How to Save Money in No Sale Tax States

In the intricate landscape of American taxation, a compelling question persists: how can residents in states that lack sales tax optimize their financial strategies to maximize savings? With over 40 states choosing to forego a state-level sales tax, consumers in these regions encounter a different set of fiscal dynamics that influence purchasing choices, investment opportunities, and overall financial health. This divergence from the common retail taxation paradigm prompts a nuanced examination of how residents can effectively leverage their unique tax environments to preserve wealth, enhance purchasing power, and plan for long-term financial security.

Understanding the Economic Environment of No-Sale-Tax States

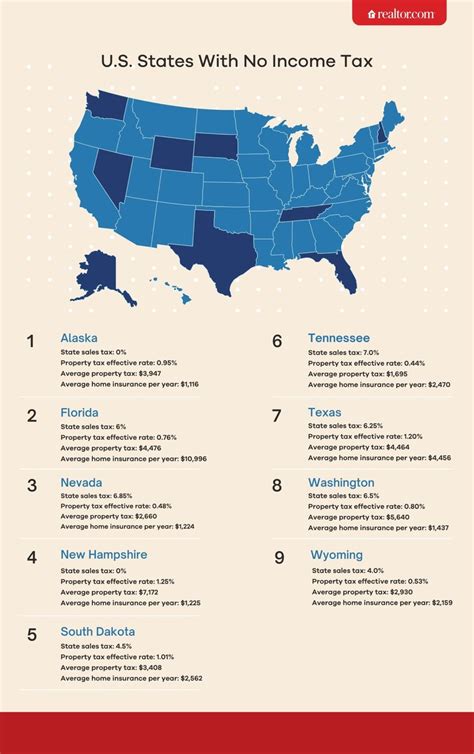

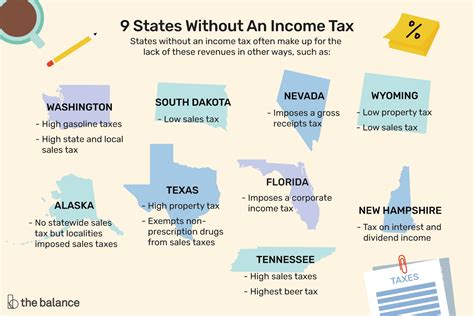

States such as Delaware, Montana, New Hampshire, Oregon, and Alaska stand apart as jurisdictions without general sales taxes. This absence fundamentally reshapes consumer behavior and fiscal planning. For many residents, the lack of sales tax results in immediate price reductions on goods and services, theoretically increasing disposable income at the point of sale. However, these states often compensate through other revenue mechanisms such as higher income taxes, property taxes, or specific excise taxes. Therefore, understanding the broader fiscal policies is essential to formulating an effective savings strategy.

Tax Revenue Structures and Their Impact on Consumer Strategies

Analyzing the revenue models reveals that while no sales tax provides direct savings during purchases, residents may encounter higher costs elsewhere. For instance, New Hampshire relies heavily on property taxes, which can elevate the cost of home ownership. Montana’s resource-extraction taxes influence gasoline and utility prices, indirectly affecting consumer expenses. Consequently, residents must adopt a comprehensive approach that considers these compensatory taxes when devising saving strategies.

| Relevant Category | Substantive Data |

|---|---|

| Average Property Tax Rate | In New Hampshire, approximately 0.83%, above the national median of 0.99% |

| State Income Tax Rates | Montana: 1% to 6.9% depending on income bracket; Oregon: 4.75% to 9.9% |

| Average Gasoline Prices | Montana: ~$3.20/gallon, influenced by resource taxes and transportation costs |

Strategies for Maximizing Savings in No-Sale-Tax States

The core advantage in these regions is straightforward—buying goods without the added sales tax. However, capitalizing on this benefit involves strategic planning beyond immediate purchasing decisions.

Leveraging Tax-Free Shopping and Big-Ticket Purchases

Residents can plan large acquisitions—vehicles, appliances, electronics—during periods when these items are on sale or when specific retailers or online stores offer tax-free promotions. For example, in Montana, where no statewide sales tax exists, shoppers often coordinate purchases during tax holiday events or utilize online platforms that ship from tax-friendly jurisdictions, further reducing costs.

Investing in Tax-Advantaged Accounts

Without sales tax, the focus shifts to income and property tax strategies. Maximizing contributions to 401(k)s, IRAs, and health savings accounts (HSAs) ensures that income tax liabilities are minimized, leading to greater wealth accumulation. These accounts not only defer taxes but also grow tax-free in many cases, amplifying savings over time.

