Property Taxes Nyc

Understanding property taxes in New York City is essential for both homeowners and prospective buyers. The process of calculating and paying these taxes can seem complex, but with the right information, it becomes clearer. In this comprehensive guide, we will delve into the intricacies of property taxes in NYC, covering everything from assessment processes to payment options and potential exemptions. By the end, you'll have a solid grasp of this critical aspect of homeownership in the Big Apple.

The Fundamentals of Property Taxes in NYC

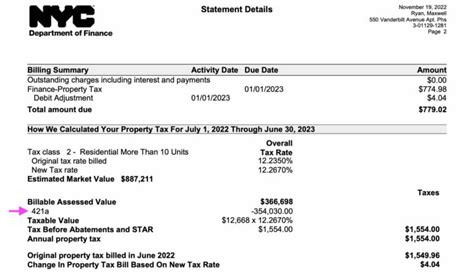

Property taxes are a crucial source of revenue for local governments, funding essential services like schools, emergency services, and infrastructure maintenance. In New York City, the Department of Finance handles the assessment and collection of these taxes. The amount owed by each property owner is determined by a combination of factors, including the assessed value of the property and the tax rate set by the local government.

The tax year for NYC properties runs from July 1 to June 30 of the following year. Property owners typically receive their tax bills in the mail or via email (if they've opted for e-billing) by July 1st of each year. These bills cover the period from July 1st to June 30th of the following year. It's important to note that property taxes are due in two installments, with the first installment typically due by January 31st and the second by July 31st. Late payments can incur penalties and interest, so staying on top of these deadlines is crucial.

Assessing Property Values

The Department of Finance employs a team of assessors who regularly evaluate properties to determine their market value. This process, known as property assessment, involves analyzing recent sales data, rental income, and construction costs. The goal is to assign a fair and accurate value to each property, ensuring that the tax burden is distributed equitably among all property owners.

Property assessments in NYC are conducted on a rolling basis, with different areas of the city being reassessed every few years. This approach helps keep the tax system up-to-date and ensures that property owners are paying their fair share based on the current market conditions. Property owners can appeal their assessment if they believe it is inaccurate or unfair. The process involves providing evidence, such as recent sale prices of similar properties or professional appraisals, to support their case. Appeals can be filed with the Tax Commission, and if successful, can result in a reduction of the property's assessed value, leading to lower tax bills.

| Assessment Year | Areas Reassessed |

|---|---|

| 2023 | Manhattan, The Bronx |

| 2024 | Brooklyn, Queens |

| 2025 | Staten Island |

Calculating Property Taxes

Once the assessed value of a property is determined, the tax bill is calculated by multiplying the assessed value by the tax rate set by the local government. This rate can vary depending on the type of property and its location within the city. For example, commercial properties typically have a higher tax rate than residential properties.

The tax rate is expressed as a mill rate, which represents the amount of tax owed per $1,000 of assessed value. To calculate the total tax bill, you multiply the assessed value by the mill rate and then divide by 1,000. For instance, if a property has an assessed value of $500,000 and the mill rate is 15, the tax bill would be calculated as follows:

$500,000 x 0.015 = $7,500

So, in this case, the property owner would owe $7,500 in property taxes for the year.

Payment Options and Exemptions

Property owners in NYC have several options for paying their taxes, including traditional methods like mailing a check or paying in person, as well as more modern options like online banking or credit card payments. The Department of Finance provides a tax payment portal on its website, allowing property owners to make payments securely and conveniently.

Additionally, NYC offers a property tax exemption program to eligible homeowners. This program provides a partial or full exemption from property taxes for qualifying properties. To be eligible, homeowners must meet certain criteria, such as owning and occupying the property as their primary residence, and their income must fall below a certain threshold. The exemption amount varies depending on the homeowner's income and the assessed value of the property.

Senior Citizen Rent and Property Tax Relief

NYC also provides tax relief for senior citizens through the Senior Citizen Rent and Property Tax Relief Program. This program offers a credit against real property taxes or a partial rent refund for eligible senior citizens. To qualify, individuals must be at least 62 years old, meet certain income requirements, and have resided in NYC for at least five years. The credit amount is determined based on the individual’s income and the assessed value of their property.

| Eligibility Criteria | Credit Amount |

|---|---|

| Income between $29,000 and $32,000 | $350 |

| Income between $32,001 and $34,000 | $300 |

| Income over $34,001 | $250 |

Other Exemptions and Abatements

Beyond the standard property tax exemptions, NYC offers a variety of other programs to help reduce the tax burden for certain property owners. These include:

- Veterans' Exemption: Provides a partial exemption for eligible veterans who own and occupy their homes.

- Star Exemption: Offers a partial exemption for primary residences, with the potential for additional savings if the property is also owner-occupied.

- J-51 Abatement: Provides a tax abatement for properties that have undergone significant renovations or improvements, encouraging property upgrades and development.

Appealing Property Taxes in NYC

If you believe your property taxes are too high or your assessment is inaccurate, you have the right to appeal. The process involves submitting an application for a tax review to the Department of Finance. You’ll need to provide supporting documentation, such as recent sale prices of similar properties or professional appraisals, to justify your claim.

The Department of Finance will then review your case and may request additional information or schedule an inspection of your property. If your appeal is successful, your property's assessed value will be adjusted, resulting in a lower tax bill. It's important to note that the appeal process can take several months, so it's advisable to start early and gather all the necessary evidence to support your case.

The Grievance Process

The Tax Commission is responsible for handling property tax grievances in NYC. To initiate a grievance, you must file a RP-524 form with the Tax Commission within a specific time frame. This form requires detailed information about your property, including its assessed value, the basis for your grievance, and any supporting evidence. It’s crucial to provide as much detail as possible to strengthen your case.

After submitting the RP-524 form, you may be invited to a hearing where you can present your case to a panel of tax experts. This is your opportunity to explain why you believe your property taxes are unfair or excessive. The Tax Commission will carefully consider your arguments and make a decision, which will be communicated to you in writing.

How often are properties reassessed in NYC?

+Properties in NYC are reassessed on a rolling basis, with different areas of the city being reassessed every few years. This ensures that assessments remain up-to-date and accurate.

Can I appeal my property tax assessment in NYC?

+Yes, you have the right to appeal your property tax assessment if you believe it is inaccurate or unfair. The process involves submitting an application and providing supporting evidence to justify your claim.

What is the tax year for NYC properties?

+The tax year for NYC properties runs from July 1 to June 30 of the following year. Tax bills are typically mailed or emailed by July 1st, and payments are due in two installments.

Are there any exemptions or abatements for property taxes in NYC?

+Yes, NYC offers a range of exemptions and abatements, including the property tax exemption program, Senior Citizen Rent and Property Tax Relief, Veterans’ Exemption, Star Exemption, and J-51 Abatement. These programs can significantly reduce your tax liability.