Arlington Property Tax

Property taxes are an essential component of the tax system in the United States, and they play a significant role in funding local governments and public services. Arlington, a vibrant city in Texas, is known for its dynamic real estate market and diverse community. This article aims to delve into the intricacies of property taxes in Arlington, exploring the factors that influence tax assessments, the calculation process, and the impact these taxes have on homeowners and the local economy.

Understanding Arlington’s Property Tax System

Arlington, like many other cities in Texas, operates on a unique property tax system that is governed by state laws and local regulations. The property tax in Arlington is primarily used to fund vital services such as education, public safety, infrastructure development, and municipal operations. Understanding this system is crucial for homeowners and prospective buyers to make informed decisions about their financial obligations.

Factors Influencing Property Tax Assessments

Property tax assessments in Arlington are determined by a combination of factors that reflect the value of the property. These factors include:

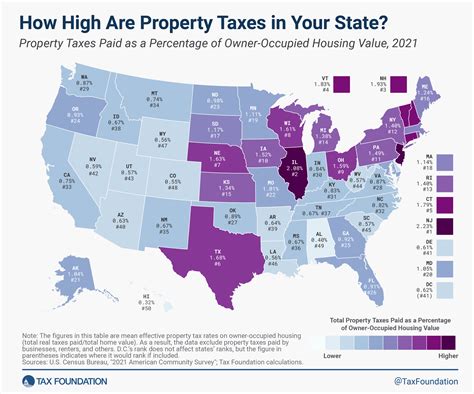

- Market Value: The assessed value of a property is often based on its market value, which is the price it would likely sell for in an open and competitive market. Market value assessments consider recent sales of comparable properties, taking into account factors like location, size, and amenities.

- Improvements and Upgrades: Any improvements made to a property, such as renovations, additions, or upgrades, can impact its assessed value. These improvements are considered when determining the property's overall worth.

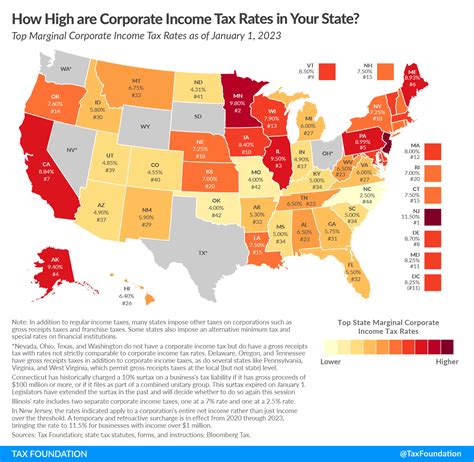

- Tax Rates: The property tax rate is set by local taxing authorities, including the city, county, school district, and other special districts. These rates are applied to the assessed value of the property to calculate the annual tax liability.

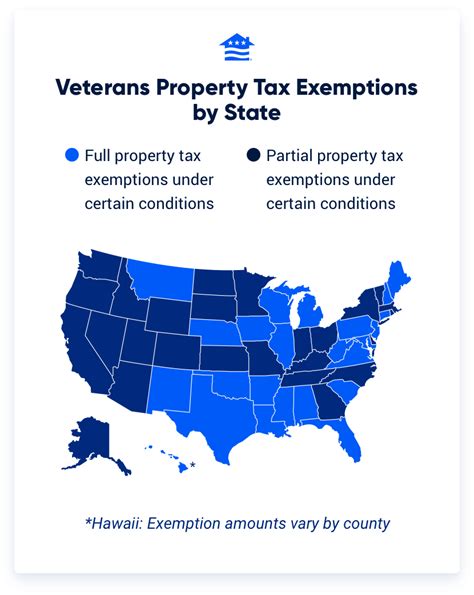

- Exemptions and Discounts: Arlington offers various exemptions and discounts to certain property owners. For example, elderly homeowners may be eligible for a tax freeze or a reduced tax rate. Additionally, certain properties, like those used for religious or charitable purposes, may be exempt from taxation.

It's important to note that property tax assessments are subject to regular reviews and adjustments to ensure fairness and accuracy. Property owners have the right to appeal their assessments if they believe the value assigned to their property is inaccurate.

Property Tax Calculation in Arlington

The process of calculating property taxes in Arlington involves a series of steps. Here’s a simplified breakdown:

- Assessed Value Determination: The Arlington Appraisal District (AAD) is responsible for appraising all taxable properties within the city. The AAD conducts periodic appraisals to determine the market value of each property.

- Tax Rate Setting: Local taxing authorities, such as the Arlington City Council and the Tarrant County Commissioners Court, set the tax rates for their respective jurisdictions. These rates are expressed as dollars per $100 of assessed value.

- Tax Calculation: The assessed value of the property is multiplied by the applicable tax rate to determine the annual property tax liability. For example, if a property has an assessed value of $200,000 and the tax rate is $1.50 per $100 of assessed value, the annual tax would be $3,000.