Exploring Property Tax Reduction Opportunities

Property taxes can be substantial, especially in popular no-sales-tax states like New Hampshire. Residents should explore exemptions, credits, and appeal processes to reduce their property tax burden. Additionally, investing in energy-efficient upgrades can qualify for property tax incentives, further diminishing long-term costs.

Capitalizing on Residency Incentives and Credits

States like Oregon and Alaska offer various tax credits to promote economic activity, renewable energy, or local employment. Savvy residents can explore these programs to offset other tax liabilities, thereby increasing their overall savings.

Balancing Consumption and Income Strategies

In regions without sales tax, understanding the indirect effects of other taxes becomes crucial. For example, higher income taxes may offset the benefits of no sales tax, which necessitates a balanced approach: cultivating sources of tax-efficient income, reducing taxable wealth, and timing expenditures prudently.

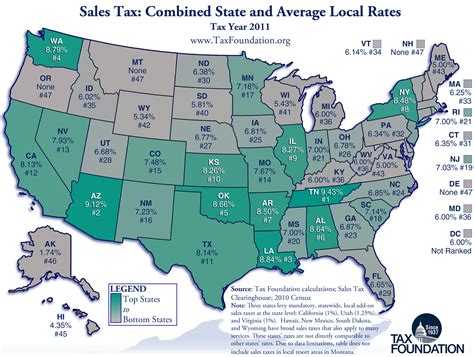

Offshore and Online Shopping Considerations

Many consumers take advantage of online retailers based in states or countries with lower or no sales tax—such as Delaware or Oregon—to enjoy savings. However, recent tax law changes, including economic nexus laws, complicate this practice. Staying informed of evolving regulations ensures residents do not inadvertently breach tax laws or lose out on savings opportunities.

| Relevant Category | Substantive Data |

|---|---|

| Online Sales Tax Legislation | As of 2023, over 20 states have enacted laws requiring remote sellers to collect sales tax if exceeding a sales threshold, impacting online shopping savings. |

Potential Pitfalls and Considerations

While no-sales-tax states offer tangible benefits, they are not without potential drawbacks. Residents must remain vigilant about higher property or income taxes, local costs of living, and changing legislation. For example, Oregon’s recent discussions about implementing a statewide income tax could alter the landscape. Such shifts emphasize the importance of proactive planning and regular review of tax policies to sustain savings benefits.

Evaluating Long-term Cost of Living

Cost-of-living indices indicate that while sales tax may be absent, housing, utilities, and healthcare expenses can be elevated, particularly in cities or rural areas with limited competition. Analyzing these expenses relative to potential sales tax savings enables residents to make informed decisions about relocating or investing.

Geographical and Lifestyle Constraints

Employment opportunities, educational quality, and community amenities vary widely. Sometimes the financial advantages of low or no sales tax are offset by lifestyle costs or limited options. Strategic choices involve weighing these trade-offs to optimize overall financial well-being.

Synthetic Synthesis and Final Perspectives

In sum, residents of no-sales-tax states have a distinctive advantage that, if wielded with deliberate planning, can lead to significant savings. The key lies in recognizing that the absence of sales tax is but one dimension of a complex fiscal environment. Success entails a holistic approach—maximizing rebates and credits, optimizing income and property tax strategies, leveraging digital commerce, and remaining adaptable to legislative changes.

Additionally, long-term wealth preservation requires vigilance in managing other tax liabilities and living costs. Strategic investments, legal planning, and continuous education about evolving tax laws serve as essential tools for residents committed to stretching their dollars further. As economic landscapes shift, so too must personal strategies—embracing flexibility and informed decision-making remains paramount.

Key Points

- Maximize online and in-store shopping during tax holidays to take full advantage of no-sales-tax benefits.

- Invest in tax-advantaged accounts like IRAs and HSAs to build wealth while minimizing income taxes.

- Reduce property taxes through available exemptions and upgrades, especially in high-tax jurisdictions.

- Stay informed about evolving legislation regarding online sales and inter-state commerce to maintain savings.

- Balance lifestyle costs with potential tax savings to ensure overall financial health in low-tax environments.

Can I legally buy online from out-of-state retailers to avoid sales tax?

+Yes, purchasing from out-of-state retailers often avoids sales tax unless the retailer has a physical presence or nexus in your state. However, recent legal shifts mean many online sellers now collect tax based on your location, so staying updated on legislation is vital.

What long-term taxes should I focus on in no-sales-tax states?

+Prioritize property taxes, income taxes, and any local or special excise taxes. Investing in exemptions and credits in these categories can offset the advantage of no sales tax, ensuring holistic savings.

Are there any risks associated with relying on no sales tax for savings?

+Yes, potential risks include rising property or income taxes, legislative changes, and higher costs of living in some regions. Regular review and diversified strategies help mitigate these risks.