Al Auto Sales Tax

Welcome to the world of automotive sales, where taxes play a significant role in the overall purchasing experience. Today, we delve into the intricacies of the Al Auto Sales Tax, a critical component that affects both dealers and customers alike. This comprehensive guide will shed light on the nuances of this tax, its impact on the industry, and how it shapes the automotive market.

The automotive industry is a complex web of regulations, and taxes are an essential part of this intricate system. Among the various taxes imposed on automotive sales, the Al Auto Sales Tax stands out as a unique and impactful component. This tax, with its specific rates and applications, influences the final price of vehicles and, subsequently, the purchasing decisions of consumers.

Understanding the Al Auto Sales Tax

The Al Auto Sales Tax, a levy specifically tailored for automotive transactions, is a critical consideration for both buyers and sellers. This tax is applied to the sale of new and used vehicles, impacting the overall cost and shaping the market dynamics. Let’s explore the key aspects of this tax to gain a comprehensive understanding.

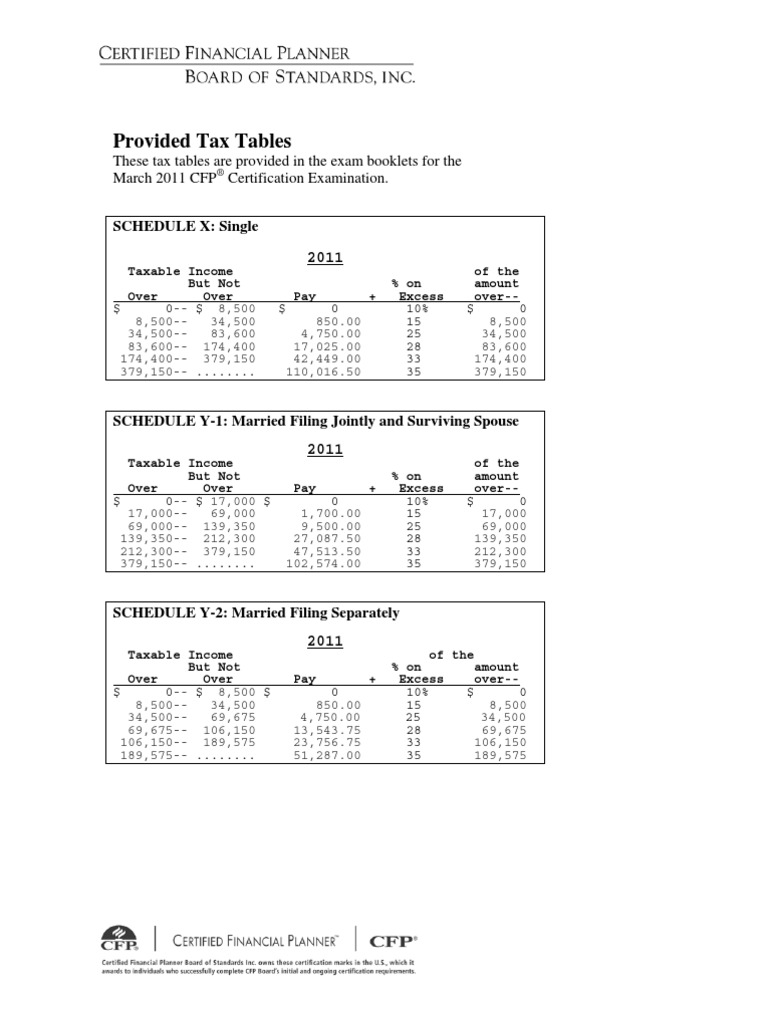

Tax Rates and Calculations

The Al Auto Sales Tax is not a flat rate across the board. Instead, it is calculated based on the vehicle’s value, with different rates applicable to new and used cars. For new vehicles, the tax rate stands at 6% of the total purchase price. On the other hand, used cars attract a slightly higher tax rate of 7%, reflecting the potential for increased depreciation and wear and tear.

| Vehicle Type | Tax Rate |

|---|---|

| New Vehicles | 6% |

| Used Vehicles | 7% |

For instance, if a customer purchases a new car priced at $30,000, the Al Auto Sales Tax would amount to $1,800 (6% of $30,000). Similarly, for a used car valued at $25,000, the tax would be $1,750 (7% of $25,000). These calculations are a crucial part of the sales process, impacting the final cost and consumer decision-making.

Tax Exemptions and Benefits

While the Al Auto Sales Tax is a standard levy, there are certain exemptions and benefits that can reduce the tax burden for consumers. For instance, electric vehicles (EVs) often enjoy a reduced tax rate or even a complete exemption, encouraging the adoption of environmentally friendly transportation. Additionally, certain states or regions may offer tax incentives for purchasing vehicles with high fuel efficiency or low emissions.

