Madison County Tax Collector

In the realm of local governance and financial administration, the role of the Madison County Tax Collector is pivotal, offering insights into the intricate web of municipal finances and taxpayer obligations. This article delves deep into the functions, responsibilities, and impact of the Madison County Tax Collector's Office, shedding light on its critical role in the financial landscape of Madison County.

The Role and Functions of the Madison County Tax Collector

The Madison County Tax Collector serves as a key administrative officer, entrusted with the responsibility of collecting and managing various taxes and fees within the county. This comprehensive role extends to the collection of property taxes, vehicle registration fees, business taxes, and other revenue streams vital to the county’s financial stability and growth.

At the core of their function, the tax collector's office ensures that Madison County residents and businesses comply with their tax obligations. This involves a meticulous process of assessing, billing, and collecting taxes, often requiring a delicate balance between public service and financial accountability.

Property Tax Assessment and Collection

One of the primary responsibilities of the Madison County Tax Collector is the assessment and collection of property taxes. This involves evaluating the value of properties within the county and determining the corresponding tax liability for each property owner. The tax collector’s office then issues tax bills, often annually, and oversees the collection process, ensuring that taxes are paid on time and in full.

| Property Tax Revenue | 2023 Est. Collection |

|---|---|

| Residential Properties | $42.5 Million |

| Commercial Properties | $28.7 Million |

| Agricultural Lands | $6.2 Million |

Vehicle Registration and Fees

Another critical function of the tax collector’s office is the management of vehicle registration and related fees. This includes processing new vehicle registrations, renewals, and transfers, as well as collecting fees for title transfers, license plate fees, and various other motor vehicle-related taxes.

The office also plays a vital role in ensuring road safety and compliance with vehicle regulations, often working in conjunction with the Madison County Sheriff's Department and the Department of Motor Vehicles.

| Vehicle Registration Fees | Annual Revenue |

|---|---|

| New Registrations | $1.2 Million |

| Renewals | $2.1 Million |

| Title Transfers | $0.8 Million |

Business Tax Administration

The Madison County Tax Collector is also responsible for administering business taxes, which include occupational license taxes, sales taxes, and other business-related levies. This involves working closely with local businesses to ensure compliance with tax regulations and to provide efficient tax services.

The tax collector's office offers a range of services to support businesses, including online tax payment options, tax consultation, and assistance with tax filing.

Impact and Community Engagement

Beyond the administrative duties, the Madison County Tax Collector’s office plays a significant role in community engagement and economic development. By effectively collecting taxes and managing financial resources, the office contributes to the county’s overall financial health and stability.

The tax collector's office often serves as a point of contact for taxpayers, providing valuable information and assistance on tax matters. This includes offering guidance on tax payment plans, tax exemptions, and other tax-related queries.

Community Initiatives and Outreach

The Madison County Tax Collector actively participates in community initiatives and outreach programs. This involves educating residents about tax responsibilities, hosting community forums, and providing support during tax season.

Additionally, the office often collaborates with local schools and community organizations to promote financial literacy and tax awareness among the county's residents.

Economic Development and Investment

The efficient collection and management of taxes by the Madison County Tax Collector contribute to the county’s ability to invest in critical infrastructure, education, and social services. This, in turn, fosters economic growth and improves the overall quality of life for residents.

By ensuring a steady flow of revenue, the tax collector's office enables Madison County to attract businesses, create jobs, and promote sustainable economic development.

Technological Innovations and Efficiency

The Madison County Tax Collector’s office embraces technological advancements to enhance its efficiency and service delivery. This includes implementing online tax payment systems, digital record-keeping, and utilizing data analytics for better decision-making.

By leveraging technology, the office streamlines its operations, reduces administrative costs, and provides a more convenient and efficient service to taxpayers.

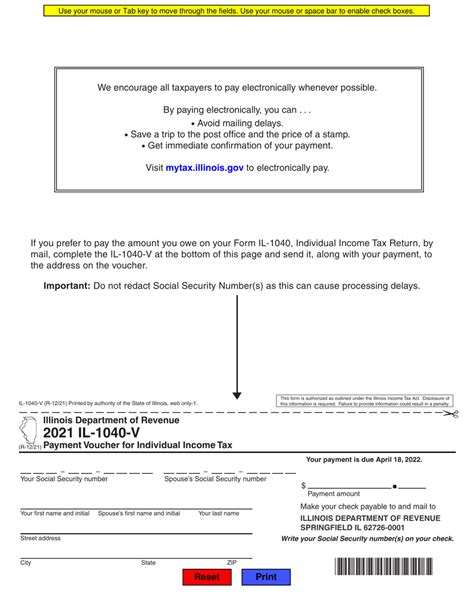

Online Services and Digital Payment Options

The tax collector’s office has developed a user-friendly website and mobile app, offering a range of online services. Taxpayers can now access their tax records, pay taxes online, and receive real-time updates on their tax status.

The digital payment options not only provide convenience but also ensure security and accuracy in tax transactions.

Data Analytics for Informed Decision-Making

The Madison County Tax Collector’s office employs data analytics to identify trends, patterns, and areas of improvement in tax collection and administration. This data-driven approach allows the office to make informed decisions, optimize its processes, and enhance taxpayer services.

By leveraging data analytics, the office can forecast revenue, identify potential tax evasion, and streamline its operational strategies.

Conclusion

The Madison County Tax Collector’s office is an essential component of the county’s financial ecosystem, playing a pivotal role in revenue generation, financial management, and community engagement. Through its efficient administration and innovative use of technology, the office ensures that Madison County remains financially stable and able to invest in its future.

As the county continues to grow and evolve, the tax collector's office will remain a critical link between taxpayers and the county government, ensuring a fair and transparent tax system.

FAQs

What are the office hours of the Madison County Tax Collector’s office?

+

The Madison County Tax Collector’s office is open from 8:00 a.m. to 5:00 p.m., Monday through Friday, excluding public holidays.

How can I pay my property taxes in Madison County?

+

Property taxes can be paid online through the Madison County Tax Collector’s website, by mail, or in person at the tax collector’s office. The office also offers a convenient drop box for after-hours payments.

Are there any tax exemptions available for seniors or veterans in Madison County?

+

Yes, Madison County offers various tax exemptions for seniors, veterans, and other eligible groups. These exemptions can reduce the taxable value of your property, leading to lower property taxes. Contact the tax collector’s office or visit their website for more information and eligibility criteria.

How often are property taxes assessed in Madison County?

+

Property taxes in Madison County are typically assessed annually. The assessment is based on the property’s value as of January 1st of each year. Tax bills are usually mailed out in November, and payments are due by a specified deadline, typically in January or February of the following year.

Can I set up a payment plan for my tax obligations?

+

Yes, the Madison County Tax Collector’s office offers payment plans for taxpayers who may struggle to pay their taxes in full by the due date. These plans allow taxpayers to pay their obligations in installments over a period of time. Contact the office to discuss your options and eligibility.