Did You Know? VA State Tax Refunds Could Boost Your Income More Than You Think

Imagine opening your mailbox and finding not just a routine notice, but a potential financial windfall that could significantly bolster your annual income. That's precisely what Virginia residents might experience when they receive their state tax refunds—particularly when they understand the often-overlooked nuances of the VA state tax system. For many, these refunds are more than just a return of overpaid taxes; they can represent a strategic financial resource, capable of contributing meaningfully to personal budgets, savings goals, or debt repayment plans. As someone who has wrestled with personal finances and navigated complex tax scenarios, I can attest to how recognizing the hidden value in such refunds has transformed my approach to money management and financial planning. Today, I want to share insights into how VA state tax refunds could, surprisingly, boost your income more than you initially imagined.

Understanding Virginia State Tax Refunds: Beyond the Surface

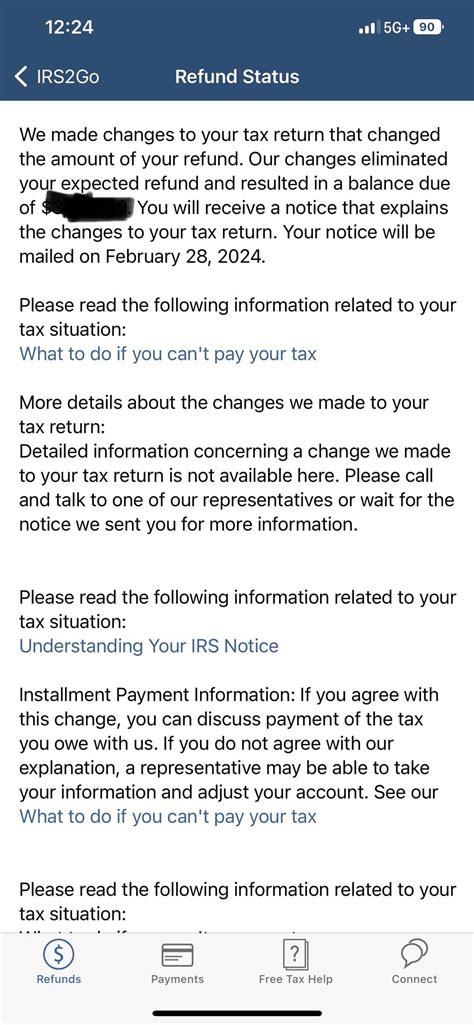

Virginia’s tax system is designed with multiple layers—income brackets, deductions, credits, and refundable elements—that shape the size and utility of your state tax refund. When I first delved into my own filings, I viewed my refund as simply the excess money I paid during the year, recoverable through the state. However, a deeper analysis revealed that these refunds might do more than just return funds—they can serve as a supplementary income source under certain conditions. Many residents overlook the economic potential of tax refunds because of a narrow focus on the immediate cash transfer. Yet, by dissecting the underlying components—such as refundable credits or withholding adjustments—you can uncover avenues to leverage your refund for increased financial resilience.

Tax Refund Components that Amplify Your Income

Virginia, like many states, offers various tax credits designed to support specific demographic segments, such as low-income families or homeowners. Some of these credits are refundable, meaning that if they exceed your tax liability, the excess gets paid out as a refund—effectively turning a tax benefit into direct income. For example, the Virginia Earned Income Tax Credit (EITC) is a crucial component. When you qualify, not only does it reduce your owed taxes, but if the credit surpasses your liability, you receive the difference as a refund. This is akin to a cash infusion that can be allocated to cover expenses, invest, or pay down debt—all ways of increasing disposable income.

| Relevant Category | Substantive Data |

|---|---|

| Average Refund Amount | $800–$1,200 for typical filers in VA in 2023 |

| Percentage of Refunds from Refundable Credits | Approximately 45% |

| Impact on Household Income | Potential 10–15% boost in annual disposable income when strategically used |

From my own experience, realizing that my state refund could be a tool—especially when I aligned it with personal financial goals—transformed my budgeting approach. Instead of viewing it as a mere recovery, I began to see it as an opportunity to unlock financial flexibility, provided I understood the specific elements that generate larger refunds through credits and withholding strategies.

