Value Added Tax England

Welcome to a comprehensive guide on the intricate topic of Value Added Tax (VAT) in England. As one of the most significant taxes in the country, VAT plays a pivotal role in the economy and understanding its nuances is crucial for businesses and consumers alike. In this article, we will delve into the depths of English VAT, exploring its history, current regulations, rates, and the impact it has on various industries and daily life. We will also provide expert insights and strategies to navigate this complex tax system efficiently.

The Evolution of Value Added Tax in England

Value Added Tax was introduced to England in 1973, as part of the nation’s alignment with the European Economic Community (EEC), now the European Union (EU). This tax system was designed to replace the former purchase tax, bringing England in line with the rest of Europe’s tax structures. Over the decades, English VAT has undergone various reforms and amendments to adapt to changing economic landscapes and global trade dynamics.

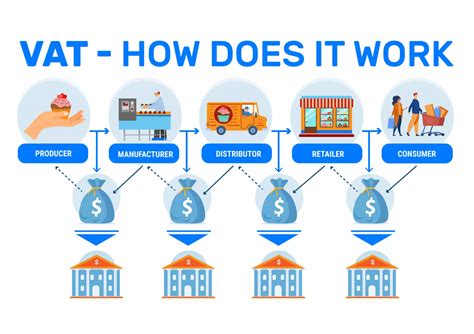

The initial rate of VAT in England was set at a standard 8%, with a reduced rate of 4% for certain goods and services. This system aimed to provide a more equitable tax structure, where the final consumer bears the burden of tax, regardless of the number of transactions involved in producing a good or service.

Key Milestones in English VAT History

Since its inception, English VAT has witnessed several significant milestones and changes. Here’s a timeline of some notable events:

- 1991: The standard rate of VAT was increased to 17.5%, a significant jump from the initial rate. This move aimed to address the country's economic challenges and budget deficits.

- 2001: In response to the global economic slowdown, the standard rate was temporarily reduced to 15% to stimulate consumer spending. However, it was reverted to 17.5% in 2007.

- 2010: A major reform occurred with the introduction of the reduced rate of 0% for certain energy-saving materials and home insulation products, encouraging environmentally conscious consumer choices.

- 2011: The standard rate was increased to 20% as part of the government's austerity measures, impacting businesses and consumers across the country.

- 2014: A new reduced rate of 5% was introduced for certain home renovations and improvements, a measure aimed at supporting the construction industry and encouraging homeowners to invest in their properties.

These historical changes highlight the dynamic nature of English VAT and its role in shaping the economy and consumer behavior.

Understanding Current English VAT Regulations

As of 2023, English VAT regulations are governed by the Value Added Tax Act 1994, which provides the legal framework for the tax’s administration and collection. This act, along with various subsequent amendments and regulations, forms the basis for VAT compliance in England.

English VAT is administered by HM Revenue and Customs (HMRC), the government department responsible for tax collection and administration. HMRC provides guidance, support, and enforcement of VAT regulations, ensuring compliance across various industries and sectors.

VAT Registration and Thresholds

Businesses in England are required to register for VAT if their taxable turnover exceeds a certain threshold. As of 2023, the VAT registration threshold is set at £85,000. This means that any business with a taxable turnover above this amount must register for VAT and charge VAT on its goods and services.

Once registered, businesses must charge VAT at the appropriate rate on their sales and declare and pay the tax to HMRC on a regular basis, typically quarterly or annually depending on the business's turnover and tax liability.

VAT Rates in England

English VAT is currently structured with three primary rates: the standard rate, the reduced rate, and the zero rate. Each rate applies to different goods and services, with certain items being exempt from VAT altogether.

| Rate | Percentage | Applicable Goods and Services |

|---|---|---|

| Standard Rate | 20% | Most goods and services, including clothing, electronics, and financial services. |

| Reduced Rate | 5% | Certain goods and services, such as domestic fuel and power, children's car seats, and some mobility aids. |

| Zero Rate | 0% | A wide range of goods and services, including most food products, books, newspapers, and children's clothing. |

| Exempt | N/A | Certain items and services are exempt from VAT, including postal services, financial services, and education. |

The UK government periodically reviews and adjusts these rates, often to support specific industries or to encourage certain consumer behaviors, such as the reduced rate for energy-efficient products.

The Impact of English VAT on Industries

English VAT significantly influences various industries, shaping their pricing strategies, profitability, and overall business models. Let’s explore the impact of VAT on a few key sectors.

Retail Sector

In the retail industry, VAT directly affects the prices consumers pay for goods. Retailers must carefully consider their pricing strategies to remain competitive while ensuring they can meet their VAT obligations. For instance, a retailer selling electronics must add 20% VAT to the sale price, which can impact consumer demand and the retailer’s profitability.

