Florida Sales Tax Rate Miami

In the vibrant city of Miami, Florida, understanding the intricacies of sales tax is essential for both residents and businesses alike. The state of Florida, known for its sunny beaches and diverse economy, has a unique sales tax system that can impact various aspects of financial planning and business operations. This article aims to provide a comprehensive guide to the Florida sales tax rate in Miami, shedding light on its structure, applicability, and potential implications.

The Foundation of Florida Sales Tax

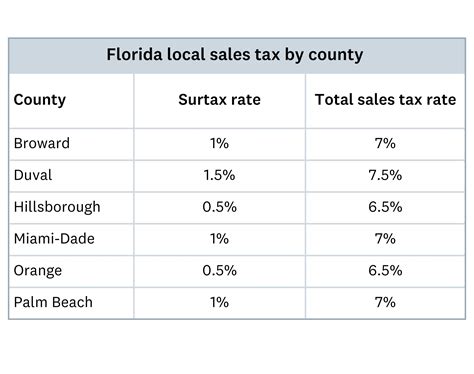

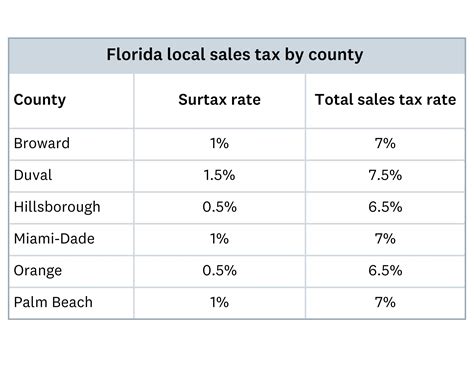

Florida’s sales and use tax is a fundamental component of the state’s revenue generation strategy. It is a tax imposed on the sale of goods and services within the state, with the primary responsibility of collection falling on the seller. The state sales tax rate is set at 6%, which serves as a base for the overall tax burden. However, it is important to note that Florida’s sales tax system is not uniform across the state.

Miami’s Sales Tax Rate: A Local Perspective

When discussing sales tax in Miami, it is crucial to consider the additional tax rates that may apply. Miami, being a bustling metropolis, often has specific tax considerations due to its urban nature and diverse commercial landscape. As of the latest available information, Miami’s sales tax rate stands at 7%, which includes the state sales tax and a 1% local option tax approved by the city.

This local option tax is a common feature in many cities and counties across Florida, allowing them to generate additional revenue for specific purposes. In Miami's case, the proceeds from this tax are often directed towards infrastructure development, public safety initiatives, and other essential municipal services.

The Impact of Miami’s Sales Tax Rate

The additional 1% local option tax in Miami can have a notable impact on the cost of goods and services for both consumers and businesses. For consumers, it means that the total sales tax they pay on eligible purchases in Miami is 7%, which is higher than the state average. This can influence purchasing decisions and budgeting, especially for individuals and families living on a tight budget.

From a business perspective, the higher sales tax rate can affect pricing strategies and overall profitability. Businesses may need to carefully consider their pricing models to remain competitive while still covering the increased tax burden. Additionally, businesses that operate in multiple locations, both within and outside Miami, must be vigilant in ensuring compliance with the varying sales tax rates to avoid penalties and legal complications.

Sales Tax Exemptions: Navigating the Exceptions

While sales tax is a widespread tax in Florida, it is not applicable to all goods and services. Florida, like many other states, has a list of exemptions that can significantly impact the tax burden for certain industries and individuals. These exemptions can be a critical consideration for businesses and consumers alike, offering potential savings and strategic advantages.

Exemptions in Practice

One of the most notable exemptions in Florida’s sales tax system is the exemption for groceries. This exemption is a welcome relief for households, as it reduces the tax burden on essential food items. Additionally, certain services, such as medical and educational services, are often exempt from sales tax, providing a financial benefit to those sectors.

Furthermore, Florida offers various exemptions for specific industries, including manufacturing, agriculture, and technology. These exemptions can be complex and may require specialized knowledge to navigate. For instance, the state provides tax incentives and exemptions for businesses engaged in research and development, which can be a significant advantage for companies in the innovation sector.

| Exemption Category | Description |

|---|---|

| Groceries | Food items purchased for home consumption are exempt from sales tax. |

| Medical Services | Healthcare services and certain medical equipment are not subject to sales tax. |

| Educational Supplies | Textbooks and educational materials are exempt, promoting accessibility in education. |

| Manufacturing | Certain machinery and equipment used in manufacturing processes are exempt. |

| Agricultural Sales | Sales of agricultural products, including livestock and crops, are often exempt. |

Compliance and Reporting: A Responsibility Shared

Ensuring compliance with Florida’s sales tax laws is a shared responsibility between businesses and consumers. For businesses, this involves accurately collecting and remitting sales tax on taxable transactions. The Florida Department of Revenue provides guidelines and resources to assist businesses in understanding their obligations and navigating the complexities of sales tax reporting.