Furthermore, trade-in allowances can reduce the taxable value of a vehicle. When a customer trades in their old car towards the purchase of a new one, the value of the trade-in is deducted from the purchase price, effectively lowering the tax base. This strategy not only benefits consumers financially but also promotes sustainable practices by keeping older vehicles off the road.

Impact on Automotive Sales and Market Dynamics

The Al Auto Sales Tax has a profound impact on the automotive sales landscape. It influences consumer behavior, pricing strategies, and market trends. Let’s explore some of these effects in detail.

Firstly, the tax acts as a price regulator, ensuring that the market price of vehicles remains within a certain range. By adding a significant percentage to the final cost, it discourages excessive price inflation, fostering a more competitive and stable market.

Secondly, the tax encourages consumers to make informed choices. With the tax amount often constituting a substantial portion of the total cost, buyers are more likely to consider various factors, such as fuel efficiency, longevity, and maintenance costs, in their purchasing decisions. This leads to a more conscious and sustainable automotive market.

Lastly, the Al Auto Sales Tax influences the timing of purchases. Consumers often plan their vehicle acquisitions to align with tax seasons or sales events, taking advantage of potential tax breaks or dealer incentives. This seasonal aspect adds an interesting dynamic to the automotive market, with periods of heightened activity and strategic sales strategies employed by dealers.

Case Studies: Real-World Applications

To illustrate the impact of the Al Auto Sales Tax, let’s examine a few real-world scenarios. These case studies will provide a practical understanding of how this tax affects different consumer profiles and market situations.

Scenario 1: The Eco-Conscious Consumer

Imagine a consumer who is environmentally conscious and is in the market for a new vehicle. With the Al Auto Sales Tax offering a reduced rate or exemption for electric vehicles, this consumer is incentivized to choose an EV over a traditional combustion engine vehicle. This decision not only benefits the environment but also saves the consumer a significant amount in taxes, making the overall purchase more affordable.

Scenario 2: Strategic Timing for Maximum Savings

Consider a family planning to upgrade their vehicle during the tax season. By timing their purchase strategically, they can take advantage of potential tax breaks or dealer incentives. This approach not only saves them money but also ensures they receive the best value for their investment. The Al Auto Sales Tax, in this case, becomes a tool for consumers to maximize their savings and make informed, financially sound decisions.

Scenario 3: Trade-In Strategies

A savvy consumer looking to purchase a new car might employ a trade-in strategy. By trading in their old vehicle, they can significantly reduce the taxable value of the new car. This approach not only saves them money on taxes but also provides a practical solution for disposing of their old vehicle. The Al Auto Sales Tax, in this scenario, becomes a motivator for consumers to adopt sustainable practices and make the most of their trade-in allowances.

Future Implications and Industry Trends

As the automotive industry evolves, so too will the Al Auto Sales Tax and its implications. Let’s explore some potential future trends and their impact on the market.

The Rise of Electric Vehicles

With the global shift towards sustainable transportation, the demand for electric vehicles is expected to soar. As more consumers opt for EVs, the Al Auto Sales Tax will play a crucial role in encouraging this transition. The tax exemptions or reduced rates for EVs will likely become a standard feature, further promoting the adoption of environmentally friendly vehicles.

Smart Taxation Strategies

In the future, we can expect to see more sophisticated taxation strategies. This could involve dynamic tax rates based on vehicle performance, emissions, or even the buyer’s location. For instance, regions with high pollution levels might implement higher tax rates to encourage the purchase of cleaner vehicles. Such strategies would not only benefit the environment but also align with the growing trend of sustainable development.

Digital Transformation in Tax Calculations

The digital revolution is set to transform the way taxes are calculated and applied. With advanced technologies, the Al Auto Sales Tax could be calculated in real-time, taking into account various factors such as the vehicle’s specifications, location, and even the consumer’s financial status. This digital transformation would streamline the tax calculation process, making it more accurate and efficient.

Conclusion: Navigating the Al Auto Sales Tax Landscape

The Al Auto Sales Tax is a complex yet crucial component of the automotive industry. Its impact on sales, consumer behavior, and market dynamics cannot be overstated. By understanding its intricacies, consumers can make informed decisions, while dealers can strategize effectively to maximize sales and customer satisfaction.

As we navigate the future of automotive sales, the Al Auto Sales Tax will continue to evolve, shaping the industry in exciting and sustainable ways. Whether through incentives for eco-friendly vehicles or dynamic taxation strategies, this tax will remain a key influencer in the automotive market.