Furthermore, VAT can influence retail operations, especially for businesses operating across different VAT jurisdictions. Retailers must be well-versed in the VAT regulations of each region they operate in to ensure compliance and avoid penalties.

Construction Industry

The construction sector has unique VAT considerations, especially with the introduction of the reduced rate for home renovations and improvements. This rate aims to encourage homeowners to invest in their properties, boosting the construction industry. However, it also presents complex challenges for construction businesses, as they must carefully manage their projects to ensure they meet the criteria for the reduced rate.

Additionally, the construction industry often deals with complex VAT issues related to subcontractors, materials, and project phases, making VAT compliance a critical aspect of their business operations.

Hospitality and Tourism

The hospitality and tourism industry is heavily influenced by VAT, particularly with the standard rate of 20% applied to most services. This rate can significantly impact the cost of travel and leisure activities for consumers, influencing their choices and spending habits. For businesses in this sector, VAT management is crucial to remain competitive and maintain profitability.

Moreover, with the rise of online travel agencies and booking platforms, the hospitality industry must navigate the complexities of VAT across different jurisdictions, ensuring they comply with local regulations and avoid potential legal pitfalls.

Expert Strategies for Navigating English VAT

Given the complexity of English VAT, businesses and individuals often seek expert guidance to navigate this tax system efficiently. Here are some strategies and insights from industry experts to help you manage your VAT obligations effectively.

Stay Informed and Updated

VAT regulations are subject to change, and staying informed is crucial for compliance. Keep yourself updated with the latest VAT news, amendments, and guidance from HMRC. Utilize official resources and subscribe to newsletters or alerts to ensure you are aware of any changes that might impact your business or personal finances.

Seek Professional Advice

Engaging the services of a tax professional or accountant with expertise in VAT can provide valuable insights and guidance tailored to your specific situation. They can help you navigate the complexities of VAT registration, rates, and compliance, ensuring you meet your obligations while optimizing your tax position.

Utilize Technology and Software

In today’s digital age, there are numerous software solutions designed to simplify VAT management. These tools can automate various aspects of VAT compliance, from calculating VAT on sales and purchases to generating VAT returns and managing VAT registration. Investing in such software can significantly streamline your VAT processes and reduce the risk of errors.

Understand VAT Exemptions and Reliefs

English VAT offers various exemptions and reliefs that can significantly impact your tax liability. Understanding these provisions is crucial for optimizing your tax position. For instance, the zero-rating for exports or the reduced rate for certain charitable activities can provide significant tax savings. Work with your tax advisor to identify any applicable exemptions or reliefs for your business.

Future Implications and Potential Changes

As the economic landscape continues to evolve, English VAT is likely to undergo further changes and reforms. The UK government regularly reviews the VAT system to ensure it remains fair, effective, and aligned with the country’s economic goals.

Potential future changes could include further adjustments to VAT rates, particularly for certain industries or goods, to support economic growth or address specific societal needs. Additionally, with the ongoing digital transformation of the economy, there might be shifts in how VAT is administered and collected, potentially introducing more efficient and automated systems.

Furthermore, as the UK's relationship with the EU evolves, especially post-Brexit, there could be implications for English VAT, particularly regarding cross-border transactions and trade. Staying informed about these potential changes is crucial for businesses to adapt and ensure continued compliance.

What is the current VAT registration threshold in England?

+As of 2023, the VAT registration threshold in England is £85,000. Businesses with a taxable turnover exceeding this amount must register for VAT and charge VAT on their goods and services.

How often do businesses need to declare and pay VAT in England?

+The frequency of VAT returns and payments depends on the business’s turnover and tax liability. Generally, businesses can choose to file VAT returns and make payments quarterly or annually. However, some businesses with higher turnovers might be required to file returns more frequently.

Are there any VAT exemptions or reliefs in England?

+Yes, English VAT offers various exemptions and reliefs. These include zero-rating for exports, reduced rates for certain goods and services, and exemptions for specific industries or activities, such as financial services and education. It’s important to consult with a tax professional to understand the specific exemptions and reliefs applicable to your business.

How does Brexit impact English VAT regulations and compliance?

+Brexit has introduced several changes to English VAT, particularly for businesses trading with the EU. These changes include new registration requirements, increased administrative burdens, and potential customs duties for certain goods. Businesses must stay updated with these changes and ensure they comply with the new VAT regulations for cross-border transactions.

What are the potential consequences of non-compliance with English VAT regulations?

+Non-compliance with English VAT regulations can lead to significant penalties and legal consequences. These may include fines, interest charges on overdue VAT payments, and potential criminal prosecution for serious or repeated offences. It’s crucial for businesses to ensure they understand and meet their VAT obligations to avoid these penalties.