, and social programs. A well-managed and sustainable tax system can attract businesses, create jobs, and foster economic prosperity.

Population and Demographic Changes

Population growth and demographic shifts can influence the income tax base and revenue generation. As Montana’s population evolves, the state’s tax system may need to adapt to accommodate changing needs and preferences. Understanding these demographic trends is crucial for ensuring the tax system remains fair and effective for all residents.

Comparative Tax Analysis

Conducting a comparative analysis of Montana’s income tax system with those of other states can provide valuable insights. This analysis helps taxpayers, businesses, and policymakers evaluate the state’s tax competitiveness and make informed decisions. It also allows for strategic planning to attract and retain talent, businesses, and investments.

Frequently Asked Questions

How does Montana’s income tax system compare to other states in terms of complexity and rates?

+

Montana’s income tax system is known for its simplicity and relatively low tax rates compared to many other states. With only five tax brackets and a progressive structure, it offers a straightforward approach to taxation. This can make it more appealing to taxpayers seeking a less complex and potentially more cost-effective tax environment.

Are there any special deductions or credits available for specific groups or circumstances in Montana’s tax system?

+

Yes, Montana provides a range of deductions and credits to support various groups and circumstances. These include standard deductions, itemized deductions for eligible expenses, personal exemptions, and tax credits for education, low-income individuals, and veterans. These incentives aim to provide relief and support to specific segments of the population.

How does Montana’s income tax system impact businesses, and are there any incentives for businesses to operate in the state?

+

Montana’s income tax system applies to businesses, with a flat corporate tax rate of 6.9%. This rate is competitive compared to many other states, making Montana an attractive destination for businesses. Additionally, the state offers various business tax credits, research and development incentives, and rural development initiatives to support economic growth and attract investments.

What are the potential future implications of Montana’s income tax system, and how can taxpayers prepare for potential changes?

+

Montana’s income tax system may undergo reforms and adjustments in response to economic changes and legislative decisions. Taxpayers can prepare by staying informed about proposed amendments and legislative discussions. Additionally, conducting comparative tax analyses and considering long-term planning strategies can help individuals and businesses navigate potential changes effectively.