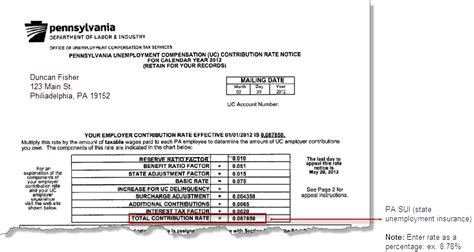

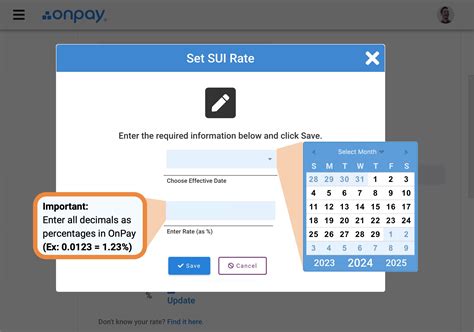

Pa Sui Tax

Welcome to the world of Pa Sui Tax, a unique and fascinating concept that has gained traction in certain industries and regions. Pa Sui Tax, or as it is sometimes referred to, "the invisible tax," is a term used to describe a hidden or additional cost that consumers may incur when purchasing certain products or services. This tax is not an official government levy but rather a strategic pricing tactic employed by businesses to maximize profits. In this comprehensive guide, we will delve into the intricacies of Pa Sui Tax, exploring its origins, its impact on consumers, and its potential consequences for the market.

Unveiling the Mystery of Pa Sui Tax

Pa Sui Tax is a relatively new phenomenon that has emerged in response to the evolving dynamics of the global marketplace. While it may not be as well-known as traditional taxes, its impact on consumers and businesses is significant. Let’s explore the key aspects of this intriguing concept.

The Origins of Pa Sui Tax

The term “Pa Sui” is derived from the Chinese phrase “八水,” which translates to “eight waters.” In the context of tax, it represents the hidden costs that can be likened to eight invisible streams of water, each carrying away a portion of the consumer’s money. The concept gained popularity in the early 2000s, particularly in the electronics industry, where manufacturers and retailers began employing this pricing strategy to boost their profit margins.

The origins of Pa Sui Tax can be traced back to the competitive nature of the global market. As businesses strive to offer competitive prices, they often resort to creative pricing tactics. Pa Sui Tax is one such tactic, where businesses incorporate additional costs into the price of their products or services without explicitly stating them. This strategy allows companies to maintain attractive price tags while still maximizing their profits.

How Does Pa Sui Tax Work?

Pa Sui Tax operates through a variety of methods, each designed to conceal the true cost of a product or service. Here are some common tactics employed by businesses:

- Bundled Services: Some companies offer "bundled" packages, where multiple services or products are combined into one price. While this may seem convenient, it often hides the true cost of each individual item, making it difficult for consumers to compare prices accurately.

- Hidden Fees: Many businesses include hidden fees, such as processing charges, administrative costs, or convenience fees, which are only revealed during the payment process. These fees can significantly increase the final cost, catching consumers off guard.

- Variable Pricing: Some industries, especially in the travel and hospitality sectors, employ variable pricing strategies. This means that the price of a product or service can fluctuate based on various factors, such as demand, seasonality, or even the consumer's location. This makes it challenging for consumers to predict the actual cost.

- Subscription Models: With the rise of subscription-based services, Pa Sui Tax has found a new avenue. Companies often offer discounted rates for long-term subscriptions, but these rates may not reflect the true cost of the service. Consumers may find themselves locked into contracts with higher-than-expected costs.

Real-World Examples of Pa Sui Tax

To illustrate the impact of Pa Sui Tax, let’s examine a few real-world scenarios:

| Industry | Pa Sui Tax Example |

|---|---|

| Electronics | A popular smartphone manufacturer releases a new model with an attractive price tag. However, upon closer inspection, consumers discover that certain features, such as fast charging or high-quality speakers, are only available as add-ons, effectively increasing the overall cost. |

| Travel | A budget airline advertises incredibly low airfares, but when booking, passengers are hit with various additional charges, including baggage fees, seat selection fees, and even a "fuel surcharge." These hidden costs can double the initial price. |

| Streaming Services | A streaming platform offers a monthly subscription with a seemingly reasonable price. However, to access premium content or remove ads, users must upgrade to a higher-priced plan, making the initial offer less appealing. |

The Impact on Consumers and the Market

Pa Sui Tax has both short-term and long-term implications for consumers and the market as a whole. Let’s explore these impacts in detail.

Short-Term Effects

In the short term, Pa Sui Tax can lead to a sense of confusion and frustration among consumers. When faced with hidden costs, consumers may feel deceived or taken advantage of, especially if they have already committed to a purchase. This can result in a negative perception of the brand or service provider.

