Phantom Tax

The concept of the "Phantom Tax" has gained attention in economic circles, sparking discussions and raising questions about its impact and implications. This article aims to delve deep into the intricacies of Phantom Tax, exploring its definition, historical context, and real-world examples. By understanding this unique form of taxation, we can gain valuable insights into its role in shaping economic policies and the potential consequences it may have on individuals and businesses.

Unraveling the Enigma: Phantom Tax Deconstructed

Phantom Tax, a term coined to describe a peculiar form of taxation, refers to the unintended or indirect costs imposed on individuals and entities due to certain government policies or regulations. Unlike traditional taxes, which are explicitly stated and levied on specific activities or incomes, Phantom Taxes operate in the shadows, often unnoticed by those affected. These hidden costs can manifest in various forms, from increased prices of goods and services to reduced purchasing power and opportunities.

The origins of Phantom Tax can be traced back to the early 20th century when governments began implementing complex tax systems to fund public projects and social welfare programs. Over time, these systems evolved, becoming more intricate and far-reaching. As a result, unintended consequences emerged, giving rise to the phenomenon of Phantom Taxation.

Unseen Forces at Play

Phantom Tax operates through a web of interconnected factors, making it a complex issue to unravel. One of its primary mechanisms is the tax incidence, which describes how the burden of a tax is distributed among various economic agents. In the case of Phantom Taxes, the incidence often shifts unexpectedly, impacting individuals or businesses differently than intended.

For instance, consider a government policy aimed at reducing carbon emissions by imposing a tax on fossil fuel producers. While the intention is to encourage a shift towards renewable energy, the tax may inadvertently increase the cost of energy for consumers, thus impacting their disposable income and spending habits. This unintended consequence, though indirectly related to the original policy, falls under the realm of Phantom Taxation.

| Tax Type | Impact |

|---|---|

| Carbon Tax | Increased energy costs for consumers |

| Regulatory Fees | Higher operating costs for businesses |

| Import Tariffs | Elevated prices of imported goods |

The Ripple Effect: Real-World Examples

Phantom Tax’s influence extends across various sectors and industries, leaving no economic domain untouched. Here are some concrete instances of how Phantom Taxes manifest in everyday life:

- Healthcare Sector: Government-imposed regulations on pharmaceutical companies may result in higher medication prices, indirectly impacting patients' access to essential treatments.

- Retail Industry: Increased minimum wage requirements can lead to higher prices for consumers, as businesses pass on the additional costs to maintain profitability.

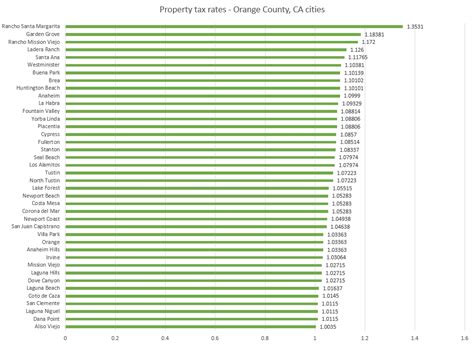

- Real Estate Market: Rising property taxes may deter potential homebuyers, leading to a decline in homeownership rates and an increase in rental costs.

- Financial Services: Complex banking regulations can increase compliance costs, potentially reducing the availability of credit and increasing borrowing costs for individuals and businesses.

Analyzing the Impact: A Comprehensive Assessment

Understanding the magnitude and reach of Phantom Tax requires a meticulous analysis of its effects on different economic segments. While it may be challenging to quantify precisely, several indicators provide valuable insights into its impact:

Inflationary Pressures

Phantom Taxes can contribute to inflation, as businesses and producers often pass on the additional costs to consumers. This can lead to a general increase in the price level, eroding the purchasing power of consumers and potentially disrupting economic stability.