Registration and Remittance

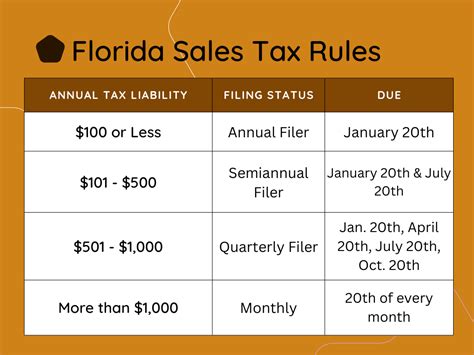

Businesses operating in Florida must register with the Department of Revenue and obtain a sales tax permit. This permit allows them to collect and remit sales tax on eligible transactions. The frequency of remittance depends on the business’s sales volume and can range from monthly to quarterly filings.

It is crucial for businesses to maintain accurate records of taxable sales and to ensure that the appropriate tax rates are applied. Failure to comply with sales tax regulations can result in penalties, interest charges, and legal consequences. Therefore, staying informed and maintaining a robust sales tax compliance strategy is essential for businesses of all sizes.

Consumer Responsibility

Consumers, on the other hand, play a vital role in ensuring the accuracy of sales tax collection. When making purchases, it is essential to understand that sales tax is typically added to the purchase price at the point of sale. Consumers should review their receipts to verify that the correct tax rate has been applied.

In cases where sales tax is not collected at the time of purchase, such as online or out-of-state purchases, consumers may be responsible for self-reporting and remitting the tax. This process, known as use tax, ensures that all eligible purchases are taxed fairly, regardless of where the transaction occurs.

Future Implications: Navigating Tax Reforms

The sales tax landscape in Florida, and specifically in Miami, is subject to potential reforms and policy changes. As economic conditions evolve and new initiatives are proposed, the sales tax rate and structure may undergo adjustments. Staying informed about these potential changes is crucial for both businesses and consumers to adapt their financial strategies accordingly.

Proposed Reforms and Their Impact

One of the key considerations in Florida’s tax reform discussions is the potential expansion of sales tax to include services. Currently, many services are not subject to sales tax, which can create a disparity in the tax burden between goods and services. If such a reform were to be implemented, it could significantly impact various industries, including technology, entertainment, and professional services.

Additionally, there have been discussions about simplifying the sales tax structure by reducing or eliminating local option taxes. While this may streamline the tax system, it could also impact the revenue streams of cities like Miami, which rely on these local taxes for essential services. Balancing the need for a simplified tax system with the financial sustainability of local governments is a delicate task that policymakers must navigate.

Conclusion: A Comprehensive Approach to Sales Tax in Miami

Understanding and navigating Florida’s sales tax rate, especially in Miami, is a crucial aspect of financial planning and business operations. The city’s unique tax landscape, with its additional local option tax, requires a nuanced approach to ensure compliance and optimize financial strategies. By staying informed about the latest regulations, exemptions, and potential reforms, individuals and businesses can make informed decisions and adapt to the ever-evolving tax landscape.

As Miami continues to thrive as a hub of commerce and tourism, a comprehensive understanding of its sales tax rate and its implications becomes increasingly essential. This article aims to provide a solid foundation for that understanding, offering insights into the intricacies of Florida's sales tax system and its impact on the vibrant city of Miami.

How often do businesses need to remit sales tax in Florida?

+The frequency of sales tax remittance depends on the business’s sales volume. Typically, businesses with higher sales volumes are required to remit sales tax more frequently, often on a monthly basis. Smaller businesses may remit quarterly or semi-annually. The Florida Department of Revenue provides guidelines and tools to help businesses determine their remittance schedule.

Are there any online tools available to help calculate sales tax in Miami?

+Yes, there are several online calculators and tools available to help calculate sales tax in Miami. These tools consider the base state sales tax rate and any applicable local option taxes. By inputting the purchase amount, these calculators provide an estimate of the total sales tax due. However, it is always recommended to verify the accuracy of these tools and consult official sources for precise calculations.

What happens if a business fails to collect and remit sales tax in Florida?

+Failure to collect and remit sales tax in Florida can result in significant penalties and interest charges. The Florida Department of Revenue has the authority to audit businesses and assess penalties for non-compliance. Additionally, businesses may face legal consequences, including the revocation of their sales tax permit. Therefore, it is crucial for businesses to maintain accurate records and ensure timely remittance to avoid these repercussions.