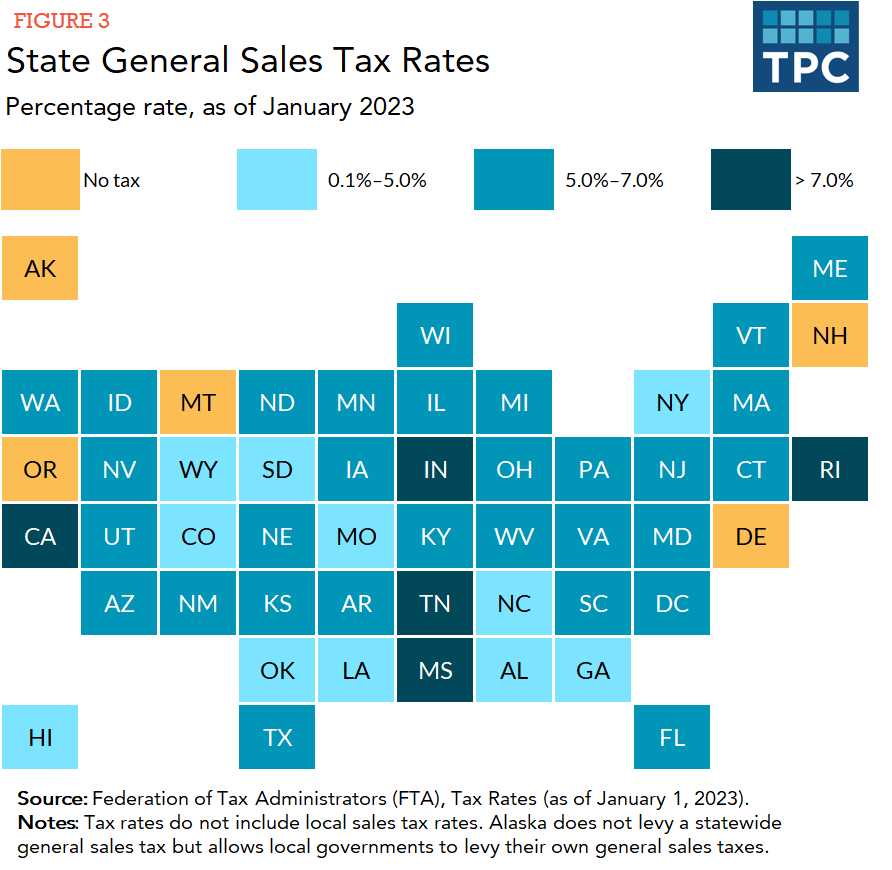

How does the Al Auto Sales Tax compare to other state or regional taxes on automotive sales?

+

The Al Auto Sales Tax is unique in its structure and rates, offering a differentiated approach compared to other state or regional taxes. While some regions may have similar tax rates for new and used vehicles, the Al Auto Sales Tax’s incentives for electric vehicles and potential trade-in allowances set it apart. Additionally, the tax rates and regulations can vary significantly across different states or regions, making the Al Auto Sales Tax a distinct and impactful component in the automotive market.

Are there any tax breaks or incentives for specific consumer groups, such as veterans or students, under the Al Auto Sales Tax?

+

Yes, the Al Auto Sales Tax often includes tax breaks or incentives for specific consumer groups. For instance, veterans, first-time buyers, or students may be eligible for reduced tax rates or other benefits. These incentives are designed to support and encourage certain consumer segments, making vehicle purchases more affordable and accessible. It’s essential to check the specific regulations and guidelines to understand the available benefits for different consumer groups.

Can the Al Auto Sales Tax be combined with other tax incentives or rebates offered by the government or automotive manufacturers?

+

Absolutely! The Al Auto Sales Tax can often be combined with other tax incentives or rebates offered by the government or automotive manufacturers. For example, a consumer may be eligible for a federal tax credit for purchasing an electric vehicle, which can be stacked with the Al Auto Sales Tax exemption or reduced rate for EVs. Similarly, manufacturers may offer rebates or discounts that can be applied in conjunction with the Al Auto Sales Tax. It’s crucial to explore all available options to maximize savings and benefits.

How does the Al Auto Sales Tax impact the pricing strategies of automotive dealers?

+

The Al Auto Sales Tax significantly influences the pricing strategies of automotive dealers. Dealers must carefully consider the tax rates and their impact on the final cost to the consumer. They often build the tax into the overall pricing strategy, ensuring that the vehicle’s price remains competitive while also factoring in the tax burden. Additionally, dealers may offer incentives or discounts to offset the tax, making the purchase more attractive to consumers.