Reduced Business Competitiveness

For businesses, Phantom Taxes can create a significant competitive disadvantage. Higher operating costs due to regulatory fees or unexpected tax burdens may make it challenging for companies to remain profitable, especially in a globalized market where competitors from other regions may face different tax structures.

Inequality and Social Impact

The distribution of Phantom Tax burdens is often unequal, disproportionately affecting certain socioeconomic groups. Low-income individuals, for instance, may find themselves struggling to cope with increased prices and reduced access to essential goods and services, exacerbating existing income inequality.

Market Distortions

Phantom Taxes can distort market dynamics, affecting supply and demand. For example, a sudden increase in import tariffs may discourage importers, leading to a shortage of certain goods and an artificial increase in prices. Such distortions can disrupt the natural flow of the market and hinder economic efficiency.

Addressing the Challenge: Strategies and Solutions

Given the complex nature of Phantom Taxation, addressing its challenges requires a multi-faceted approach. Policymakers and economists must work together to implement strategies that mitigate its adverse effects while still achieving the intended policy goals.

Transparent Tax Policies

One of the most effective ways to combat Phantom Taxation is through transparency. Governments should strive to provide clear and concise information about the potential indirect costs associated with new policies and regulations. This transparency can help individuals and businesses make more informed decisions and adapt their strategies accordingly.

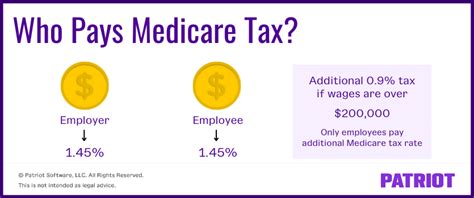

Progressive Tax Reform

Reforming the tax system to ensure fairness and equity is crucial. A progressive tax structure, where higher incomes are taxed at a higher rate, can help redistribute wealth and mitigate the impact of Phantom Taxes on lower-income individuals. This approach can also provide additional resources for social programs and infrastructure development.

Regulatory Flexibility

Regulations, while necessary for a well-functioning economy, should be designed with flexibility in mind. Governments should regularly review and update regulations to ensure they remain relevant and do not impose unnecessary burdens on businesses and consumers. A more adaptive regulatory framework can help reduce the incidence of Phantom Taxation.

International Collaboration

In today’s interconnected global economy, addressing Phantom Taxation requires international cooperation. Governments should collaborate to harmonize tax policies and regulations, reducing the potential for unintended consequences that may arise from divergent tax structures. Such collaboration can also foster a more level playing field for businesses operating across borders.

Conclusion: Navigating the Phantom Tax Landscape

Phantom Tax is a complex and multifaceted issue that requires careful consideration and proactive strategies. While it may be challenging to eliminate entirely, a combination of transparency, progressive tax reform, regulatory flexibility, and international collaboration can help mitigate its impact. By understanding the dynamics of Phantom Taxation and its real-world implications, policymakers, economists, and individuals can work together to create a more equitable and efficient economic system.

What are some common examples of Phantom Taxes?

+

Common examples include increased prices due to regulatory fees, higher energy costs from carbon taxes, and elevated import prices resulting from import tariffs. These indirect costs are often unnoticed but can have significant economic impacts.

How does Phantom Tax affect different socioeconomic groups?

+

Phantom Tax can disproportionately affect low-income individuals, as they may struggle to cope with increased prices and reduced access to essential goods and services. This can exacerbate existing income inequality and create economic challenges for vulnerable populations.

What steps can governments take to address Phantom Taxation?

+

Governments can combat Phantom Taxation through transparent tax policies, progressive tax reforms, flexible regulations, and international collaboration. These measures aim to mitigate the unintended consequences of tax policies and promote a more equitable economic environment.

Can Phantom Tax be completely eliminated?

+

While it may be challenging to eliminate Phantom Tax entirely, proactive strategies and continuous policy refinement can significantly reduce its impact. A combination of transparent policies, equitable tax structures, and adaptive regulations can help navigate the Phantom Tax landscape effectively.