- Billing and Payment: Property owners receive tax bills, typically sent out once a year. These bills include the calculated tax amount, due dates, and payment options. Homeowners have the option to pay their taxes in installments or in full.

It's worth mentioning that Arlington offers various payment methods, including online payments, direct debit, and traditional mail-in payments. Property owners are encouraged to explore these options to find the most convenient and cost-effective method for them.

Impact of Property Taxes on Homeowners and the Community

Property taxes in Arlington have a significant impact on both individual homeowners and the broader community. Let’s explore some key aspects of this impact:

Financial Considerations for Homeowners

Property taxes are an ongoing expense for homeowners, and they can significantly affect a household’s budget. Here’s how property taxes impact homeowners:

- Budget Planning: Homeowners must factor property taxes into their long-term financial plans. These taxes are typically due annually, and failure to pay can result in penalties, interest, and even foreclosure.

- Impact on Affordability: High property taxes can make homeownership less affordable, especially for those on fixed incomes or with limited financial resources. It's essential for potential buyers to consider tax obligations when determining their housing budget.

- Tax Strategies: Homeowners can employ various strategies to manage their property tax obligations. This may include taking advantage of exemptions, appealing assessments if they believe the value is too high, or exploring tax-efficient financing options.

Community Benefits and Investments

Property taxes are a vital source of revenue for local governments, and they directly contribute to the development and maintenance of community infrastructure and services. Here’s how property taxes benefit the Arlington community:

