Cleveland County Nc Tax

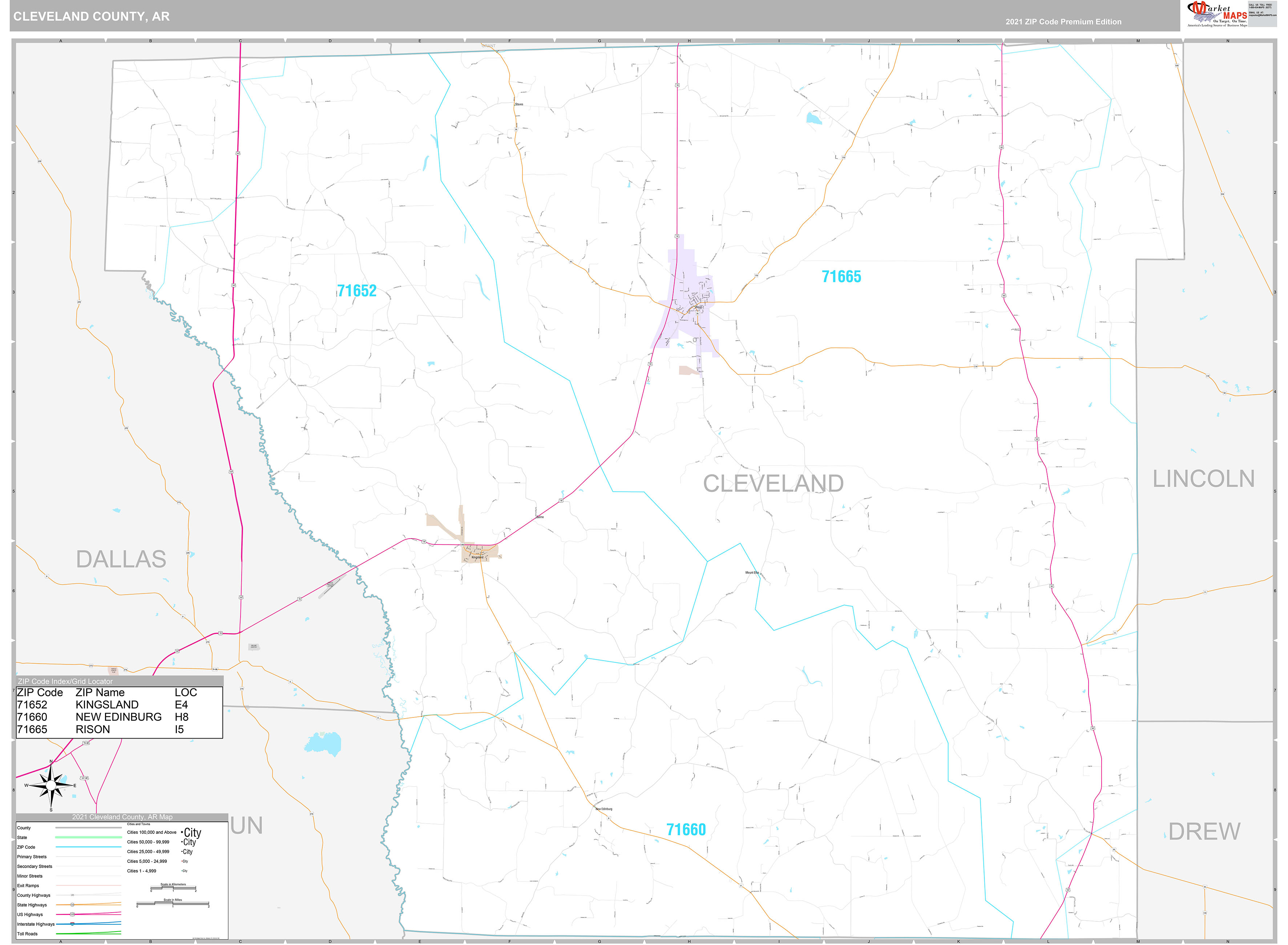

Cleveland County, located in the heart of North Carolina, is a vibrant community with a rich history and a thriving economy. One aspect that plays a significant role in the county's development and sustainability is its tax system. Understanding the intricacies of Cleveland County's tax structure and its implications is crucial for both residents and businesses alike. In this comprehensive guide, we will delve into the world of Cleveland County NC Tax, exploring its various components, rates, and how it impacts the local community.

A Deep Dive into Cleveland County’s Tax Landscape

Cleveland County, like many other counties across the United States, relies on a combination of property taxes, sales taxes, and other revenue streams to fund essential services and infrastructure projects. This intricate tax system forms the backbone of the county’s financial stability and overall development.

Property Taxes: The Backbone of County Revenue

Property taxes are a significant source of revenue for Cleveland County. These taxes are assessed on real estate properties, including residential homes, commercial buildings, and land. The ad valorem taxation method is employed, which means the tax is based on the property’s assessed value.

The property tax rate in Cleveland County is set annually by the Cleveland County Board of Commissioners. This rate is expressed in terms of dollars per hundred dollars of assessed value, known as the tax rate per $100 valuation. The rate can vary slightly from year to year, depending on the county's budgetary needs and the assessed property values.