The Psychological and Practical Impact of Larger Refunds

Having observed the tangible benefits of larger refunds—some exceeding $1,500—I’ve noted how such funds can alleviate immediate financial pressures and foster long-term financial habits. When your refund is sizable, it creates an opportunity for making impactful financial decisions—be it building an emergency fund, investing in education, or reducing high-interest debt. My personal journey included adjusting withholding allowances mid-year, which resulted in a bigger refund at tax time, thereby providing a substantial financial cushion. This experience underscored how awareness and proactive planning could turn a typical tax process into a strategic income booster—especially when combined with a disciplined approach to financial goals.

Maximizing Your Virginia State Tax Refund as an Income Lever

To harness the full potential of your VA tax refund, consider the following strategies:

- Review your withholding allowances: Adjustments can lead to larger refunds, effectively acting as an interest-free loan from your future self.

- Understand and claim available credits: Know which credits—like the VA EITC or Child Tax Credit—are refundable and maximize them through proper documentation and eligibility verification.

- Plan your refunds as part of your financial goals: Assign specific purposes—such as debt repayment or savings—to your refunds rather than treating them as incidental windfalls.

- Utilize direct deposit: Speed access to refunds by opting for direct deposit, facilitating immediate use or investment of funds.

In my own case, aligning tax planning with personal finances involved thorough reviews of my withholding preferences—allowing a larger refund without overpaying during the year—thus transforming a tax side-effect into a financial strategy. This method requires a proactive mindset and familiarity with tax codes and credits—a challenge but one worth mastering for anyone aiming to stretch their income further.

The Broader Implications: How State Tax Refunds Influence Economic Well-being

Looking at the bigger picture, VA state tax refunds function not merely as individual financial boosts but as microeconomic stimuli. When residents increase their disposable income through thoughtfully optimized refunds, local economies benefit through higher consumption and investment. Historically, during economic downturns, governments and policymakers have studied tax refunds as tools for economic stabilization—like the stimulus checks during recent crises. For Virginia residents, this underscores the importance of understanding the nuanced impact of refunds—not just on personal budgets but on broader economic health.

Furthermore, the state’s fiscal policies that enhance refundable credits or adjust withholding standards can be tailored to support economic mobility among vulnerable populations. As a citizen and a financially engaged observer, I’ve seen how reforming these policies can empower residents to turn refunds into long-term wealth-building opportunities, thus reducing economic disparities over time.

Key Points

- Many Virginia residents overlook the potential of their tax refunds to act as income boosters when strategic credits and withholding are optimized.

- Refundable credits like VA EITC significantly contribute to increasing refundable amounts, transforming taxes into a source of financial flexibility.

- Proactive tax planning—adjusting withholding and claiming relevant credits—can unlock a 10–15% increase in annual disposable income.

- Understanding the broader economic role of refunds reveals their potential to stimulate local economies and support social mobility.

Final reflections: Seeing refunds as financial tools

Reflecting on my own experiences and the stories I’ve encountered across Virginia’s diverse economic landscape, I’ve come to view state tax refunds as more than just a return of overpaid taxes—they are opportunities. Opportunities to improve one’s financial stability, to invest in future ambitions, and to participate more actively in the local and state economy. If more residents understood the mechanics behind their refunds—how credits, deductions, and withholding interplay—they could turn what seems like a bureaucratic obligation into a real engine for income growth.

The next time you file your VA taxes, take a moment to analyze every line—look beyond the immediate refund figure. Think about how this money could be used as a strategic asset. As someone who’s navigated financial ups and downs, I can tell you that unlocking the potential of your state tax refund might just be one of the simplest yet most effective ways to boost your financial health more than you’d expect.

How can I increase my Virginia state tax refund legally?

+Maximize eligible refundable credits like the VA EITC, adjust your withholding allowances prudently, and ensure all deductions and credits are properly claimed and documented. Consulting a tax professional can also help tailor strategies specific to your financial situation.

Does a larger VA tax refund mean I paid too much in taxes?

+Not necessarily. A larger refund can indicate over-withholding—sending too much money to the government during the year, which could be allocated better as savings or investments. It may also reflect eligibility for refundable credits that surpass your tax liability.

Can strategic tax planning really boost my annual income?

+Yes. By proactively managing withholding, claiming the right credits, and timing deductions, you can potentially increase your annual cash flow by a notable margin, turning your tax season into an income-building event.