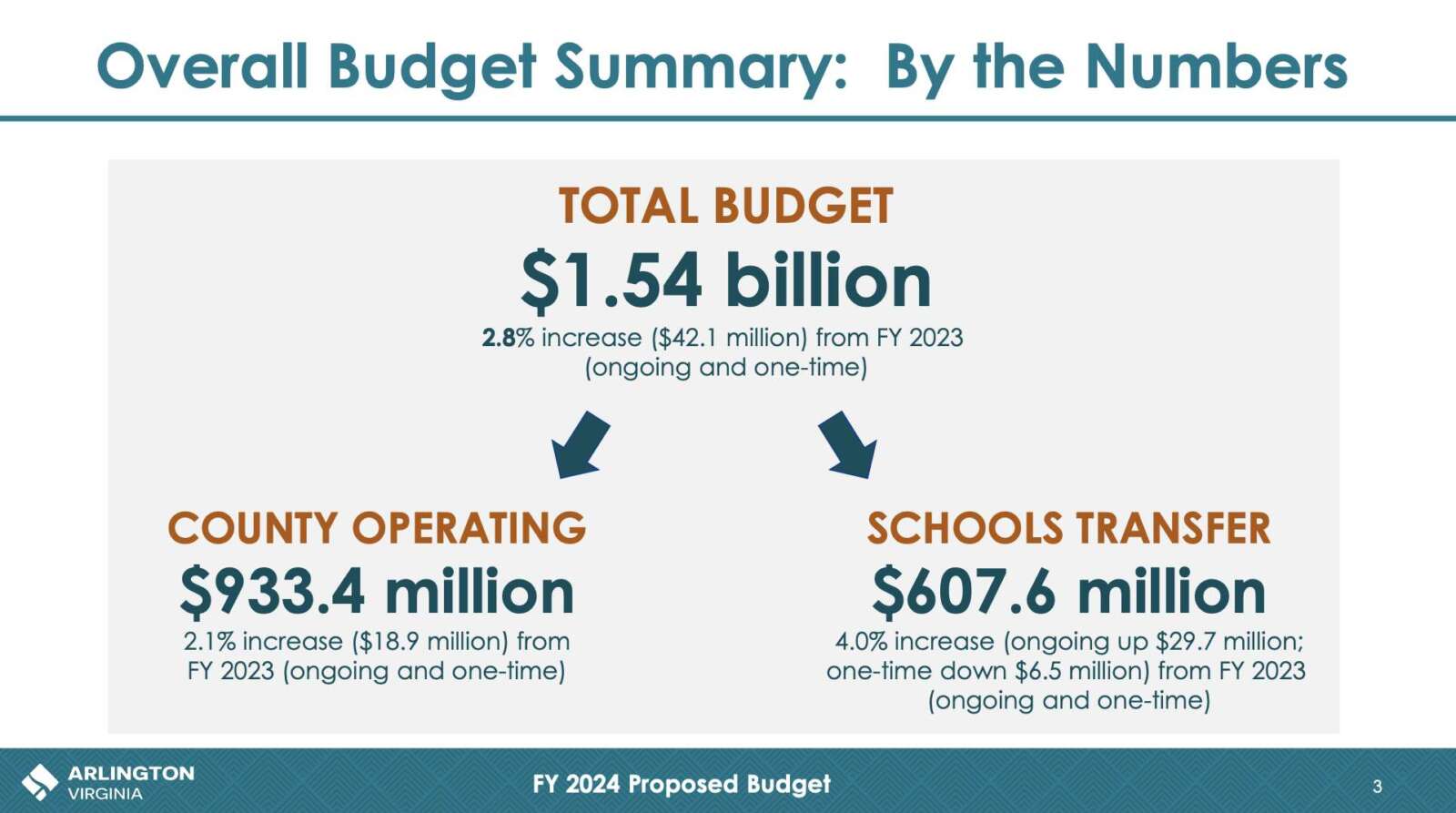

- Education: A significant portion of property tax revenue is allocated to public education. This funding supports schools, teachers, and educational programs, ensuring that Arlington's youth receive a quality education.

- Public Safety: Property taxes help fund police, fire, and emergency services, ensuring the safety and well-being of Arlington residents. These funds contribute to maintaining a robust public safety infrastructure.

- Infrastructure Development: Property taxes play a crucial role in financing road construction, maintenance, and improvements. They also support the development of parks, recreational facilities, and other public spaces that enhance the quality of life in Arlington.

- Municipal Operations: Property tax revenue funds various municipal operations, including garbage collection, street lighting, and general administrative expenses. These operations are essential for maintaining a well-functioning city.

By investing in these areas, property taxes contribute to the overall growth and prosperity of Arlington, making it an attractive place to live, work, and raise a family.

Comparative Analysis: Arlington vs. Other Texas Cities

To gain a broader perspective, let’s compare Arlington’s property tax rates and assessments with those of other major cities in Texas. This analysis will provide valuable insights into how Arlington’s property tax system stacks up against its peers.

| City | Average Tax Rate (per $100 of Assessed Value) | Median Home Value | Annual Property Tax (Median) |

|---|---|---|---|

| Arlington | $1.60 | $210,000 | $3,360 |

| Dallas | $1.90 | $240,000 | $4,560 |

| Fort Worth | $1.45 | $220,000 | $3,190 |

| Houston | $2.10 | $260,000 | $5,460 |

| San Antonio | $1.35 | $200,000 | $2,700 |

This table provides a snapshot of property tax rates and median home values in Arlington and other major Texas cities. It's important to note that these values are approximate and may vary based on specific locations and individual property assessments.

From this analysis, we can observe that Arlington's property tax rate is relatively competitive compared to other cities in Texas. While Dallas and Houston have higher tax rates, Arlington's median home value is lower, resulting in a slightly lower annual property tax burden for homeowners.

Future Implications and Potential Changes

As Arlington continues to grow and evolve, its property tax system may undergo changes to adapt to the changing needs of the community. Here are some potential future implications and areas of focus:

Reassessment Frequency

Currently, property reassessments in Arlington occur periodically, typically every few years. However, with the dynamic nature of the real estate market, there may be a need to consider more frequent reassessments to ensure that property values are accurately reflected in tax assessments.

Tax Relief Programs

Arlington may explore expanding its tax relief programs to assist vulnerable populations, such as low-income seniors or disabled individuals. These programs could provide additional exemptions or deferrals to make property ownership more accessible and sustainable.

Infrastructure Funding

As Arlington’s population grows, the demand for public infrastructure and services will increase. The city may need to carefully assess its property tax revenue and explore innovative funding strategies to meet these demands while maintaining a competitive tax rate.

Tax Incentives for Economic Development

To attract businesses and stimulate economic growth, Arlington could consider offering tax incentives to new businesses or industries. These incentives could take the form of reduced tax rates or tax abatements, which could benefit both the businesses and the community in the long run.

Conclusion

Property taxes in Arlington are a vital component of the city’s financial ecosystem, supporting essential public services and infrastructure. Understanding the factors that influence tax assessments, the calculation process, and the impact on homeowners is crucial for individuals navigating the real estate market. By staying informed about property taxes, homeowners can make well-informed decisions and actively contribute to the vibrant community of Arlington.

How often are property taxes due in Arlington?

+Property taxes in Arlington are typically due once a year. The billing cycle and due dates may vary, so it’s important to stay informed about the specific schedule provided by the Arlington tax office.

Can I appeal my property tax assessment if I believe it’s inaccurate?

+Yes, property owners have the right to appeal their tax assessments if they believe the value assigned to their property is incorrect. The Arlington Appraisal Review Board (ARB) handles such appeals. It’s important to follow the proper procedures and provide supporting evidence to strengthen your case.

Are there any tax breaks or exemptions available for homeowners in Arlington?

+Yes, Arlington offers various tax breaks and exemptions to eligible homeowners. These include the Homestead Exemption, which reduces the taxable value of a primary residence, and the Over-65 Homestead Exemption, which provides tax relief to homeowners aged 65 or older. It’s advisable to consult with the Arlington tax office or a tax professional to determine your eligibility.