For the current fiscal year, the property tax rate stands at $0.6894 per $100 valuation. This rate is composed of various components, including taxes allocated to the county, city or town, schools, and special districts.

| Taxing Entity | Rate per $100 Valuation |

|---|---|

| Cleveland County | $0.3010 |

| Cleveland County Schools | $0.3135 |

| Cities and Towns | Varies by municipality |

| Special Districts | Varies by district |

It's important to note that property tax rates can differ based on the specific municipality or special district within Cleveland County. For instance, the city of Shelby, the county seat, has its own property tax rate, which is $0.4859 per $100 valuation for the current fiscal year.

Sales Taxes: Funding Essential Services

In addition to property taxes, Cleveland County also collects sales taxes on various goods and services. Sales taxes are a significant source of revenue for the county, contributing to the funding of essential services such as education, public safety, and infrastructure projects.

The North Carolina Department of Revenue oversees the administration of sales taxes in the state, including those collected in Cleveland County. The state's base sales tax rate is 4.75%, which is then subject to additional local taxes, known as local option taxes.

Cleveland County has a local option sales tax of 2%, which is applied to the base state sales tax rate. This means that the total sales tax rate in Cleveland County is 6.75%. This rate applies to most tangible personal property sold at retail, as well as certain services provided within the county.

The revenue generated from sales taxes is distributed to various entities within Cleveland County, including the county government, cities and towns, and school districts. These funds are crucial for maintaining and improving the county's infrastructure, supporting public safety initiatives, and ensuring a high-quality education system.

Other Revenue Streams: A Diverse Funding Approach

While property taxes and sales taxes are the primary revenue streams for Cleveland County, the county also relies on a variety of other sources to fund its operations and services.

One notable source of revenue is the lodging tax, which is levied on hotel and motel stays within the county. This tax is typically used to promote tourism and enhance the local hospitality industry. Cleveland County has a 4% lodging tax, which is applied to the cost of accommodations.

Additionally, the county collects vehicle registration fees, which contribute to the maintenance and improvement of the county's transportation infrastructure. These fees are based on the type of vehicle and its value.

Cleveland County also generates revenue through various user fees and permits, such as building permits, business licenses, and special event permits. These fees are designed to cover the costs associated with providing specific services or regulating certain activities within the county.

Furthermore, the county may receive grants and federal or state funding for specific projects or initiatives. These external funding sources can provide additional resources for critical projects and programs that benefit the community.

The Impact of Cleveland County’s Tax System

Cleveland County’s tax system has a profound impact on the local community, influencing various aspects of daily life and economic development.

Economic Development and Business Growth

The tax policies and rates in Cleveland County play a crucial role in attracting and retaining businesses. A competitive tax structure can encourage economic growth, job creation, and investment in the county.

Businesses consider various factors when deciding on a location, and tax rates are often a significant consideration. Cleveland County's tax rates, particularly its property tax rates, can influence a business's decision to establish or expand operations within the county. A favorable tax environment can lead to increased business activity, creating job opportunities and stimulating the local economy.

Furthermore, the county's sales tax rate can also impact consumer spending and business revenue. A well-managed tax system can ensure that businesses are not overburdened, allowing them to thrive and contribute to the local economy.

Funding Essential Services and Infrastructure

The revenue generated from Cleveland County’s tax system is vital for funding essential services and maintaining a high quality of life for its residents.

Property taxes, sales taxes, and other revenue streams contribute to the funding of critical services such as education, public safety, healthcare, and social services. These taxes enable the county to provide adequate resources for schools, police and fire departments, healthcare facilities, and social programs that support vulnerable populations.

Additionally, tax revenue is essential for maintaining and improving the county's infrastructure. This includes roads, bridges, water and sewer systems, parks, and other public facilities. A well-maintained infrastructure not only enhances the quality of life for residents but also attracts businesses and investment.

Community Engagement and Civic Responsibility

Cleveland County’s tax system also fosters a sense of community engagement and civic responsibility among its residents.

Property owners and businesses understand that their tax contributions directly impact the community's well-being. By paying taxes, individuals and businesses become active participants in shaping the future of Cleveland County.

The tax system encourages community members to stay informed about local issues, attend public meetings, and engage in civic discussions. This engagement leads to a more transparent and accountable governance process, where residents have a say in the allocation of tax revenue and the overall direction of the county.

Conclusion: A Sustainable and Thriving Cleveland County

Cleveland County’s tax system is a complex yet crucial aspect of its economic and social landscape. By understanding the various components of this system, residents and businesses can make informed decisions and actively contribute to the county’s development.

From property taxes to sales taxes and a diverse range of revenue streams, Cleveland County's tax structure supports essential services, fosters economic growth, and enhances the overall quality of life for its residents. The county's commitment to effective tax management ensures a sustainable and thriving future for all who call it home.

What is the current property tax rate in Cleveland County, NC?

+The current property tax rate in Cleveland County, NC, is 0.6894 per 100 valuation for the fiscal year. This rate may vary slightly from year to year and can differ based on the specific municipality or special district within the county.

How does Cleveland County’s sales tax rate compare to other counties in North Carolina?

+Cleveland County’s total sales tax rate of 6.75% is relatively competitive compared to other counties in North Carolina. The state’s base sales tax rate is 4.75%, and counties can impose additional local option taxes, which Cleveland County does at a rate of 2%.

What are some of the key revenue streams for Cleveland County aside from property and sales taxes?

+Cleveland County generates revenue from various sources, including a 4% lodging tax, vehicle registration fees, user fees, permits, and grants. These additional revenue streams contribute to the county’s financial stability and its ability to provide essential services.