Additionally, Pa Sui Tax can make it challenging for consumers to make informed purchasing decisions. Without transparent pricing, it becomes difficult to compare prices across different brands or services, leading to potential overspending or suboptimal choices.

Long-Term Consequences

Over time, the prevalence of Pa Sui Tax can have far-reaching consequences for the market. Here are some key implications:

- Consumer Trust: Repeated experiences with Pa Sui Tax can erode consumer trust in brands and businesses. As consumers become more aware of these tactics, they may be less likely to engage with companies that employ such strategies, opting for more transparent alternatives.

- Market Competition: The presence of Pa Sui Tax can create an uneven playing field for businesses. Companies that rely heavily on these tactics may gain an unfair advantage over those that offer transparent pricing. This can lead to a decline in market competition and innovation.

- Regulatory Scrutiny: As Pa Sui Tax becomes more widespread, it may draw the attention of regulatory bodies. Governments may introduce measures to ensure fair pricing practices, potentially imposing fines or restrictions on businesses that engage in deceptive pricing tactics.

- Consumer Education: With increased awareness of Pa Sui Tax, consumers may become more vigilant and educated about pricing strategies. This can lead to a shift in consumer behavior, with a preference for transparent and ethical pricing models.

Strategies for Consumers

To navigate the world of Pa Sui Tax, consumers can employ various strategies to protect their interests and make informed choices. Here are some tips:

- Research: Before making a purchase, take the time to research and compare prices across different brands or services. Look for reviews and experiences shared by other consumers to get a clearer picture of the actual costs involved.

- Read the Fine Print: Always scrutinize the fine print and terms and conditions associated with a product or service. Look for any mention of hidden fees or additional charges that may not be immediately apparent.

- Negotiate: In certain situations, especially when dealing with businesses that offer customizable services, negotiation can be an effective strategy. By discussing the pricing and potential discounts, consumers may be able to reduce the impact of Pa Sui Tax.

- Support Transparent Businesses: Vote with your wallet by supporting businesses that prioritize transparent pricing. By choosing these brands, consumers can encourage fair pricing practices and promote market competition.

The Future of Pa Sui Tax

As consumer awareness and regulatory attention grow, the future of Pa Sui Tax is uncertain. Here are some potential scenarios for its evolution:

- Decline in Usage: With increased scrutiny and consumer education, businesses may be compelled to abandon Pa Sui Tax tactics. Transparent pricing may become a competitive advantage, leading to a decline in hidden costs.

- Regulatory Interventions: Governments may introduce stricter regulations to protect consumers from deceptive pricing practices. This could include mandatory disclosure of all fees and charges, ensuring that consumers are fully informed before making a purchase.

- Innovation in Pricing Models: Businesses may explore alternative pricing models that prioritize transparency and fairness. This could involve subscription-based models with no hidden fees or dynamic pricing strategies that offer discounts to loyal customers.

- Consumer Empowerment: As consumers become more aware of their rights and options, they may actively seek out transparent pricing. This shift in consumer behavior could drive businesses to adapt their pricing strategies to meet consumer expectations.

Conclusion

Pa Sui Tax is a complex and intriguing concept that has impacted consumers and businesses alike. While it may provide short-term benefits for some companies, its long-term consequences could be detrimental to the market as a whole. As consumers become more educated and empowered, the future of Pa Sui Tax remains uncertain. However, with increased awareness and regulatory interventions, we may witness a shift towards more transparent and ethical pricing practices.

What industries are most affected by Pa Sui Tax?

+Pa Sui Tax is prevalent in industries where competition is fierce and pricing is a key differentiator. This includes sectors such as electronics, travel, hospitality, and subscription-based services. These industries often employ creative pricing strategies to maintain their market position.

How can consumers protect themselves from Pa Sui Tax?

+Consumers can protect themselves by being vigilant and conducting thorough research before making a purchase. Reading reviews, comparing prices, and understanding the fine print are essential steps to avoid unexpected costs. Additionally, supporting transparent businesses can encourage fair pricing practices.

Are there any legal implications for businesses that employ Pa Sui Tax tactics?

+The legality of Pa Sui Tax tactics varies across jurisdictions. In some regions, certain pricing practices may be considered deceptive or unfair, leading to potential legal consequences. However, the enforcement of such regulations can be challenging, and businesses may find loopholes to exploit.

What is the role of regulatory bodies in addressing Pa Sui Tax?

+Regulatory bodies play a crucial role in ensuring fair pricing practices and protecting consumer rights. They can introduce regulations, guidelines, and consumer protection laws to combat deceptive pricing tactics. However, the effectiveness of these measures depends on their enforcement and the willingness of businesses to comply.