Sales Tax Walnut Creek

In the vibrant city of Walnut Creek, nestled in the heart of California's Contra Costa County, the intricacies of sales tax regulations form an essential part of the local business landscape. This comprehensive guide aims to unravel the complexities surrounding Sales Tax in Walnut Creek, providing a detailed analysis of the rates, regulations, and implications for businesses and consumers alike.

Understanding Sales Tax in Walnut Creek

Sales tax in Walnut Creek, like many other regions in California, is a vital component of the city’s revenue system, contributing significantly to the overall economic health and development of the area. It is a tax levied on the sale of goods and services within the city limits, and its administration is overseen by both state and local authorities.

Sales Tax Rates

The sales tax rate in Walnut Creek is a combination of state, county, and city rates. As of the latest available information, the state sales tax rate in California stands at 7.25%, while the Contra Costa County adds an additional 0.75%, bringing the total countywide rate to 8%. The city of Walnut Creek, however, has its own unique rate, currently set at 0.5%, making the total sales tax in the city a substantial 8.5%.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| State of California | 7.25% |

| Contra Costa County | 0.75% |

| City of Walnut Creek | 0.5% |

| Total | 8.5% |

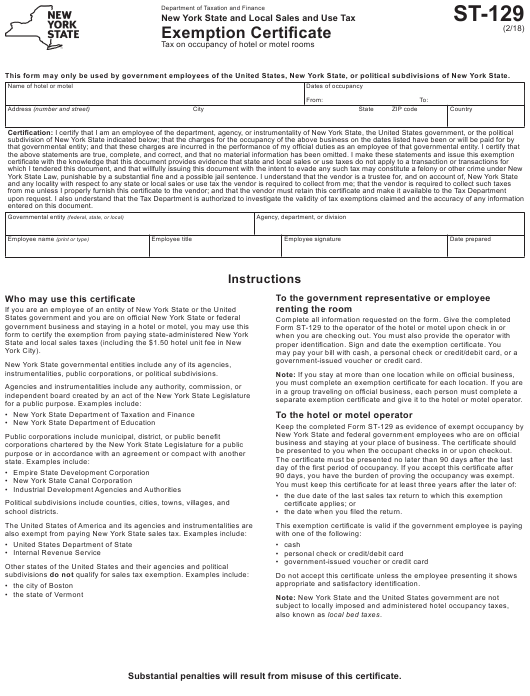

Sales Tax Exemptions and Special Considerations

While the sales tax in Walnut Creek applies to most goods and services, there are certain exemptions and special considerations that businesses and consumers should be aware of. For instance, certain essential goods like food, prescription drugs, and clothing items under $100 are exempt from sales tax in California.

Additionally, the state of California offers specific exemptions for qualified organizations, such as nonprofit groups and charities. These organizations can apply for a Seller's Permit, which allows them to make tax-free purchases for their operations.

Registration and Compliance

For businesses operating within Walnut Creek, registering for a Seller’s Permit is a crucial step. This permit, issued by the California Department of Tax and Fee Administration (CDTFA), authorizes businesses to collect and remit sales tax on behalf of the state. Failure to register can result in significant penalties and fines.

Once registered, businesses must adhere to strict compliance regulations. This includes accurately calculating and collecting the correct sales tax rate, maintaining detailed records of sales transactions, and submitting regular tax returns to the CDTFA. Non-compliance can lead to legal consequences and may impact a business's reputation and standing in the community.

The Impact on Local Businesses and Consumers

The high sales tax rate in Walnut Creek has a notable impact on both local businesses and consumers. For businesses, it can affect their pricing strategies and overall profitability. A higher sales tax rate can make it challenging for businesses to remain competitive, especially when catering to price-conscious consumers.

Consumers, on the other hand, bear the brunt of the sales tax directly at the point of sale. The added tax can significantly increase the final cost of goods and services, influencing purchasing decisions and potentially affecting consumer spending habits.

Strategies for Businesses

To navigate the challenges posed by high sales tax rates, local businesses in Walnut Creek often employ strategic pricing tactics. This may involve absorbing a portion of the tax to maintain competitive pricing, offering discounts or promotions to offset the tax, or bundling services to provide perceived value beyond the tax rate.

Furthermore, many businesses focus on providing exceptional customer service and unique experiences to differentiate themselves from competitors. By offering added value beyond the basic transaction, businesses can encourage customer loyalty and repeat business, mitigating the impact of high sales tax rates.

Consumer Awareness and Behavior

Aware of the substantial sales tax rate, many consumers in Walnut Creek adopt strategic shopping behaviors. This includes comparing prices across different retailers, both in-store and online, to find the best deals. Some consumers may also choose to make larger purchases outside the city limits to avoid paying the higher sales tax rate.

Additionally, consumer awareness of sales tax exemptions can lead to more informed purchasing decisions. For instance, buying essential items that are exempt from sales tax or taking advantage of tax-free shopping periods can help consumers save money and manage their budgets effectively.

Future Implications and Potential Changes

The sales tax landscape in Walnut Creek is subject to change, influenced by various economic and political factors. While the current rate has been stable for some time, there is always the potential for adjustments, whether through state or local legislation.

One potential change could be the introduction of special tax districts, which are areas designated for specific projects or improvements. These districts can levy additional taxes, including sales tax, to fund targeted initiatives. While this could provide much-needed funding for local projects, it would also increase the overall sales tax rate in those areas.

Furthermore, the ongoing debate surrounding online sales tax collection, particularly with the rise of e-commerce, could also impact the sales tax landscape in Walnut Creek. As more transactions move online, the state and local governments may seek to ensure that sales tax is collected and remitted fairly, which could lead to new regulations and potentially affect both online and brick-and-mortar businesses.

Staying Informed and Prepared

For businesses and consumers alike, staying informed about sales tax regulations and potential changes is crucial. This includes keeping abreast of any proposed or enacted legislation, understanding the implications of special tax districts, and being aware of any shifts in online sales tax collection policies.

By staying informed, businesses can adapt their strategies and compliance measures to ensure they remain in line with the latest regulations. Consumers, on the other hand, can make more informed purchasing decisions, understanding the true cost of goods and services and how sales tax impacts their overall spending.

Conclusion

The intricacies of sales tax in Walnut Creek present both challenges and opportunities for local businesses and consumers. With a comprehensive understanding of the rates, exemptions, and potential future changes, stakeholders can navigate the sales tax landscape effectively, ensuring compliance, competitiveness, and financial stability.

How often are sales tax rates updated in Walnut Creek?

+Sales tax rates in Walnut Creek are typically updated annually, effective from the beginning of the calendar year. However, changes can occur at any time due to legislative decisions, so it’s essential to stay informed about any updates.

Are there any online resources to help calculate sales tax in Walnut Creek?

+Yes, there are several online calculators and tools available that can assist in calculating the sales tax for Walnut Creek. These tools consider the combined state, county, and city rates, providing an accurate estimate of the total sales tax.

What happens if a business fails to collect and remit sales tax in Walnut Creek?

+Businesses that fail to collect and remit sales tax in Walnut Creek can face severe penalties and fines. The California Department of Tax and Fee Administration (CDTFA) has strict regulations and may impose significant financial consequences, including interest and penalties, on non-compliant businesses.